Company Encyclopedia

View More

Doximity

DOCS.US

Doximity, Inc. operates as a digital platform for medical professionals in the United States. Its platform provides its members with digital tools built for medicine, that enables its members to collaborate with colleagues, stay up to date with the latest medical news and research, manage their careers and on-call schedules, streamline documentation and administrative paperwork, and conduct virtual patient visits. The company primarily serves physicians, nurse practitioners, physician assistants, medical students, pharmaceutical manufacturers, and healthcare systems.

64.63 B

DOCS.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

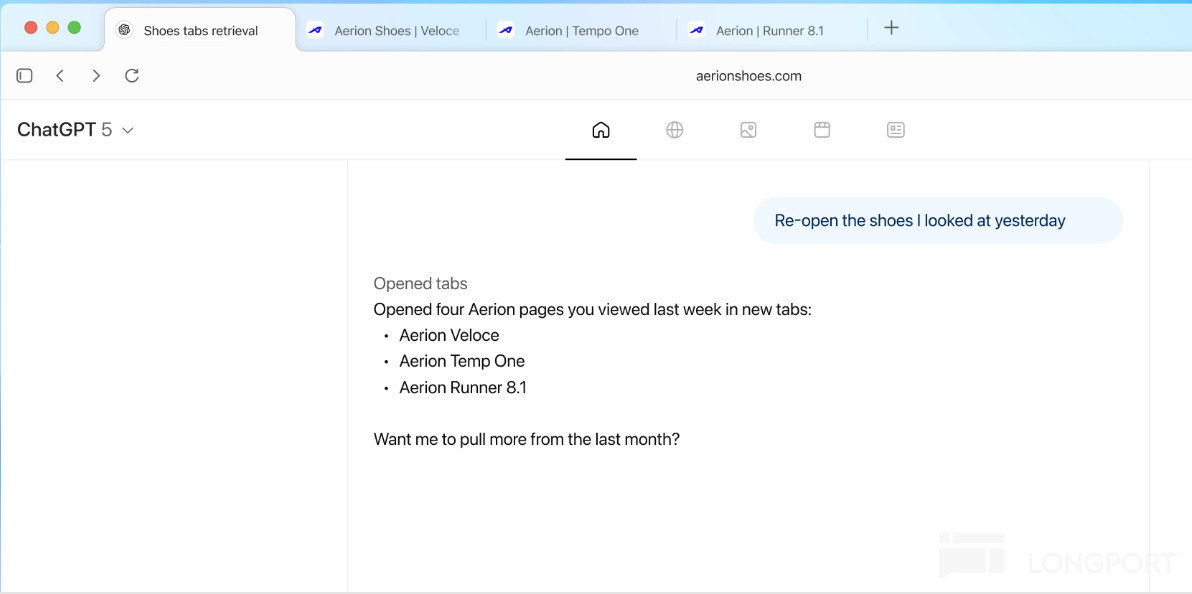

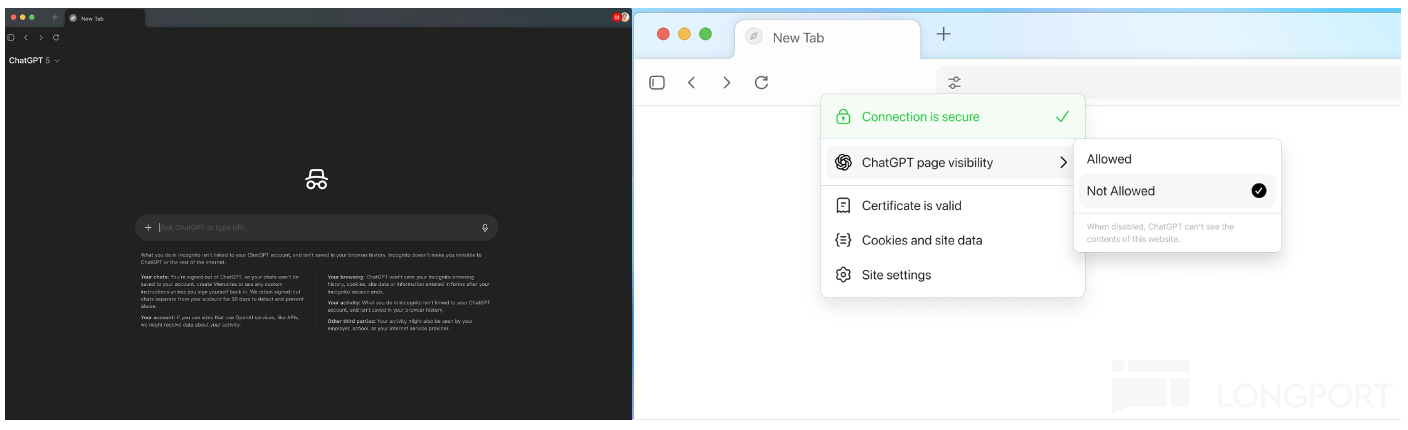

OpenAI has been incredibly busy lately, dabbling in e-commerce, social media, and now launching a browser. Emmmm... it seems they've made enemies with half of the 'Seven Sisters.' Dolphin Research can......