Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

MSFT, GOOGL and other giants rally behind US 'Project Genesis'; TikTok US plan finalized | Daily News Recap

1219 Dolphin Research Focus: 🐬 Macro/Industry.

BOJ raised its policy rate by 25bps to 0.75%, in line with market expectations, marking a 30-year high and the second hike within 11 months since Jan 202...

Elon Musk reveals new information about Tesla AI5; CDF plans its first interim dividend | Today's Important News Recap

1105 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. China has made adjustments to its tariff policy on the United States, announcing the suspension of the previously imposed 24% tariff rate on cert...

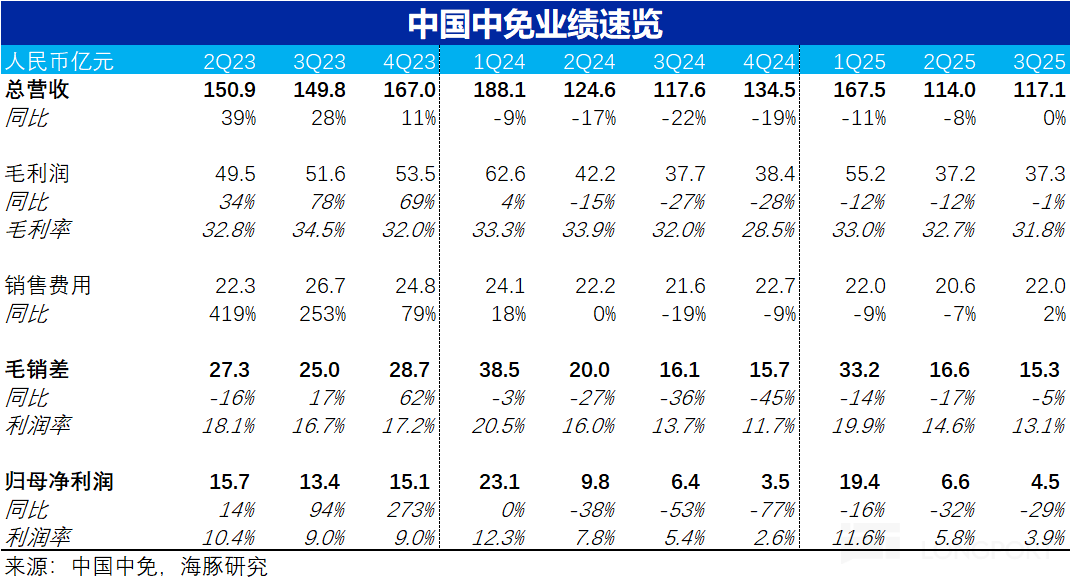

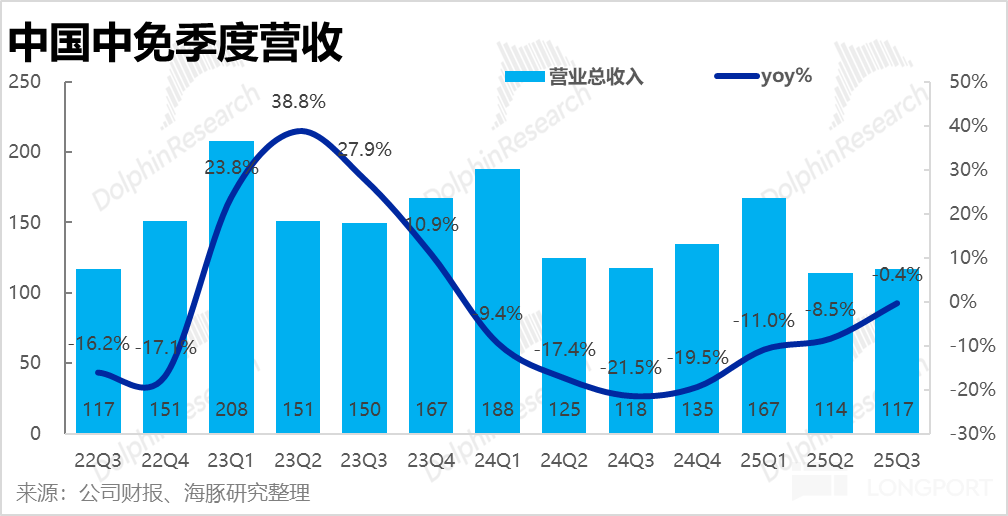

A few days ago, China Duty Free Group (CDFG) released its Q3 2025 financial report. Due to previous conflicts with other financial report release times, Dolphin Research is providing a brief commentar...

The US-China meeting ends with market volatility; Google and Meta experience 'two different worlds' after hours | Today's Important News Recap

1030 |Dolphin Research Focus: 🐬 Macro/Industry 1. On October 29th, Eastern Time, the Federal Reserve announced its second rate cut of the year by 25 basis points, lowering the interest rate range to ...

Micron to Stop Selling Server Chips to Chinese Data Centers; Meta Plans to Raise $30 Billion to Build Data Centers | Today's Important News Recap

1017 | Dolphin Research Focus: 🐬 Macro/Industry 1. Shares of two U.S. regional banks plummeted due to loan fraud and bad debt issues, with the regional bank index posting its worst performance since ......