In the previous report, we reviewed Sanhua Intelligent Controls’ growth trajectory and core product lines.

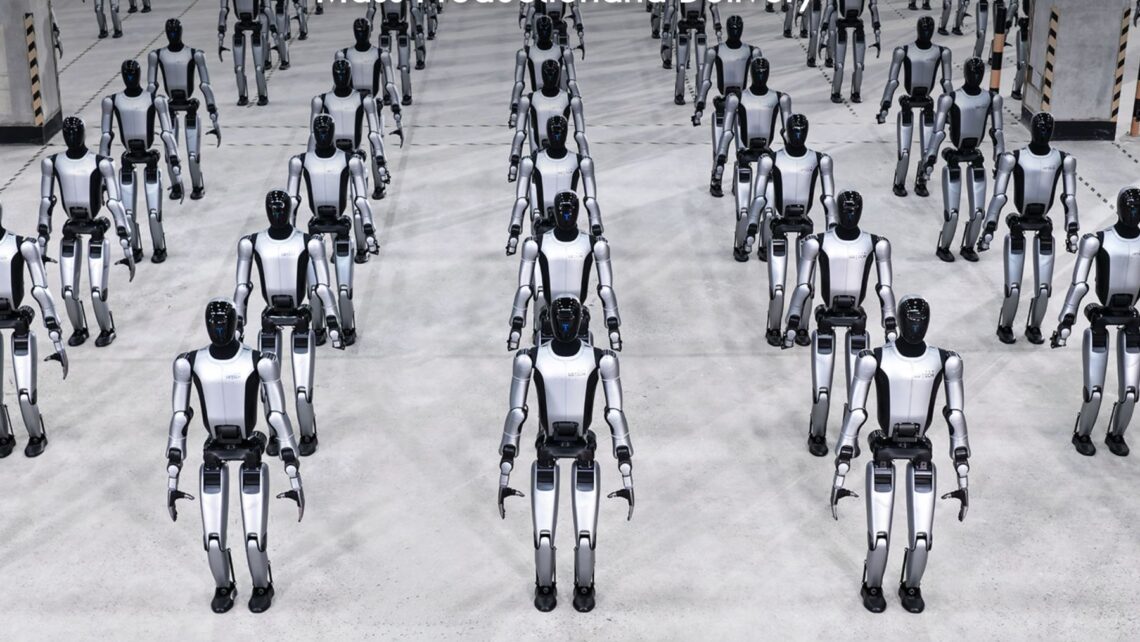

In this piece, we look ahead to assess Sanhua’s runway in data-center thermal management and h...Any deep dive into the humanoid robot supply chain has to cover Sanhua Intelligent Controls.

To unpack its core capabilities, we mapped the company in detail; as the first note in the series, we focus......2026 is also the year of optical communication. The global optical module market is expected to grow by 35% annually, with silicon photonics solutions + CPO networks set to double explode.

Below is a l...

In the prior piece, Dolphin Research reviewed Meitu's history, product suite, and competitive landscape in depth. This follow-up focuses on Meitu's growth potential.

1) Will large models eat Meitu's lu...

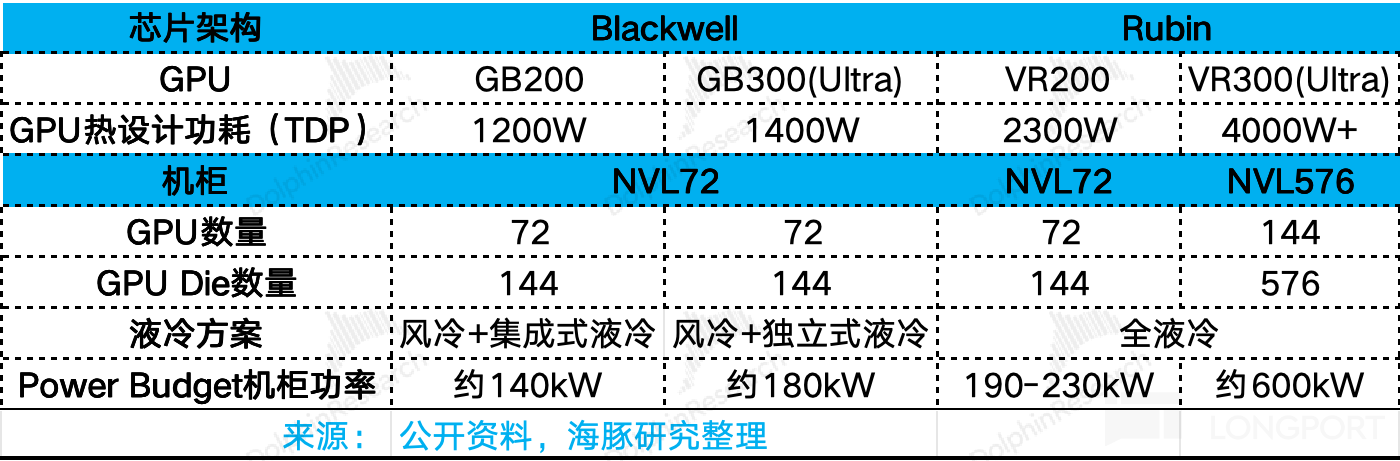

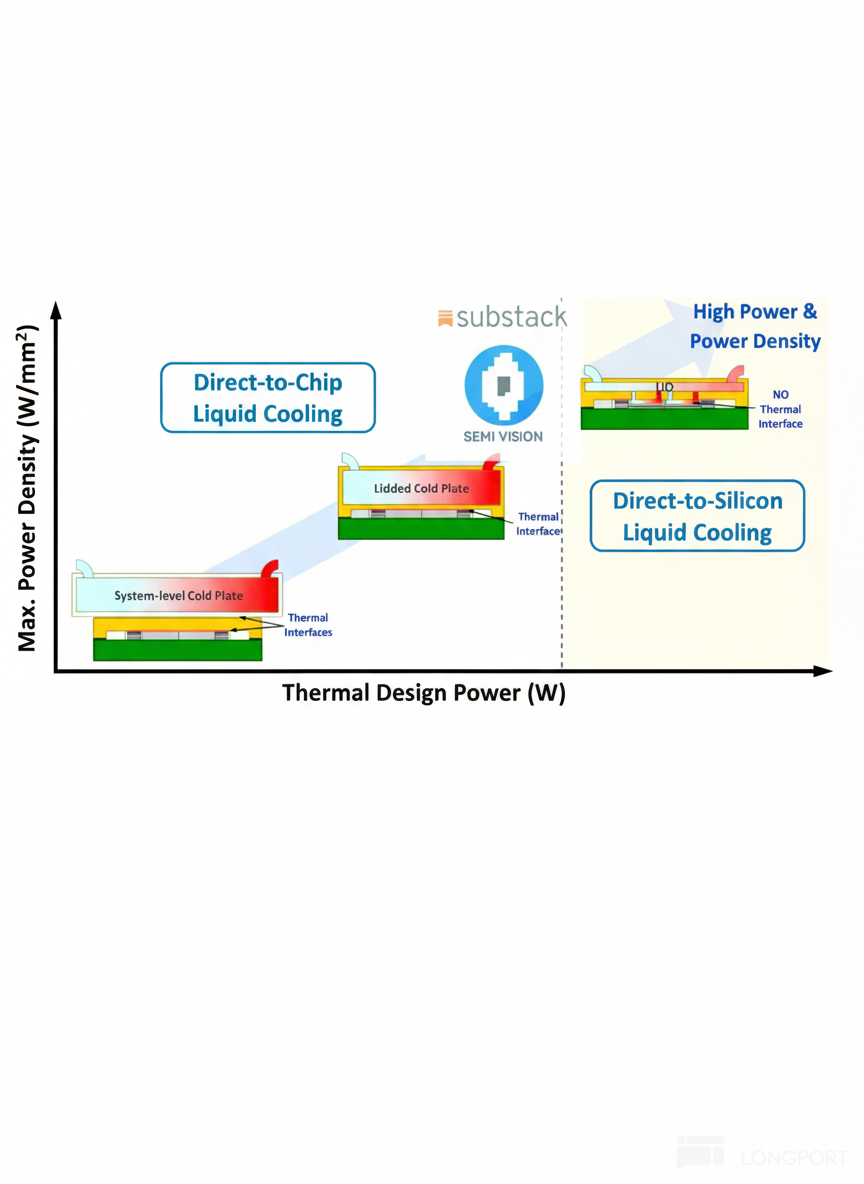

Entering 2025, three years into the OpenAI-led AI cycle, the industry remains in a full-on AI investment phase. Based on our recent work, Dolphin Research sees 2026 hinging on compute cost-down and on...

......