Shenwan Hongyuan: The adjustment is merely "doubting the bull market level"

Shenwan Hongyuan believes that the current market adjustment is at a "doubtful bull market level," similar to historical trends in the ChiNext, food and beverage, and new energy sectors. The adjustment aligns with historical patterns, and the two-stage theory of the bull market remains valid. The bull market 1.0 phase has been validated, and the transition period awaits the accumulation of conditions for a comprehensive bull market. After the adjustment, the spring market is worth looking forward to, with improved cost-effectiveness in the technology growth sector, and the economic growth target needs to maintain a high growth rate

1. The adjustment is at the "doubtful bull market level": The AI industry chain "the industrial trend big wave has not ended + small and medium wave has fluctuations + big wave cost-effectiveness is temporarily insufficient," which resembles the ChiNext in early 2014, food and beverage in early 2018, and new energy in early 2021. In this case, the occurrence of quarterly "high-level fluctuations" and "adjustment phases" conforms to historical patterns.

The adjustment is merely at the "doubtful bull market level": The "two-stage bull market theory" is a typical feature of the A-share bull market cycle. After the adjustment, patiently wait for the cyclical improvement of fundamentals + new stage of technology industry trends + residents' asset allocation shifting towards equities + the resonance of China's influence enhancement, to initiate the comprehensive bull market phase 2.0.

The judgment of the "two-stage bull market theory" remains unchanged. The high-level area judgment of the bull market 1.0 phase has been verified. The "two-stage bull market theory" is a typical feature of the A-share bull market cycle: the bull market 1.0 phase (2013, 2017, and 2025), the style switch of institutional investors is basically completed + the accumulation of profit effects leads to qualitative changes (the net value of public funds from the previous issuance peak returns above the waterline) + the cost-effectiveness of industrial trend assets is insufficient. The transition period from bull market 1.0 to 2.0 (February to October 2014, 2018, and this round may be the first half of 2026), waiting for the accumulation of comprehensive bull market conditions + the adjustment of industrial trends to bottom out, digesting the cost-effectiveness issues. The comprehensive bull market 2.0 (2015, 2021, and this round may be the second half of 2026), the core is the cyclical improvement of fundamentals/ new stage of industrial trends + residents' asset allocation shifting towards equities.

The adjustment at the "doubtful bull market level" is occurring, but at this stage, it is even more important to be firm in the recognition of the bull market. When the adjustment is in place (near the bull-bear boundary of the core track), it represents a major bottom, and one can wait for "bull market 2.0."

2. After the adjustment, the spring market is more worth looking forward to: To achieve the goal of becoming a moderately developed country by 2035, economic growth needs to maintain a high growth rate. The economy in Q3 2025 is relatively weak, and the end of the year is a key window for laying out the economy for 2026, and the "policy bottom" may be verified in advance. The short-term cost-effectiveness of technology growth is rapidly improving, institutional investors are reducing their positions in technology in the short term, and the microstructure is improving synchronously, making technology growth an important part of the spring sector rotation.

After the adjustment, the spring market is more worth looking forward to. We discuss two clues for the spring market:

-

The management attaches importance to economic growth, and the "policy bottom" may be verified in advance. To achieve the goal of becoming a moderately developed country by 2035, economic growth needs to maintain a high growth rate. The economy in Q3 2025 is relatively weak, and December 2025 is a key window for laying out economic policies for 2026, and the "policy bottom" may be verified in advance.

-

The mid-term upward trend of the technology industry remains unchanged. The AI industry trend is still in "stage 3," transitioning from "stage 3" to "stage 4," with non-linear growth in industry profits. The domestic technology industry trend is also continuously improving. The bottoming and rebound of the primary and secondary markets have been verified (the bottoming and rebound of venture capital financing amounts in the primary market usually occur in the structural bull years of A-shares in 2013, 2019, and 2025) From the perspective of cost-effectiveness, the short-term cost-effectiveness of technology growth has rapidly improved, and institutional investors have reduced their technology positions, easing micro-structural pressures. Both cyclical and technology sectors may have rebound opportunities in the spring.

III. Outlook for industry style rhythm in 2026: Transition phase from Bull Market 1.0 to 2.0, high dividend defensives may dominate. The Bull Market 2.0 phase will see improvements in economic sentiment (actual improvements) catalyzing cyclical leadership to break through indices, ultimately the trend of the technology industry and the global influence of manufacturing will be the main line of the bull market.

Spring 2026: Early verification of policy bottom + cyclical price increases + expectations of year-on-year improvement in PPI, cyclical sectors may be the underlying assets for the spring market, with basic chemicals and industrial technology remaining more elastic directions. The technology rebound will seek cost-effectiveness, focusing on innovative drugs and national defense military industry. In spring, AI computing power, storage, energy storage, and robotics will also have rebound opportunities.

Main text:

I. The adjustment is a "doubtful bull market level": The AI industry chain "the major trend of the industry has not ended + small fluctuations have setbacks + the major trend's cost-effectiveness is temporarily insufficient," resembling the ChiNext in early 2014, food and beverage in early 2018, and new energy in early 2021. In this case, the occurrence of quarterly-level "high-level fluctuations" and "adjustment phases" aligns with historical patterns.

The adjustment is merely a "doubtful bull market level": The "two-stage bull market theory" is a typical feature of the A-share bull market cycle. After the adjustment, patiently wait for cyclical improvements in fundamentals + new phases of technology industry trends + migration of resident asset allocation towards equities + resonance of China's influence enhancement to initiate a comprehensive bull market in the Bull Market 2.0 phase.

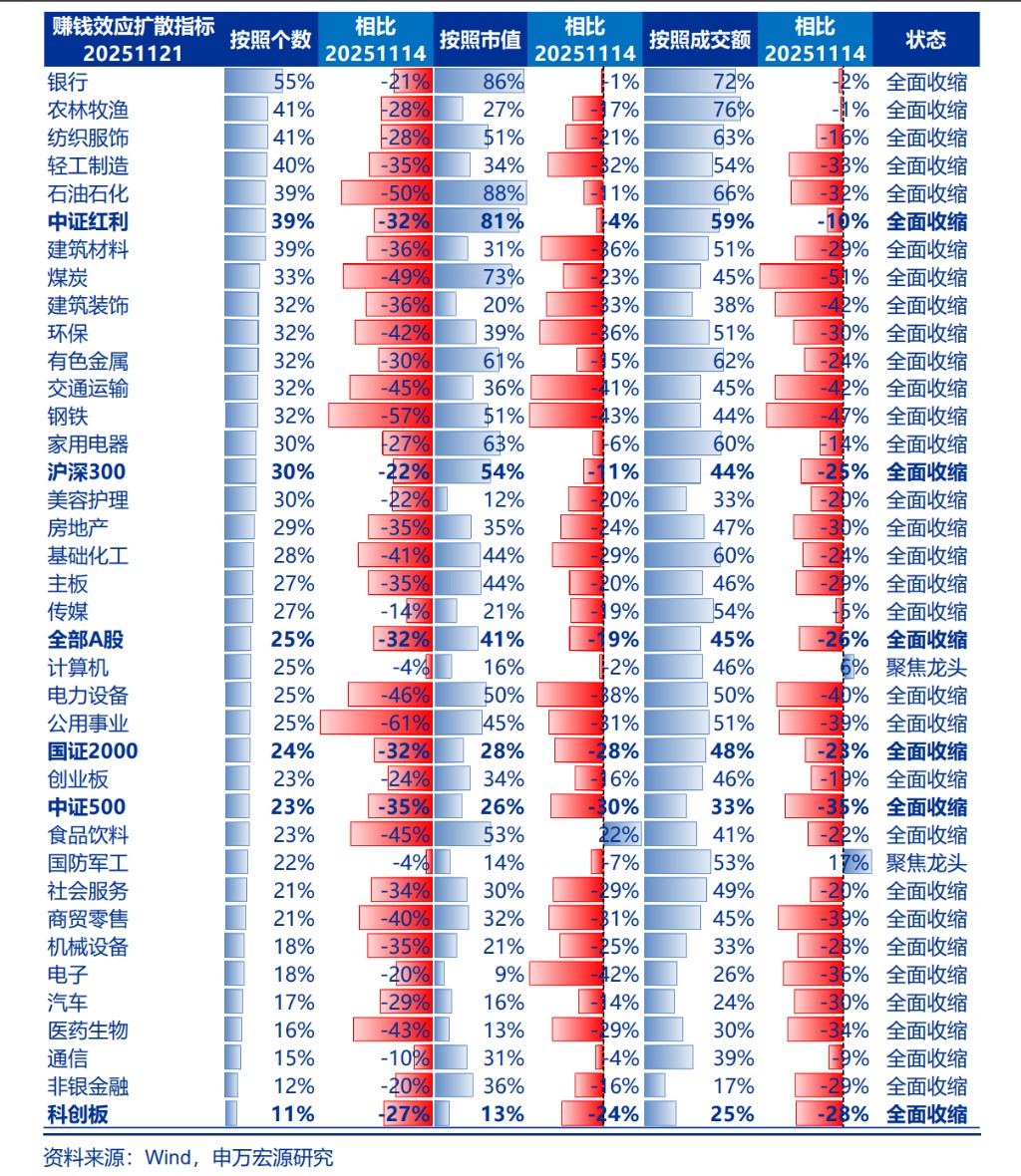

Background and level of adjustment: The AI industry chain's cost-effectiveness is temporarily insufficient, and the adjustment aims to rectify the cost-effectiveness issue. Market expectations for an immediate bull market have rapidly declined. Historical experience suggests that the adjustment is a "doubtful bull market level."

Currently, the implied ERP of telecommunications, electronics, and the Science and Technology Innovation 50 is still away from historical lows, but PE is at historically absolute highs. At present, the AI industry chain "the major trend of the industry has not ended + small fluctuations have setbacks + long-term low cost-effectiveness areas," resembling the ChiNext in early 2014, food and beverage in early 2018, and new energy in early 2021. None of these three segments marked the end of a major trend, but all experienced "adjustments at the doubtful bull market level."

Two historical experiences are highlighted:

1. High-level fluctuation phase: The difficulty of earning valuation money increases. New industry catalysts/performance high growth continuation are also difficult to break upwards, leaning more towards rebounds within high-level fluctuation ranges. The market's sensitivity to liquidity shocks will increase. The high-level fluctuation phase is usually at the quarterly level.

Since September, the AI industry chain has been in a high-level fluctuation phase. In the short term, the probability of the Federal Reserve lowering interest rates in December has only swayed at low levels, and if the easing is below expectations, it triggers a global decline in high-standard assets (global tech stocks, gold, Bitcoin), fundamentally due to insufficient asset cost-effectiveness, increased fragility, and heightened sensitivity to liquidity shocks 2. Adjustment Phase: Typically triggered by clear industrial disturbances (in 2014, the ChiNext was affected by the suspension of QR code payments for security reasons; in 2018, the food and beverage sector faced pressure due to economic downturns, impacting the fundamentals of liquor; in 2021, the new energy sector was affected by chip shortages in new energy vehicles, and the price surge of upstream silicon materials in photovoltaics suppressed downstream demand). This disturbance ultimately verifies that it is not the end of the industrial trend, but it does trigger an adjustment of "doubtful bull market level." The adjustment phase is usually at a quarterly level, and an adjustment near the bull-bear boundary is a reasonable range.

The judgment of the "two-stage bull market" remains unchanged. The high-level area judgment of the bull market 1.0 phase is verified. The "two-stage bull market" is a typical feature of the A-share bull market cycle: the bull market 1.0 phase (2013, 2017, and 2025) sees the style switch of institutional investors basically completed + the accumulation of profit effects leads to a qualitative change (the net value of public funds from the previous issuance peak returns above the waterline) + insufficient cost-performance ratio of industrial trend assets. The transition period from bull market 1.0 to 2.0 (February to October 2014, 2018, and this round may be the first half of 2026) waits for the accumulation of comprehensive bull market conditions + the adjustment of industrial trends to grind the bottom, digesting the cost-performance ratio issues. Bull market 2.0 is a comprehensive bull (2015, 2021, and this round may be the second half of 2026), with the core being cyclical improvement in fundamentals/ new phase of industrial trends + the shift of resident asset allocation towards equities.

The adjustment of the "doubtful bull market level" is happening, but at this stage, it is more important to firmly recognize the bull market. When the adjustment is in place (near the core track bull-bear boundary), it represents a significant bottom, and one can wait for "bull market 2.0."

II. After the adjustment, the spring market is more worth looking forward to: To achieve the goal of becoming a moderately developed country by 2035, economic growth needs to maintain a high growth rate. The economy in Q3 2025 is relatively weak, and the end of the year is a key window for laying out the economic policies for 2026, where the "policy bottom" may be verified in advance. The short-term cost-performance ratio of technology growth is rapidly improving, institutional investors are reducing their positions in technology in the short term, and the micro-structure is improving synchronously. Technology growth is also an important part of the spring sector rotation.

After the adjustment, the spring market is more worth looking forward to. We discuss two clues for the spring market:

-

The management attaches importance to economic growth, and the "policy bottom" may be verified in advance. To achieve the goal of becoming a moderately developed country by 2035, economic growth needs to maintain a high growth rate. The economy in Q3 2025 is relatively weak, and December 2025 is a key window for laying out the economic policies for 2026, where the "policy bottom" may be verified in advance.

-

The mid-term upward trend of the technology industry remains unchanged. The AI industry trend is still in "Stage 3."

From "Stage 3" to the transition phase towards "Stage 4," the industry's profits are experiencing non-linear growth. The domestic technology industry trend is also continuously improving.

The linkage between the primary and secondary markets has already been verified with a bottoming rebound (the bottoming rebound of venture capital financing amounts in the primary market usually occurs in the structural bull years of A-shares in 2013, 2019, and 2025). From a cost-performance perspective, the short-term cost-performance ratio of technology growth has rapidly improved, institutional investors have reduced their technology positions, and micro-structural pressures have eased Spring cyclical and technology may both have rebound opportunities.

III. Outlook for industry style rhythm in 2026: Transition phase from Bull Market 1.0 to 2.0, high dividend defense may dominate. The Bull Market 2.0 phase will see improvements in economic sentiment (actual improvements) catalyzing cyclical stocks to lead the index breakout, with the ultimate trend in the technology industry and the enhancement of global manufacturing influence being the main line of the bull market.

Spring 2026: Early verification of policy bottom + cyclical price increases + expectations of year-on-year improvement in PPI, cyclical stocks may be the underlying assets of the spring market, with basic chemicals and industrial technology being more resilient directions for cyclical Alpha. The technology rebound will seek cost-performance ratios, focusing on innovative drugs and national defense military industry. In spring, AI computing power, storage, energy storage, and robotics will also have rebound opportunities.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk