BABA Return Rate

BABA Return Rate BABA Diamond Holder

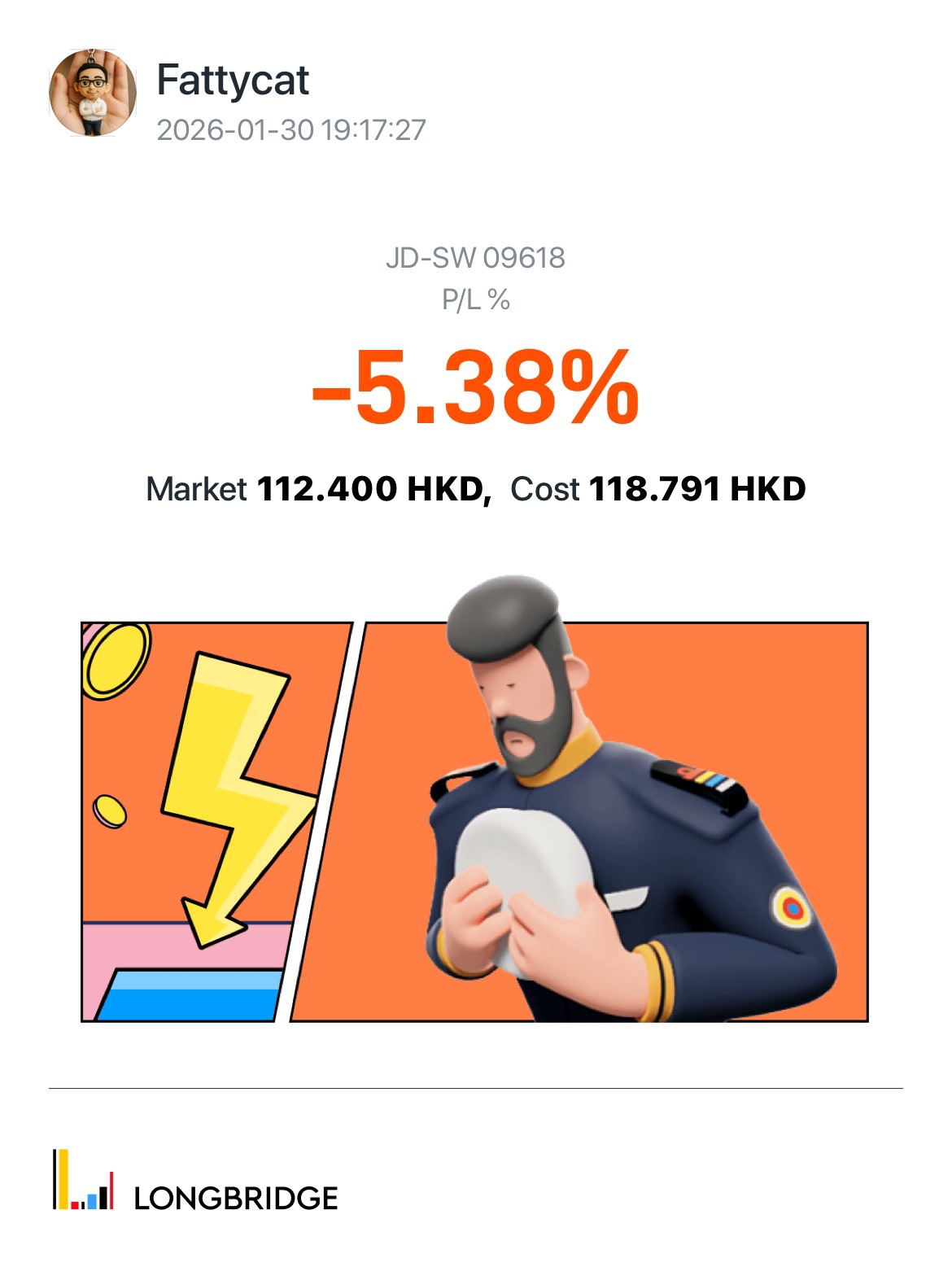

BABA Diamond Holder$JD-SW(09618.HK)

I view JD.com as an attractive investment given its strong balance sheet and aggressive shareholder returns.

The company’s conservative financial structure is highlighted by a cash-to-equity ratio of 0.65 and a low debt-to-equity ratio of 26.5%. It provides meaningful downside protection, balance sheet flexibility, and resilience across economic cycles. Its investment-grade credit rating from S&P further reinforces its financial strength.

JD.com is also actively returning capital to shareholders through a $5.0 billion share repurchase program running through August 2027, signaling strong confidence in intrinsic value.

At a price-to-earnings multiple of around 7, the stock appears deeply undervalued, offering a compelling risk-reward profile for long-term value investors.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.