$Hang Seng Index(00HSI.HK)has evolved into a hybrid market that reflects China’s economic cycle more than Hong Kong’s domestic fundamentals. Its performance is increasingly driven by mainland policy f...

$XTALPI(02228.HK) The first to rise in the Hong Kong stock watch list! Push it up!

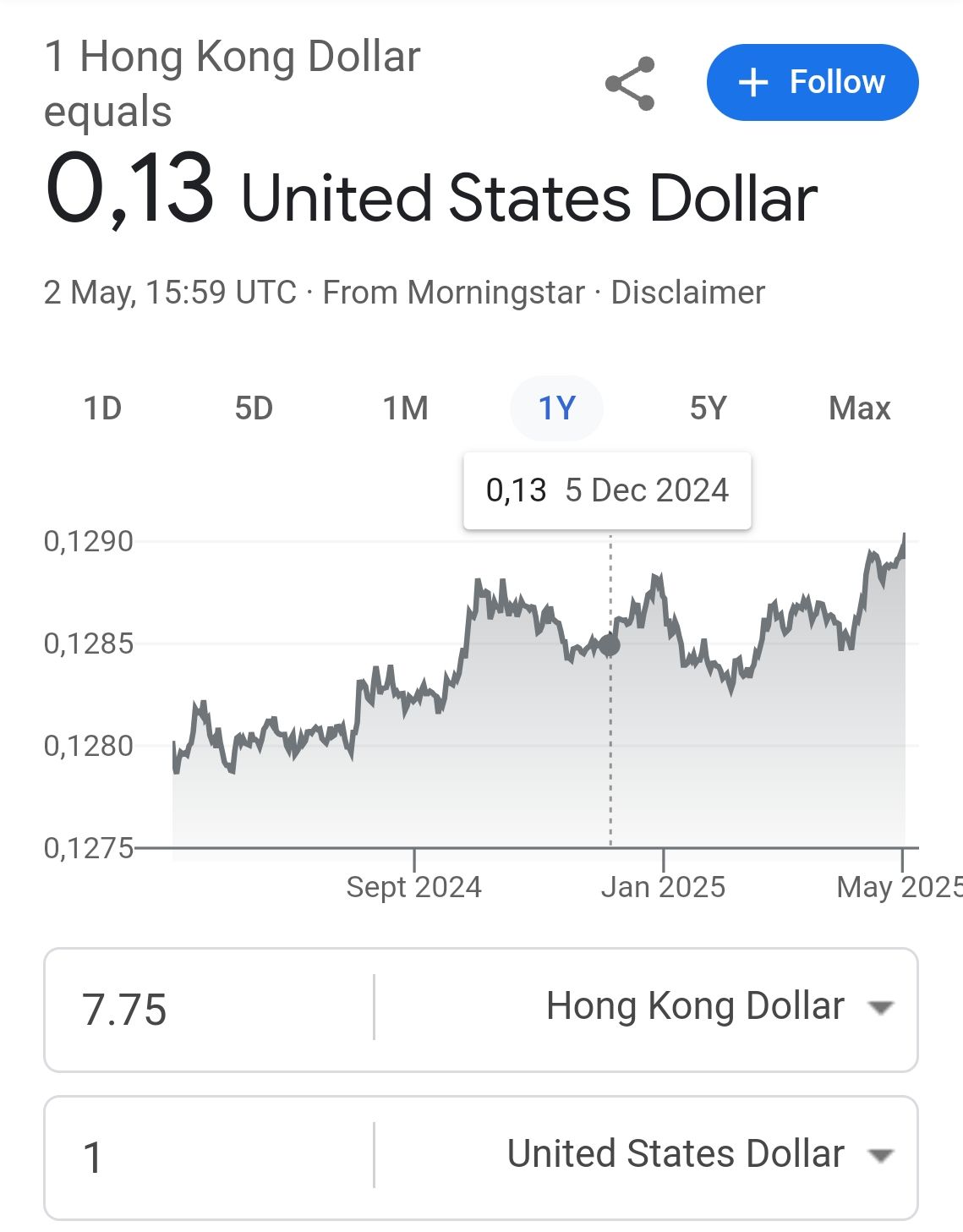

The exchange rate of HKD against USD is rising rapidly. Will there still be big opportunities in Hong Kong stocks? $Hang Seng Index(00HSI.HK) $Hang Seng TECH Index(STECH.HK)

While the US stock market hovers under the shadow of tariffs, the Hong Kong stock market is experiencing a liquidity-driven structural frenzy. But is this 'Hong Kong stocks feast' the beginning of a t...

$Hang Seng Index(00HSI.HK)

When the Hong Kong dollar triggers the strong-side convertibility undertaking, the Hong Kong government will be forced to issue Hong Kong dollars to buy US dollars (unless Ho...