Buffett's senior apprentice

Buffett's senior apprentice NVIDIA Diamond Holder

NVIDIA Diamond Holder👀👀👀👀👀

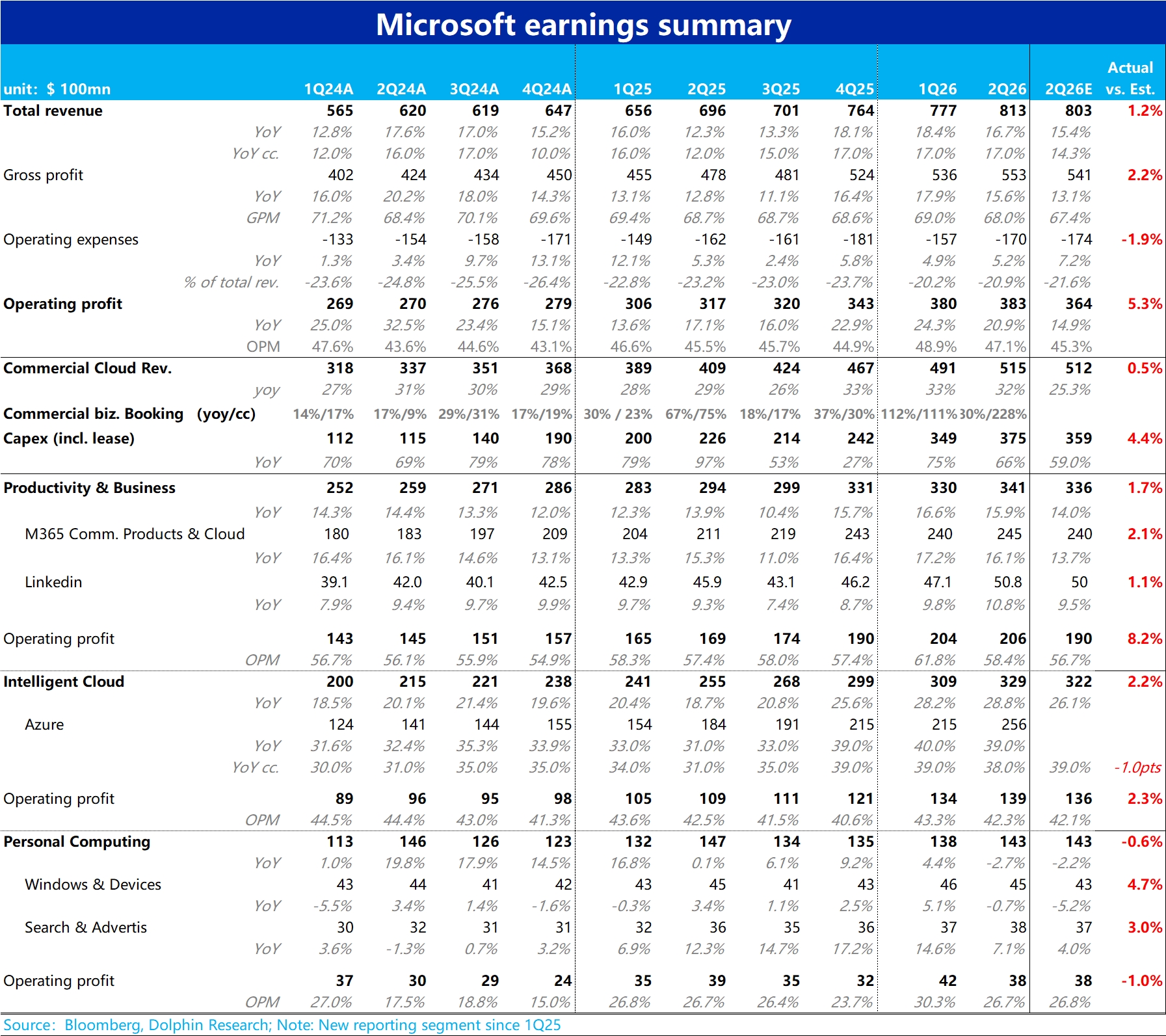

MSFT F2Q26 First Take. Overall, revenue, GP, and OP were solid, modestly ahead of prior guidance and the Bloomberg sell-side consensus.

The key watch was Azure’s unexpected slowdown, with growth at 38% cc. This appears to validate worries that, after the OpenAI partnership became less tight and as Google’s AI stack shows signs of catching up or overtaking, MSFT’s AI lead is eroding. The stock reaction post-print was weak.

1) Headline metrics held up: total revenue grew +17% YoY (cc), slightly ahead of expectations. GPM was pressured by Capex intensity, down 70bps YoY but better than feared. With tight opex control (up just +5.2% YoY), OPM expanded and OP rose +20.9% YoY, ~5ppt above estimates.

2) Azure slowdown matters: Azure grew +38% YoY (cc), above company guidance but below the market’s 39–40% bogey. It also marked the first QoQ deceleration in a year (-1ppt QoQ).

Dolphin Research views this as evidence that, as OpenAI shifted part of its compute to Oracle and CoreWeave, and as Google and Amazon rapidly close or surpass the AI gap, investors are questioning Azure’s moat and growth outlook. Concerns on its forward trajectory are rising.

3) Capex kept surging: total Capex incl. leases reached 37.5bn, maintaining the ~15bn YoY step-up. MSFT said 2/3, ~25bn, went to shorter-cycle assets such as GPUs (vs. 1/2, ~17.5bn, last quarter).

This is clearly positive for upstream semis. For MSFT, however, heavy Capex—especially on GPUs—has not translated into faster Azure growth; instead, growth slowed, rekindling ROI concerns on whether massive cloud buildout can earn sufficient returns.

4) RPO spike? Mostly OpenAI-related: RPO jumped ~230bn QoQ to 625bn, eye-popping at first glance. But as flagged last quarter by Dolphin Research, MSFT signed a ~250bn mega-deal with OpenAI, so this was not a surprise.

MSFT also disclosed that ~45% of total RPO, ~281bn, comes from OpenAI. The remainder from other customers grew just 28% YoY, a normal pace.$Microsoft(MSFT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.