Li Auto 3Q25 Quick Interpretation: Dolphin Research's first glance at Li Auto's financial report can only be described as 'unbearable to look at,' with a significant drop in gross margin and net profit turning from a gain to a loss.

However, upon closer examination, it was found that the main culprit behind Li Auto's 'unbearable' quarterly financial report was the Mega recall event, which had a negative impact on the cost side, amounting to nearly 1.11 billion yuan.

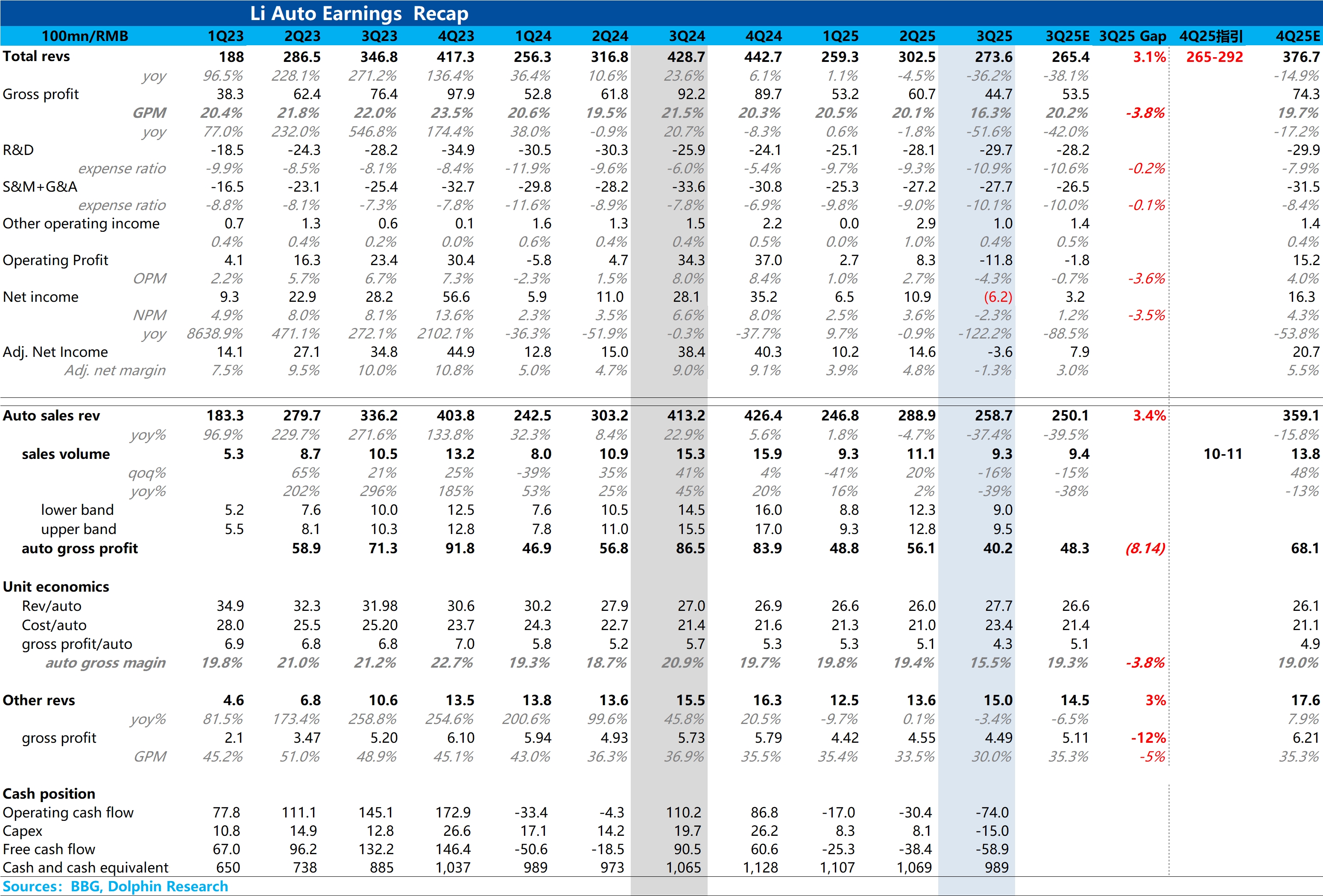

After accounting for the impact of this one-time event, Li Auto's 'real' gross profit for the third quarter was 5.58 billion yuan, with an overall gross margin of 20.4%. Both overall revenue and gross margin slightly exceeded market expectations. Therefore, excluding the impact of the Mega recall, the overall performance of the third-quarter financial report slightly exceeded market expectations.

Specifically:

Third-quarter vehicle sales revenue was 25.87 billion yuan, exceeding the expected 25 billion yuan. This was mainly due to the high prices of the i8 and Mega pure electric models, which raised the average selling price to 277,000 yuan, surpassing the market expectation of 266,000 yuan.

Excluding the negative impact of the Mega recall on the cost side, the vehicle sales gross margin for this quarter was 19.8%, up about 0.4 percentage points from 19.4% in the previous quarter. This performance was still acceptable, mainly due to the increase in the average selling price of vehicles, which offset the negative impact of the increase in per-vehicle amortized costs due to a quarter-on-quarter decline in sales volume.

Finally, driven by the quarter-on-quarter increase in the 'real' gross margin, although R&D expenses continued to increase, the 'real' net profit after excluding the impact of the Mega recall was 490 million yuan, slightly exceeding the market expectation of 320 million yuan.

However, Dolphin Research needs to remind that compared to the third-quarter performance itself, the market will be more concerned about the fourth-quarter guidance, and Li Auto's fourth-quarter guidance does not meet expectations.

According to the guidance, fourth-quarter sales guidance is only 100,000-110,000 units. Given that October sales were 32,000 units, the implied average monthly sales for November/December are only 34,000-39,000 units, significantly lower than the market expectation of 138,000 units. This indicates that the ramp-up speed of the i6, a popular model, is below expectations. More importantly, it implies that the sales of the L series extended-range models will decline significantly quarter-on-quarter compared to the third quarter, especially as Li Auto continues to increase discounts on the L series. The 'internal and external troubles' of the L series are more severe than expected.

With the i6 launching at a low price and the L series increasing discounts but still experiencing a significant quarter-on-quarter decline in sales, Li Auto's fourth-quarter vehicle sales gross margin is expected to remain under significant pressure. The specific outcome will depend on the guidance from the management. $Li Auto(LI.US) $LI AUTO-W(02015.HK)