Trending | BMY Surges 5% on Wednesday, Some Call options Soar 460%

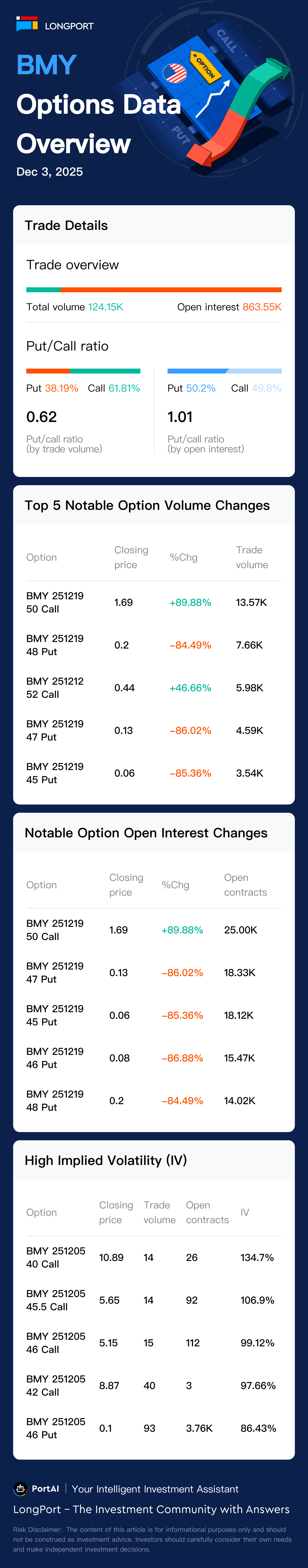

On December 3, Eastern Time, Bristol Myers Squibb options saw a total of 124148 contracts traded, with calls accounting for 61% and puts making up 38%.

On December 3, Eastern Time, Bristol Myers Squibb options saw a total of 124148 contracts traded, with calls accounting for 61% and puts making up 38%.

Bristol Myers Squibb has 863550 contracts outstanding, with calls accounting for 49% and puts making up 50%.

The top volume gainer was the 50 dollars Call option expiring on December 5, 2025, with 3299 contracts traded.

On the news front, Based on recent key news:

1. Dec 3, Bristol Myers Squibb announced a delay in the readout of a key Phase 3 clinical trial for its drug Cobenfy, intended for Alzheimer’s disease psychosis. The delay is due to the need to enroll more patients, pushing the data release to next year. This unexpected positive market reaction suggests investors may have factored in potential risks or are optimistic about the drug's eventual success. Source: Business Wire

2. Dec 2, a U.S. judge rejected Bristol Myers Squibb's bid to dismiss a $6.7 billion lawsuit over the Celgene deal. The lawsuit claims Bristol Myers breached contract by delaying FDA approvals for three drugs, including Breyanzi. This legal development has added pressure on the stock. Source: Reuters

3. Dec 3, Cantor Fitzgerald maintained its Neutral rating and $45 price target on Bristol-Myers Squibb after new data bolstered confidence in the company's milvexian SSP program. The firm described the update as a 'needed win' following previous setbacks. Source: Business WirePharmaceuticals face patent cliffs, pricing pressure.

Please note: The chart below does not include options expiring within five days.