Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

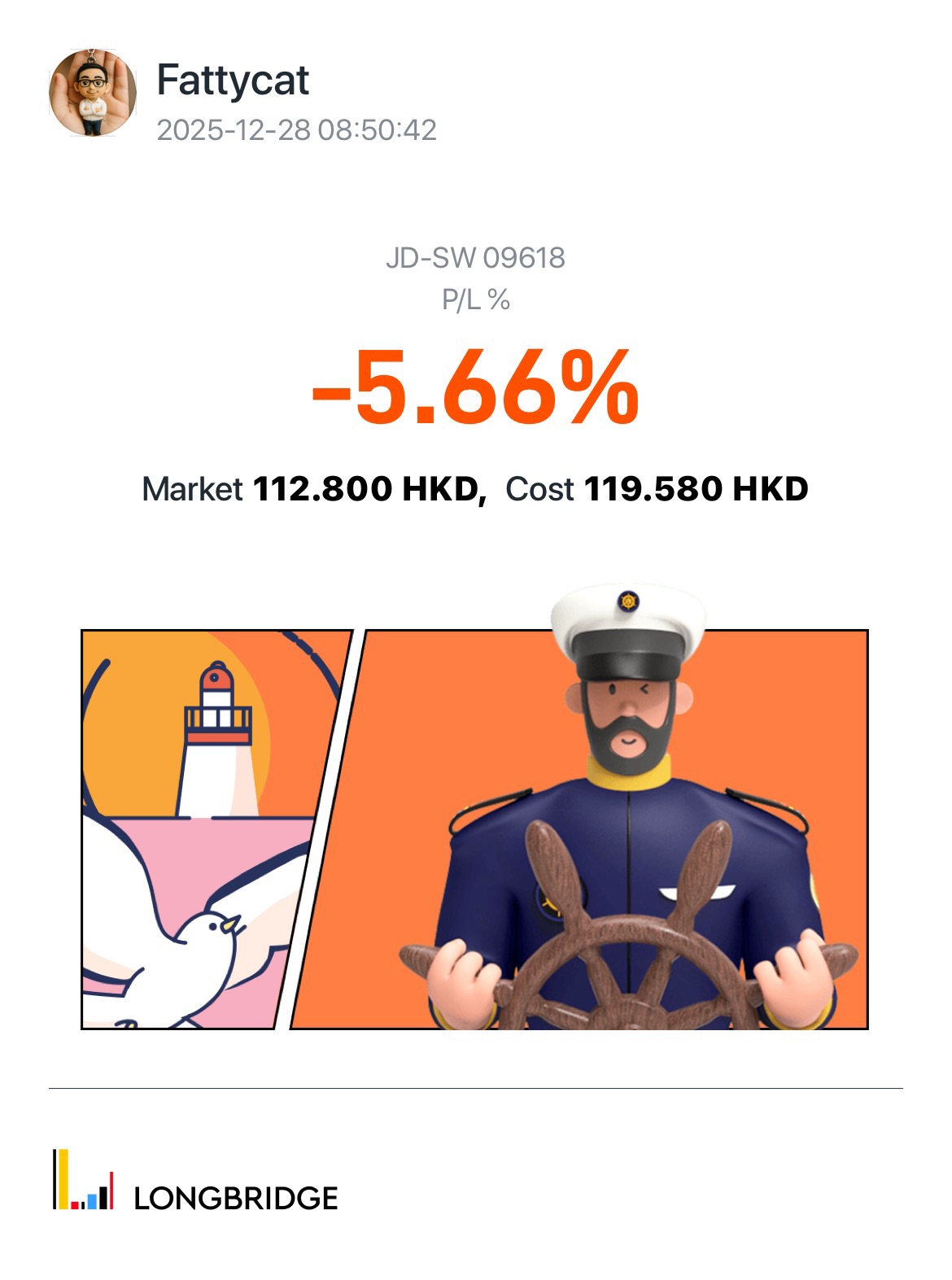

$Alibaba(BABA.US)as a former Alibaba employee, witnessed so many people joined the company when stock price is over 200, they wait for so many year hoping the price can go rally up, but every time is ...

actively started to learn n trade with longbridge on 2025..

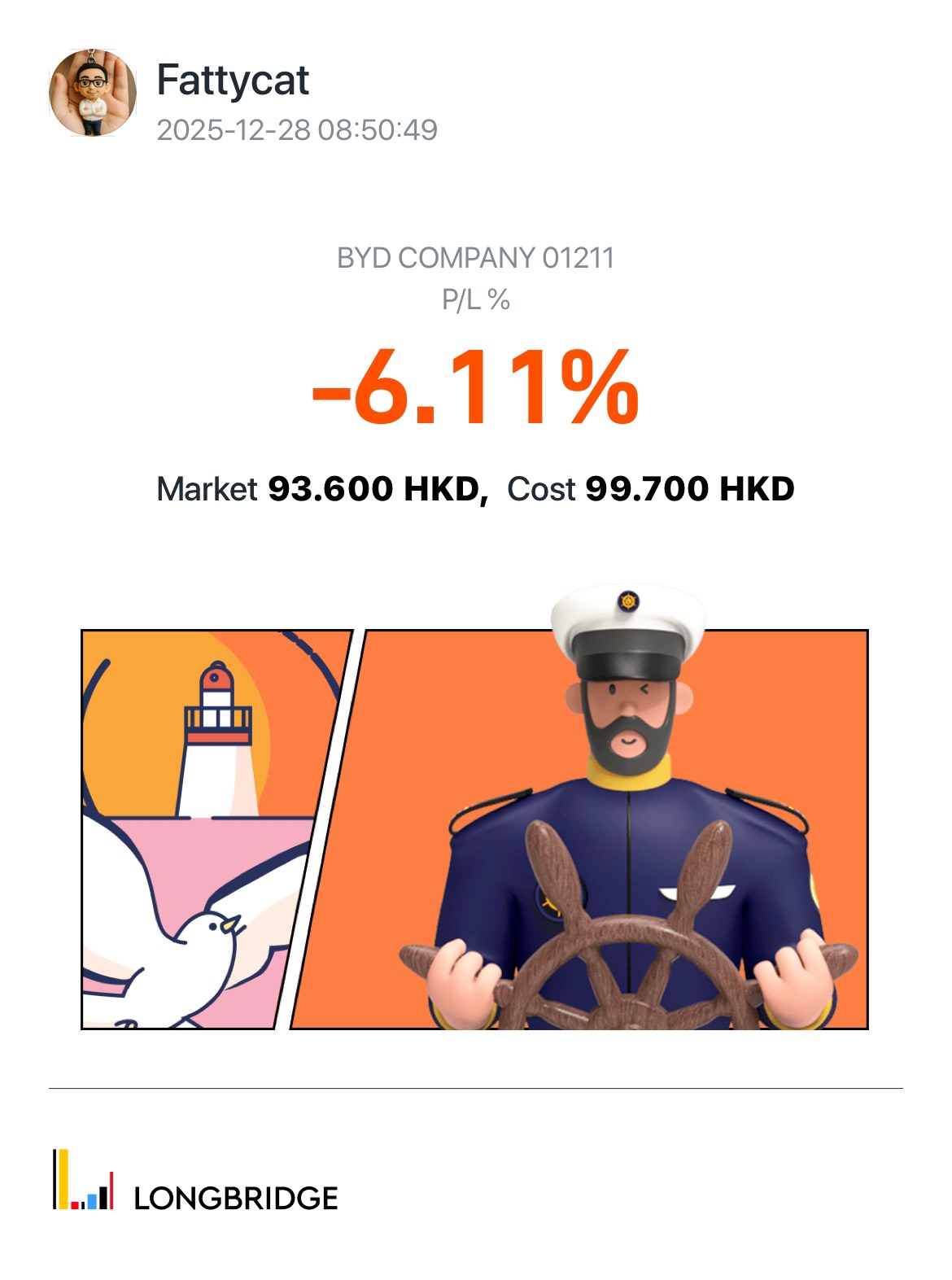

there is a lesson to be learnt for me. I have dabbled heavily on crypto before joining here. almost losing 70% on S coins.. now learning to t...

2025 Reflection:

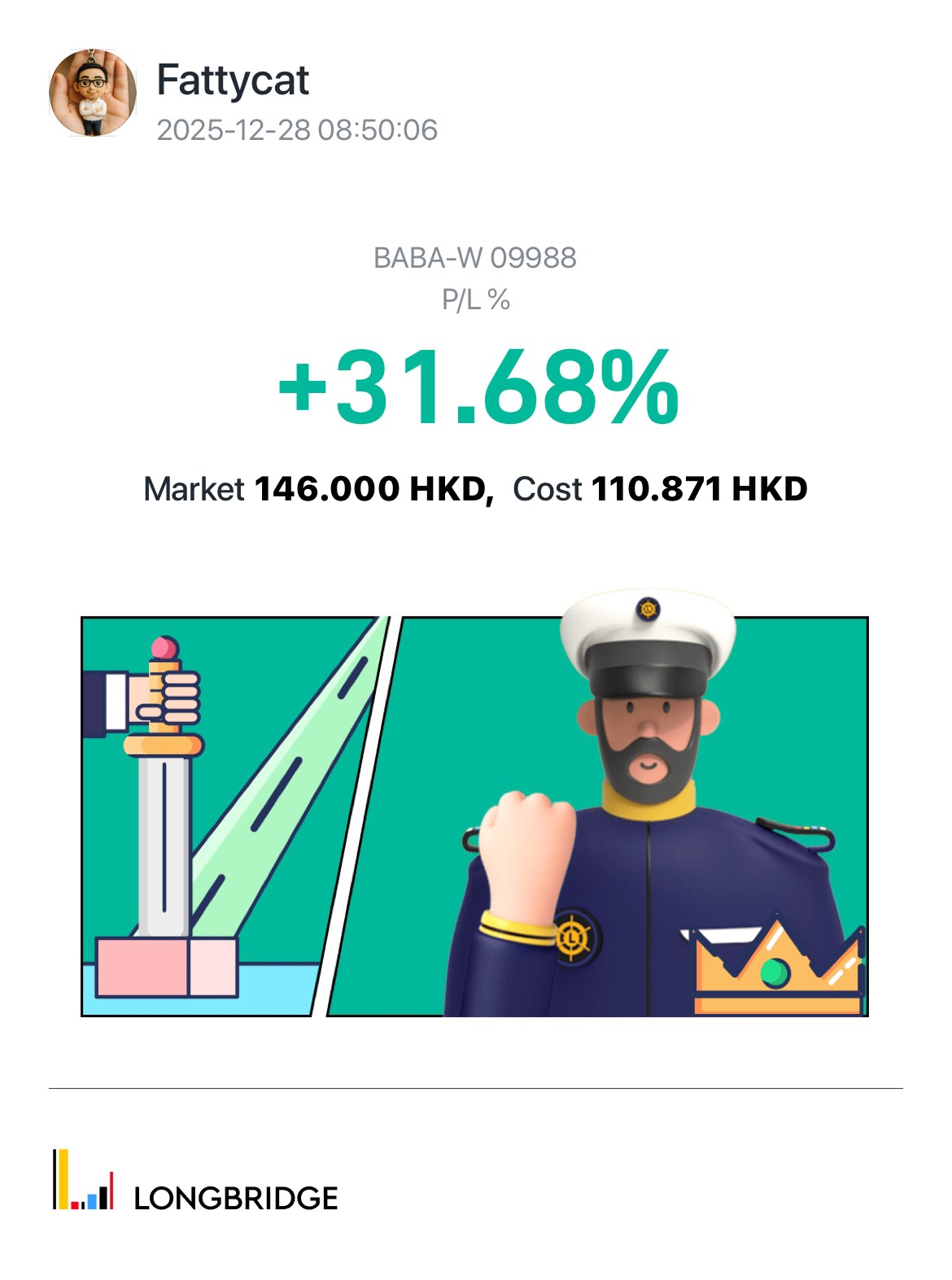

2025 was a strong year where I successfully locked in gains during the bull run. Learning value investing from a YouTuber , Master Leong. My $110 entry into Alibaba stands as my best “...

I'm excited by the upcoming Nvidia China deals next year. Even though Nvidia's Blackwell chips are not allowed to be sold to China, any deal is still better than no deal as China is a huge market.

Yes, I agree with the comments on Nvidia by @AetherCore. Nvidia has been quietly strategising and entering alliances with companies like Groq, OpenAI, Anthropic, Intel & Nokia. Nvidia is a $5 trillio...