Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Nvidia H200 chips are already in use at China’s leading universities, military groups, research institutes and more in limited quantities, purchased through an active grey market in the nation, and bi............

China’s leading chip manufacturer, SMIC, has made progress on the road to 5nm with its latest production process, but “it remains significantly less scaled than leading commercial 5nm nodes offered by.........

$Intel(INTC.US)

CEO Tan Lip Bu has a fantastic track record of turning a business around. The metrics in the last few quarters clearly show the momentum.

Give him more time and he will deliver the profi...

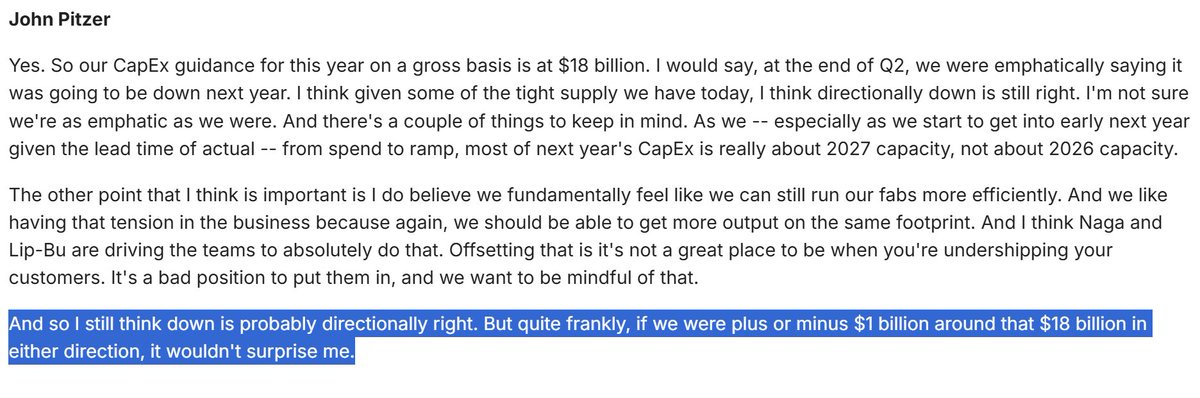

Intel's CY26 capex to remain nearly flat. More optimistic than previous guidance of above maintenance and $16B. Next year capex will be for 2027 capacity. Around which time Intel's external foundry bu...

I saw Intel opened below $40 this morning and thought, "Uh oh, is this bad?" But then it rallied so fast. I'm not sure what to make of those news about Ukraine-Russia missiles and chips—my brain can't...