Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

While we don’t currently own $Tesla(TSLA.US), many on X mischaracterize my TSLA views as bearish even though I have reiterated almost daily for months that “the next major $Tesla(TSLA.US) catalyst is ......

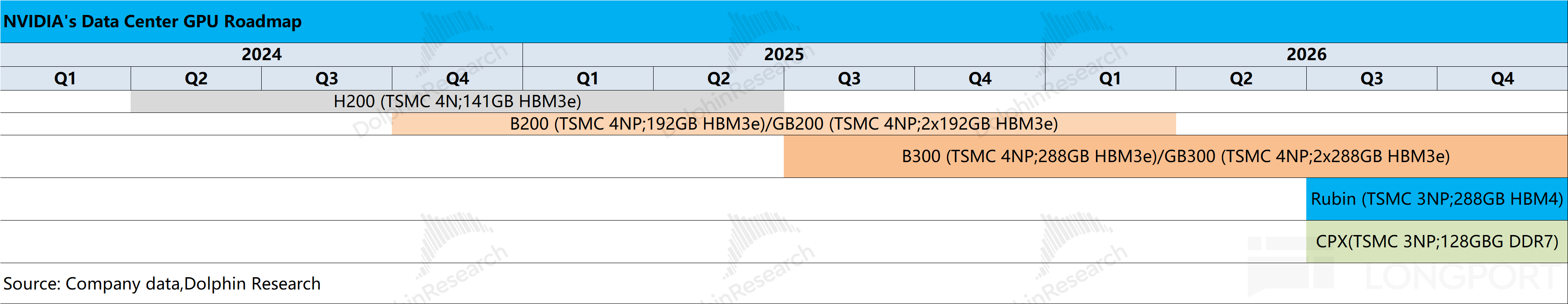

.....................Rumors and media chatter had been building for weeks, including reports that Jensen Huang sparred with White House conservatives and warned that H200 sales to China might still be blocked. President T...

......Here’s what’s heating up this Monday:

Baidu Spins Off Kunlunxin for IPO; Ele.me Completes Official Rebranding | Today's Important News Recap

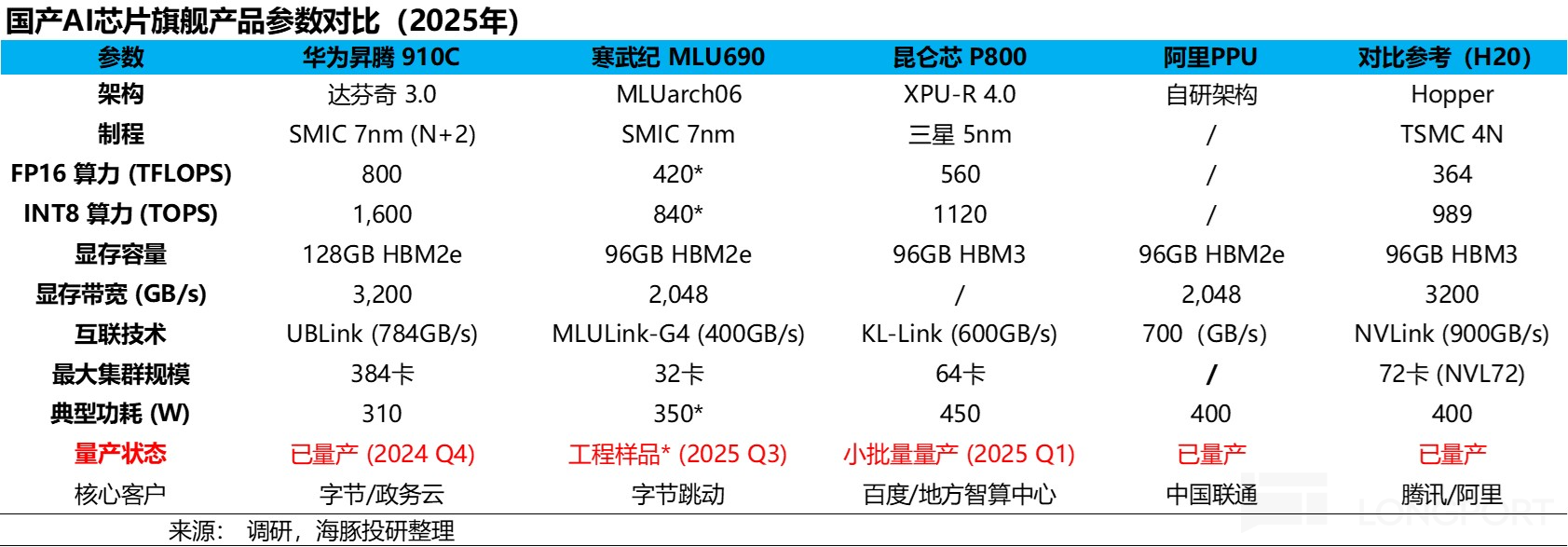

1205 | Dolphin Research Key Focus: 🐬 Stock 1, $BIDU-SW(09888.HK) According to reports, Kunlun Chip (Baidu's AI chip subsidiary) has initiated preparations for listing in Hong Kong, planning to submit...

1126 | Dolphin Research Key Focus: 🐬 Stocks 1. $MEITUAN(03690.HK) Meituan saw a significant rebound today. Alibaba's China E-commerce Business Group CEO, Jiang Fan, pointed out that the first phase o......