Company Encyclopedia

View More

SANHUA

02050.HK

Zhejiang Sanhua Intelligent Controls Co.,Ltd engages in the research, manufacture, and sale of refrigeration and air-conditioning electrical parts, and auto parts in China and internationally. Its products include valves, four-way reversing valves, electronic and thermal expansion valves, solenoid valves, micro-channel heat exchangers, omega pumps, electronic water pumps, energy vehicle thermal management integrated components, and accumulators. The company’s products are used in air conditioners, refrigerators, cold chain logistics, and dishwashers, as well as automobiles and other fields. Zhejiang Sanhua Intelligent Controls Co.,Ltd was founded in 1994 and is headquartered in Shaoxing, China.

577.46 B

02050.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

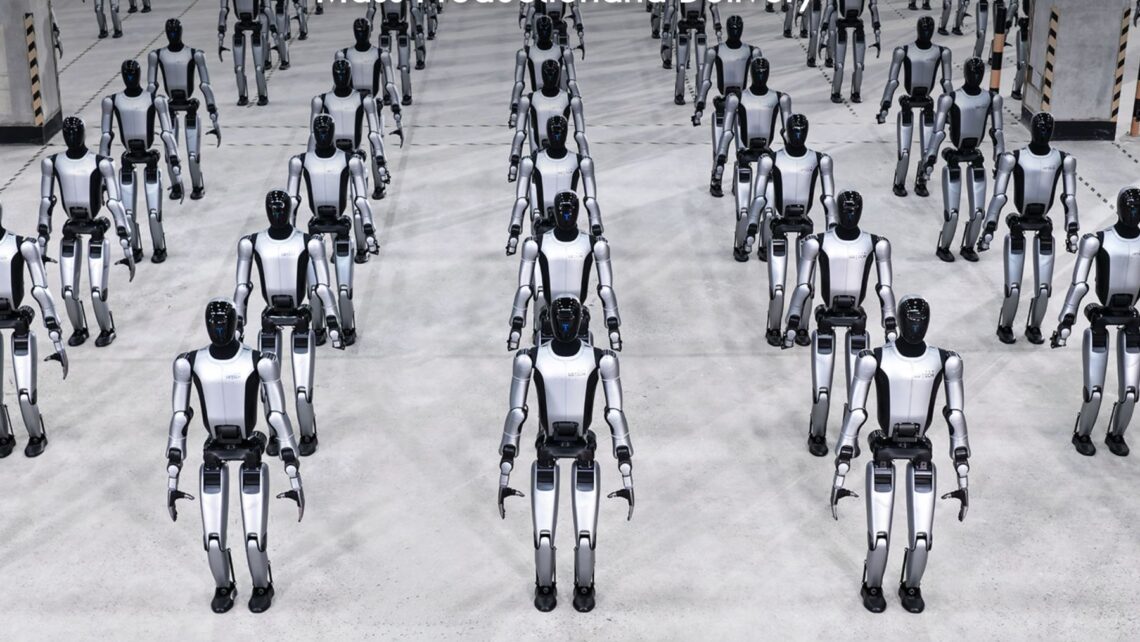

Entering 2025, three years into the OpenAI-led AI cycle, the industry remains in a full-on AI investment phase. Based on our recent work, Dolphin Research sees 2026 hinging on compute cost-down and on...

......$SANHUA(02050.HK) MS worked hard to support the market today, but it feels like it will follow the same trend as Haitian starting tomorrow...

$SANHUA(02050.HK) Deposited 2 million in the morning, aiming for these 17 cornerstone investors.