Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Li Auto releases AI glasses Livis; Micron exits retail storage business to focus on AI | Today's Important News Recap

1204 | Dolphin Research Focus: 🐬 Macro/Industry 1. The Beijing Consumer Association, in collaboration with eight major e-commerce platforms including JD.com, Meituan, Pinduoduo, Vipshop, Douyin, Kuai...

Reshaping the Global Industrial Landscape: In-Depth Strategic Evaluation Report of China's Top 10 Leading Enterprises Benchmarking Against Global Giants (2024-2025)

Why are there two Alibaba icons? 😂, I don't know either, Gemini, do you have any special thoughts? Executive Summary: A Historic Leap from Follower to Definer In the 2024-2025 cycle, as the global ec...

$Alibaba(BABA.US)The brutal e-commerce competition is taking its toll—Alibaba just got another reality check from the market 😅. The stock is down 3.53% over the past few days. Honestly, Alibaba‘s rev...

Nio's intelligent driving chip supplied externally for the first time; Nvidia's earnings report countdown|Today's important news review

1119 | Dolphin Research Key Focus: 🐬 Stocks 1, $Microsoft(MSFT.US), $NVIDIA(NVDA.US). Microsoft, NVIDIA, and AI startup Anthropic announced the establishment of a strategic partnership. Microsoft and...

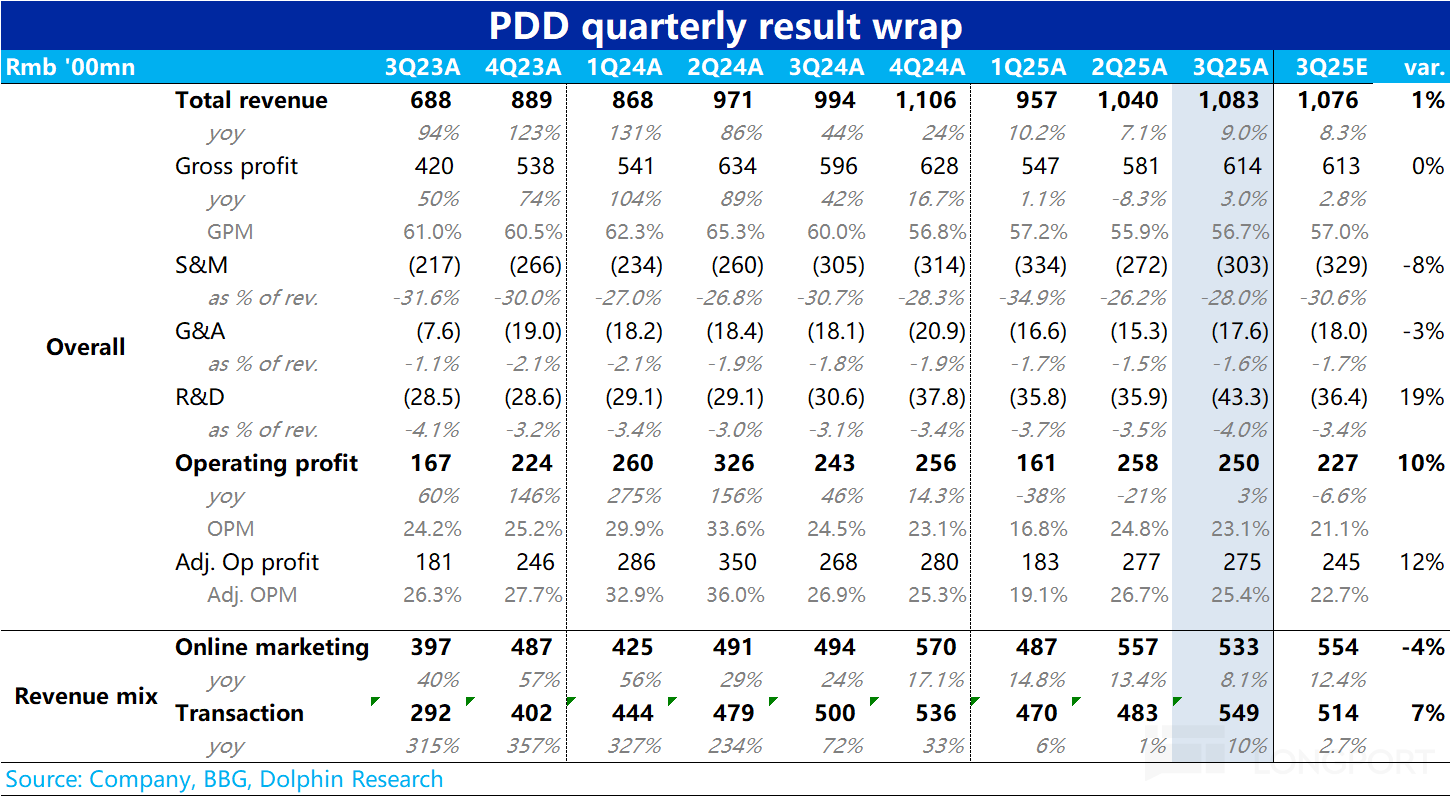

The following are the Minutes of the 3Q25 conference call for $PDD(PDD.US) organized by Dolphin Research. For the financial report commentary, please see "Pinduoduo's Embarrassment: Rapid 'Aging,' but...