Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

LightCounting: Sales of optical transceivers will rise 50% to over US$23 billion this year, led by Ethernet optical transceivers, $17 billion of the total, up 60% from last year, with active optical c...............

Nvidia has increased orders 35% for 800G optical communication modules in 2026 as optical begins to replace copper wires in AI data centers (“light in, copper out”), media report, noting Jensen Huang ..................

Interesting development for AI Data Centers.

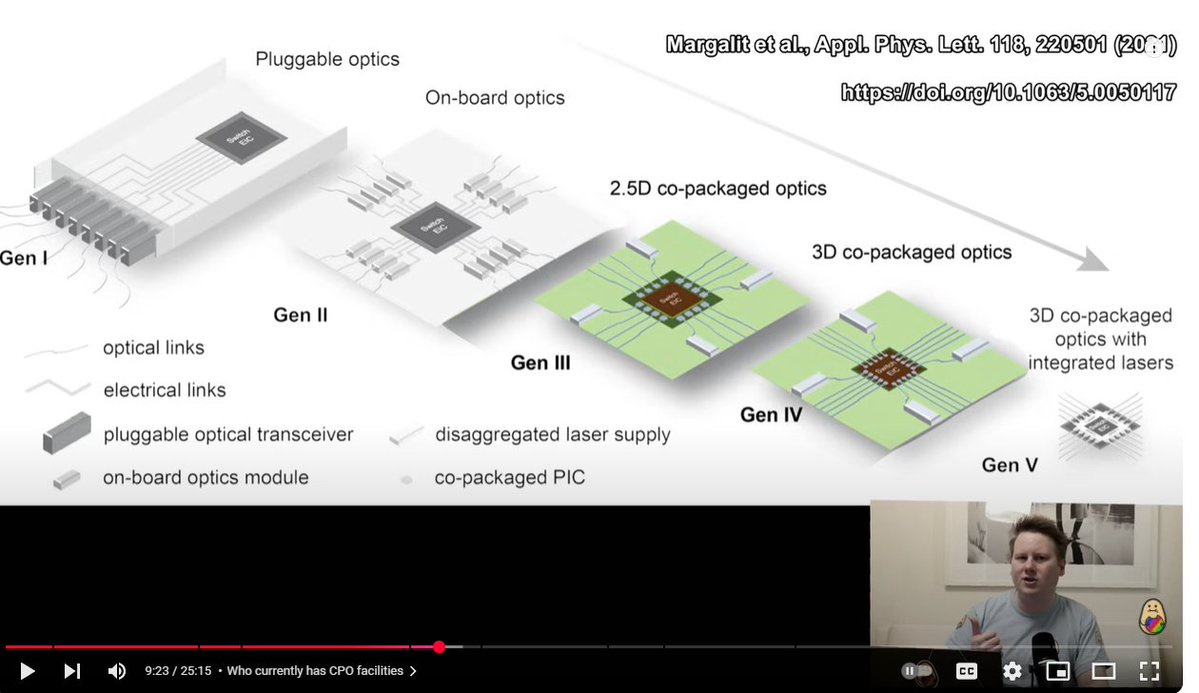

OCS (Optical Circuit Switch) is a data center switch technology which keeps data in the optical realm for longer and minimizes the amount of electro-optical..................This is an absolutely fantastic video explaining the evolution of co-packaged optics.

Sounds like it's inevitable, but 2.5D and 3D co-packaged optics won't hit HVM until 2027/8 at least.$Lumentum(LITE................Cerebras Systems and chip designer Ranovus have been awarded a US$45 million US military contract to develop co-packaged optics (CPO) for high speed connections for wafer-sized computing chips, Reuter...............