Company Encyclopedia

View More

Phunware

PHUN.US

Phunware, Inc., together with its subsidiaries, provides integrated software platform that equips companies with the products, solutions, and services to engage, manage, and monetize their mobile application portfolios in the United States and internationally. It operates through two segments: software subscriptions and services and advertising. The company’s products and services include mobile software and application transaction solutions comprise integration of software development kit (SDK) licenses, which consists of analytics that offers data related to application use and engagement; content management that allows application administrators to create and manage app content in a cloud-based portal; alerts, notifications, and messaging, which enables brands to send messages; marketing automation that enables location-triggered messages and workflow; advertising; and location-based services, such as mapping, navigation, wayfinding, workflow, asset management, and policy enforcement. It is also involved in the integration of its SDK licenses into existing applications maintained by its customers, as well as custom application development and support services; and provision of cloud-based vertical solutions for healthcare, retail, sports, aviation, real estate, hospitality, education, and other applications, as well as application transactions, including re-occurring and one-time transactional media purchases for application discovery, user acquisition and audience building, audience engagement, and audience monetization.

2.707 T

PHUN.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

💤 While Singapore slept, the U.S. markets were buzzing with some major moves. Here’s your quick but juicy rundown of what happened and what it could mean for your watchlist:

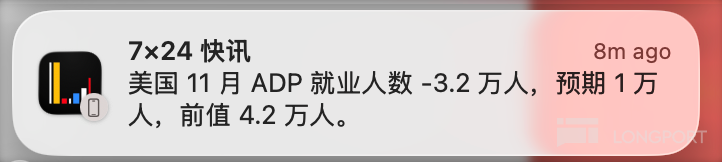

$Tesla(TSLA.US) $iShares Bitcoin Trust ETF(IBIT.US) Yes, this data is completely authentic, just released by ADP at 8:15 AM ET today (December 3, 2025). The confirmed figures are as follows (identical...

Last night’s U.S. session was packed with moves and news. Here’s what caught our attention:

Donald J. Trump Truth Social 11.28.25 07:22 AM EST

Tariffs have made our Country Rich, Strong, Powerful, and Safe. They have been successfully used by other Countries against us for Decades, but when i...$AT & T(T.US)rump Media & Tech.US DJT is fluctuating so wildly today—the trading action is as changeable as Trump's moods, one moment at $11 and then shifting the next. With a market cap of over $3B, ...