BMNR recently appointed Young Kim as the company's CFO and COO, who is a fellow Korean of Tom Lee, with a very Wall Street-standard resume, educational background from MIT+HBS, professional experience...

0109 | Dolphin Research Focus. 🐬 Macro/Industry 1) HKEX announced it will add six stock options effective Jan 19, covering names such as Zijin Gold Intl, Laopu Gold, and Horizon Robotics.

The addition...

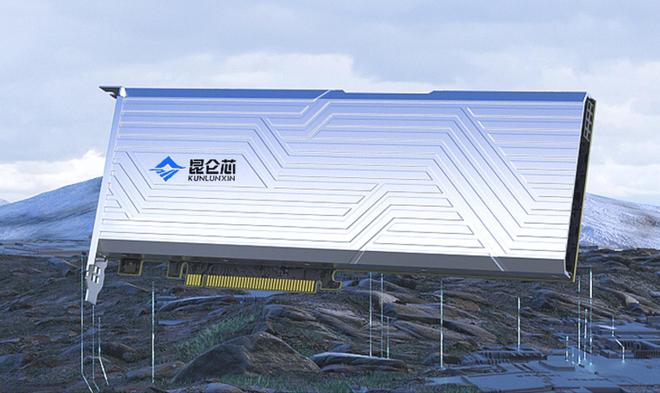

Long-rumored Kunlun Chip spin-off is now official as $Baidu(BIDU.US) announced it.

On Jan 2, BIDU proposed to spin off Kunlun Chip Technology for an independent listing on the HKEX Main Board, while re...

Bought some at HK35 and HK44 few months back. Hope to see HK70 soon. Bullish trending still in play.

Merry Christmas. Santa Clause Rally.

PIng An HK$70 target on its way…now trading at 66.20

$PING AN(02318.HK)