Trending | ACHR Surges 7% on Thursday, Some Call options Soar 350%

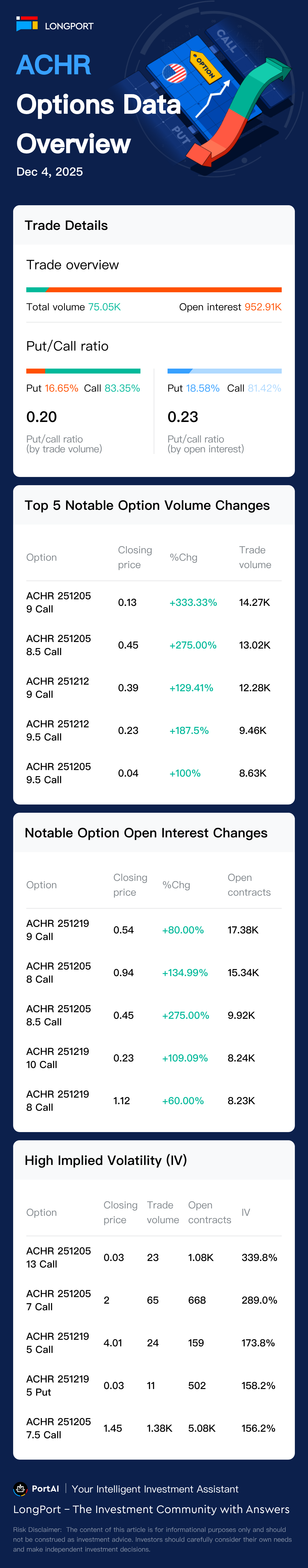

On December 4, Eastern Time, Archer Aviation options saw a total of 75046 contracts traded, with calls accounting for 83% and puts making up 16%.

On December 4, Eastern Time, Archer Aviation options saw a total of 75046 contracts traded, with calls accounting for 83% and puts making up 16%.

Archer Aviation has 952912 contracts outstanding, with calls accounting for 81% and puts making up 18%.

The top volume gainer was the 9 dollars Call option expiring on December 5, 2025, with 14273 contracts traded.

On the news front, Based on recent key news:

1. Dec 2, Archer Aviation announced an exclusive collaboration with Karem Aircraft to enhance its VTOL aircraft technology. This partnership aims to modernize U.S. and allies' vertical lift capabilities, strengthening Archer's position in the hybrid VTOL space. Shares rose 1.4% in premarket trading.

2. Dec 3, Archer revealed plans for an air taxi network in Miami, featuring partnerships with Related Ross and Magic City Innovation District. This strategic move is expected to boost Archer's market presence and operational capabilities.

3. Dec 4, Goldman Sachs rated Archer Aviation as Neutral, citing lagging U.S. certification and fewer flight hours compared to rivals. Despite the neutral rating, the stock saw a significant surge.The air taxi industry is gaining momentum with increased federal investment.

Please note: The chart below does not include options expiring within five days.