Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

$Costco Wholesale(COST.US) is indeed worth considering. Using leaps call to deploy might be a good idea.

Below is Dolphin Research's full earnings call Trans for $Costco Wholesale(COST.US) FY26 Q1. For our First Take, see 'US Gov. shutdown victim? Is Costco's last leg down?'

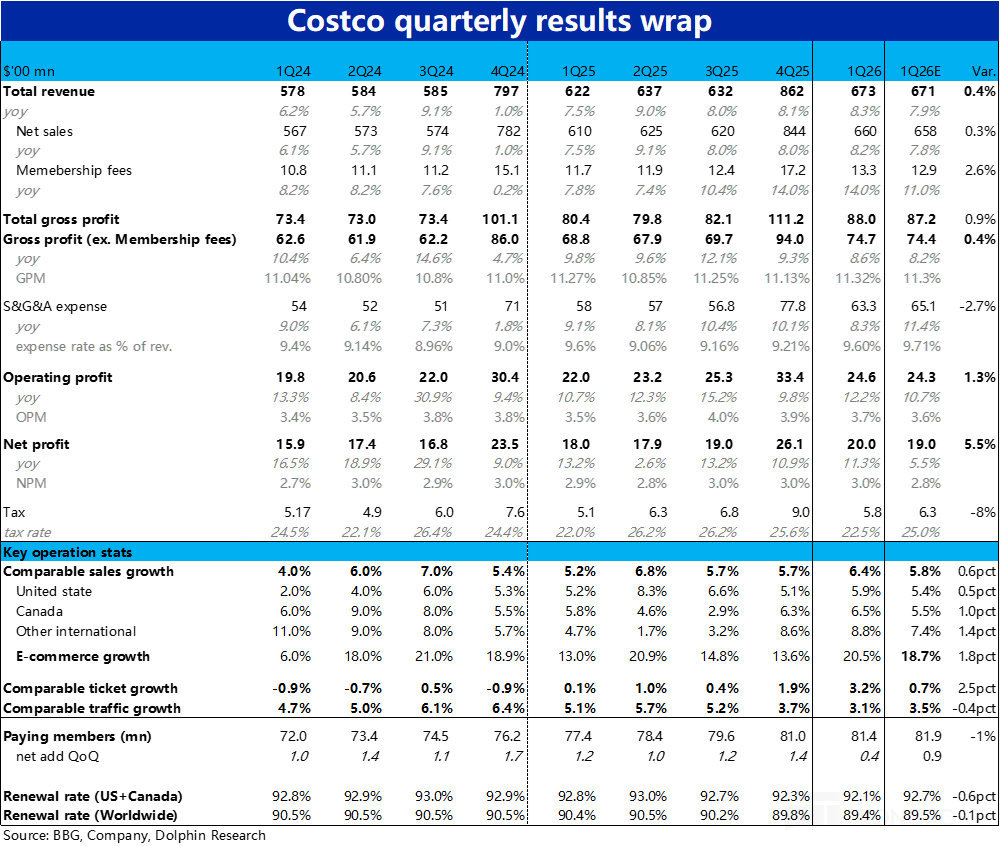

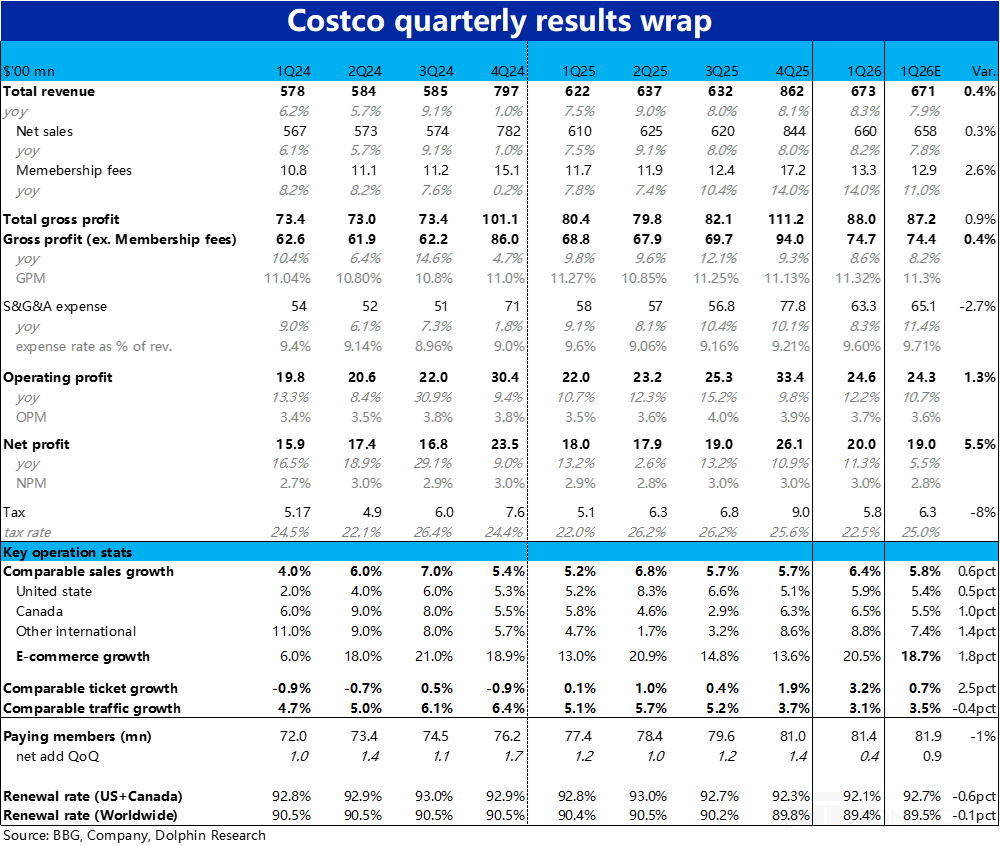

1) Key metrics recap. Headline...

The global discount retail leader — $Costco Wholesale(COST.US) — reported FY2026 Q1 results for the quarter ended Nov 23 after the U.S. close on Dec 11.

Overall performance was steady, with revenue and...............COST 1QFY26 First Take: Overall results remained solid.Top-line and OP YoY growth edged up QoQ and slightly beat consensus, a clear bright spot.

However, same-store traffic growth continued to slow and...

1211 | Dolphin Research Focus: 🐬 Macro/Industry 1) The Fed cut rates by 25bps to 3.50%-3.75%, the third cut this year, in line with market expectations. It also announced $40bn of short-dated Treasur...

.........