Feed Explorer

Feed Explorer Rate Of Return

Rate Of ReturnThe fault tolerance of free cash flow is low, much lower than Google and Microsoft🤔 There's a trend of going ALL IN on AI, but Amazon has an unspoken "profit point"—replacing productivity with AI to lay off mid-to-high-level positions. Calculating 30,000 people at $150,000 per year, the "profit" recovered in a year would be $4.5 billion, and this number will keep increasing by 2026~🤔

200bn Arms Race: AMZN Raises the Bar in AI

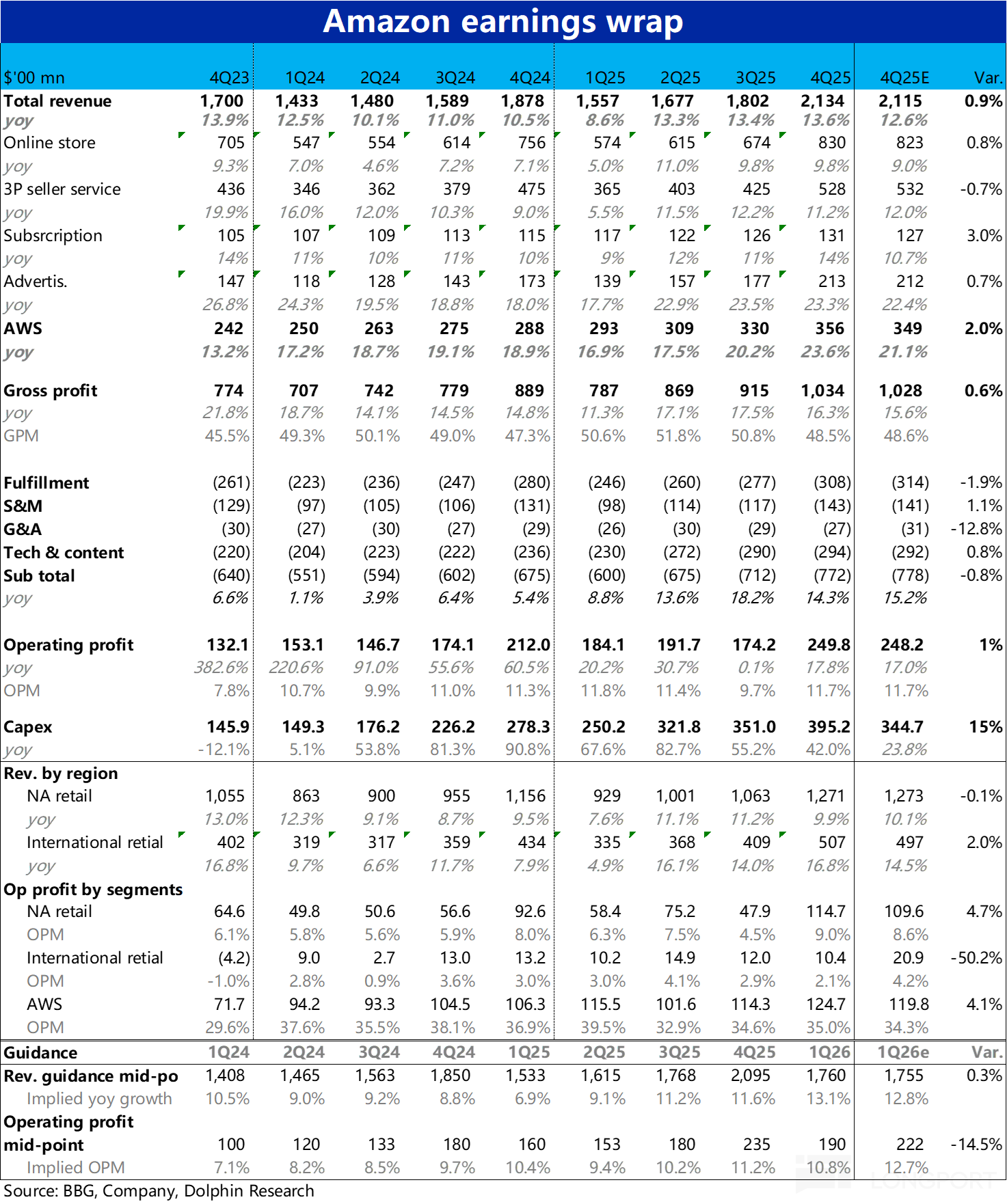

$Amazon(AMZN.US) reported Q4 2025 results after-hours on Feb 6 Beijing time. Overall, the quarter was solid with some blemishes. Revenue and OP came in slightly above estimates.

Core AWS growth accelerated meaningfully as expected. However, the market reaction was familiar—shares plunged despite decent prints.Specifically, 1) AWS accelerated as expected, with revenue up 23.6% YoY (similar on a constant FX basis). That represented a further 340bps acceleration vs. last quarter, and a cumulative 670bps pickup from early-year levels...The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.