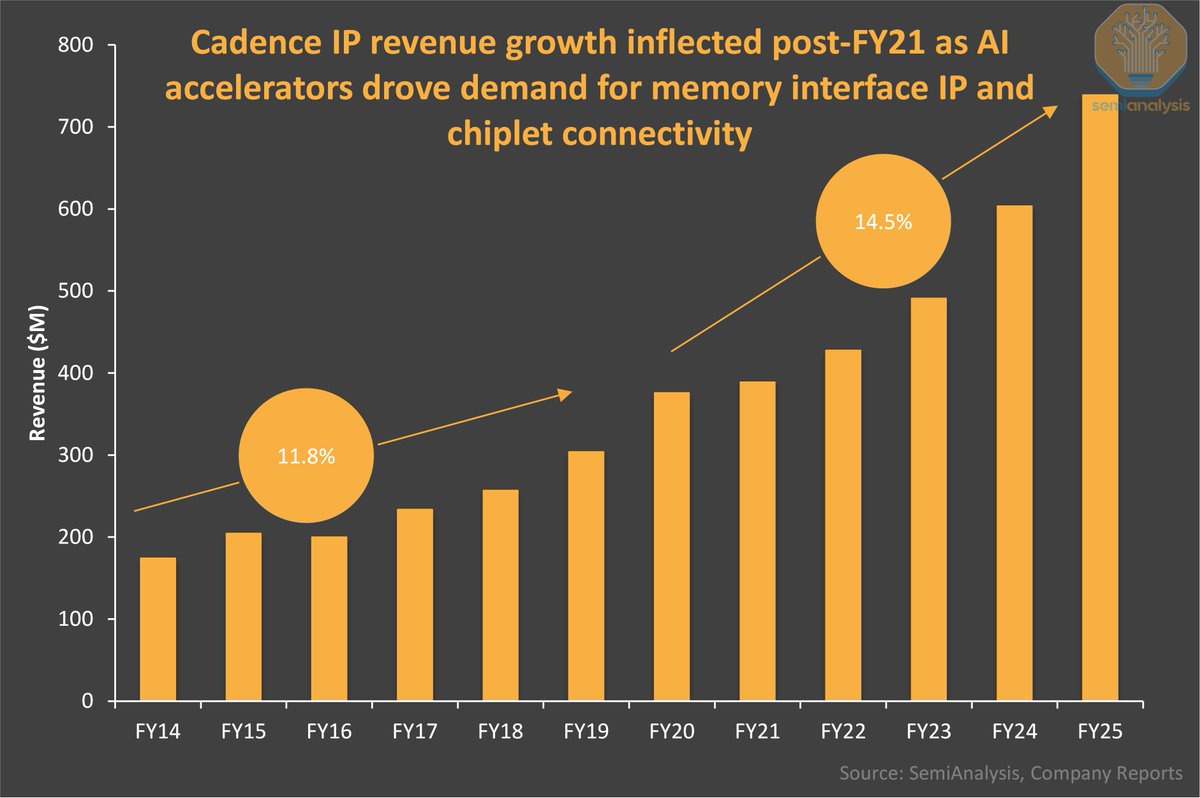

Cadence IP revenue inflected post FY21, driven by AI accelerators. Outgrowing Synopsys in this area, which issued muted guidance for IP for '26. SNPS has >2x IP revenue though. Cadence sees IP outgrowing the company average. Currently 14% of revenue and has below corporate margin. Strong at TSMC but Intel and Samsung expansion could drive CDNS' IP growth.

Source: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.