Posts

Posts Likes Received

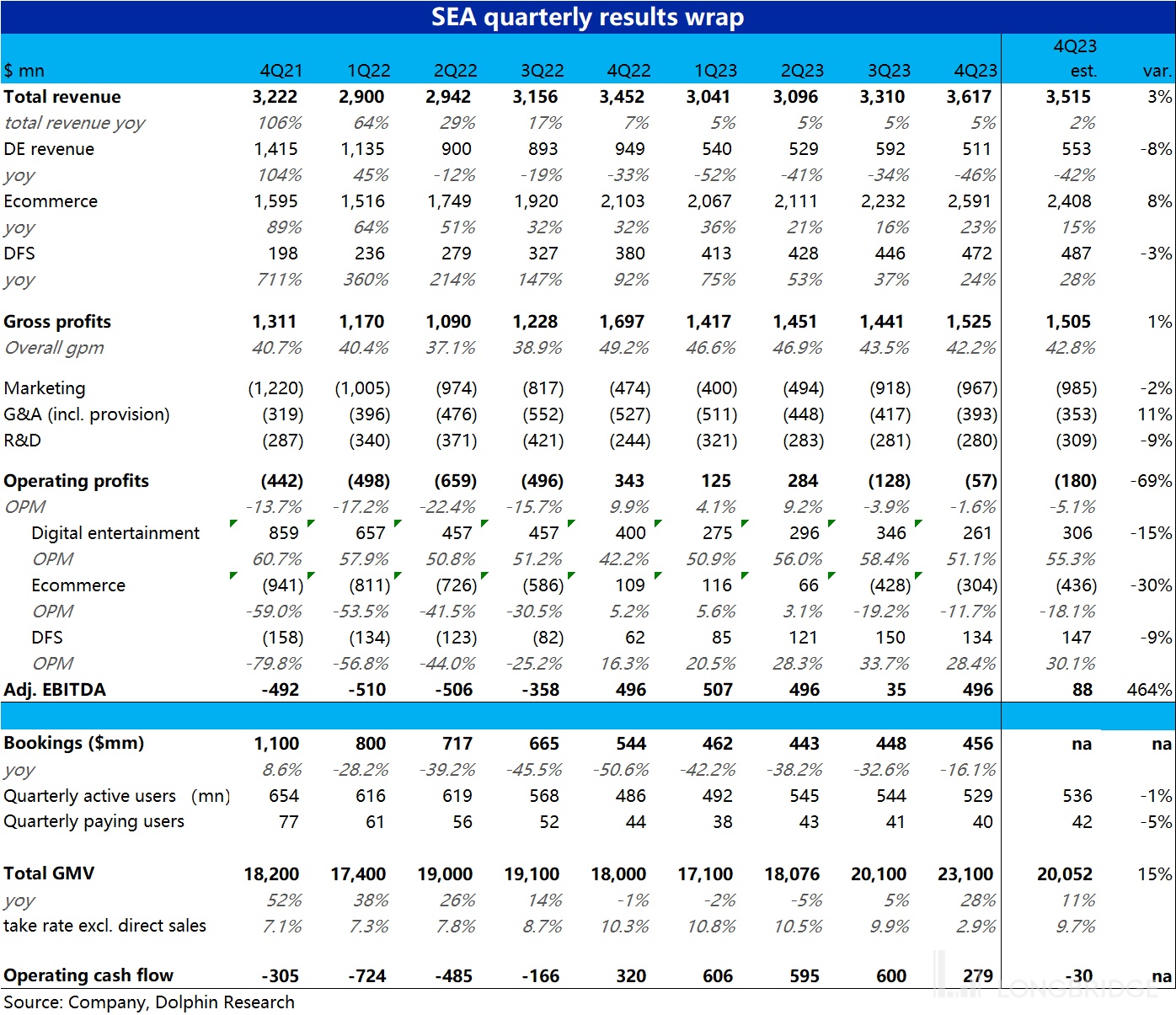

Likes ReceivedSea: E-commerce GMV is expected to achieve around an 18% growth in 24 years.

Below is the summary of the earnings conference call for the fourth quarter of 2023 for Dolphin Research. For an interpretation of the earnings report, please visit "Tiktok Absent Turns the Tide, Is Spring Coming for Dolphin Research?"

1. Review of Core Financial Information:

2. Details of the Earnings Conference Call:

2.1. Key Points from Executive Statements:

Profit Milestone for the Year: The company achieved annual profitability for the first time since its IPO, strengthened its position in the e-commerce market in 2023, expanded digital financial services, and stabilized digital entertainment business. By the end of 2023, the company's cash reserves increased to $8.5 billion, with expectations of continued profitability in 2024.

Sea Market Share and Growth: Sea achieved significant growth in the Southeast Asian market, planning to maintain and expand its position in the next four years, with GMV expected to maintain high growth. a) Sea will focus on improving buyer services, product price competitiveness, and content ecosystem. By optimizing delivery, return processes, customer service, and collaborating with more seller supply chain resources. b) Sea's GMV and order volume in the fourth quarter increased by 29% and 46% YoY, respectively, with adjusted EBITDA losses decreasing by 35% MoM, indicating strong growth. c) Sea has established sorting centers and distribution points in Asia to enhance logistics coverage, reduce costs per order through automation and operations. Live e-commerce is rapidly expanding, becoming a competitive advantage. d) Sea's per-order profit loss in Brazil improved by nearly 90% YoY, attributed to user profitability and cost efficiency improvements, achieving a leading position in logistics costs.

SeaMoney Credit Business Highlights: a) Since 2019, SeaMoney has responded to Sea buyers' needs with "buy now, pay later" services, later expanding to provide cash loans to buyers and sellers. b) In 2023, SeaMoney achieved profitability for the first time, with full-year adjusted EBITDA of $550 million. c) Outstanding balances for consumer and SME loans grew by 27% YoY to $3.1 billion. In the fourth quarter, active loan users grew by 28% YoY, exceeding 16 million. d) Plans to continue investing in user acquisition for credit business in 2024 and prudently manage risks. e) In addition to credit, also developing digital banking and insurance services to capture future opportunities.

Garena Gaming Experience and Innovation: a) Garena successfully enhanced and optimized player experience for games like "Free Fire," introducing localized content. Trends in user acquisition and retention for "Free Fire" improved, with the highest global download volume in 2023. In February 2024, "Free Fire" peaked with over 100 million daily active users, with double-digit YoY growth expected in user base and bookings.

Collaborating with Lamborghini to allow players to drive their cars in the game, enhancing immersion. Collaborating with JKT48 as the brand ambassador in Indonesia to nurture the local community.

Cash Flow and Investments:

At the end of Q4 2023, the total cash, cash equivalents, short-term and other treasury investments amounted to $8.5 billion, with a net increase of $566 million compared to the previous quarter.

The increase includes gains from the resale of lower-value securities purchased under banking business agreements, amounting to approximately $370 million.

2.1 Q&A Analyst Q&A

Q: What are Sea's more 2024 guidance? What are the assumptions regarding the competitive environment and market share, especially in Indonesia? How to achieve a high double-digit growth rate? Where does the confidence in restoring profitability in the second half of this year come from? What is the expected EBITDA profit margin that can be achieved in the near term? Why is SeaMoney's EBITDA weaker this quarter compared to the previous quarter? Has there been more investment in marketing this quarter? What are the growth prospects for 2024? Can we still expect EBITDA growth?

A: The company believes it can achieve high-speed growth throughout 2024, especially in the Indonesian market. The company expects the growth trend to continue from the fourth quarter to the first quarter and remain consistent with other markets. Compared to a year ago, the company is now in a better position in terms of scale and believes it has gained market share in Indonesia. In Indonesia, the company's logistics coverage is much larger than before, with significant reductions in transportation costs over the past few quarters, along with improved quality. The company recently introduced instant return services for users, which have received positive feedback not only in Indonesia but also in Vietnam. Additionally, the company has launched differentiated services such as on-the-go returns and order modifications during transportation, which other companies in the market have not yet provided. The strong integration with digital financial services not only reduces transaction costs (e.g., in payments) but also unlocks potential market cycles by providing data upgrade services to a wider user base. These efforts help reduce costs and improve market conversion rates.

The company's goal is to achieve a balance between profit and loss for Sea's overall business in the second half of this year while maintaining its current market share. This also applies to the Indonesian market. The live streaming business has seen rapid growth this quarter, with about 15% of orders coming from live streaming, a higher proportion in Indonesia. The company believes it is one of the largest live streaming platforms in the market and has significantly reduced operating costs over the past few months, with plans to continue this trend in the first quarter. SeaMoney business achieved profitability for the first time in 2023, with a healthy profit margin from Q1 to Q4. In Q4, the company invested more in facilities to attract new users to the platform, which will bring better possibilities in the long run. The company carefully measures user acquisition costs to ensure that each new user can generate positive profits over time.

Q: In Q4, did the company's performance improve due to TikTok's absence in the market? Has the competition intensity changed between TikTok and Tokopedia's entity after TikTok's re-launch and approaching the end of the trial period? How will cash be used and allocated, including the possibility of stock repurchases and other purposes?

A: TikTok's partial absence in Q4 did benefit the company to some extent, but it was not the sole reason for the good growth in Q4. Even after the situation changed, the company also saw a similar growth trend in Q1. The company believes that the most important thing is to focus on its strengths, such as scale advantage, local leadership and operations team, long-established infrastructure, integration with DFS, etc., which have provided a competitive advantage in the past few quarters and will continue to do so in the coming quarters. Sea is expected to have good growth in 2024 and the following quarters. Maintaining a strong cash balance, the company does not rule out any options for using the cash balance.

Q: Will there be increased spending to cope with competition? Will it hinder the profitability to recover EBITDA in the second half of this year? What are the main sources of confidence in maintaining double-digit growth in bookings and user growth for "Free Fire" this year? What measures have been taken or planned to restore user attractiveness and commercialization?

A: Market share is always dynamic, and it is important to ensure that the company always maintains a visible leadership position relative to its competitors to sustain its scale advantage. In the past few quarters, despite intense competition, the company has been able to reduce costs and increase market share. The company is encouraged by the positive trends of "Free Fire" this year, including active user base and monetization in various markets. It is currently expected that the game will achieve double-digit year-on-year growth in users and bookings. The focus in the future is on improving user experience, such as simplifying user file download sizes and data requirements, introducing more engaging content, and strengthening the esports community.

Q: The GMV in the fourth quarter implies a year-on-year growth rate of about 18% for 2024. Why does the company only expect growth in the "high teens" range? What leads to this conservative guidance? Does the expected profitability in the second half mean that Sea's adjusted loss will narrow year-on-year in 2024? Why did the number of paying users decrease in the fourth quarter? What is the profit outlook for the Garena business?

A: The growth guidance provided by the company is based on market growth rates and the set EBITDA target. The "high teens" growth rate is considered a reasonable estimate while maintaining market leadership and strengthening the competitive model established over the past few years. The company has not provided a clear guidance on whether Sea's full-year loss will narrow. Quarterly user fluctuations may be caused by various reasons, including seasonality, overall game releases by Garena, and esports events. The company holds a very positive outlook on the trends of "Free Fire".

Q: How do you view the fee trend of Sea in 2024 (including advertising and commissions)? In terms of financial technology, given the strong growth momentum observed, what user acquisition strategies are in place? Apart from organic growth, what other channels are used to acquire new users? How do you anticipate the expected proportion of long-term loans (as a percentage of total loans)? How can technological or data insights help maintain this proportion at a lower level?

A: The company has been continuously adjusting commission rates recently to maintain a healthy market ecosystem, ensure sellers' reasonable profits, and promote overall market development. Specific adjustments are expected to be made this year for certain categories or countries. Meanwhile, the company sees significant growth potential in advertising click-through rates, has enhanced click-through rates through technological improvements, and plans to continue optimizing them in the coming quarters. Currently, the company's focus is on the credit sector while actively expanding into digital banking and insurance businesses. Plans are in place to further expand e-commerce platform penetration through SeaPay Later, despite being in the early stages of expanding digital financial platforms, the potential is immense. In countries like Indonesia with low credit card penetration rates, leveraging Sea's market penetration, the company is poised to be the first to provide credit services to the broader market. In addition to ecosystem users, the company plans to attract users outside the system through offline QIS payments, products, theme consumer loans, and other channels. Furthermore, the company plans to cross-sell other financial products to user groups, utilizing e-commerce transactions and external data to enhance credit rating efficiency. As users join the Sea platform and accumulate credit data, the company will sell them more credit products to meet various scenario needs. To enhance economic benefits, the company is gradually launching new products and reducing service costs as it scales up. The stable non-performing loan ratio is attributed to the company's excellent credit modeling team. The company carefully evaluates the overall situation, pursues long-term profitable growth rather than short-term gains.

Q: What are the differences in average order value (AOV) and profit margins between traditional e-commerce and live streaming businesses? What are the EBITDA margin expectations for the live streaming business in a stable state? Does the expected release of "Free Fire" in the Indian market contribute to the double-digit growth expectations? Are there specific markets that are driving the company's optimistic outlook on overall growth?

A: The unit economic benefits of the live streaming business have improved in the past few months, but compared to the non-live streaming parts, its economic benefits are still lower due to initial investments and the need to drive growth. In the long run, the unit economic benefits of the live streaming business are expected to be similar to other parts of the platform. The LV of the live streaming business was initially lower but is gradually converging with other parts of the platform over time, and in some markets, even higher. This trend is expected to continue in major markets. There may be different changes in smaller markets, but these changes are not significant for the current discussion purposes. "Free Fire" has not seen significant developments in the Indian market yet. The company is adjusting "Free Fire" in the Indian market to better cater to local user preferences.

Q: What is the view on growth and momentum in the first quarter? The decline in value-added services (VAS) in logistics, at least partially due to transportation subsidies. Besides subsidies, are there other reasons or strategic considerations leading to this significant difference? Considering the subsidy factor, is the VAS growth similar to the growth in core markets?

A: The company is satisfied with the growth in the first quarter, although external data may not be accurate enough. Considering that the first quarter is the Ramadan season, especially in Indonesia, and the New Year in other markets, these factors have influenced the growth trend. Overall, the company is satisfied with the performance in the first quarter so far. It is encouraged to focus on the growth in core markets to measure the growth, revenue, and profitability of the entire platform. The top-line growth of VAS differs from the growth in core markets, mainly due to accounting treatment. The reverse revenue effect generated by transportation subsidies has impacted the growth of VAS, affecting not only profits but also the top line of that revenue segment, leading to an overall deviation in trends. The company cannot discuss non-GAAP revenue or adjusted revenue, but if these factors are taken into account, the overall growth aligns with the platform's growth.

Q: Has cohort analysis been conducted to study the impact of live streaming on GMV after removing buyer incentives? Apart from Free Fire, does Garena have any development plans to transition from a single franchise operation to a broader studio approach?

A: The team has conducted cohort analysis on live streaming and observed high retention and repurchase rates. Live streaming has attracted a large number of new users, which helps the company further expand its market. New users not only make purchases on the live platform but also engage in cross-purchases from other long-term live platforms. These signs indicate that the economic benefits of the live streaming business are improving. Garena is not just a platform for a single franchise operation. Garena's success is attributed to the strong operational capabilities of its global team, collaborations with content partners and self-developed collaborations, and the growth of the global esports community. The company is very focused on building future content pipelines, including expanding the mix of game types and content, increasing user-generated content, and deploying more artificial intelligence tools to enhance user interaction.

Q: How to maintain price competitiveness and ensure the sustainability of the supply chain? How does the overlap of merchants on the platform compare to other e-commerce applications in Indonesia? How will the overall dynamics of e-commerce develop in the end? How to assess the long-term profit level in terms of EBITDA?

A: The key to maintaining price competitiveness lies in several aspects: the company's large scale gives it stronger bargaining power for sellers with higher sales volumes on the platform; from the seller's perspective, the company simplifies the transaction process, provides tools, policies, and basic concepts of market operations, making it easier for sellers to succeed on the platform; through trust allocation algorithms and policies, the company can identify well-performing sellers with strong price competitiveness and provide them with better traffic. There are sellers in the market focusing on certain parts of the value chain, such as production or import. As a market platform, the company must serve these sellers well to help them sell smoothly on the platform.

By leveraging the strengths of sellers rather than demanding excellence in all aspects, many sellers can stand out on the platform. Our market is not expected to differ significantly in long-term development from other major e-commerce platforms seen in the past. The projected profit levels will be reasonable and may be slightly better in certain markets due to our market position and the nature of retail profit margins. While facing more intense competition in some markets, overall, we do not believe that our market differs significantly from others.

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure