Company Encyclopedia

View More

AKESO

09926.HK

Akeso, Inc., a biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide. The company develops AK104, a PD-1/CTLA-4 bi-specific antibody to treat cervical cancer, gastric cancer, lung cancer, liver cancer, and esophageal cancer; and AK112, a PD-1/VEGF bi-specific antibody to treat lung cancer, biliary tract cancer, head and neck squamous cell carcinoma, breast cancer, colorectal cancer, and pancreatic cancer. It is also developing AK117, a CD47 monoclonal antibody to treat myelodysplastic syndrome, acute myeloid leukemia, and recurrent or refractory classical Hodgkin lymphoma; AK109, a PD-1 monoclonal antibody to treat G/GEJ patients; penpulimab, a PD-1 for the treatment of recurrent or metastatic nasopharyngeal carcinoma (NPC); and tagitanlimab, a PD-L1 for treating recurrent or metastatic NPC. In addition, the company develops AK102, a PCSK9 monoclonal antibody to treat hypercholesterolemia and mixed hyperlipidemia; AK101, an IL-12/IL-23 monoclonal antibody to treat moderate-to-severe psoriasis and ulcerative colitis; AK111, an IL-17 monoclonal antibody to treat moderate-to-severe psoriasis and ankylosing spondylitis; and AK120, an IL-4R monoclonal antibody to treat moderate-to-severe atopic dermatitis.

1.377 T

09926.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

Hot Trades in Hong Kong Stocks (8.14) | Hang Seng Index Hits Four-Year High at Opening, Morgan Stanley Says Foreign Capital Accelerated Inflows into Chinese Stock Market in July

The Hang Seng Index opened higher, refreshing its nearly four-year high; Tencent's performance exceeded expectations, receiving collective bullish calls from major banks; Chip stocks strengthened on t...

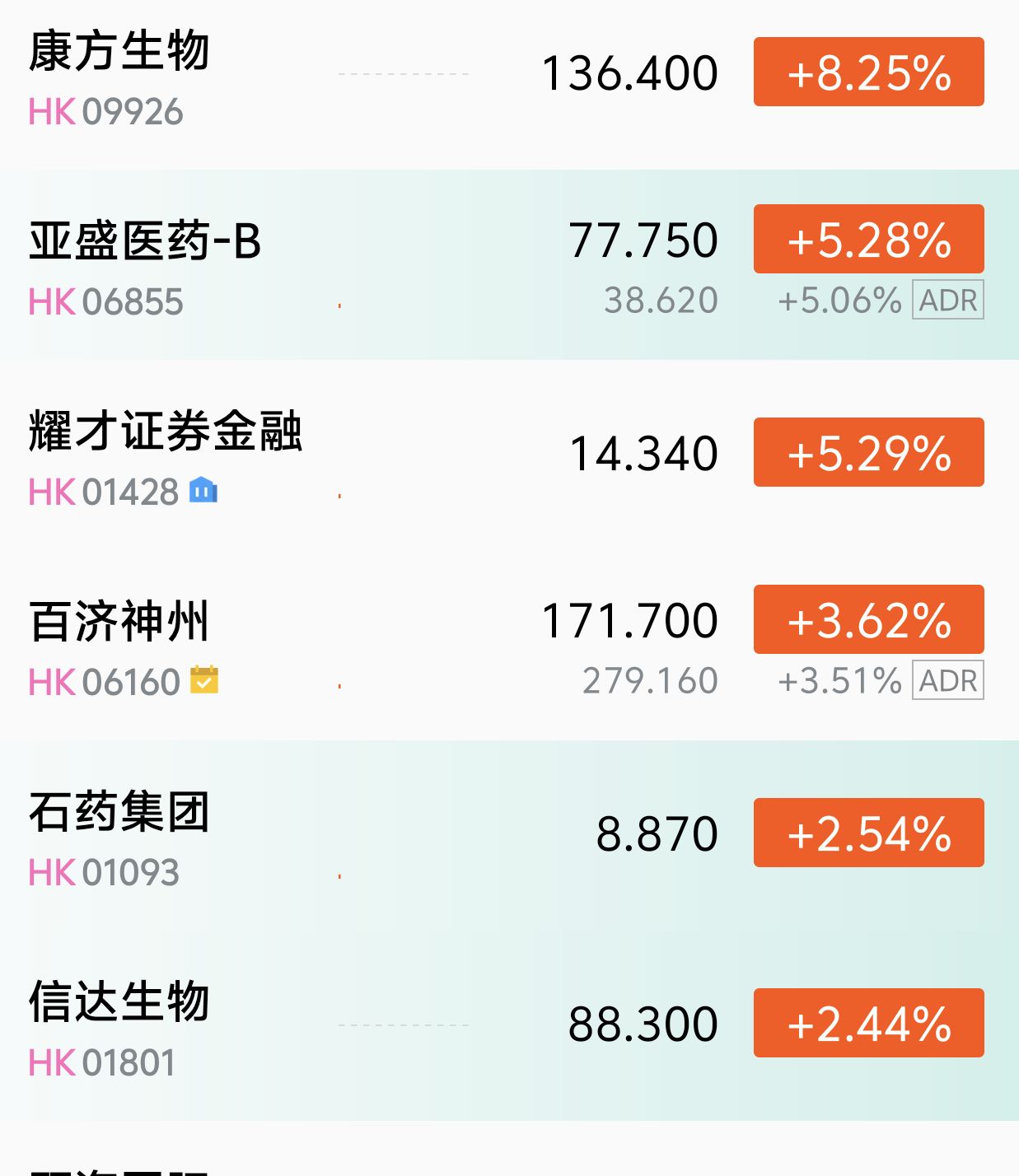

Another day where biotech stocks stand out in the Hong Kong market $AKESO(09926.HK) sold too early, lacking vision.

In my Hong Kong stock watchlist, it's another day for innovative drugs. $AKESO(09926.HK) was sold too soon, missing a 40% gain.

Hong Kong stocks' innovative drugs surge 66%! Three major catalysts ignite the 'golden track', can we still get on board in the second half of the year?

Hong Kong stocks' innovative medicine sector surges 66%, three-pronged approach ignites the golden track

The Hang Seng Index is approaching its highest level in nearly 3 years, with Chinese brokerage, insurance, and stablecoin concept stocks remaining hot!

On July 11, the three major stock indices in Hong Kong rose together. In terms of sectors, technology stocks rose collectively, and securities and brokerage stocks mostly increased.