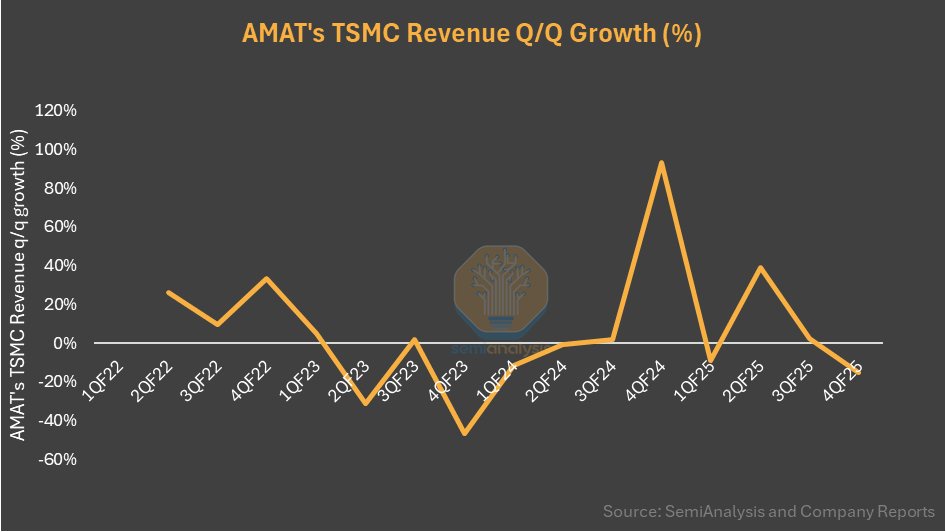

After hitting a four-year low in FY24, AMAT's TSMC revenue recovered well and hit an all-time high in FY25, driven by leading-edge logic. Its TSMC revenue grew 80% y/y in FY25, Samsung revenue up 31% and China down -16%. TSMC accounted for nearly 40% of AMAT's foundry/logic revenue in FY25. AMAT had $4.5B in GAA (gate-all-around) revenue and most of that is driven by TSMC. GAA capacity still has a long ramp ahead and will likely triple from current industry capacity. AMAT claims over 50% share of the GAA and backside power SAM, with roughly 30% incremental revenue per fab for GAA versus FinFET.

Source: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.