Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

On Dec. 7, the long-running WBD sale neared the finish line as NFLX emerged as the buyer. The company agreed to acquire WBD's assets excluding cable TV for $72bn and to assume $10.7bn of WBD debt.

The ...$Recursion Pharmaceuticals(RXRX.US) Recursion Pharmaceuticals Inc.(RXRX)Weekly Report (2025.11.22-11.29) The extent of your achievements can largely be seen from how much pain you can endure...

Reverend Jesse Jackson, pictured below gave Trump an award from his Rainbow Coalition organization. Jackson publicly praised Trump for his contributions to minority communities, including providing f...

💤 While Singapore slept, the U.S. markets were buzzing with some major moves. Here’s your quick but juicy rundown of what happened and what it could mean for your watchlist:

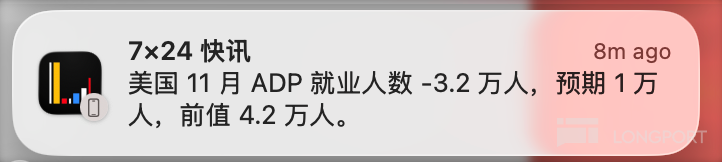

$Tesla(TSLA.US) $iShares Bitcoin Trust ETF(IBIT.US) Yes, this data is completely authentic, just released by ADP at 8:15 AM ET today (December 3, 2025). The confirmed figures are as follows (identical...