Trending | INTC Plummets 7% on Thursday, Some Put options Soar 784%

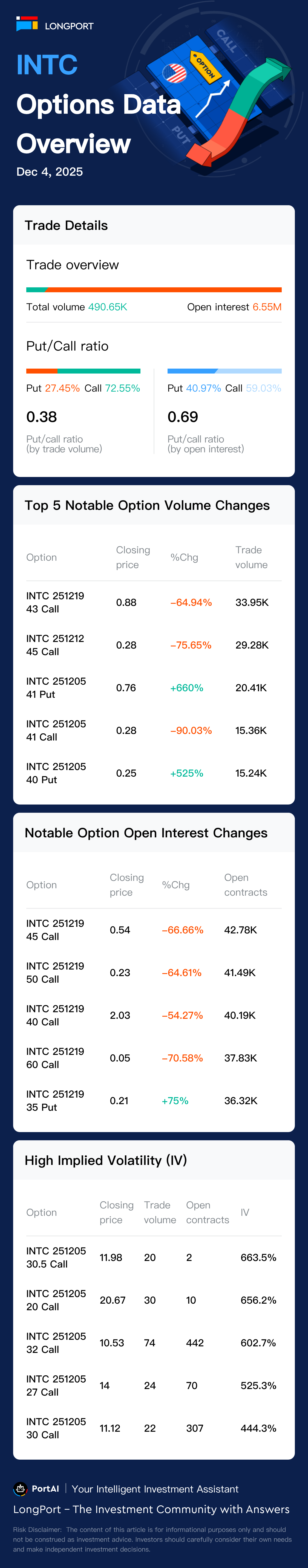

On December 4, Eastern Time, Intel options saw a total of 490646 contracts traded, with calls accounting for 72% and puts making up 27%.

On December 4, Eastern Time, Intel options saw a total of 490646 contracts traded, with calls accounting for 72% and puts making up 27%.

Intel has 6553549 contracts outstanding, with calls accounting for 59% and puts making up 40%.

The top volume gainer was the 41 dollars Put option expiring on December 5, 2025, with 20405 contracts traded.

On the news front, Based on recent key news:

1. Dec 3, Intel announced a $208 million investment to expand its semiconductor packaging and testing operations in Malaysia. This strategic move aims to diversify Intel's production locations and alleviate supply chain pressures amidst high chip demand. The stock surged by approximately 8.5% following the announcement.

2. Dec 2, Intel was downgraded from Buy to Hold by analyst Motti Sapir, citing slow recovery and potential overvaluation amid intense competition and execution risks. This downgrade contributed to negative sentiment around the stock.

3. Dec 4, Intel decided to keep its networking and communications unit (NEX) after a strategic review, reversing earlier plans to spin out the unit. The decision was part of CEO Lip-Bu Tan's strategy to focus on core businesses, but the market reaction was relatively muted.Analysts have a Hold consensus rating on INTC stock.

Please note: The chart below does not include options expiring within five days.