Posts

Posts Likes Received

Likes ReceivedLi Auto: No Big Talk, Just Hard Work

Li Auto released its fourth-quarter earnings report on the evening of February 26th, Hong Kong time, after the Hong Kong stock market closed and before the U.S. stock market opened in 2023. Excluding the noise of record-high revenue and profit in 2023, as a response within the vehicle model transition period, Li Auto's performance can be considered close to "outstanding." However, this excellence was discounted by an accounting adjustment that is somewhat unclear:

1. Gross profit margin in the fourth quarter "seems decent": As a key indicator to observe market competition, at first glance, the gross profit margin for car sales increased to 22.7%, which was expected to be roughly the same as the third quarter's 21.2%, or even slightly lower. This would have been considered outstanding given the significant decrease in per-vehicle revenue by 13,500 yuan. However, the company explained that the increase was due to adjustments made to the provision for warranty reserves on the cost side based on new estimates, resulting in a higher gross profit margin. Excluding these adjustments, the actual gross profit margin in the fourth quarter would have been similar to the same period last year when excluding the impairment provision for Li Auto One. The quarter-on-quarter increase was also due to this accounting adjustment.

Moreover, this time there was no quantitative description provided. Based on this description, it can be roughly inferred that, excluding this accounting adjustment, the actual gross profit margin for cars in the fourth quarter should be similar to that of the third quarter.

2. Single-vehicle revenue in the fourth quarter is not as bad: If the improvement in the gross profit margin for car sales in the fourth quarter is indeed significant, looking solely at the single-vehicle revenue for the fourth quarter, it is actually quite good. The company originally implied a single-vehicle price of less than 300,000 yuan for the fourth quarter, but the actual figure reached 306,000 yuan, which is a much smaller decrease. This was achieved even with the increase in the proportion of L7 in the fourth quarter. This indicates that the overall promotional efforts for cars in the fourth quarter are still manageable.

3. Sales volume guidance is the real source of optimism: Li Auto expects to deliver 100,000 to 103,000 vehicles in the first quarter of 2024, which may seem lower than market expectations. However, due to the outdated nature of these expectations, they are not reliable. What Dolphin Research is observing is the momentum behind the sales volume guidance: the company delivered over 30,000 vehicles in January, and based on the weekly sales situation up to the present in February during the Chinese New Year, it is estimated to be around 25,000 vehicles. This guidance implies that the delivery volume in March should reach at least 45,000 vehicles.

Considering that the new models of Li Auto's digital series are scheduled to be released in March, Mega will also be launched in March, and L6 will be released in April, achieving over 45,000 in sales volume in the month of new model releases indicates a very rapid recovery in sales. Following this implied momentum, there is hope to reach monthly sales of "over 50,000 approaching 60,000" in the second quarter.

4. Sales volume guidance implies price expectations "no hidden risks": Initially, Li Auto announced a price reduction of 33,000 to 38,000 yuan for all old models since the beginning of the year. However, the implied single-vehicle price in the first quarter is only reduced by less than 4,000 yuan, which is a significant difference. Dolphin Research's rough assessment is that on one hand, Li Auto had been continuously reducing prices and promoting sales in the fourth quarter before officially cutting the official prices, so the actual sales price reduction was not as significant. Combined with the significant concentration of first-quarter sales in March, Dolphin Research reasonably estimates that the new model should have been launched in early March, and the price difference between the new model and the old model before the price reduction may not be too large.

In other words, even without excessive discounts on the new car prices, the new car order expectations are quite good. If this is the case, it indicates that after experiencing the depreciation of Li Auto One, Li Auto has smoothly passed through this car replacement cycle, proving to be a new force company with exceptional execution reliability.

Overall View of Dolphin Research:

Although the accounting adjustments in this quarter have somewhat clouded the "exploding" gross profit margin in the fourth quarter, the actual decrease in unit price in the fourth quarter is not too significant. The implied normal gross profit margin should still be good, clearly indicating that under the scale effect of 50,000 monthly sales, Li Auto has not only reduced the depreciation cost per vehicle but also significantly increased the bargaining power with suppliers, leading to a noticeable decrease in variable costs per vehicle, offsetting the price reduction caused by competition.

The real information lies in the first-quarter guidance, where the climbing speed of unit sales in March is what truly surprises Dolphin Research. If the monthly sales of the new car can exceed 45,000 units just after its launch, coupled with the implied slight decrease in unit price in the first quarter as indicated by Li Auto, it suggests that after going through another car replacement cycle, Li Auto has smoothly cleared out the old inventory and the new car is smoothly hitting the road.

If sales can climb to over 45,000 units in March, and the more affordable L6 will be launched in April, combined with Li Auto's current accelerated expansion of its sales network, these pieces of information collectively point to one conclusion: precise product positioning + reliable execution. Li Auto is like a piece of real gold in the crucible, able to withstand the test of fierce market competition.

Dolphin Research roughly estimates that the current pricing basically implies a requirement of around 650,000 Li Auto annual sales by 2024, corresponding to a neutral expectation of an average of 54,000 units per month. Considering the optimistic information implied by the first-quarter guidance, the company's stock price is likely to move in a more optimistic direction.

Detailed Analysis:

Since Li Auto's sales volume has been announced, the most important marginal information lies in: 1. Fourth-quarter gross profit margin; 2. Performance outlook for the first quarter of 2024.

1. Car sales gross profit margin of 22.7%, exceeding the market's expected 21.1%

The fact that Li Auto had a strong sales performance in the fourth quarter is already established, but is the gross profit margin behind this sales surge still perfect? Let's take a look at the actual situation:

In the fourth quarter, Li Auto's automotive business gross profit margin was 22.7%, an increase of 1.5% compared to the third quarter, exceeding the market's expected 21.1%. However, Li Auto pointed out in the financial report that the quarter-on-quarter increase in gross profit margin in the fourth quarter was mainly due to an accounting adjustment for the provision for warranty reserves (previously over-provided, now adjusted back), indicating that the fourth-quarter gross profit margin actually has flaws. In Li Auto's earnings report, it simply mentioned that compared to a 20% car sales gross profit margin (including the impairment of Li One) in the fourth quarter of last year, the gross profit margin in the fourth quarter of 23 was 22.7%, which remained stable when excluding the impairment of Li One last year and accounting adjustments this year. The increase from the third quarter's 21.2% was also due to these accounting adjustments.

From this description, it is estimated that without these factors, the gross profit margin guidance is basically consistent with market expectations.

In terms of unit economics, although the unit price is still declining significantly, the increase in gross profit margin is caused by accounting adjustments in the warranty reserve in unit costs:

- Intense competition led to significant price declines due to limited-time subsidies and discounts:

The average unit price in the fourth quarter was 306,000 yuan, with a decrease of 14,000 yuan per vehicle compared to the previous quarter, but higher than the market's expected 302,000 yuan.

The main reason for the price decline in the fourth quarter was the overall price reduction of all models to compete with Aito's M7 and M9, with a reduction of 10,000-20,000 yuan (through maintenance funds, regional subsidies, and other undisclosed price reduction methods), as well as the delivery of orders with a 10,000 yuan insurance subsidy in September flowing into the fourth quarter. Additionally, the slightly increased proportion of lower-priced L7 models this quarter contributed to this.

- Although the unit price decreased significantly, the unit cost rarely decreased by the same magnitude:

In the fourth quarter, Li Auto's unit cost per vehicle was 237,000 yuan, saving 15,000 yuan compared to the previous quarter. Dolphin Research analyzed the cost reduction effect brought to Li Auto from both variable and fixed costs:

a. Although Li Auto has not yet disclosed this quarter's depreciation expenses, depreciation expenses are relatively stable and predictable. Looking at the 400 million amortization depreciation expenses this quarter, compared to the previous quarter, the nearly full production capacity in the fourth quarter due to continued production ramp-up brought a dilution effect on fixed costs, contributing to a 0.3 percentage point increase in gross profit margin for Li Auto.

b. However, the decrease in unit cost this quarter was mainly due to the accounting adjustment of the warranty reserve fund and the cost reduction brought by the scale sales volume in procurement price pressure + materials such as lithium carbonate, resulting in a 14,000 yuan decrease in variable costs compared to the previous quarter.

- There was a slight increase in unit gross profit:

In terms of the profitability of each vehicle, Li Auto earned 69,600 yuan per vehicle in the fourth quarter, an increase of 1,800 yuan compared to the previous quarter. The overall gross profit margin from selling cars increased from 21.2% in the third quarter to 22.7% in the fourth quarter. However, excluding the warranty reserve fund accounting adjustment, the gross profit margin is estimated to be in line with market expectations.

2. However, the sales guidance for the first quarter of 2024 is conservative, but the expected price reduction is not significant

a) Sales target for the first quarter of 2024: 100,000-103,000 units, March needs to pick up!

Due to the general MoM decline in sales in the new energy vehicle industry since the beginning of the year, affected by the substantial promotion overdraft of sales by car companies at the end of last year, and Li Auto is also affected by competition from Huawei's M7, achieving only 31,000 units in January, a MoM decline of 38%.

In February, sales have not yet recovered due to the Chinese New Year holiday. Based on the current weekly sales trend, Dolphin Research estimates that Li Auto is expected to achieve sales of 25,000 units in February. The sales guidance corresponds to sales of 44,000-47,000 units in March, a 7-13% decline from the peak sales in December last year. This also indicates that Li Auto is optimistic about the stabilization and rebound of sales for the L series and the mega launch (possibly indicating listing and delivery).

b) The implied price reduction is not significant

Li Auto's revenue for the first quarter of 2024 is estimated to be between 31.3 billion and 32.2 billion, with an estimated contribution of 1.55 billion from other revenues. The corresponding unit price for the first quarter of 2024 is about 302,000 yuan, a decrease of 4,000 yuan compared to the previous quarter.

However, compared to the 4,000 yuan lower unit price guidance in the fourth quarter of 2023, in the case of Li Auto reducing prices by 33,000-38,000 yuan for the entire old model series for model upgrades (the L series will be facelifted in March 2024), it means that the new L series and high-margin mega in March will quickly make up for it, resulting in only a slight decrease of 4,000 yuan in unit price.

3. Looking beyond the model upgrade period in the first quarter of 2024, sales in the second quarter of 2024 are expected to stabilize and rise

The performance in the fourth quarter barely passed, with sales expectations relatively sluggish in the first quarter. However, Li Auto is in a model upgrade period during this time, and the new product cycle for Li Auto will begin in March 2024. The market is more willing to overlook the sluggishness of the first quarter and focus on the sales increase brought by the new product cycle.

Li Auto is set to launch all facelifts of the L series in March, with the expected facelift prices at least not lower than before the price reduction. In March, they will also introduce the all-electric MPV mega and the budget model L6 to be launched in April. The sales guidance given by Li Auto for this quarter corresponds to sales of 44,000-47,000 units in March, indicating that sales in the second quarter are expected to rise to a peak monthly sales of 50,000 units or even continue to climb. The market is still concerned about Aito's competition. As of January this year, Aito M7 has received orders for over 130,000 vehicles, but the cumulative delivery volume of M7 has reached 86,000 vehicles. With only around 45,000 to 50,000 orders remaining, it indicates that Aito's delivery volume in the second quarter of this year is about to enter a weak state. Li Auto's L6 model will also face competition from Aito M7 in April to compete for M7's order volume, providing Li Auto with a sufficient window of opportunity in the second quarter.

4. Continued Rigidity in R&D and Sales Expenses to Compensate for Weaknesses in Competition with Aito

1) R&D Expenses: Continued Rigidity to Address Pure Electric and Intelligent Shortcomings

This quarter, Li Auto's R&D expenses were 3.49 billion, an increase of 670 million from the previous quarter, continuing to grow rigidly and exceeding the market's expectation of 3.22 billion.

At this stage, Li Auto has cash reserves of 103.7 billion, providing sufficient funds for strategic investments. Over the next 24 years, Li Auto will continue to invest in developing pure electric platforms and models, with a delayed investment in intelligence by half a year. Li Auto also considers leading in intelligence as a core strategic goal and will use ample cash reserves to support the development of intelligent driving. It is expected that R&D expenses will remain rigid in 2024.

Previously, Li Auto L7's disadvantage in competing with Aito was also in intelligent driving. In terms of deployment speed, Huawei is expected to push for nationwide urban intelligent driving functionality (independent of high-precision maps) before the Spring Festival. Li Auto has already achieved the opening of NOA in 100 cities (without maps). Although temporarily lagging behind Huawei, in terms of intelligent driving, sales volume affects the size of data and data loop capability. Li Auto has a fleet that is ahead of Huawei, and NOA is standard. With a healthy cash flow and sales data loop, Li Auto is expected to catch up in autonomous driving.

2) Sales and Management Expenses: Accelerating Channel Expansion to Face Aito, while Channel Sinking Lays the Foundation for L6

This quarter, sales and management expenses were 3.27 billion, an increase of 730 million from the previous quarter, exceeding the market's expectation of 2.98 billion.

Looking at the fourth quarter, Li Auto accelerated the expansion of its channels, opening 106 new stores compared to a significant increase from 30 new stores in the third quarter.

In the competition with Aito, Li Auto also realized that the degree of channel sinking is still insufficient, and there is still significant room for incremental sales from second and third-tier cities.

Benchmarking against Huawei's approximately 1,000 stores, Li Auto is also accelerating the layout of channel sinking. Li Auto previously planned to expand to 600-800 stores this year, laying the groundwork for the price reduction of L6 (priced at 200,000-300,000).

Five, Revenue and Gross Margin Exceed Expectations

With the sales volume already announced, Li Auto's total revenue in the fourth quarter was 41.7 billion, a year-on-year increase of 136%, exceeding the market's expectation of 39.8 billion. The fourth-quarter gross margin was 23.5%, surpassing the market's expectation of 21.6%.

The revenue exceeding expectations was mainly due to the better-than-expected decline in unit prices and delivery volume surpassing market expectations. Other businesses (insurance, used cars, etc.) continued to maintain high growth, contributing revenue of 1.35 billion this quarter, exceeding the market's expectation of 1.08 billion.

The higher-than-expected gross margin in this quarter was also due to the automotive business's gross margin exceeding expectations, mainly driven by accounting adjustments from warranty reserves. This kind of quality exceeding expectations can only be considered satisfactory.

Six, Improved Profitability

Li Auto's net profit in the fourth quarter reached 5.75 billion. In terms of operating profit, the absolute value increased from 2.34 billion in the third quarter to 3.04 billion in the fourth quarter. The operating profit margin increased from 6.7% in the third quarter to 7.3% in the fourth quarter, surpassing the market's expectation of 6.3%.

Looking at the core, R&D and sales expenses are relatively fixed, and the leverage effect has not been fully realized. Operating expenses increased by 0.6%, mainly relying on the 1.8% increase in operating profit margin brought by the 1.8% increase in gross margin.

Seven, New Product Cycle About to Begin

Looking ahead to 2024, Li Auto's product cycle and execution capabilities are the strongest among new forces. However, the 2024 P/S valuation is only 1.3 times, lower than XPeng's 1.5 times. The valuation discount mainly comes from Li Auto's lack of pure electric vehicles and market doubts about the growth potential of extended-range vehicles.

In 2024, Li Auto will start the dual path of pure electric and extended-range vehicles. Whether extended-range vehicles can continue the growth momentum of 2023 (market valuation adjustment due to competition from Aito) and whether pure electric vehicles can create popular models will be key catalysts for Li Auto's valuation improvement.

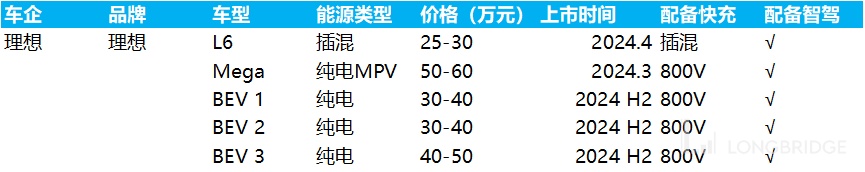

Li Auto's new product cycle is set to begin in March 2024, including: Hybrid: In 2024, Dolphin Research predicts that it will still be a big year for hybrids. Li Auto's hybrid models L7/L8/L9 will continue to benefit from the continuous expansion of the passenger vehicle market with over 300,000 units. Hybrids will continue to replace BBA brands. Meanwhile, Li Auto L6 will contribute to incremental volume as it channels down and adjusts prices.

a) Li Auto L6: The price range of L6 will continue to drop to the range of 250,000 to 300,000 RMB, directly competing with Huawei's M7. Extended-range vehicles have a competitive advantage over pure electric vehicles in third and fourth-tier cities (due to insufficient charging stations). L6 will contribute to incremental volume as Li Auto channels down. In the 200,000 to 300,000 RMB price range, the competition for plug-in hybrids is less intense than for pure electric vehicles. Dolphin Research estimates that L6 will contribute significantly to next year's sales, with Aito's December sales reaching 25,000 units (sales are still climbing). It is conservatively estimated that stable monthly sales could reach 15,000 to 20,000 units, with annual sales reaching 120,000 to 150,000 units.

b) Li Auto L7/L8/L9 Facelift: Li Auto's main price range in the high-end market benefits from consumer upgrades driven by replacement demand. The demand resilience is relatively stronger, and the competition is not as fierce as in the 200,000 to 300,000 RMB price range, which helps Li Auto maintain a stable profit margin. The 200,000 to 300,000 RMB market is relatively sensitive, with more intense price wars and greater profit margin fluctuations. Li Auto's high-end luxury brand strength has been established, and currently, L7/L8/L9 have no direct competitors except Aito. Dolphin Research estimates monthly sales of 35,000 units and annual sales of 420,000 units for next year.

Pure Electric: Dolphin Research predicts that the 800V fast charging technology, combined with both pricing and product strength, will yield results.

a) Li Auto Mega: Mega was launched later than XPeng X9. Based on the average monthly sales of 2,000 units for the pure electric ZEEKR 009, Dolphin Research conservatively estimates annual sales of 32,000 units this year. Mega may also benefit from the high-end MPV trend and the continuous expansion of the market. With unique exterior design, low wind resistance, spacious interior, and 5C super fast charging, Mega aims to replicate the success of the Tengshi D9.

b) Li Auto's 3 pure electric models: There is a lack of popular pure electric models in the new energy market above 300,000 RMB, providing space for the development of Li Auto's 4 pure electric models in 2024. However, the production capacity of the first phase of the Beijing factory is only 100,000 units (producing Mega and the three pure electric models). It is expected that Li Auto will still focus on extended-range models in 2024. Dolphin Research conservatively estimates annual sales of 60,000 units for the three pure electric models next year.

Based on the above predictions, under a neutral assumption, Dolphin Research estimates that Li Auto's annual sales in 2024 will be around 630,000 to 660,000 units. This year, Li Auto's sales target is 800,000 units. If Li Auto can successfully create a popular pure electric model, expand production capacity at the Beijing factory, the target of 800,000 units is still achievable. Overall, Li Auto's strong product cycle and aggressive channel expansion are expected to support sales continuation this year. Healthy cash flow and sales volume data are expected to achieve a catch-up in autonomous driving, while strong cost control capabilities are favorable for maintaining a good gross profit margin in the ongoing price war this year.

For historical articles by Dolphin Research, please refer to:

November 9, 2023, Earnings Report Review: "New Player vs. Old Player, Can Li Auto Compete with Huawei?"

November 9, 2023, Conference Call Summary: "Making Smart Driving a Core Goal (Li Auto 3Q23 Conference Call Summary)"

August 8, 2023, Earnings Report Review: "Unraveling Li Auto: Is the 'Explosion' Real?"

August 8, 2023, Conference Call Summary: "Li Auto Summary: Capacity Bottleneck in Components, Gross Margin Guidance Maintained at 20%+"

May 10, 2023, Earnings Report Review: "Li Auto: Leading and Capable, Leading the New Forces"

May 10, 2023, Conference Call Summary: "Li Auto Summary: Leading in Market Share, Maintaining 20%+ Gross Margin Target"

Earnings Report on February 27, 2023: "Li Auto: Strong as a Tiger? Competition as Stable as a Dog"

Summary of the phone meeting on February 27, 2023: "Li Auto: 'Capturing 20% Market Share of the 300-500k Luxury SUV Market in 2023'"

Earnings Report on December 9, 2022: "Li Auto's Profit Plunge? Not Fatal, but Quite Awkward"

Summary of the phone meeting on December 9, 2022: "In 2023, 'Billion-Dollar' Li Auto, a Pure Electric Vehicle"

Earnings Report on August 16, 2022: "Li Auto Making Waves, L9 Unable to Support the 'Collapsed Li Auto'"

Summary of the phone meeting on August 16, 2022: "Li Auto ONE Eaten by L9, Early Sales of L8 (Meeting Summary)"

Product launch highlights on June 22, 2022: "L9, Li Auto's New 'Li Auto'"

Meeting summary on May 10, 2022: "Li Auto: Introducing Three New Models in 2023, Embracing a Strong Product Cycle"

Earnings Report on May 10, 2022: "Li Auto's Li Auto, All Hopes Resting on the Second Half of the Year?"

Meeting minutes on February 26, 2022: "Completing the 0-1 Validation Period, Witnessing How Li Auto Achieves Growth from 1 to 10 (Meeting Minutes)"

Live performance briefing on February 25, 2022: "Li Auto (LI.US) 2021 Fourth Quarter Earnings Conference Call"

Financial report review on February 25, 2022: "Enhancing Cash Generating Ability, Li Xiang's Li Auto Turning Vision into Reality"

Meeting minutes on November 30, 2021: "Releasing Pure Electric Models Right After Xiaomi, How Does Li Auto Compete? (Meeting Minutes)"

Live performance briefing on November 29, 2021: "Li Auto (LI.US) 2021 Third Quarter Earnings Conference Call"

Financial report review on November 29, 2021: "Outperforming Xiaopeng and Nio in Profitability, Is Li Auto Speculative or Long-term Oriented?"

Meeting minutes on August 31, 2021: "Li Auto: Outperforming Nio and Xiaopeng in the Third Quarter, Aiming for 150,000 Vehicles Next Year (Meeting Minutes)"

Live performance briefing on August 30, 2021: "Li Auto (LI.US) 2021 Second Quarter Earnings Conference Call"

Financial report review on August 30, 2021: "Li Auto: Strong Performance, Promising Future?"

Comparative study on June 30, 2021: "New Forces in Car Manufacturing (Part 2): Fifty Days Doubling, Can the Three Musketeers Continue to Charge Forward?" On June 23, 2021, Three Idiots Comparative Study - Part II "New Forces in Car Making (II): With the Decrease of Market Enthusiasm, What Does Three Idiots Rely on to Consolidate Its Position?"

On June 9, 2021, Three Idiots Comparative Study - Part I "New Forces in Car Making (I): Invest in the Right People and Do the Right Things, Analyzing the People and Events of the New Forces"

Risk Disclosure and Statement of this Article: Longbridge Dolphin Analyst Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.