Posts

Posts Likes Received

Likes ReceivedDon't Bet too Much on US rate Cuts as Biz takes over Consumer to Support Economy

Hello everyone, here is the core content summary of this week's strategy weekly report by Dolphin Research:

1)The two pillars behind the strong consumption of American residents - excess food reserves and high employment rates. Currently, it seems that the excess food reserves are close to being depleted.

2)However, there are signs of relay in the corporate sector: the proactive destocking cycle of enterprises has basically ended, inventory investment has increased, and capital investments in equipment, transportation, roads, energy, and other categories continue to rise; real estate investment and residential real estate loans are both bottoming out and rebounding.

3)Currently in the United States, resident consumption is transitioning from overheating fueled by excess balances to the normal state before the pandemic; the adjustment of enterprise inventories is basically over, capital investment is coming out of the bottom, and under the promotion of AI technology, the upward trend is relatively stable; government investment/consumption remains aggressive.

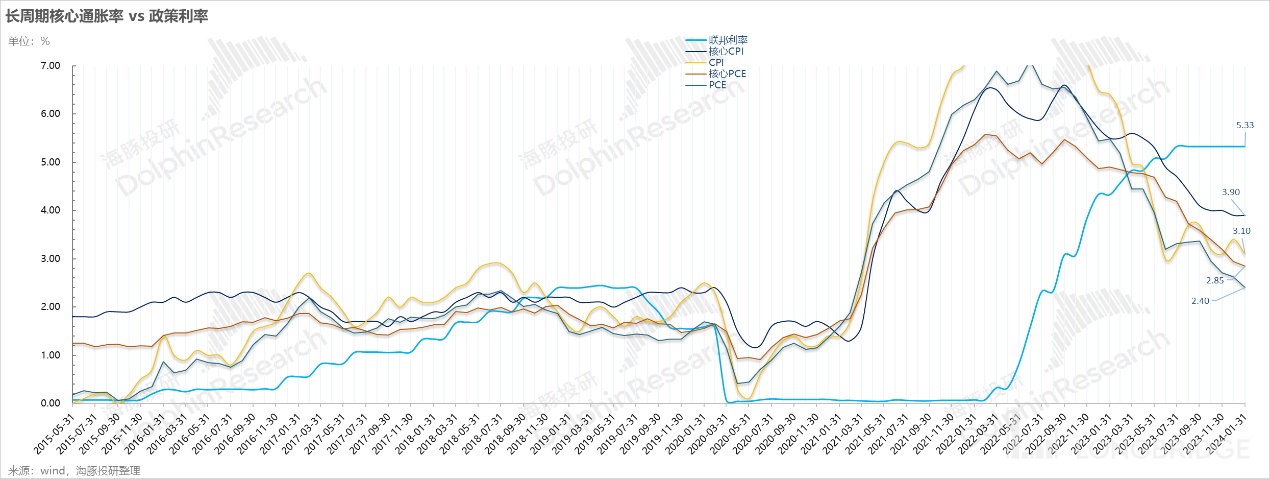

4)In the overall economy, in a high-interest environment, except for the federal government's difficulties due to high leverage, both enterprises and residents are doing well. In this situation, if interest rates are lowered quickly and significantly, it may actually lead to a substantial stimulative monetary policy, resulting in a backlash of inflation.

5)Apart from the Chinese concept financial reports this week, it is also important to focus on the macro level. Many places in the United States will enter Super Tuesday primaries, confirming the party's nominees, March employment rate, hourly wage data; domestically, there will be the Two Sessions and March CPI. Additionally, next week (March 11th), the expiration of the Fed's BTFP to rescue small and medium-sized banks will be of interest to see how it continues.

Here are the detailed contents:

As last week ended, the data for January in the United States basically confirmed the trend of declining consumption, rising inflation, and increasing labor costs.

I. Two Different Worlds of Goods and Services

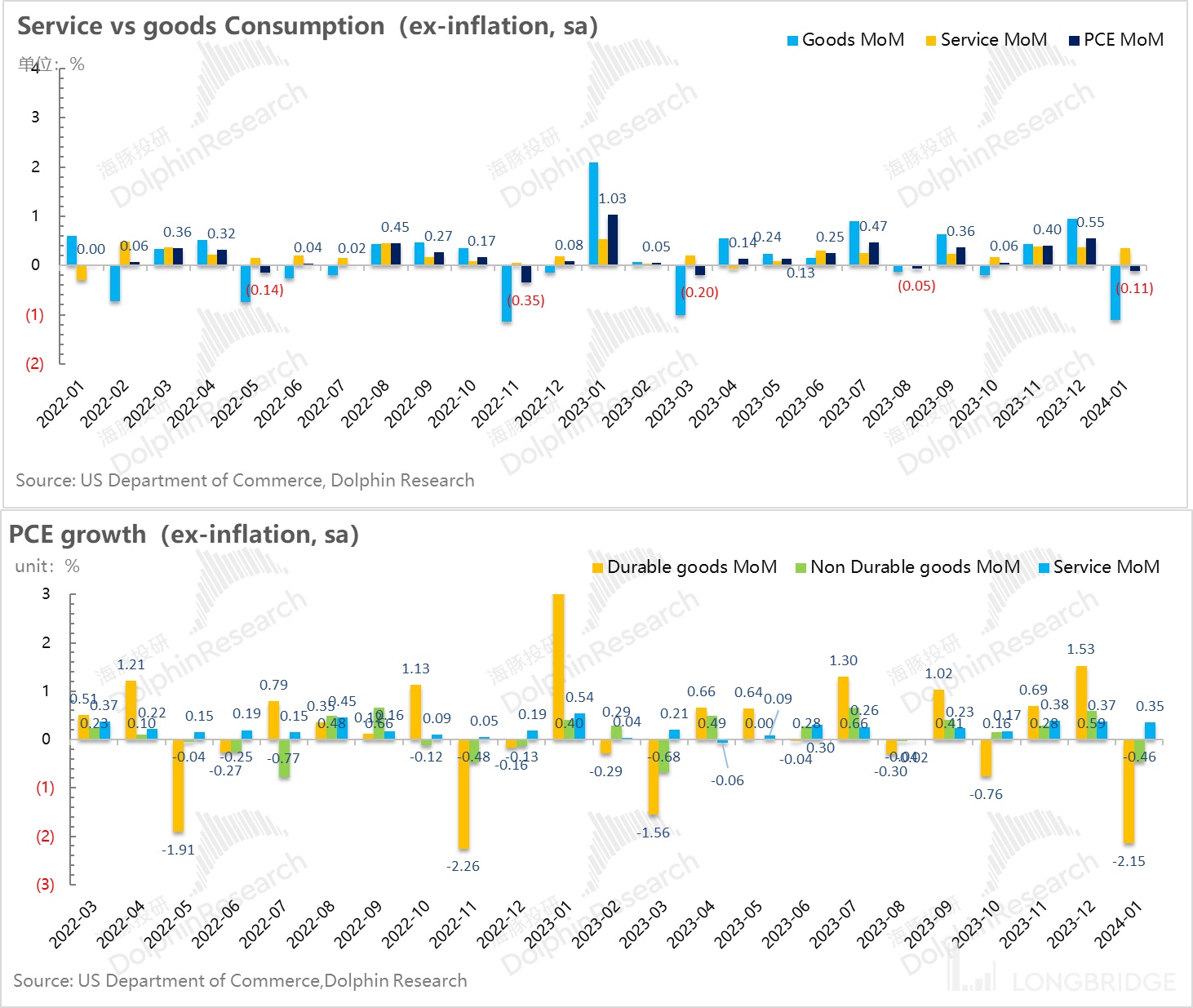

The sharp drop in social retail sales has already foreshadowed the personal consumption situation in the United States in January. The actual results showed that service consumption growth remained stable, while the decline in goods consumption was significant, resulting in an overall decline in resident consumption in January compared to December's performance.

The fluctuation in durable goods consumption was significant, with a direct monthly decline of over 2%; however, service consumption remained at around 0.35% in terms of monthly growth, maintaining a consistently high growth rate in the past three months.

However, as service consumption has a higher proportion of labor costs, the sustained high growth in services is also a reflection of labor inflation. Coupled with a large employment volume and a relatively tight labor market supply, it would be quite challenging for the market to quickly and significantly lower interest rates.

II. Slowdown in Resident Consumption Momentum

Although the weak commodity consumption in January, mainly in durable goods, may be due to seasonal factors, the credit default situation in the resident sector in the fourth quarter seems to indicate that the excess food reserves accumulated by American residents during the pandemic may be close to being depleted.

a. Currently, in terms of credit card consumption, which reflects the short-term liquidity turnover requirements of residents, the proportion of credit card spending relative to the credit limits of American residents is increasing, basically returning to the level of 2019.

From the fourth quarter onwards, the conversion rate of credit card loans to a 90-day default rate has been increasing, surpassing the small peak caused by the sudden outbreak of the epidemic in 2020, second only to the subprime mortgage crisis in 2008-09.

After the proportion of substantial defaults increased, by the fourth quarter, the 90-day default rate of credit card loans had approached the high default rate level established at the beginning of 2021.

Fortunately, due to a significant improvement in residents' repayment ability over the past year or two, the total amount of credit card defaults (excluding 30 days) is not too high at the moment.

Due to the correlation between credit cards and daily cash flow, this data, from the growth rate of loan balances to the conversion rate of substantial defaults, and to the current level of substantial defaults, is relatively high. Coupled with the overall relatively low savings rate (which increased slightly in January but is still below 4%), implying a decrease in residents' cash spending ability, this also suggests that the pressure of consumption on the savings rate should be close to ending to some extent.

Furthermore, considering the current trend, the subsidy nature of transfer payments during the epidemic has basically disappeared, and the U.S. government seems to be strengthening the collection of individual taxes. The marginal increase in consumption will increasingly depend on new employment and overall wage growth.

The two main sources of residents' consumption in this wave - excess savings related to past accumulations and employment rate/wage growth related to current earning capacity - seem to be left with only employment/wage growth as the "sole leg." Therefore, the key to the marginal growth capacity of future residents' consumption is to closely monitor the dynamic evolution of the labor market.

III. Enterprise Investment Relay?

Resident consumption is slowing down, but fortunately, from both a macro and micro perspective, there are signs of a restart in investment in the corporate sector, which has been making a lot of money.

From a micro perspective based on this quarter's earnings reports, most U.S. companies with strong profitability and earnings have generally increased capital expenditures or raised dividends and buybacks when announcing their 2024 plans. From a macro perspective:

a. Inventory cycle has bottomed out, is a rebound imminent?

Looking at the inventory relative to sales of consumer goods, and examining the manufacturing, wholesale, and retail sectors, wholesalers and manufacturers have maintained relatively high inventory levels for some time. Combined with the price trend of the PMI, it can be inferred that they are actively destocking.

However, by the end of December, with the strong retail sales in the fourth quarter leading to a significant destocking in society, there are signs of restocking in the retail and wholesale sectors. Considering capacity utilization, it can be observed that the manufacturing capacity utilization has been declining after the previous period of excessive operation, and it has now fallen back to a level that is basically consistent with the pre-pandemic level.

The accelerated rise in wholesale and retail inventories corresponds to the growth in enterprise inventory investment in the fourth quarter. This implies that the destocking cycle of goods in this phase is basically coming to an end, and enterprises are beginning to re-enter a restocking phase, which is a sign of increased investment.

b. Real estate investment stabilizes and rises, while high investment in manufacturing continues

Currently, after the stabilization of sales volume and prices in the U.S. new housing market, residential construction spending has begun to stabilize and has turned positive for the past two months.

At the same time, manufacturing investment in the U.S. continues to rise. Although there was a period of relative stability after a sharp rise early last year, the recent increase in the proportion of manufacturing investment compared to the entire construction industry can be seen.

In addition, investments in the public sector such as transportation, roads, and streets, as well as in the private sector including transportation, energy, education, and healthcare construction spending, continue to rise.

c. Increase in commercial loan disbursement

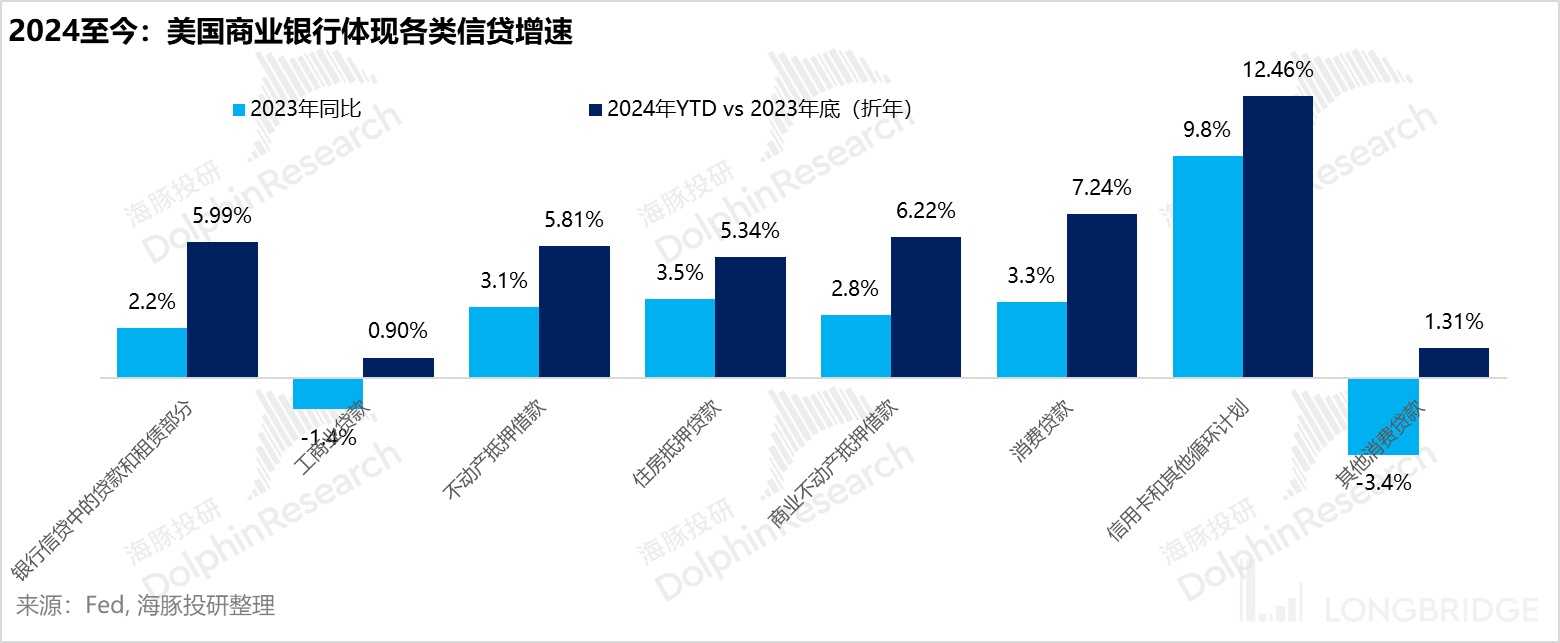

Looking at the growth of various assets in the U.S. commercial banking system, under the continuous rate hikes by the Federal Reserve in 2023, credit balances for businesses and residents in the U.S. increased slightly by 2.2% year-on-year. Last year saw negative growth in loans to industry and commerce.

As of 2024, with the Federal Reserve continuing to significantly raise interest rates, and the current FED rate reaching as high as 5.3%, not only have loans to residents accelerated (mainly in mortgage and credit card loans), but commercial real estate mortgages and loans to industry and commerce have also entered a phase of recovery and growth. At present, among the segmented loans, only the balance of car loans in consumer loans is still in a negative growth state.

IV. Summary:

From the above analysis, if an overall evaluation of the current situation of various sectors in the United States is to be made, Dolphin Research tends to believe that: the current situation in the United States is that resident consumption is transitioning from balance-driven overheating to the pre-epidemic norm; corporate inventory adjustments are basically over, capital investment is coming out of the bottom, and under the promotion of AI technology, the upward trend is relatively stable; government investment/consumption is still aggressive.

In the overall economy, in a high-interest environment, apart from the federal government facing difficulties due to high leverage, both enterprises and residents are doing well. In this situation, if interest rates are lowered quickly and significantly, it may actually lead to a substantial stimulative monetary policy, resulting in a backlash of inflation.

However, considering the rising default rate of residents' credit cards and the significant pressure on government interest payments, Dolphin Research roughly estimates that the extent of interest rate cuts this year will be between 75 and 100 basis points.

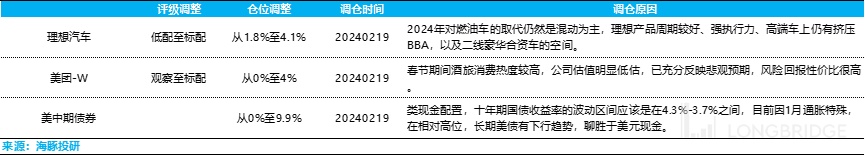

V. Portfolio Adjustment

VI. Portfolio Returns

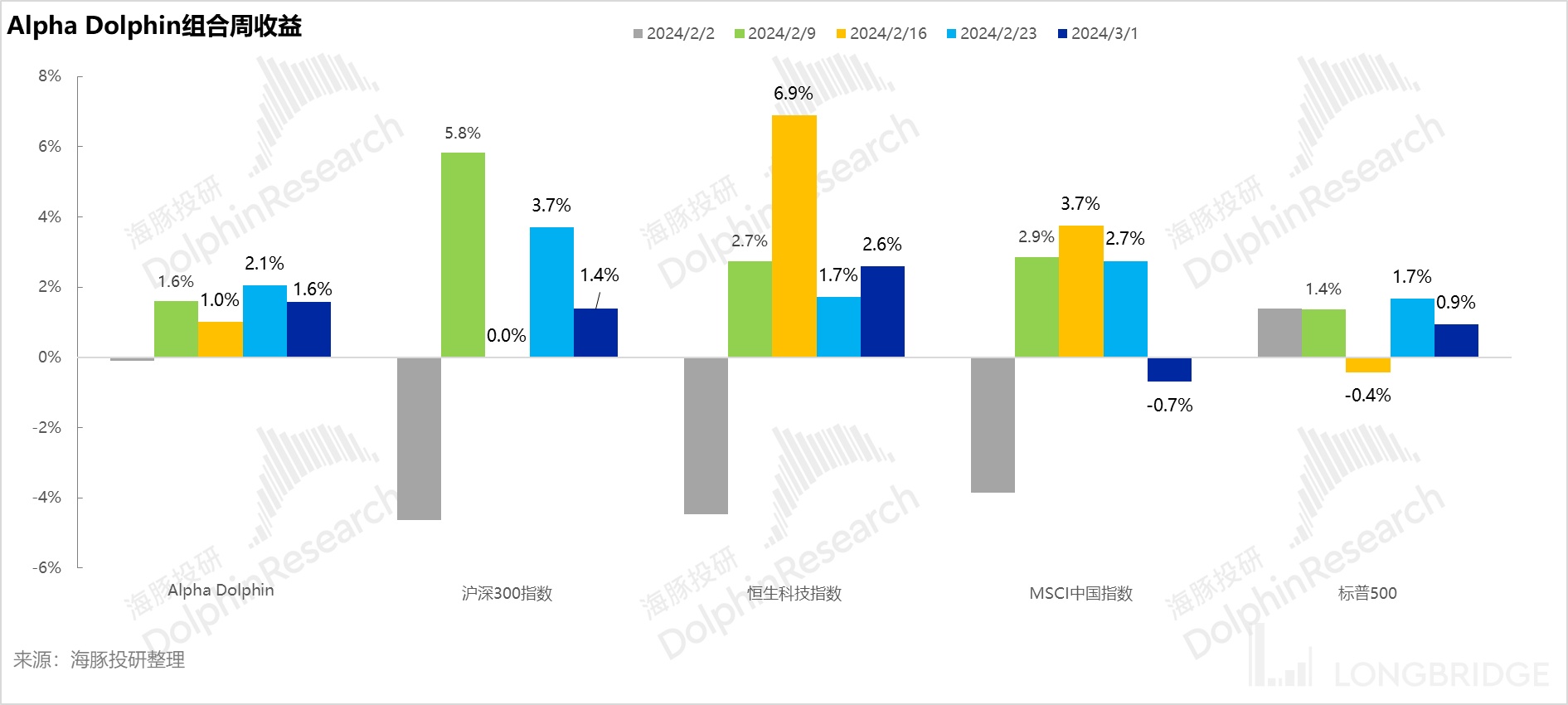

In the two weeks from February 23 to March 1, the virtual portfolio returns of Alpha Dolphin increased by 2.1% and 1.6% respectively, similar to the Hang Seng Tech Index, outperforming the S&P 500 and MSCI China.

From the start of the portfolio testing to the end of last week, the absolute return of the portfolio is 30%, with an excess return compared to MSCI China of 56%. From the perspective of asset net value, Dolphin Research's initial virtual assets of $100 million have now risen to $132 million.

VII. Individual Stock Profit and Loss Contribution

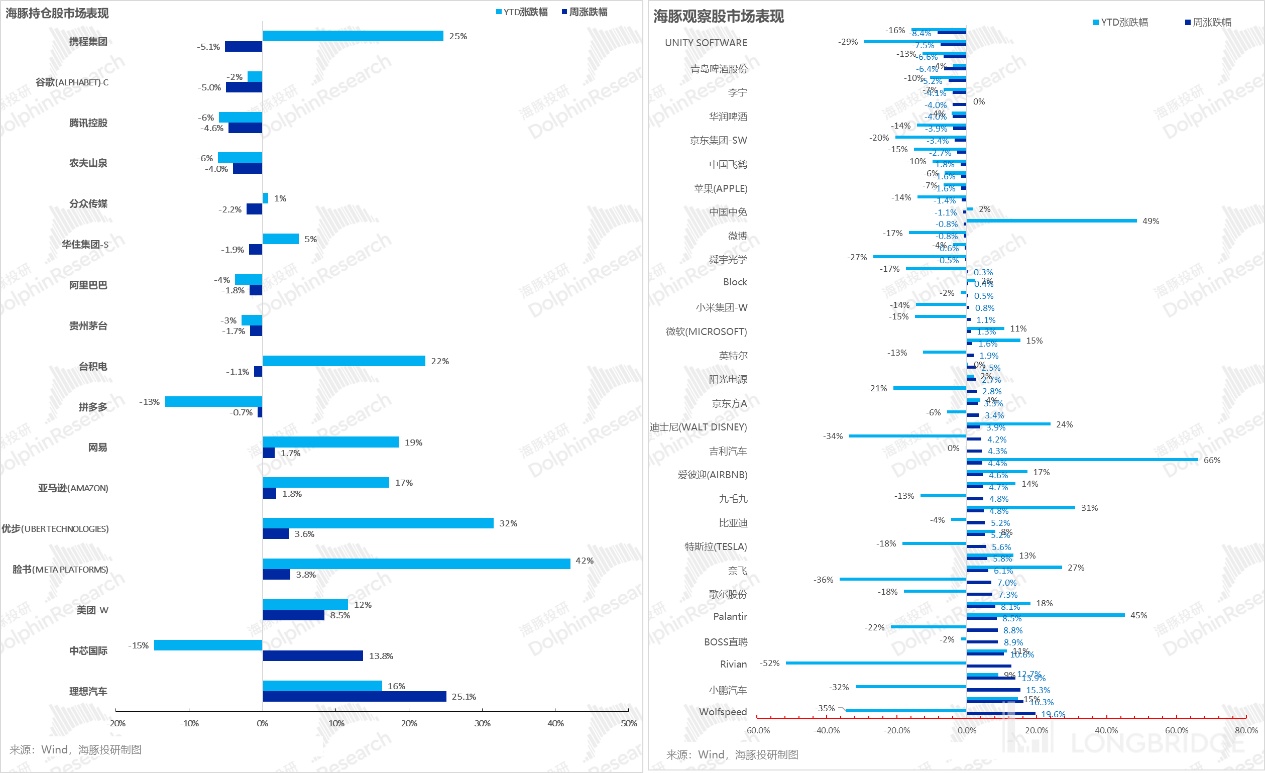

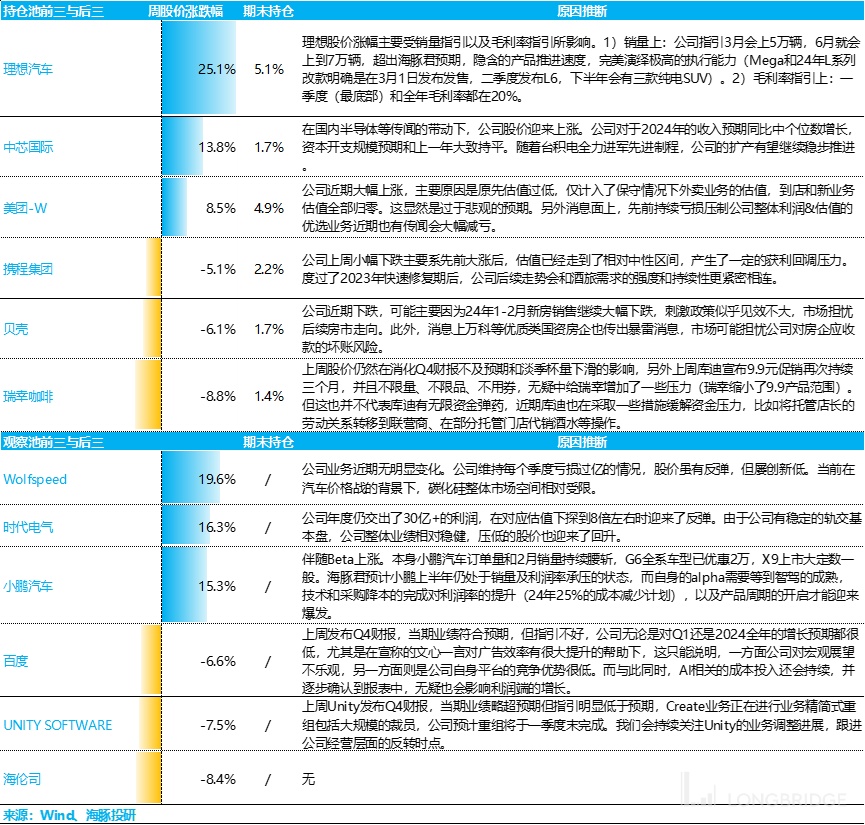

In the past two weeks, the main factors affecting the rise and fall of Dolphin Research's holdings and observed stock pools are: the revaluation of new energy, the boost from AI stories, and the performance of Chinese concept stocks.

In terms of the Dolphin Research's holding pool and watchlist, the companies with significant increases and decreases during the Spring Festival week, as well as possible reasons, are analyzed as follows:

VIII. Portfolio Asset Distribution

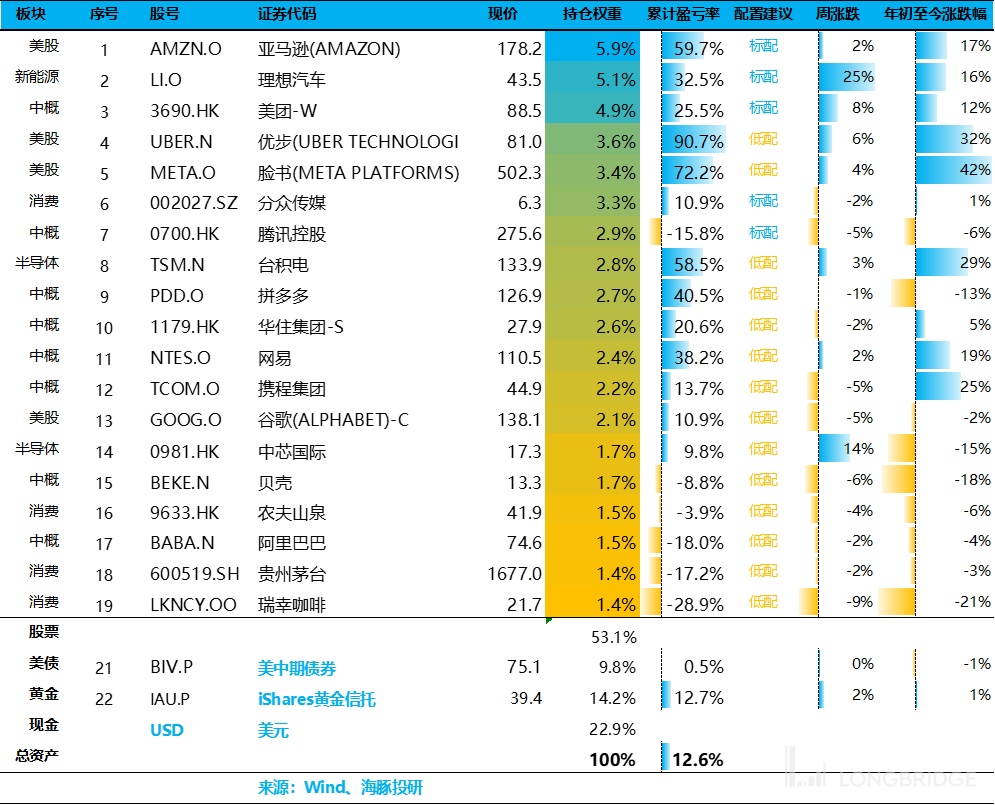

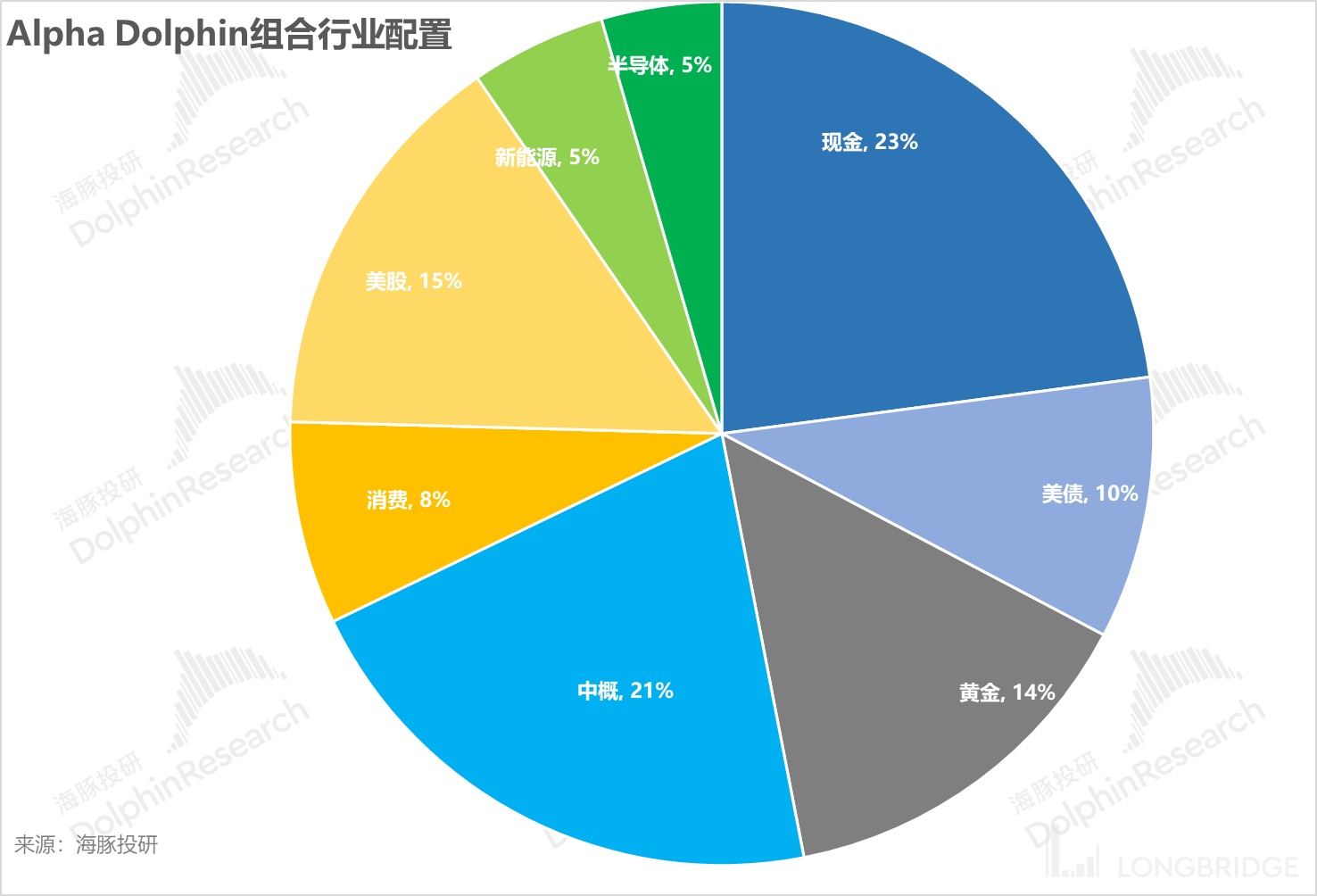

After increasing positions in Li Auto and Meituan in the past two weeks, the Alpha Dolphin virtual portfolio currently holds a total of 19 stocks, including three core holdings, with the remaining equity assets underweighted, and the rest in gold, US bonds, and US dollar cash.

As of last weekend, the asset allocation and equity asset weightings of Alpha Dolphin are as follows:

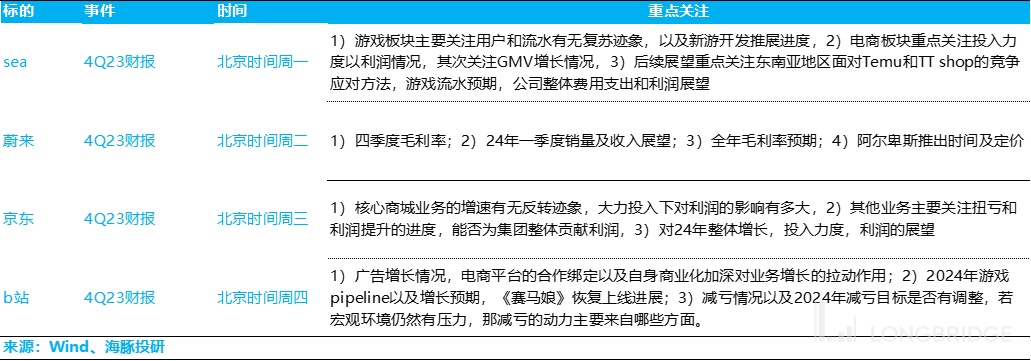

VIIII. Key Events of the Week

The earnings season for US stocks basically ended this week, and Chinese concept stocks began to release their financial reports intensively - SEA, Nio, JD.com, and Bilibili. Currently, they are all oversold companies with weak fundamentals. In the short term, there is not much opportunity for a fundamental reversal unless Bilibili and SEA can provide some unexpected surprises in their product-driven gaming business. Specific focus points summarized by Dolphin Research are as follows:

In addition, macroeconomic factors need to be closely monitored this week. Super Tuesday, where many places in the US will hold primary elections, will basically confirm the party's nominees, March employment rate, hourly wage data; China will have the Two Sessions, as well as the March CPI. Furthermore, the Fed's BTFP program to rescue small and medium-sized banks will expire before the Fed meeting on March 11th. Pay attention to how it will be extended.

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure

For recent Dolphin Research portfolio weekly reports, please refer to:

"Big Tech Stagnation, Chinese Concepts Rising, Return of Light or Style Switch?"

- 《Will the U.S. Economy Avoid a Hard Landing in 2024?》

- 《Another Critical Moment! Will Powell Bail Out Yellen Again?》

- 《Facing the Storm, How Much Faith Can Endure the Test?》

- 《Unstoppable Deficits, Holding Up the Dignity of U.S. Stocks》

- 《2024 U.S.: Strong Economy, Quick Rate Cuts? Wishful Thinking, Will Backfire》

- 《2023 U.S.: Rebirth Through Self-Destruction》

- 《Fed Makes a Sharp Turn, Can Powell Resist Yellen's Pressure?》

- Year-end U.S. Stocks: Small Gains Bring Joy, Big Gains Harm Health

- Consumer Spending Cools Down, Is the U.S. Really Just a "Stubborn" Fed Away from Rate Cuts?

- U.S. Stocks Overdrawn Again, Finally the Chance for Chinese Concepts

- The Faith in U.S. Stocks "Never Sets" Is Back, Is It Reliable This Time?

- High Interest Rates Can't Douse Consumer Spending, Is the U.S. Really Thriving or Just Hype?

- Second Half of Fed Tightening, Neither Stocks nor Bonds Can Escape!

- The Most Down-to-Earth Approach, Dolphin Investment Portfolio Sets Off

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.