Trending | SNOW Plummets 11% on Thursday, Some Put options Soar 178%

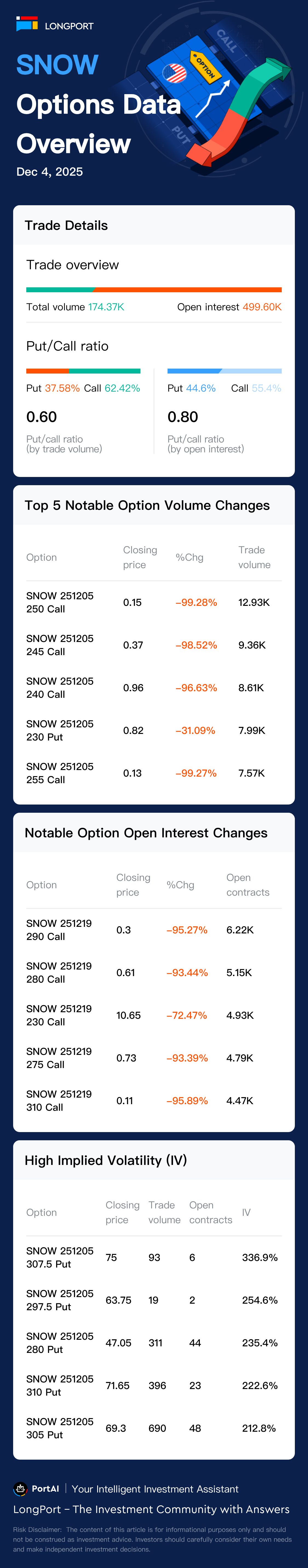

On December 4, Eastern Time, Snowflake options saw a total of 174372 contracts traded, with calls accounting for 62% and puts making up 37%.

On December 4, Eastern Time, Snowflake options saw a total of 174372 contracts traded, with calls accounting for 62% and puts making up 37%.

Snowflake has 499603 contracts outstanding, with calls accounting for 55% and puts making up 44%.

The top volume gainer was the 250 dollars Call option expiring on December 5, 2025, with 12929 contracts traded.

On the news front, Based on recent key news:

1. Dec 4, Snowflake's stock dropped significantly after the company issued a disappointing margin forecast, raising concerns about the impact of AI investments on profits. Despite beating earnings and revenue estimates, the stock fell over 11%. Source: Benzinga

2. Dec 4, Analysts adjusted their price targets for Snowflake following the earnings report. Keybanc, Baird, and Cantor Fitzgerald raised their targets, but the stock still traded 10% lower at $238.36. Source: Benzinga

3. Dec 3, Snowflake's Q3 earnings beat expectations, but product revenue guidance was only slightly above views, leading to a stock decline. Analysts noted the results were not exceptional enough. Source: LSEGCloud sector faces AI investment scrutiny.

Please note: The chart below does not include options expiring within five days.