Longbridge HK, US stocks community

- India is entering a new age of industrialization.

- Mahjong starts 😂

- Donald J. Trump Truth Social Post 10:55 AM EST 02.

- $Coinbase(COIN.US) showed promise this morning and

- Execution compounds over time. If fundamentals con

- $Grab(GRAB.US)this stock keep going down. seldom s

- happy Lunar New Year folks! I'm guessing at this p

- Nice to be back in India for the AI Impact Summit

- $NVIDIA(NVDA.US) Nvidia's partnership with MET

- $Tesla(TSLA.US) A personal view on TSLA$Tesla (TSL

- The US military budget for 2026 is close to $1 tri

- Suddenly lost interest in the stock market. After

- $Alphabet - C(GOOG.US)Alphabet dipping short term,

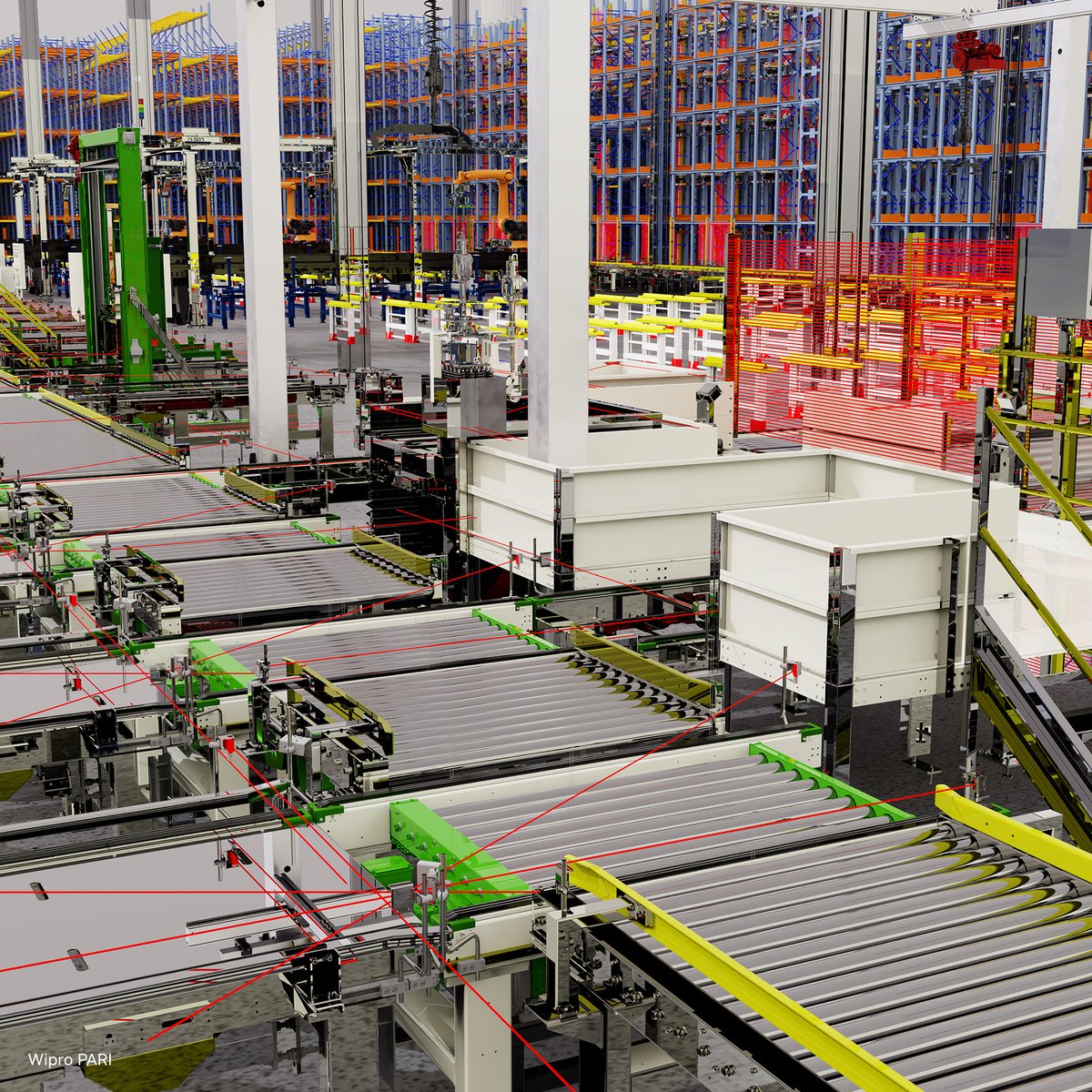

India is entering a new age of industrialization. 👏

India’s largest manufacturers are working with global service integrators including @Tata Consultancy Services , @Wipro PARI, & industrial software ...............Mahjong starts 😂

Donald J. Trump Truth Social Post 10:55 AM EST 02.17.26

Maryland, Virginia, and Washington, D.C., who are responsible for the massive sewage spill in the Potomac River, must get to work, IMMEDIATELY. I...$Coinbase(COIN.US) showed promise this morning and fizzled end of day. A move and hold over the 10ema daily and the 172 area @blondebroker1 spoke about are the levels I am watching.

Source: Sunrise T...

Execution compounds over time. If fundamentals continue strengthening, volatility becomes temporary rather than structural.

$Grab(GRAB.US)this stock keep going down. seldom see it goes up to 4.4. no sure to sell at lost or keep it

happy Lunar New Year folks! I'm guessing at this point it was a good thing I wasn't paying much attention to the markets... whatever it is, wishing everyone a healthy and prosperous year ahead! HUAT A...

Nice to be back in India for the AI Impact Summit - a very warm welcome as always and the papers looked great too:)

Source: Sundar Pichai

$NVIDIA(NVDA.US) Nvidia's partnership with META comes as a relief amongst a volatile February so far. Part of Meta's enormous Capex spending would be directed towards Nvidia's chips which further soli...

$Tesla(TSLA.US) A personal view on TSLA

$Tesla (TSLA.US)

First Trend Structure:

The long-term descending trendline above is clear. A stop-loss signal has appeared near the previous low below. The current...

The US military budget for 2026 is close to $1 trillion. Although it increased by 13% year-on-year, the most explosive part is not the total amount, but where the money is going: heavy assets are givi...

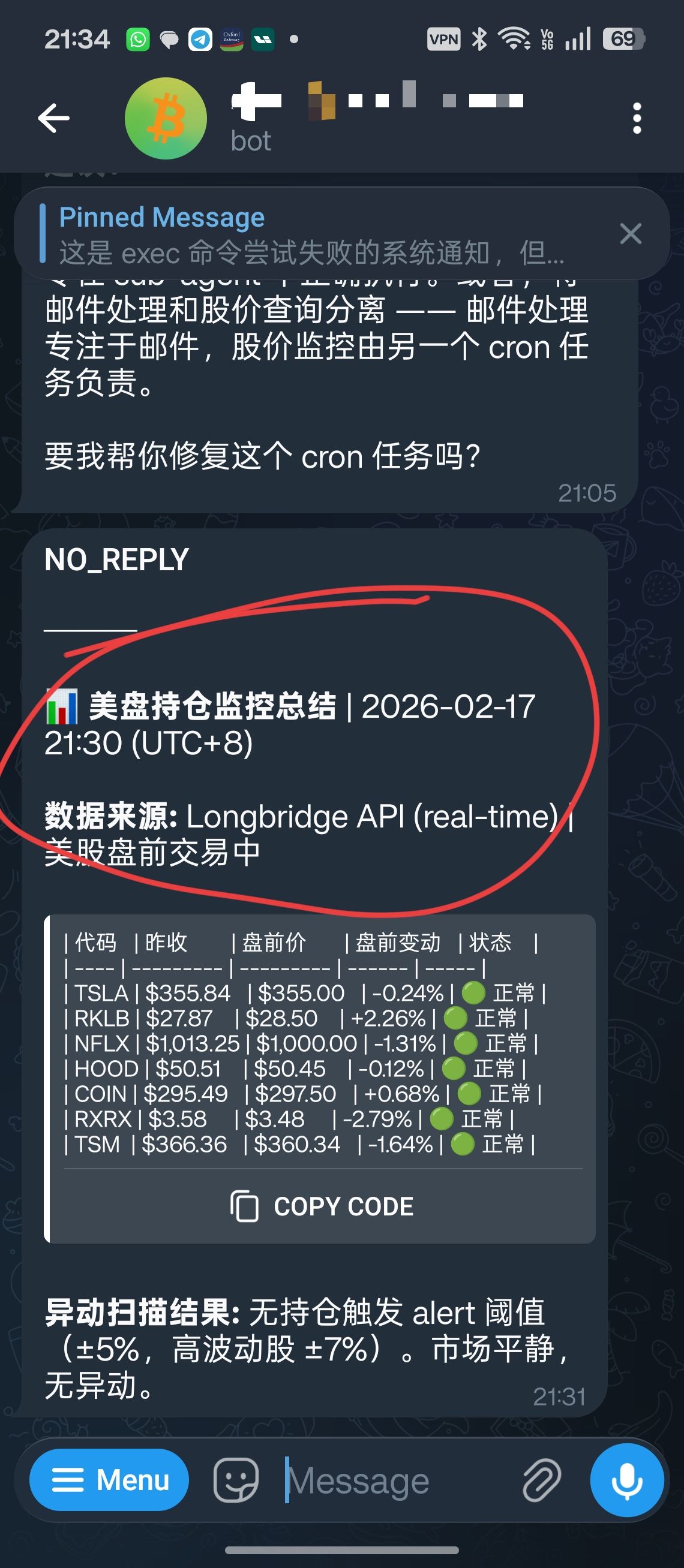

Suddenly lost interest in the stock market. After finding a new toy, who's going to save me. 😄

$Alphabet - C(GOOG.US)Alphabet dipping short term, but core business remains strong with AI, search dominance, and cloud growth. I see this as temporary weakness. Holding for long-term upside. 🚀📊