Company Encyclopedia

View More

Lakeland Industries

LAKE.US

Lakeland Industries, Inc., together with its subsidiaries, manufactures and sells industrial protective clothing and accessories for the industrial and public protective clothing market worldwide. It offers firefighting and heat protective apparel to protect against fire; high-end chemical protective suits to provide protection from highly concentrated, toxic and/or lethal chemicals, and biological toxins; and limited use/disposable protective clothing, such as coveralls, laboratory coats, shirts, pants, hoods, aprons, sleeves, arm guards, caps, and smocks. The company provides durable woven garments; high performance FR/AR apparel; and firefighter protective apparel and accessories. In addition, it provides high visibility clothing comprising reflective apparel, including vests, T-shirts, sweatshirts, jackets, coats, raingear, jumpsuits, hats, and gloves; and gloves and sleeves that are used in the automotive, glass, and metal fabrication industries.

1.145 T

LAKE.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

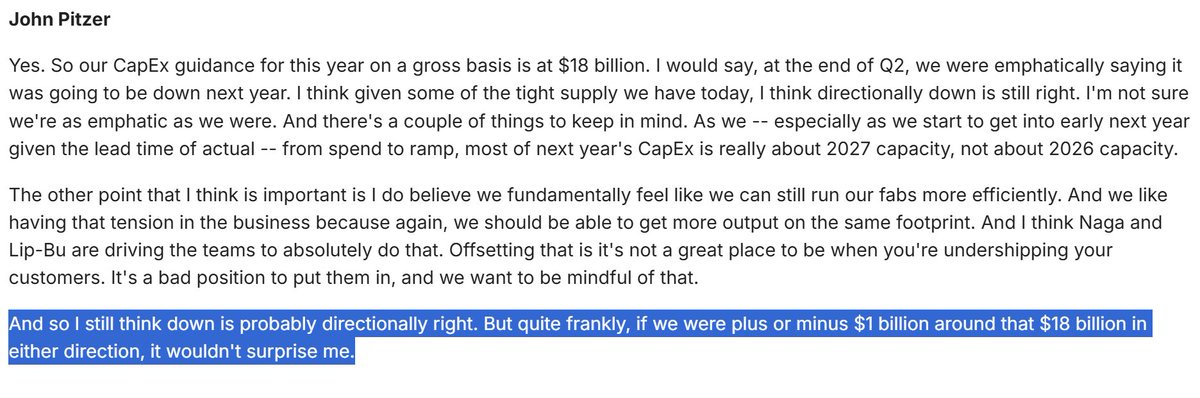

Intel's CY26 capex to remain nearly flat. More optimistic than previous guidance of above maintenance and $16B. Next year capex will be for 2027 capacity. Around which time Intel's external foundry bu...

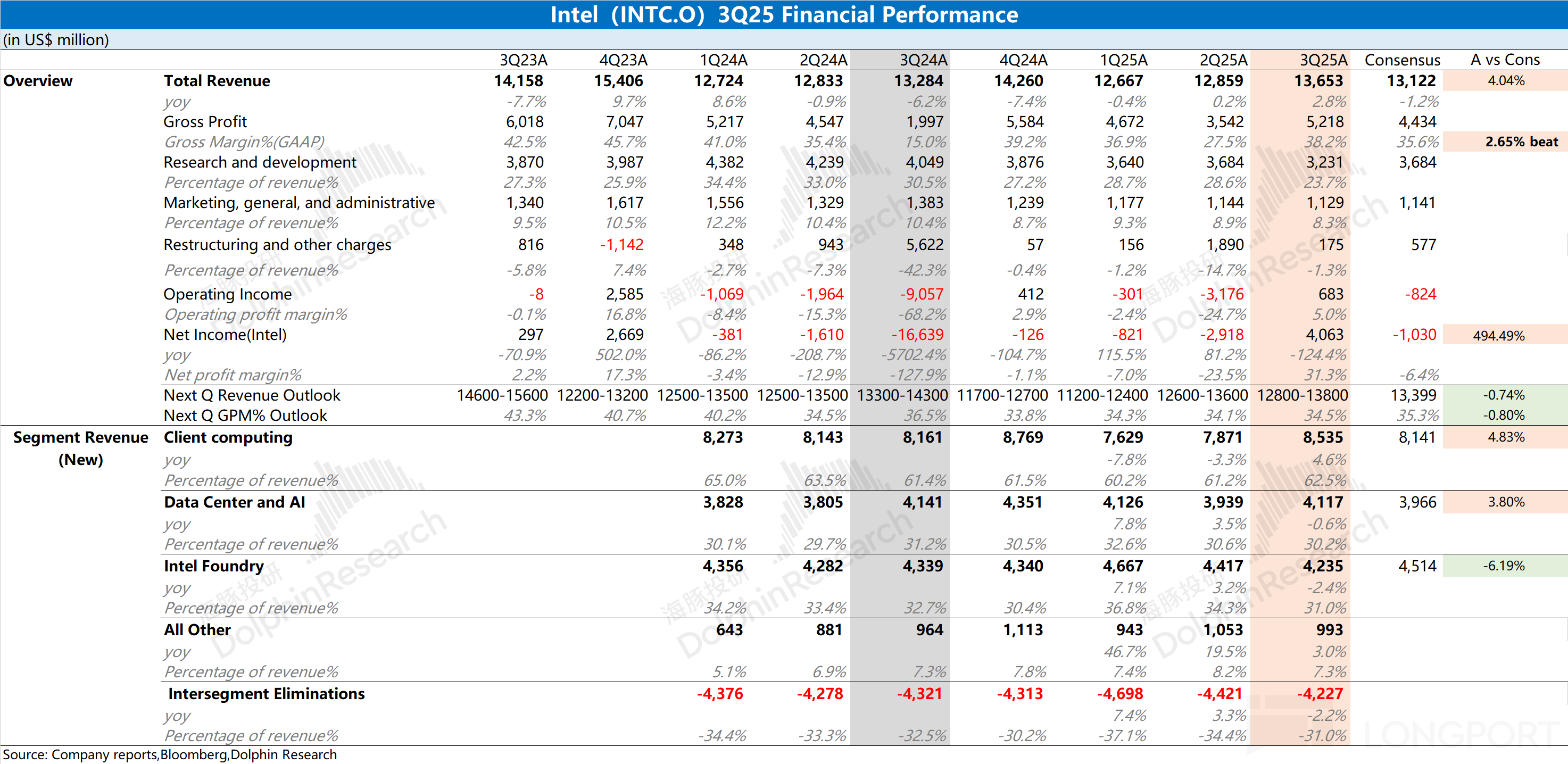

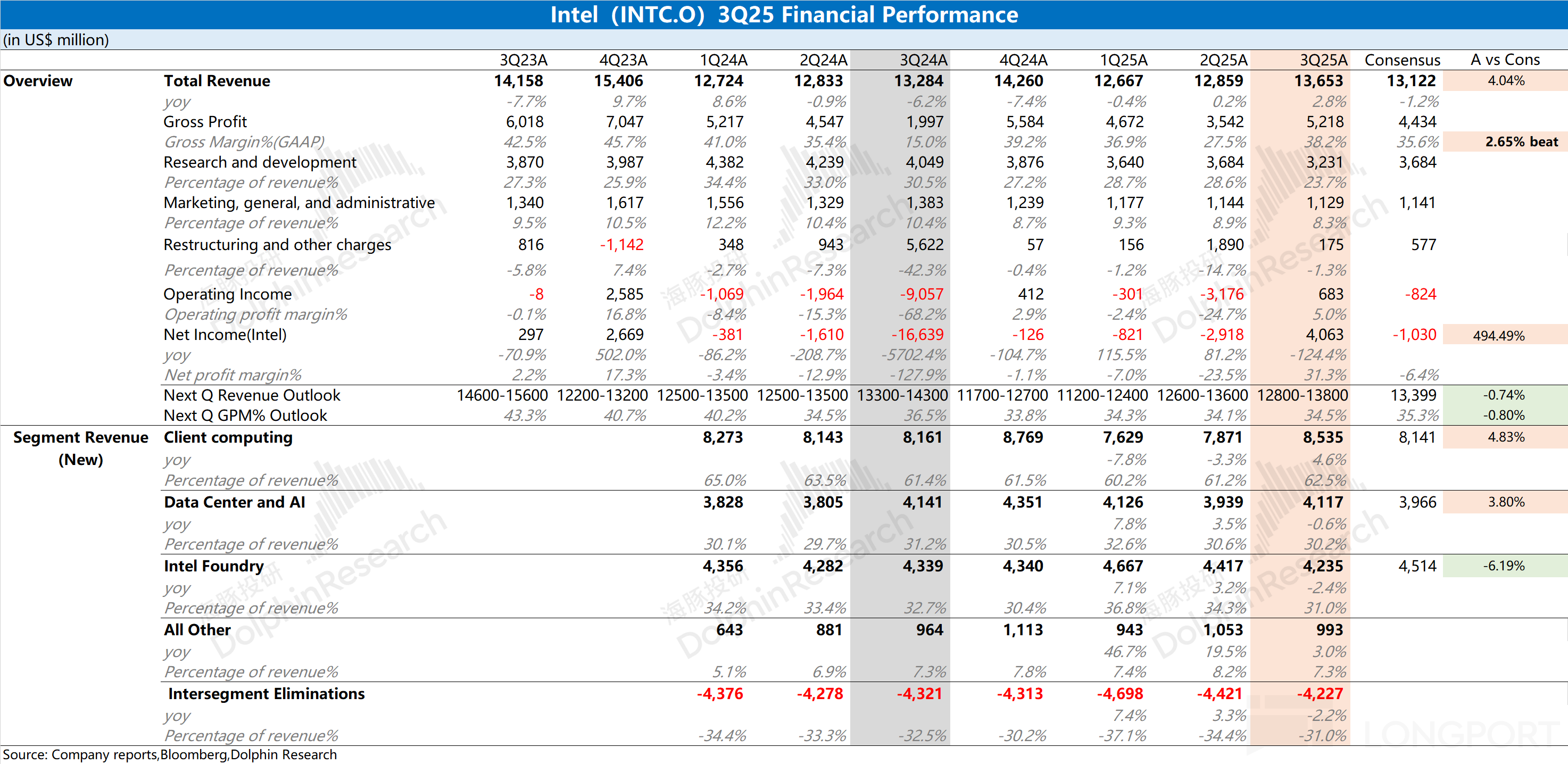

The following are the minutes of the Q3 2025 earnings call for $Intel(INTC.US) compiled by Dolphin Research. For an interpretation of the earnings report, please refer to "Intel: Stopping Losses and R...

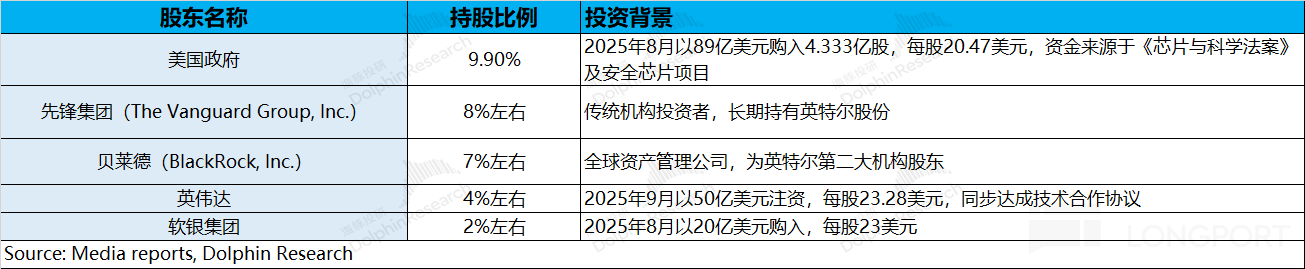

Intel released its Q3 2025 financial report (as of September 2025) after the U.S. stock market closed on the morning of October 24, 2025, Beijing time. The key points are as follows: 1. Core data: $In......