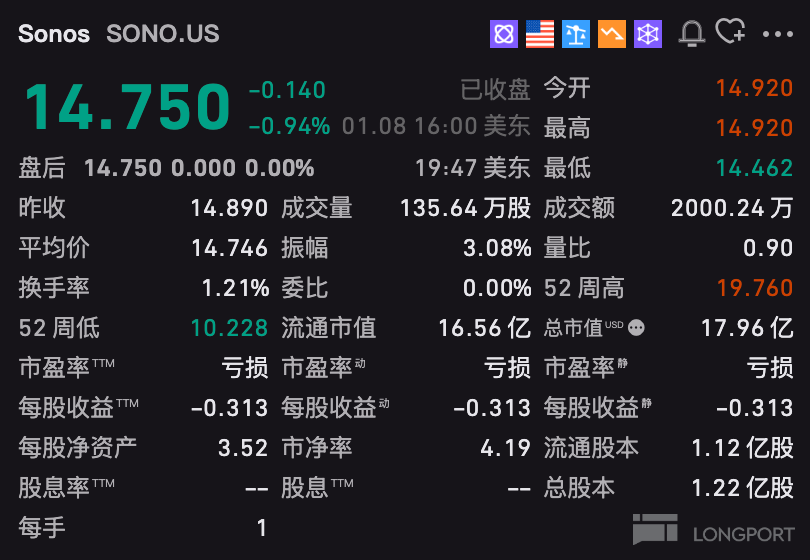

Consider paying attention to this small-cap stock Sonos:

$Sonos(SONO.US) purchased products from this company. Sonos ACE headphones, and also a pair of Five 5 speakers. I am very satisfied with them. I hadn't paid attention to this company's stock price before.

Now looking at it, it seems worth paying attention to? Should I buy $10,000 to keep an eye on it?

As of now, approximately 526 institutions hold shares of Sonos.

Here are the major institutional investors with higher shareholding ratios:

- The Vanguard Group, Inc.:

• Number of Shares Held: Approximately 9,000,000 shares

• Shareholding Ratio: Approximately 7.4%

• Background: One of the largest asset management companies in the world, managing trillions of dollars in assets, offering a variety of investment products, including mutual funds and ETFs.

- BlackRock Institutional Trust Company, N.A.:

• Number of Shares Held: Approximately 8,500,000 shares

• Shareholding Ratio: Approximately 7.0%

• Background: A leading global investment management company, providing a wide range of investment management, risk management, and advisory services.

- Morgan Stanley:

• Number of Shares Held: Approximately 5,000,000 shares

• Shareholding Ratio: Approximately 4.1%

• Background: A globally recognized financial services company, with businesses in investment banking, securities, wealth management, and investment management.

- Fidelity Management & Research Company:

• Number of Shares Held: Approximately 4,500,000 shares

• Shareholding Ratio: Approximately 3.7%

• Background: One of the largest mutual fund and financial services groups in the United States, providing investment management, retirement planning, and other services.

- JPMorgan Chase & Co.:

• Number of Shares Held: Approximately 4,000,000 shares • Shareholding Ratio: Approximately 3.3%

• Background: One of the largest financial services institutions in the world, with businesses covering investment banking, commercial banking, asset management, and private banking.

ChatGPT Search:

Sonos Inc. (stock code: SONO) is a leading wireless sound system company focused on providing consumers with high-quality home audio experiences. Below is a comprehensive analysis of Sonos to guide your medium to long-term investment decisions and provide short-term trading suggestions.

Strategic Analysis

• Assessment of the Company's Long-Term Development Strategy: Sonos is committed to consolidating its position in the high-end audio market through innovation and a diversified product line. Recently, the company launched its first headphone product, Ace, aimed at expanding into new market areas.

• Analysis of Core Competitive Advantages: Sonos is renowned for its excellent sound quality, sleek design, and user-friendly interface. Its open platform supports various streaming services, enhancing user stickiness.

• Market Position and Industry Landscape: Despite facing competition from tech giants like Apple, Amazon, and Google, Sonos maintains a strong brand influence in the high-end audio market. However, increasing market competition, especially in the headphone sector, may impact its market share.

• Innovation Capability and R&D Pipeline: The company continues to invest in new product development and technological innovation to meet the changing needs of consumers. However, recent software update issues indicate that there is still room for improvement in product release and quality control.

• Management Team Capability Evaluation: The management team led by CEO Patrick Spence has performed excellently in addressing market challenges and driving company growth. However, recent software issues have raised questions about the management's decision-making and execution capabilities.

Fundamental Analysis

• Analysis of Revenue Growth Quality: In the fiscal year ending September 30, 2024, Sonos's revenue declined year-on-year, primarily affected by software issues and intensified market competition. However, the launch of new products may provide momentum for future revenue growth.

• Trends and Expectations for Profit Margins: Profit margins have been compressed due to increased sales and marketing costs, as well as expenses related to product launches. The company needs to improve operational efficiency to enhance profitability.

• Assessment of Cash Flow Health: Despite facing challenges, Sonos has maintained robust cash flow, supporting its continued investment in R&D and market expansion.

• Asset-Liability Structure: The company's balance sheet is healthy, with moderate levels of debt, providing the ability to withstand market fluctuations.

• Analysis of Capital Return Rates: Recent investment return rates have declined, reflecting the impact of market competition and internal challenges on the company's profitability.

Valuation Analysis

• Assessment of Current Valuation Levels: Based on the current stock price, Sonos's price-to-earnings ratio and price-to-sales ratio are relatively within a reasonable range compared to industry peers • Historical Valuation Comparison: Compared to historical valuations, the current valuation has slightly decreased, which may reflect market concerns about the company's recent challenges.

• Peer Valuation Comparison: Compared to major competitors, Sonos's valuation is somewhat attractive, but its growth prospects and changes in market share need to be considered.

• Potential Value Reassessment Factors: Successful product launches, increases in market share, and the recovery of brand reputation may drive valuation upward.

• Reasonable Value Range Assessment: Based on current market conditions and the company's fundamentals, the reasonable value range may be between $14 and $18 per share.

Investment Timing

Mid to Long Term (90% Position)

• Core Position Recommendation: It is recommended to include Sonos in the core holdings, with an allocation of 5% to 7% of the investment portfolio.

• Incremental Entry Price Range: Gradually build positions between $14 and $15 per share to lower costs and risks.

• Holding Period Recommendation: It is advised to hold for more than 12 months to capture gains from the company's strategic adjustments and market recovery.

• Conditions for Increasing or Reducing Positions: If the company launches successful new products or significantly increases market share, consider adding to the position; if major negative events occur or the industry environment worsens, consider reducing the position.

• Profit Taking and Stop Loss Reference Points: Set the profit-taking point at $18 per share and the stop-loss point at $12 per share.

Short Term Trading (10% Position)

• Short Term Trading Opportunity Points: Focus on the support level at $14 per share and the resistance level at $16 per share, looking for breakout or rebound opportunities.

• Technical Signal Indicators: Pay attention to changes in the Relative Strength Index (RSI) and Moving Averages (MA) to determine buy or sell timing.

• Market Sentiment Indicators: Monitor the discussion heat on social media and investor forums to understand changes in market sentiment.

• Large Capital Flow Monitoring: Assess institutional investors' movements by observing trading volume and large transactions.

• Short-Term Risk Alerts: Be cautious of potential market volatility and internal company issues in the short term.

Risk Analysis

• Company-Specific Risk Factors: Recent software issues and product launch failures may impact brand reputation and customer loyalty.

• Industry Cycle Risks: The consumer electronics industry is significantly affected by economic cycles, and demand may fluctuate

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.