Posts

Posts Likes Received

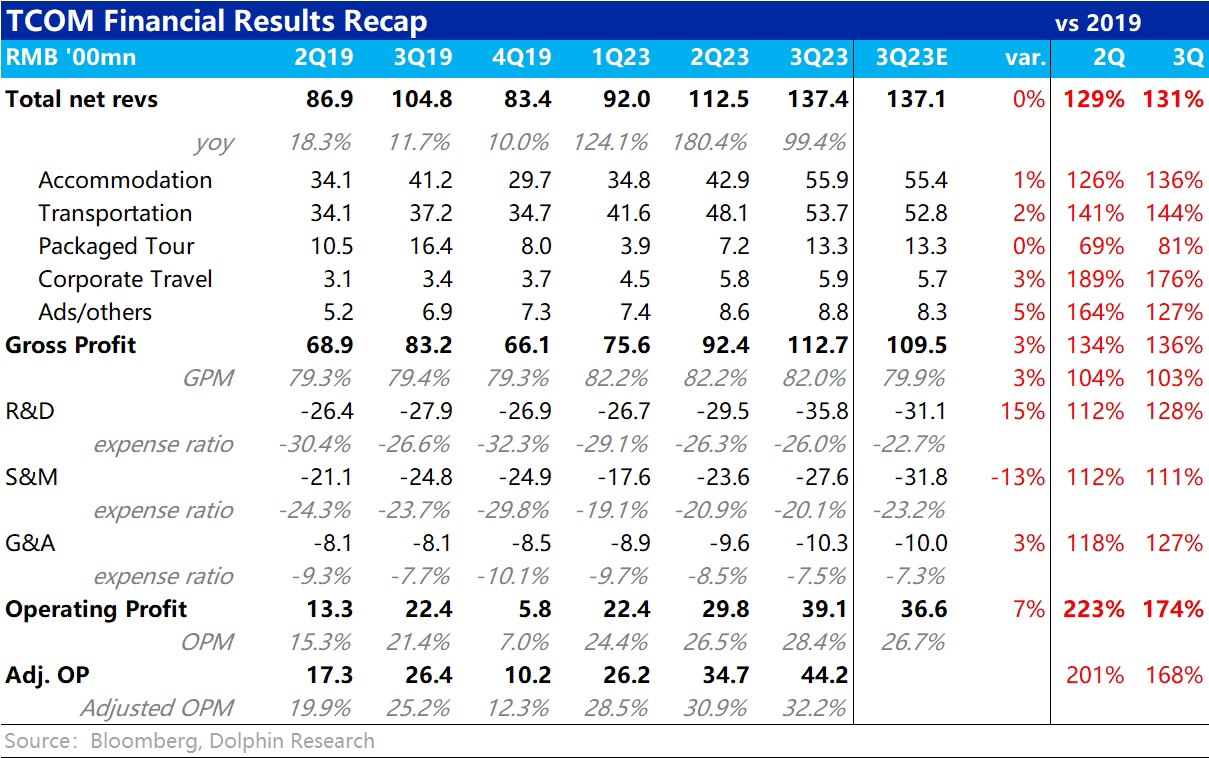

Likes Received整体来看,$Trip.com(TCOM.US)本季度交付了一份如预期内强劲的财报。对比常态下 2019 年时的财务数据,营收和利润都有高双位数的增长,但相比市场本就较高的预期也缺乏更惊喜的表现。

换言之,单从 3Q 交付的业绩来看,对公司股价的促进作用可能有限。

不过目前关注和交易的逻辑,已落在了国庆后国内酒旅市场景能否继续保持较高的景气度,以及出境游接力复苏的情况。管理层在电话会中对后续的指引更为关键。

而从估值角度,携程 2023 年实现 Rmb95-100 亿左右的经营性净利润问题不大,剔除现金后对应当前市值 PE 倍数约在 16x,也已不那么饱满。若后续海外业务复苏强劲,或国内景气度滑坡的并不那么厉害,当前仍是有机会的。

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.