Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Taiwan AI server giant Quanta Computer will invest another NT$1.5 billion (US$50M) to expand capacity at an AI server plant in Tennessee, USA, media report, as its global AI production capacity is nea............

PC giants Lenovo, Dell and HP all warned the AI boom is using up memory chips, leading to tight global supplies next year, media report, citing Lenovo’s CFO saying the cost surge is “unprecedented” an...............

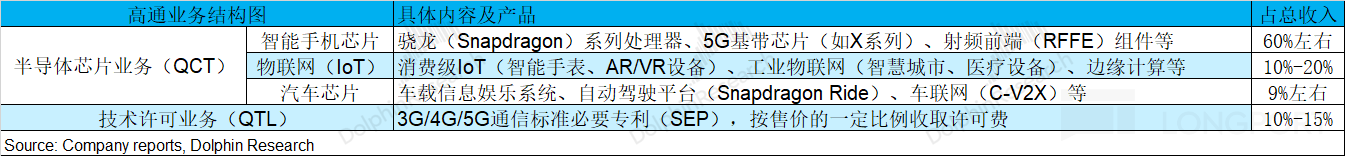

Qualcomm (QCOM.O) released its financial report for the fourth quarter of fiscal year 2025 (ending September 2025) after the U.S. stock market closed on the morning of November 6, 2025, Beijing time. ...

Some of the Layoffs Across Corporate America.

• UPS: 48,000 employees• Amazon: 30,000 employees• Intel: 24,000 employees• Accenture: 11,000 employees• USPS: 10,000 employees• Microsoft: 9,000 employee........................................................................................................................The PC market faces rising memory chip prices and tight CPU supplies, but Acer Chairman Jason Chen said he still expects demand in the 2nd half of 2025 to be better than the first due to seasonal fact...............