The debate on MSCI's removal of DAT

MSCI will decide in mid-January whether to remove DAT represented by MSTR from the index. Now we are entering a critical period of game theory. Last week, Strive, an asset management company owned by Vivik Ramaswamy (Vivik is a favorite of the Trump camp, and he co-founded Doge with Elon at the beginning of the year before leaving), published an open letter refuting MSCI. This week, MSTR also published an open letter in response to MSCI. Regardless of the outcome, I believe it is necessary to examine the logic and arguments of both sides, which will help us better understand crypto and, when facing traditional finance, identify the focus points and differences between the two sides.

Below are the main arguments of MSTR's open letter:

- Core Position

Argument: The exclusion rules proposed by MSCI lack neutrality, consistency, and foresight, artificially distorting the true picture of the global capital market.

Evidence: The fundamental mission of an index is to passively and objectively reflect the market performance of global listed companies, not to actively select companies that are "more comfortable morally or risk-wise."

MSCI has never excluded companies in the past due to their high proportion of a single asset (e.g., gold mining, energy, real estate trusts, etc.).

The 50% asset threshold for "digital asset treasury companies" this time is an unprecedented discrimination against a specific asset class.

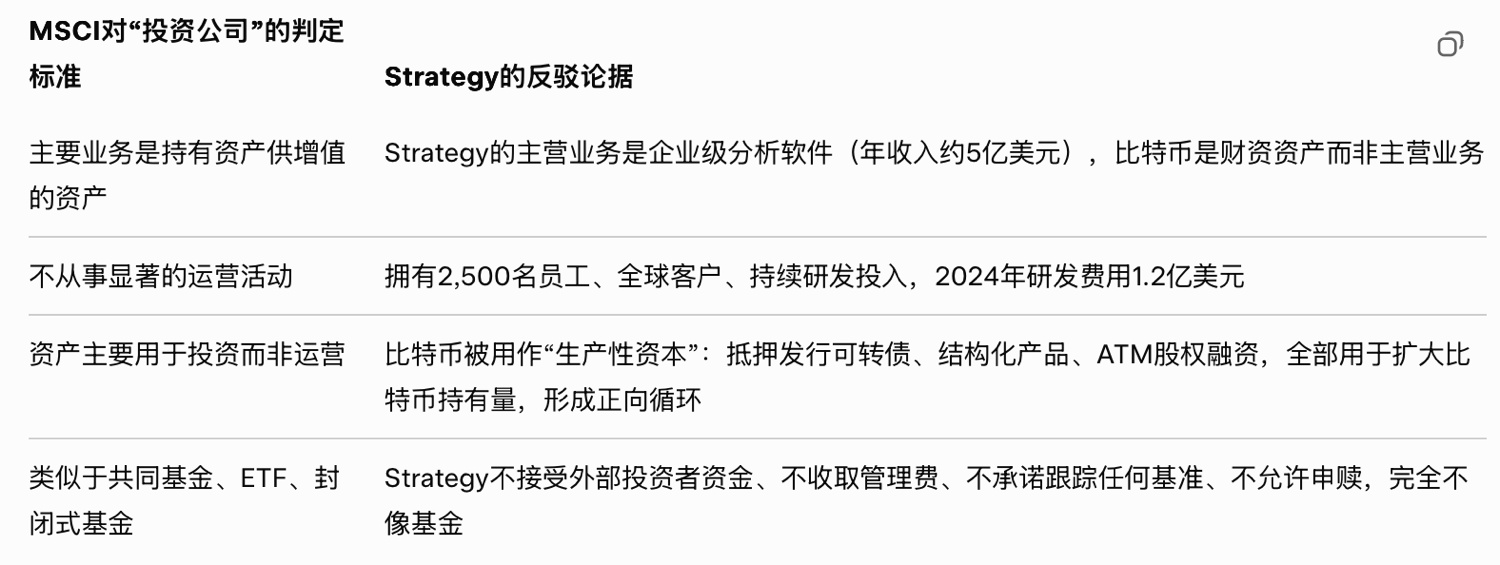

Argument 1: Strategy is not an investment fund but a hybrid operating company. MSTR repeatedly emphasizes that it does not meet MSCI's own definition of an "investment holding company/fund."

Specific evidence (point-by-point correspondence with MSCI's exclusion criteria):

Conclusion: Strategy is a hybrid of a "software company + innovative treasury strategy." Historically, MSCI has never excluded similar structures (e.g., tech companies with high cash holdings).

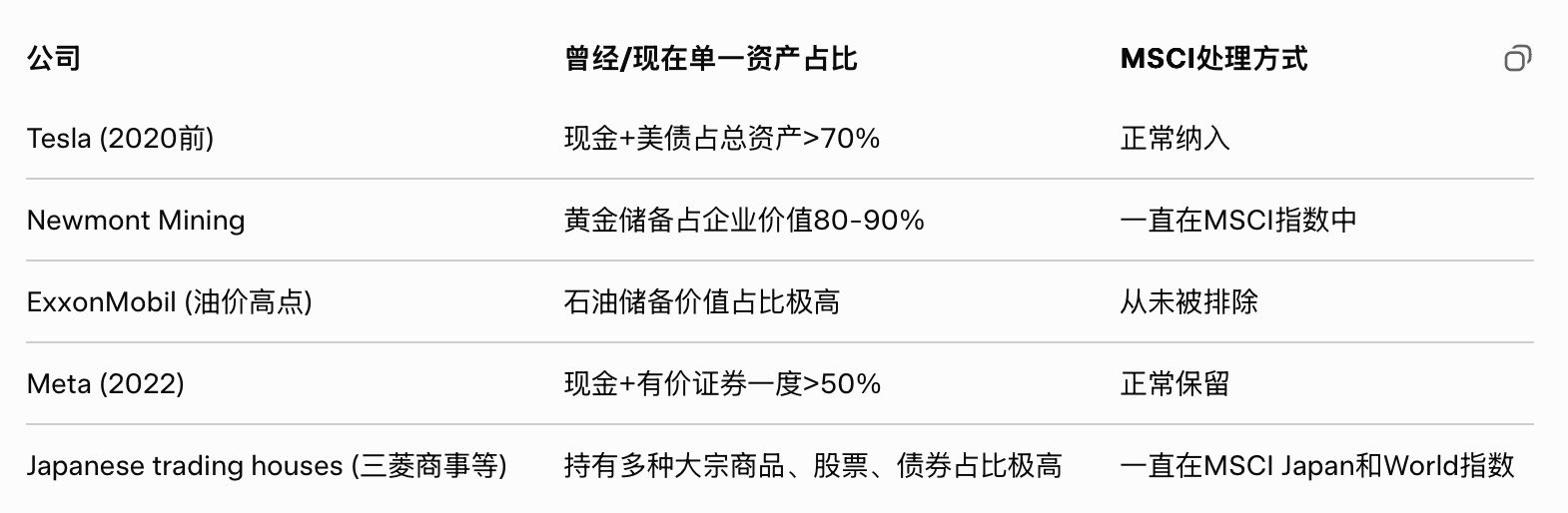

Argument 2: The exclusion rules violate MSCI's own methodological consistency

Citing numerous historical precedents to prove that MSCI has never excluded companies due to "high proportion of a single asset":

Argument 3: Bitcoin is already a globally recognized reserve asset. Excluding it would go against market evolution.

Listing the recognition of Bitcoin as a reserve asset by mainstream global institutions in 2024-2025:

- 11 U.S. states have passed or are about to pass "strategic Bitcoin reserve" bills;

- Listed companies in Japan (Metaplanet), Poland, Argentina, and other countries have followed the MSTR model;

- U.S. accounting standards have allowed fair value measurement of Bitcoin (since 2024). BlackRock, Fidelity, and other spot Bitcoin ETFs have accumulated over 1.5 million BTC;

- Central banks worldwide have net purchased over 800 BTC in 2024-2025 (for the first time).

Conclusion: The global capital market is treating Bitcoin as "digital gold," but MSCI is going against the trend, actively creating systemic bias.

Argument 4: The 50% threshold is completely arbitrary and lacks data support

MSTR refutes with data:

- MSCI's own research shows that there are numerous index constituents holding a single asset >50% (real estate, mining, energy).

- MSCI has never published any empirical research proving that "holding >50% digital assets" significantly increases index volatility or harms investability.

- Strategy's stock price has a 0.92 correlation coefficient with Bitcoin over the past 5 years, but its annualized volatility is only 8% higher than Bitcoin itself, far lower than many leveraged ETFs, yet it has never been excluded.

Argument 5: Exclusion will have severe negative externalities

- Forcing companies to sell Bitcoin to avoid the 50% threshold → short-term selling pressure → Bitcoin price drop → vicious cycle

- Hindering listed companies from adopting Bitcoin treasury strategies → slowing Bitcoin's mainstream adoption

- Sending a signal to global companies: holding Bitcoin will be punished by mainstream indices → violating market neutrality principles

Final Appeal

MSTR explicitly proposes three acceptable solutions, ranked by priority: Best: Completely withdraw the exclusion proposal for digital asset treasury companies and maintain the current rules.

Acceptable: Significantly raise the threshold to 80-90% and apply it to all asset classes (including gold, cash, real estate, etc.) to achieve true consistency.

Worst but tolerable: Provide existing DAT companies with at least 3-5 years of transition to avoid severe market shocks.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.