Posts

Posts Likes Received

Likes ReceivedAfraid to chase after Mag-7? Chinese concept stocks benefited unexpectedly.

Hello everyone, here is the core content of this week's strategy weekly report summarized by Dolphin Research:

1.The US employment data for February shows that the continuous support of the US economy by the labor supply side population is evident. Although US residents may lose the excess leg of consumer spending, the current cash generating ability supported by employment is still strong.

2. The PMI index for the US manufacturing sector in January and February shows signs of stabilization, which likely indicates that the downward trend in the service sector PMI should be nearing its end. If interest rates are lowered, the service sector PMI is likely to enter a cyclical upturn, indicating that the current heat in service sector employment may only increase.

3. Since the Spring Festival, the liquidity in the US stock market has been continuously marginally loose. Coupled with the Fed's statement on reverse distortion operations, it indicates that the Federal Reserve has sufficient policy tools to balance the market. The main issue lies in fiscal policy: fiscal financing should not be excessive or overly burdensome. Looking at fiscal revenues in January and February, as well as the financing plans for the past two quarters, there has been marginal improvement.

4. With more liquidity and funds structurally seeking undervalued companies beyond the top 7, the overall valuation of Hong Kong stocks and Chinese concept assets remains relatively low, leaving room for short-term adjustments.

Here are the detailed contents:

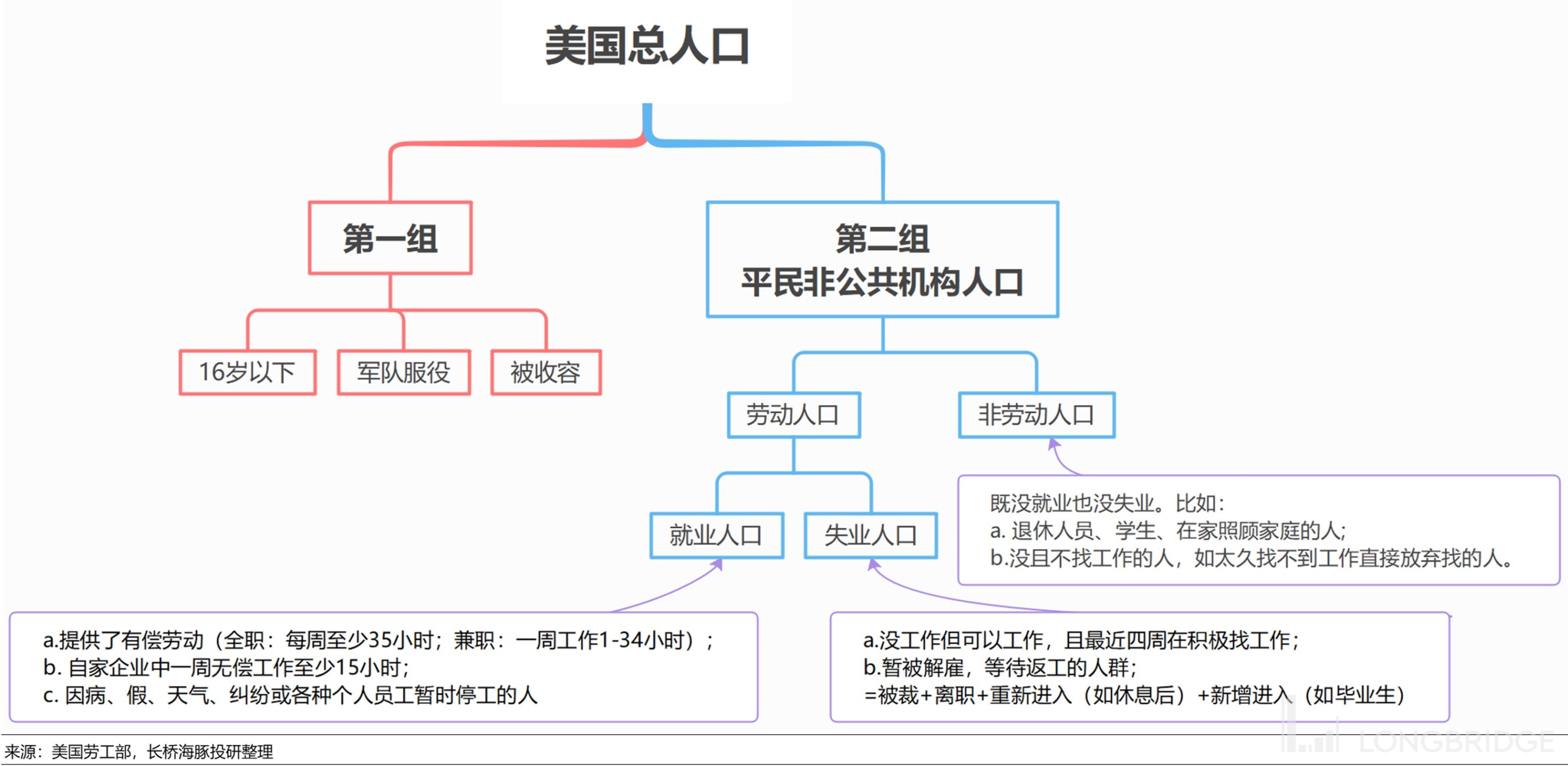

As the excess reserves of the US household sector are depleted, the purchasing power of Americans increasingly relies on their current earning and creative abilities. Within this earning capacity, the largest and most stable contribution comes from employee compensation, which is mainly composed of two aspects: (1) new employment; (2) hourly wage growth. This data was released last Friday and is worth analyzing in detail:

I. Continuous labor force support for the economy

At this stage of the labor market, one fact is very clear: the post-epidemic labor shortage is not only due to excessive demand but also because of early retirement caused by the epidemic leading to a decrease in labor force participation, as well as almost stagnant immigration during the epidemic. Supply restoration can bring about improvements in employment.

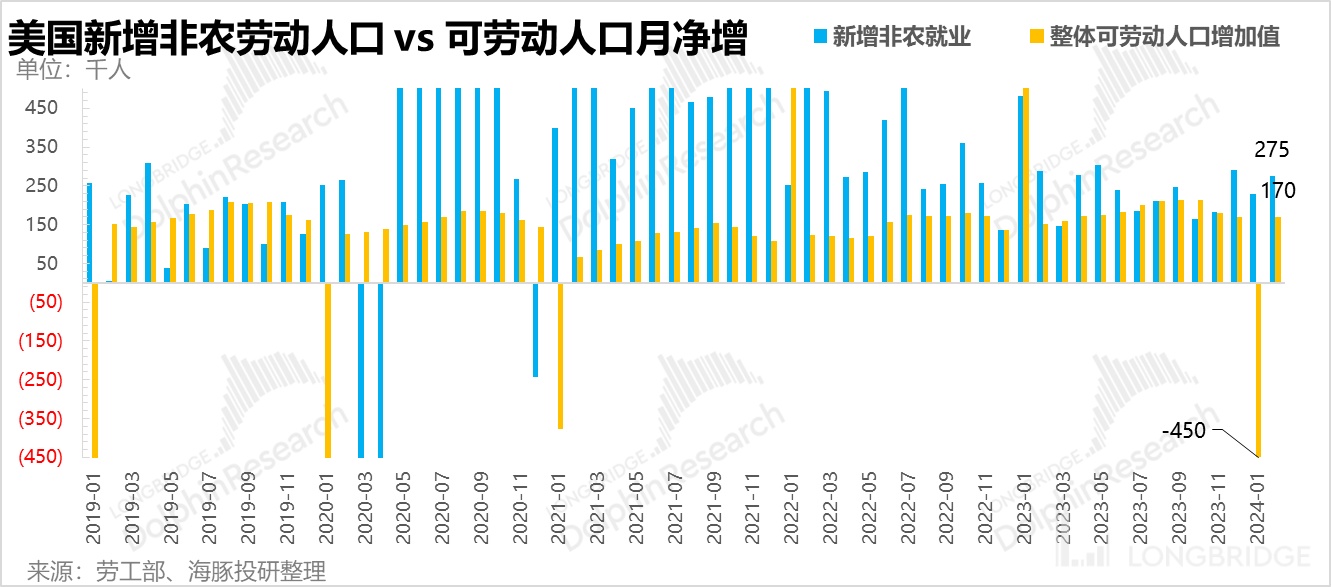

Looking at the pace after the epidemic, the monthly new supply of the entire labor force reservoir (including labor force + non-labor force) has been maintained at around 150,000. The natural increment of the labor force can maintain a monthly employment balance of around 100,000 to 150,000.

With non-farm employment continuing to exceed 150,000, the implication behind this is that there is a persistent shortage of labor supply during this period. This situation persisted in February:

In February, the labor force reservoir added 170,000 people, of which these 170,000 people need to discount the labor force participation rate to obtain the actual additional labor force. However, the net increase in non-farm labor force in February was 275,000, indicating that more unemployed individuals found jobs in the non-farm sector.

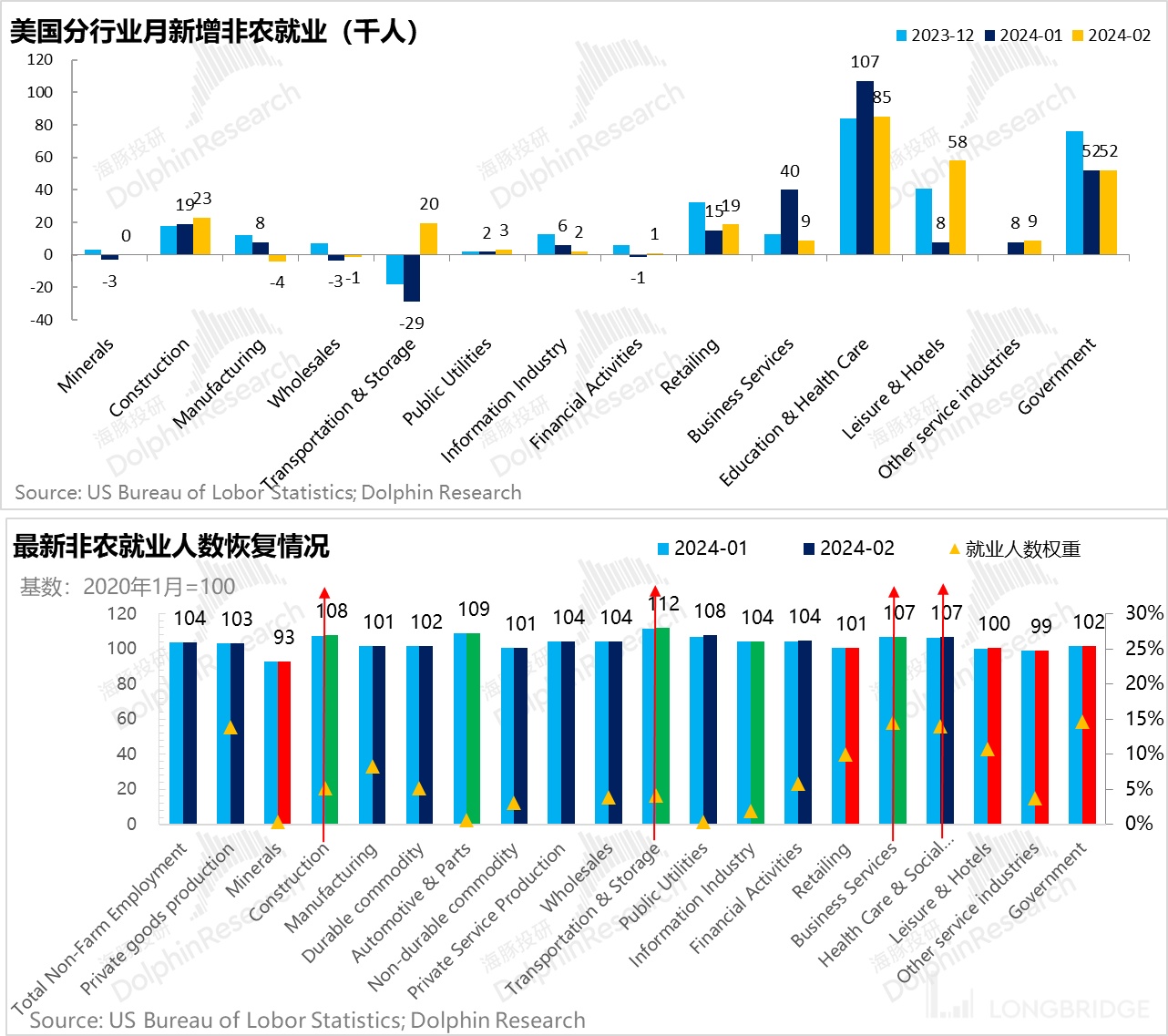

From the distribution of non-farm job growth in the two major sectors - private goods production and private service provision, it can be seen that in the goods production sector, only the construction industry has relatively strong employment, echoing the "industrial reconstruction" in the United States after the epidemic.

In the private service provision sector, the big employer is still healthcare, followed by catering and professional business services in leisure hotels. Among them, the professional sector, due to its large subcategories, is actually experiencing sustained growth in a) construction, engineering, and similar services, essentially echoing the industrial reconstruction in the United States; b) computer system design, where the expansion of personnel in this sector corroborates the technological wave driven by AI.

The sector with significant marginal changes is retail, mainly including daily necessities retail such as department stores, supermarkets, and hypermarkets, which have been steadily warming up since November last year, showing a net increase in hiring.

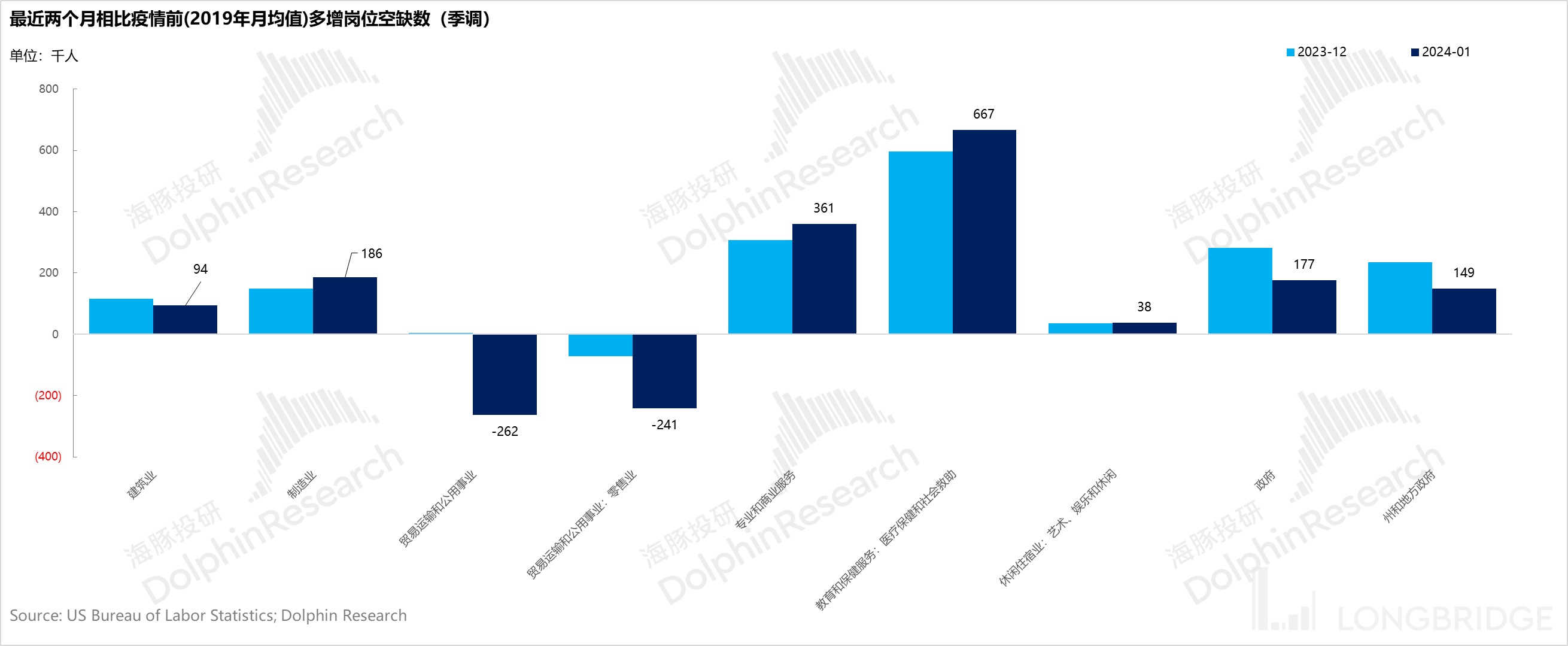

Looking at job vacancies in January, the healthcare industry is facing a severe shortage of labor supply. Despite the high number of new jobs, the employment gap is growing larger, indicating a clear trend of labor shortage in the healthcare industry post-epidemic.

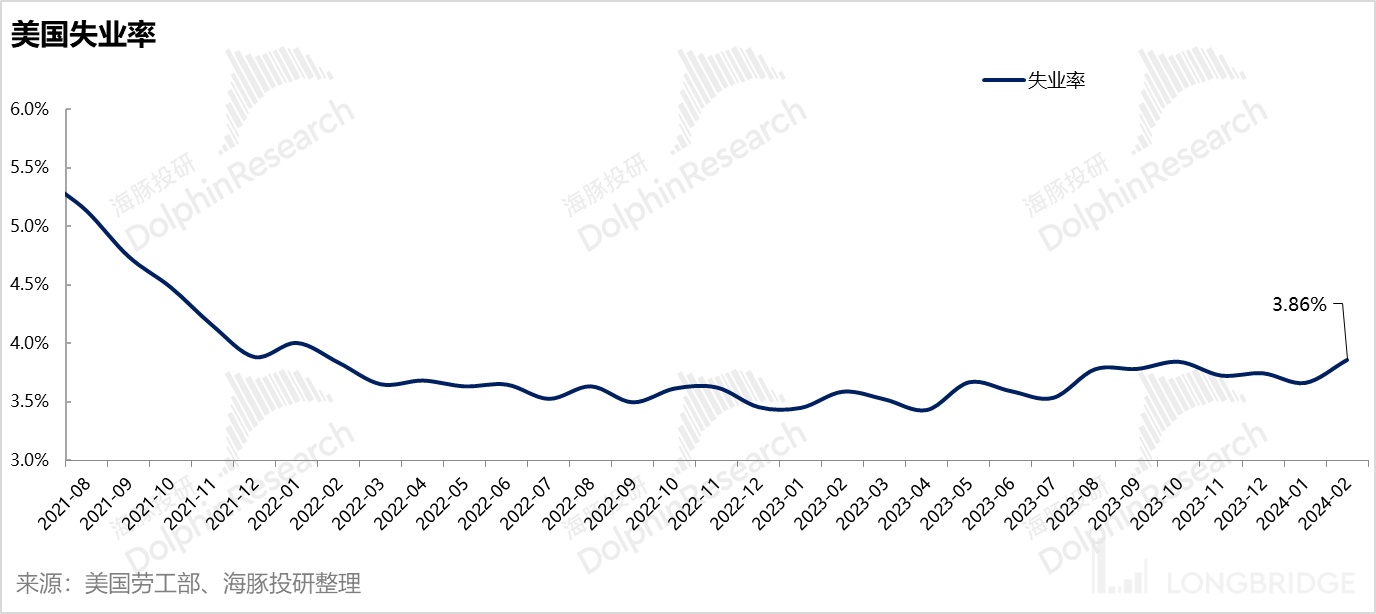

However, an interesting point is that although non-farm employment was high in February, the unemployment rate actually increased in February, reaching close to 3.9%. This is mainly due to a significant net decrease in other types of employment besides non-farm employment, such as rural employment and self-employment. Of course, it could also be due to the fact that new jobs are counted based on positions in statistics, while the unemployment rate is calculated based on individuals, leading to potential statistical errors if one person holds multiple positions.

In terms of wage growth, after a significant increase in January, the growth rate slowed down in February. Similar fluctuations were observed in January and February last year, indicating more of a seasonal fluctuation.

Overall, as of February, the performance of the U.S. labor market remains relatively robust. Behind this resilience lies a trend: the continuous support of the U.S. economy by the population filling the labor supply side, although American consumer spending may lose some excess capacity, the current earning capacity supported by employment remains intact.

II. February PMI: Signs of price expansion persist

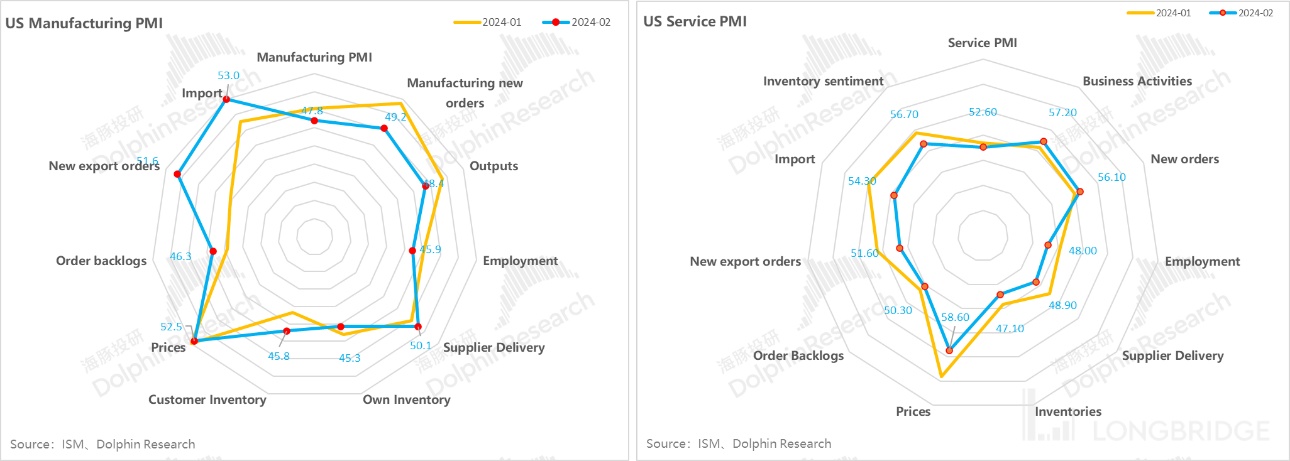

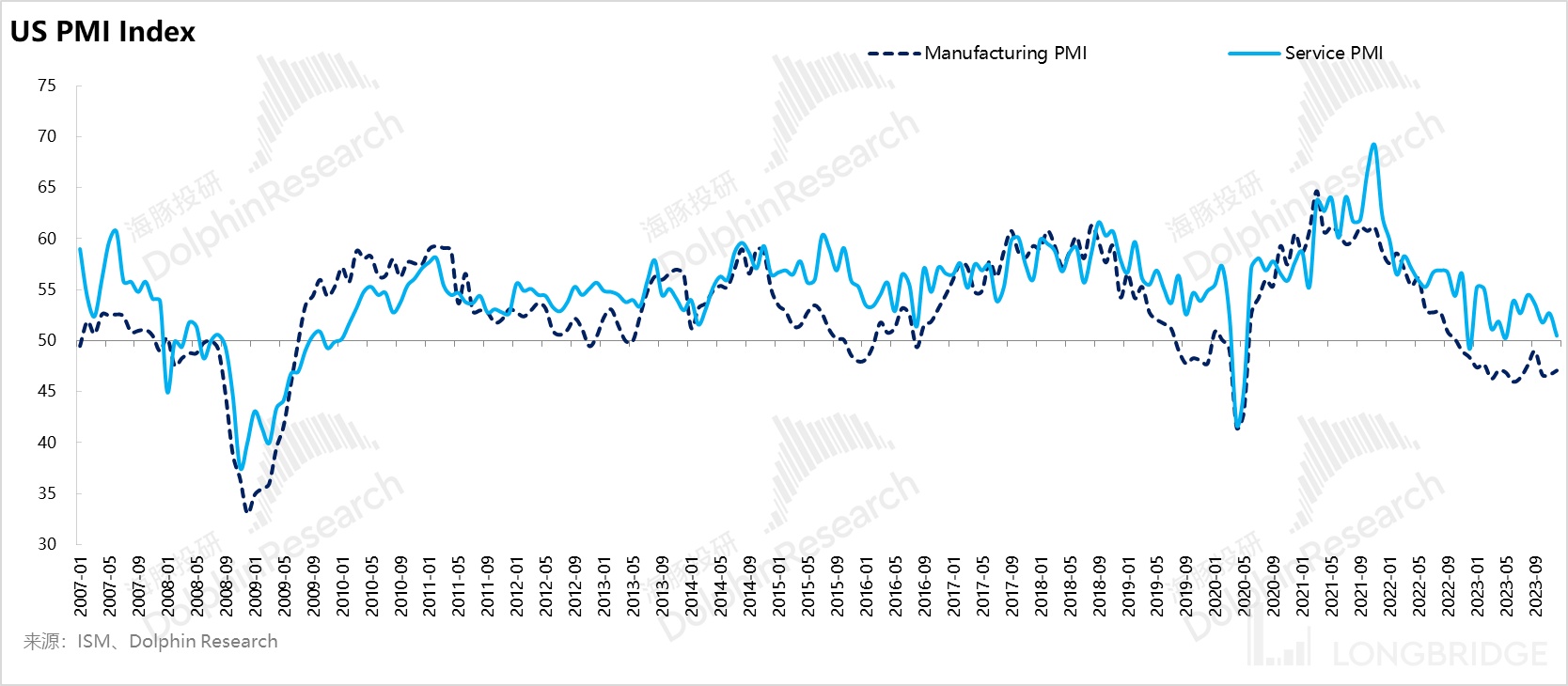

In January, the US manufacturing PMI saw new orders entering expansion territory for the first time, but in February, it contracted again. However, a consistent signal behind January and February is that both the services and manufacturing sectors have seen continuous expansion in the price index, implying that the destocking cycle is coming to an end.

Historically, during each contraction cycle, the manufacturing sector is more sensitive, and the decline in manufacturing PMI drags down the services PMI like gravity. The signal of the PMI index bottoming out suggests that the downward trend in the services PMI should be nearing its end. If there is a rate cut, the services PMI is likely to enter an upward cycle, indicating that the current heat in the service sector job market may only increase.

III, Abundant Liquidity: Reverse Repurchase Releases, High Fiscal Revenue and Expenditure

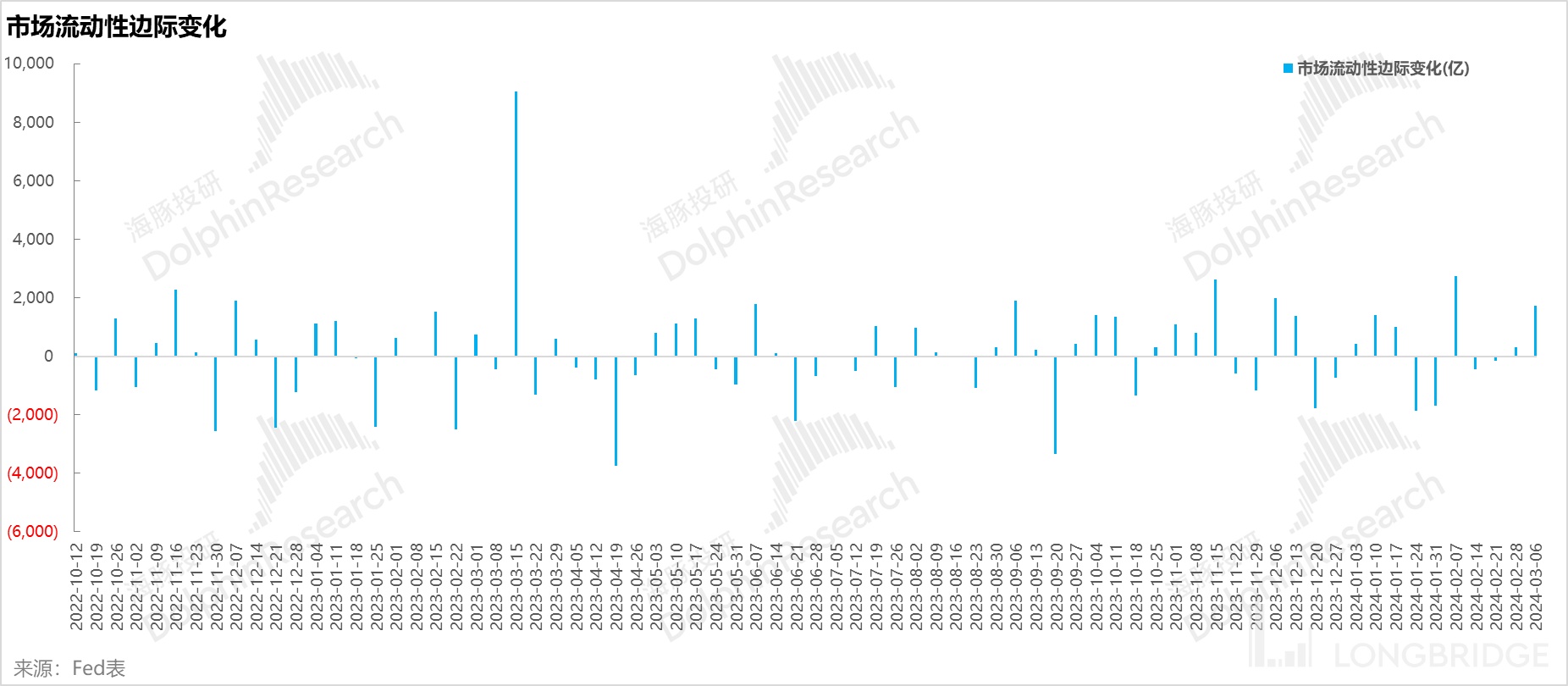

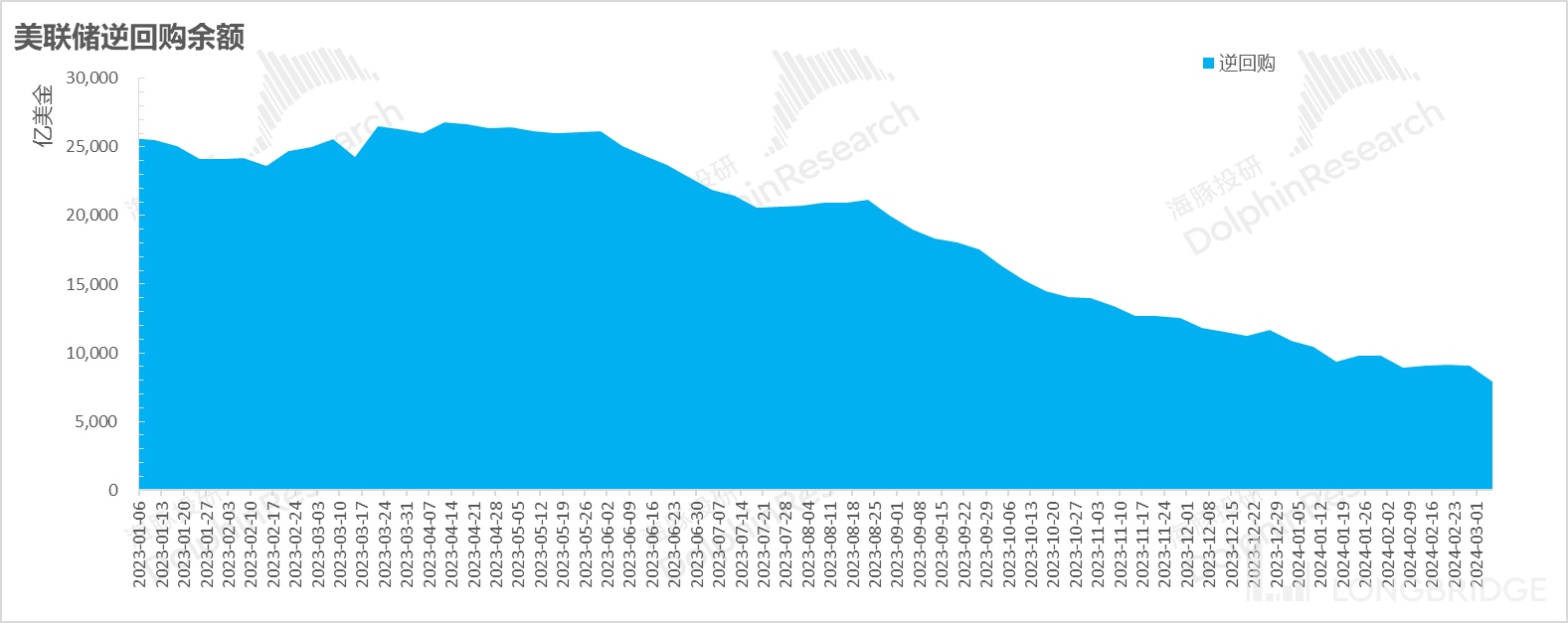

From a quantitative perspective, the current market liquidity has been marginally loose since the Chinese New Year, mainly due to three major contributions: a) the Federal Reserve's bond selling pace has slightly slowed down; b) the consumption of reverse repurchase balances; c) accelerated consumption under the high deposit balance of the TGA.

Based on Dolphin Research's calculations, liquidity in the market has actually increased marginally since the Spring Festival.

Additionally, due to the rise in fiscal revenue and the relatively ample TGA account, the pace of reverse repurchase consumption has significantly slowed down in the past month (consuming less than 150 billion). If we follow the pace of the past month, the support from reverse repurchase for liquidity (760 billion as of last week) may still last for another 2-3 months, delaying the shift from consuming reverse repurchase to consuming bank reserves, which is the turning point for liquidity.

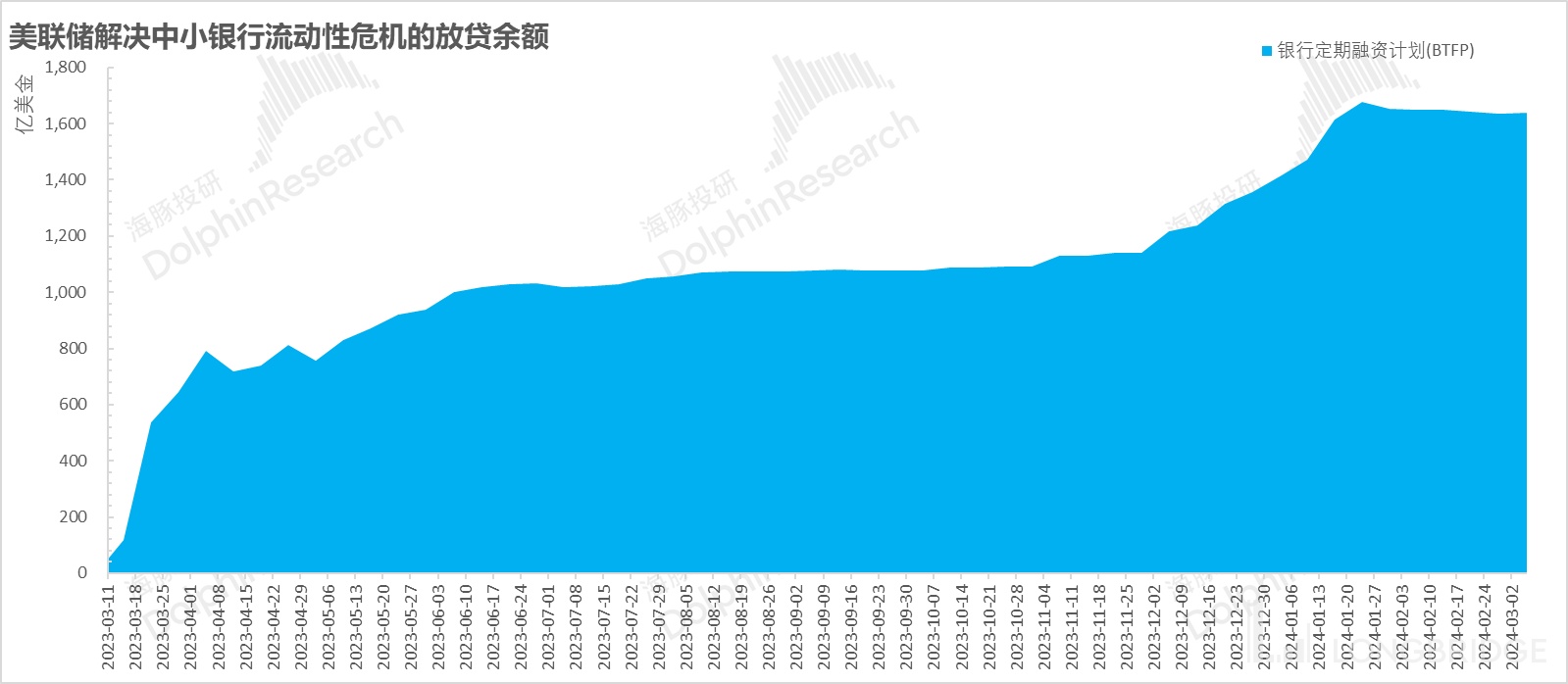

Moreover, regarding the Bank Temporary Financing Program (BTFP) for small and medium-sized banks expiring on March 11, the current approach is to stop using the tool, with existing amounts not being renewed. The current size of such assets is 164 billion US dollars, and if they are not renewed and passively cleared, they should be gradually cleared within a year. However, compared to the Federal Reserve's monthly reduction of 95 billion US dollars, this is a relatively small variable, so it is still important to monitor changes in the Fed's balance sheet reduction.

In addition, based on Powell's hearing and some statements from other central banks, Dolphin Research believes that when considering the possible slowdown of quantitative tightening (QT Tapering) by the Federal Reserve, the following methods may be taken into account:

a) Long-term bonds + MBS, with a larger proportion of long-term bonds possibly being sold off, resulting in a monthly long-term bond sales volume close to $95 billion.

b) However, the purchase of short-term bonds may be increased, using operations to distort the term structure, ultimately reducing the net amount of bond sales, while controlling the yield curve to ensure that liquidity remains reasonably abundant.

At least from the statements made, in terms of ensuring ample liquidity, the Federal Reserve actually has enough policy tools. The main issue lies in fiscal matters: fiscal financing should not be excessively heavy or burdensome. This problem seems to be marginally improving based on fiscal revenues in January and February, as well as recent fiscal financing plans over the past two quarters.

Overall, Dolphin Research's assessment of liquidity is to monitor changes in market liquidity without overemphasizing it, as there is room for liquidity adjustment under the coordination of the two economic heavyweights, fiscal and monetary policies.

IV. Where is the market heading?

With the marginal increase in liquidity in the U.S. stock market, as major players are expected to enter a capital investment cycle driven by AI computing power in 2024, the operating leverage release capacity in 2024 is likely to decline.

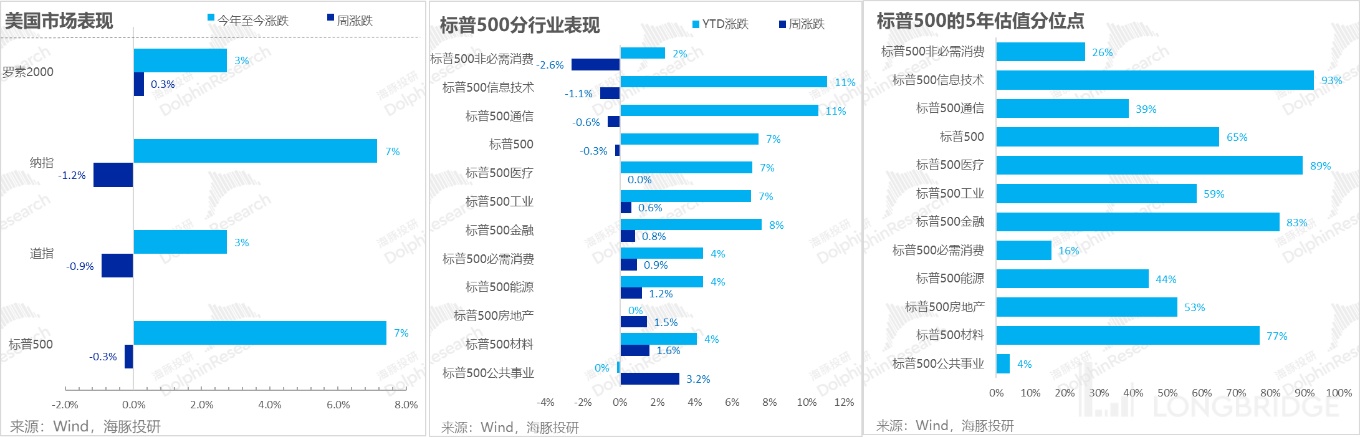

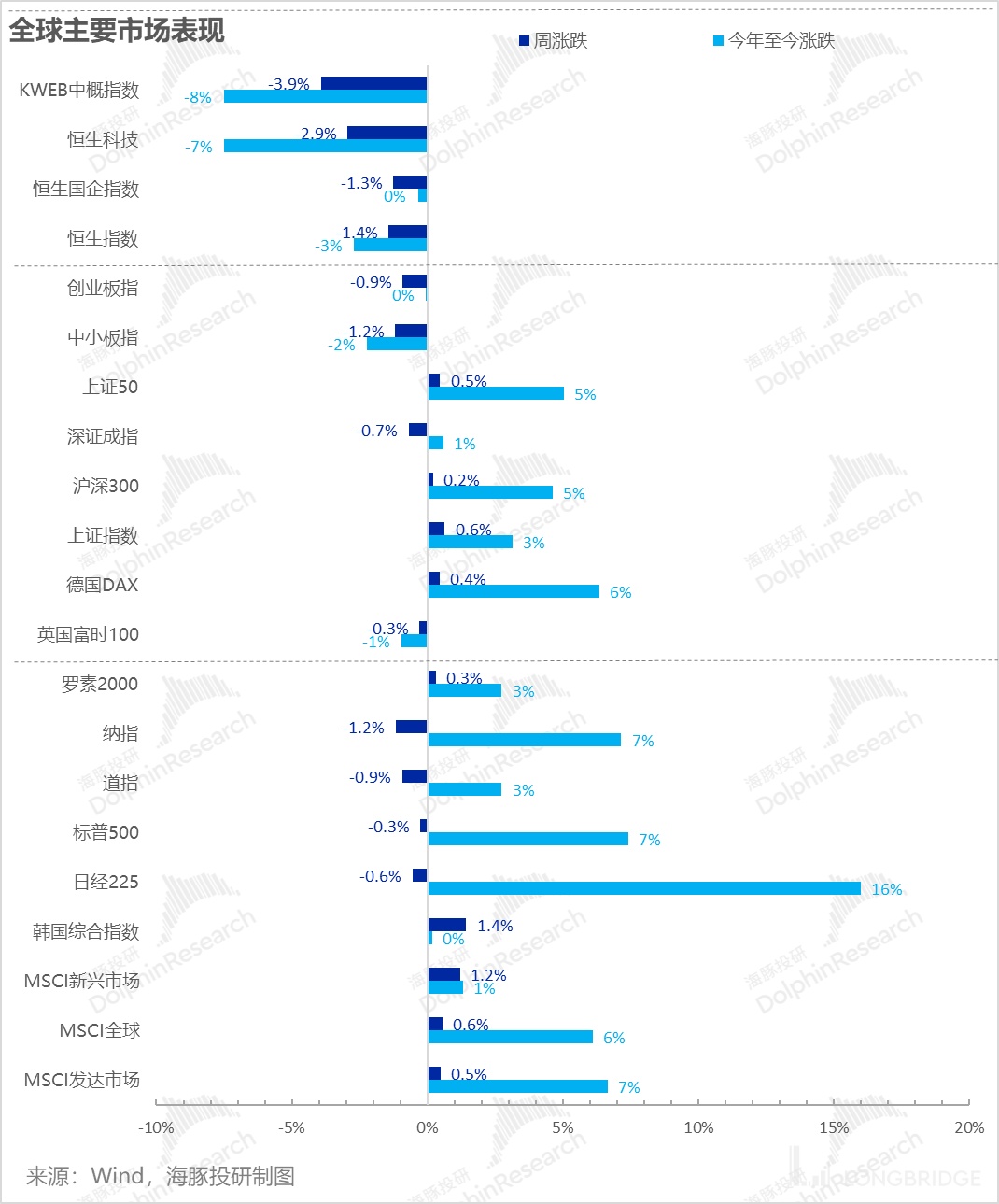

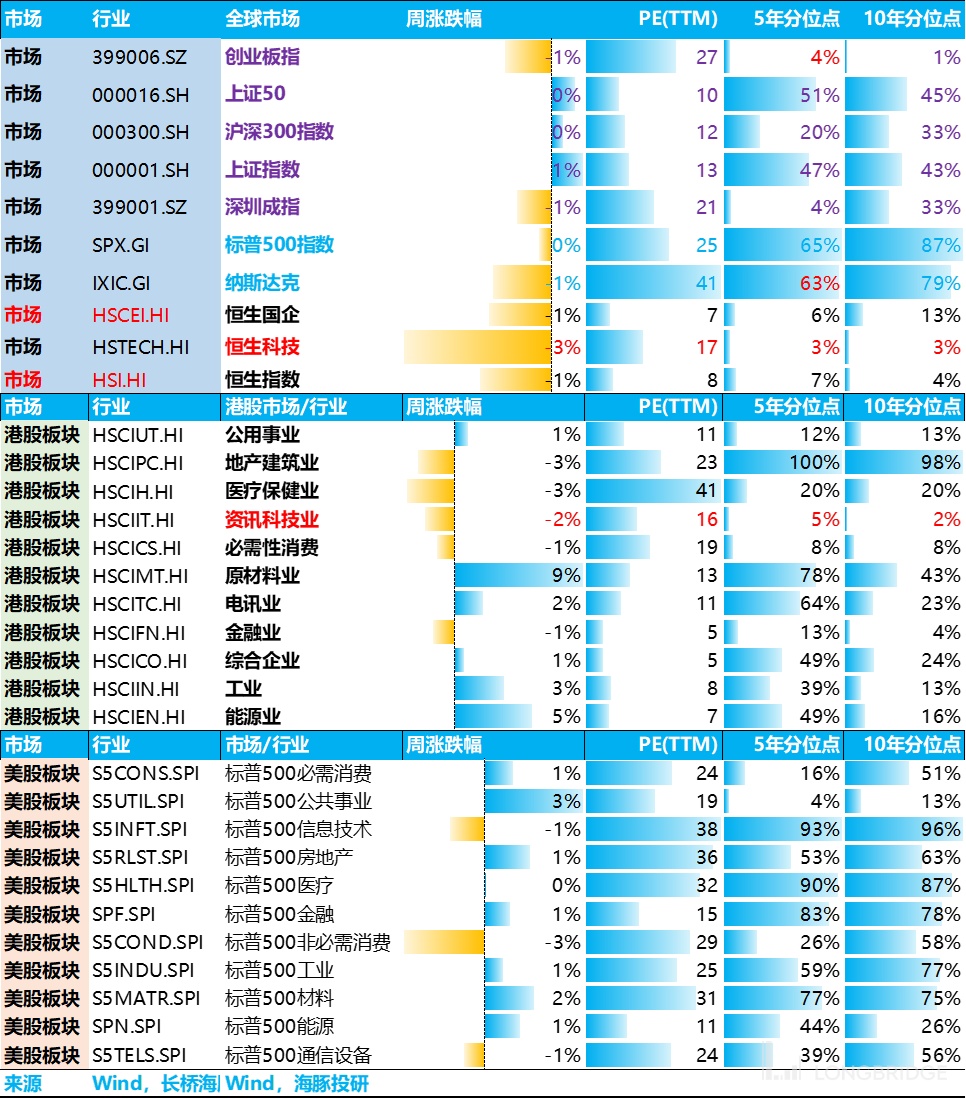

In this scenario, ample funds encountering downward marginal performance expectations and reasonably high valuations of major players lead to funds diversifying towards other markets, sectors, and undervalued individual stocks. During this process, Chinese concept stocks and Hong Kong assets are actually leading the recovery post the Chinese New Year, with a slight pullback last week due to the NPC; while other non-U.S. markets, except for Japan, are also experiencing continuous growth.

In a situation of loose liquidity and funds structurally seeking undervalued companies beyond the top 7, the overall valuation of Hong Kong and Chinese concept assets still remains relatively low, with potential for short-term recovery.

V. Portfolio Returns

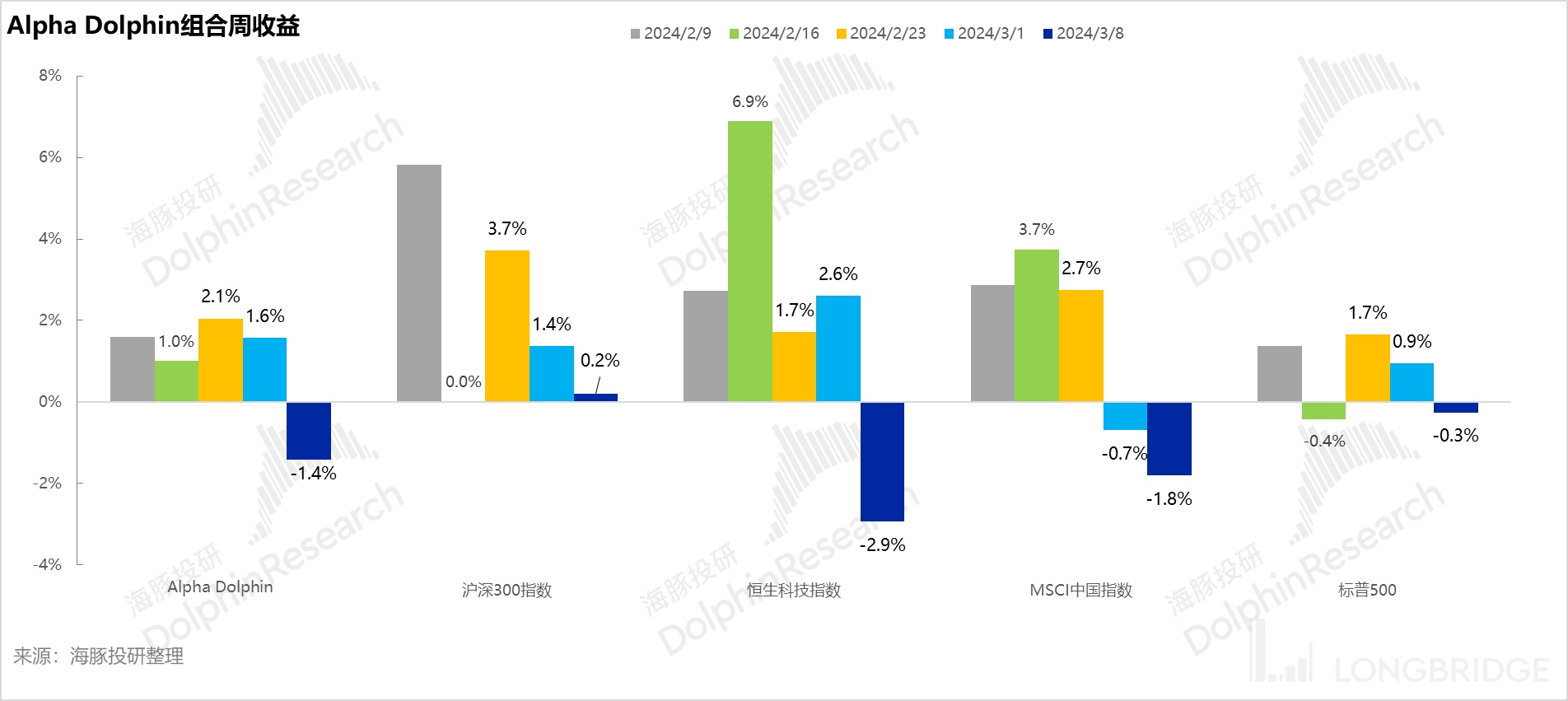

In the week of March 8th, the Alpha Dolphin virtual portfolio remained unchanged without any adjustments. The weekly portfolio return decreased by 2.2%, outperforming the Hang Seng Tech Index (-2.9%), but underperforming the Shanghai and Shenzhen 300 Index (+0.2%), S&P 500 (-0.3%), and MSCI China Index (-1.8%).

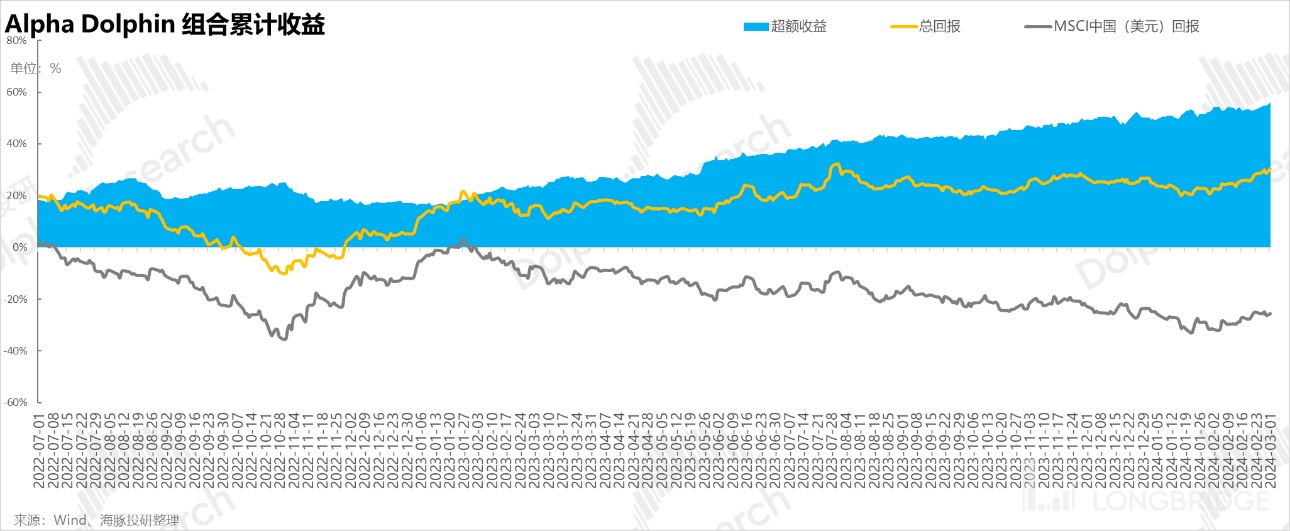

From the beginning of the test to last weekend, the absolute return of the portfolio is 29%, with an excess return compared to MSCI China of 55%. From the perspective of asset net worth, Dolphin Research's initial virtual assets of $100 million have now risen to $131 million.

VI. Individual Stock Contribution

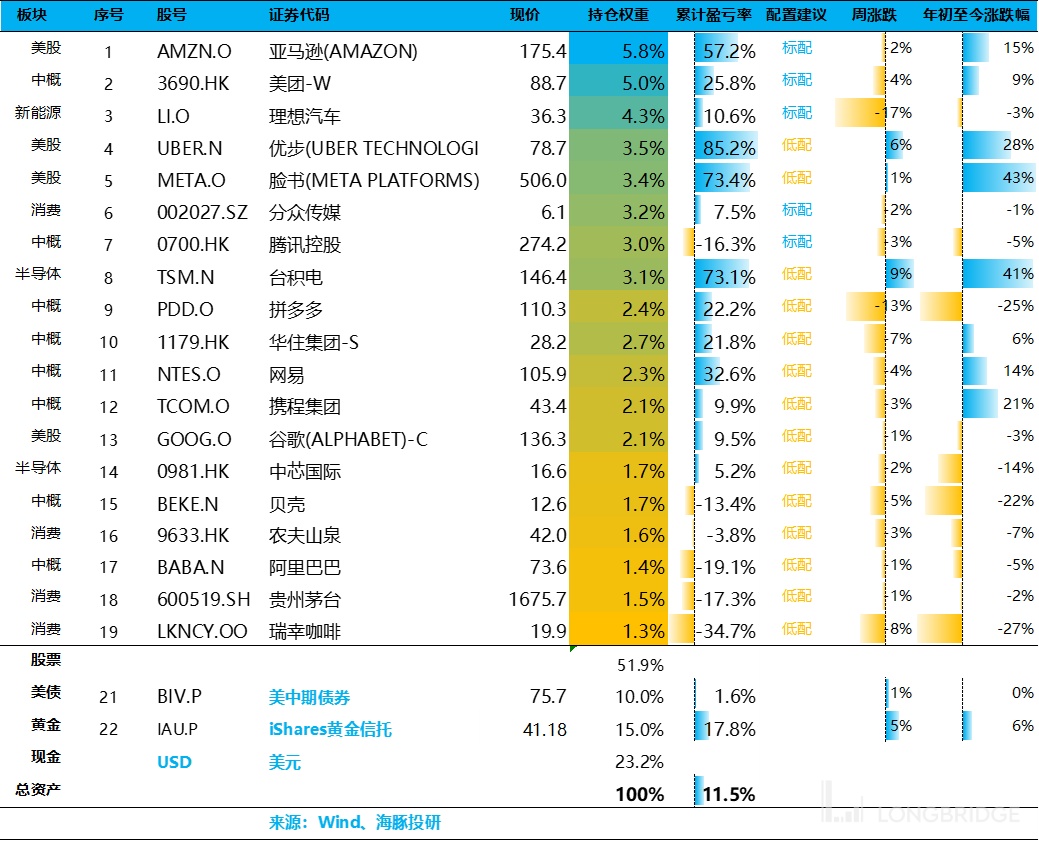

The recent fluctuations in the Dolphin Research's holdings and observed stock pools in the past week were mainly due to the significant drop in Ideal Auto's stock price caused by MEGA's disappointing data, as well as the impact on logic from the situation of TIKTOK in the US affecting Pinduoduo.

The valuation repair of Chinese concept stocks has entered the second wave - focusing on stocks with weak logic, extremely undervalued, but with potential for marginal reversal, such as Bilibili, Kuaishou, and others.

Regarding the major companies with significant price fluctuations in Dolphin Research's holding pool and watchlist last week, as well as the possible reasons, Dolphin Research's analysis is as follows:

VII. Portfolio Allocation

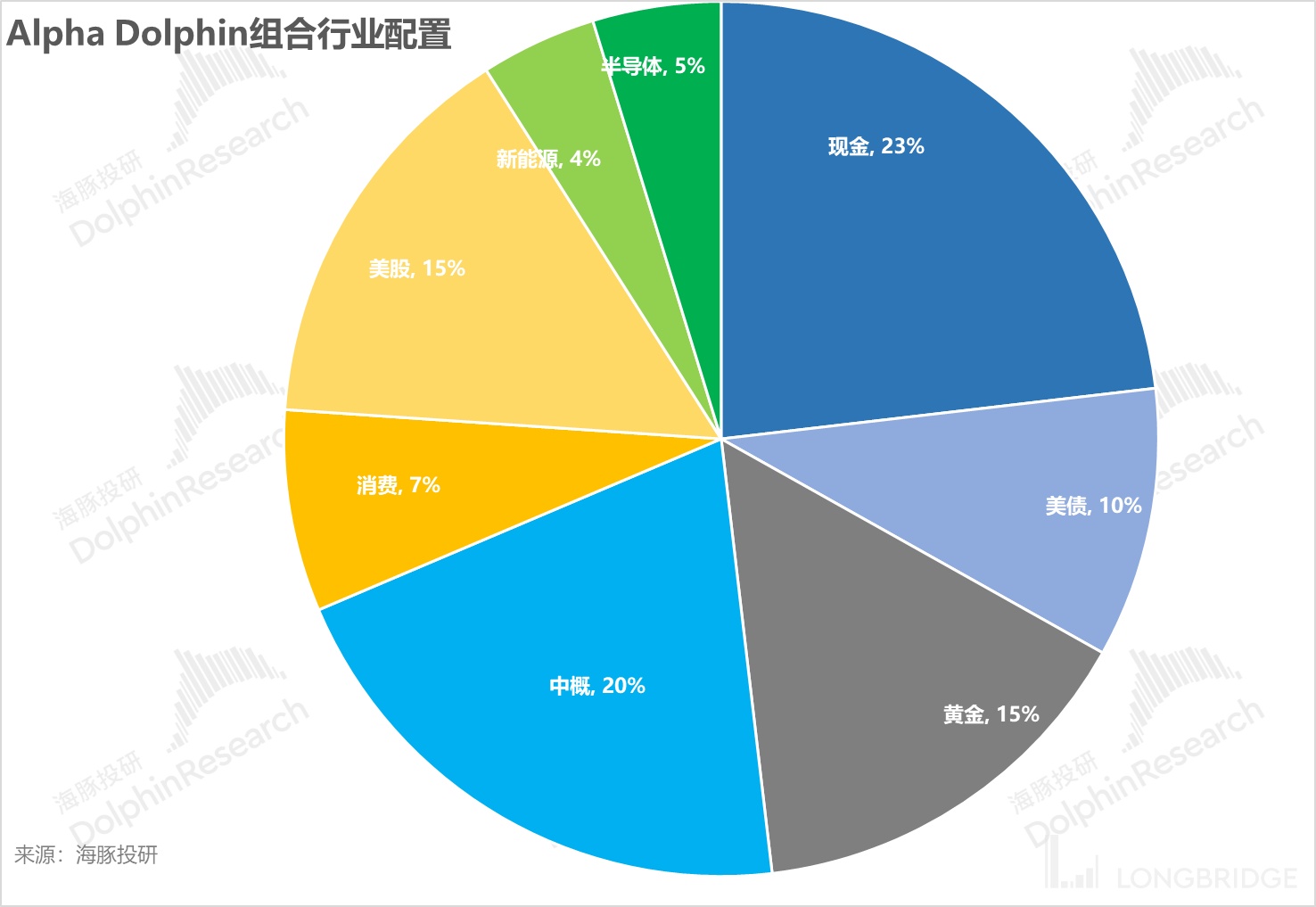

Alpha Dolphin's virtual portfolio holds a total of 19 individual stocks, with three core holdings and the remaining equity assets being underweighted, with the rest in gold, US bonds, and US dollar cash.

As of last weekend, the asset allocation and equity asset allocation of Alpha Dolphin are as follows:

VIII. Major Events to Watch

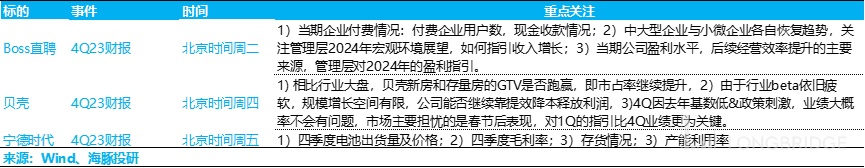

This week, Chinese concept earnings reports are entering a relatively calm period, with Boss Zhipin, Beike, and CATL releasing their performance. It is worth paying attention to the performance of CATL and Beike.

Among these three companies, although both Boss Zhipin and Beike have decent individual stock capabilities, they are unable to withstand the high beta pressure brought by the cycle. Meanwhile, CATL is struggling in the midst of industry oversupply.

Dolphin Research has compiled specific focus points as follows:

<END>

The risk disclosure and statement of this article: Dolphin Research Disclaimer and General Disclosure

Please refer to the recent Dolphin Research portfolio weekly reports:

- Big Tech Stagnation, Chinese Concepts Rising, Twilight or Style Switch?

- In 2024, Will the U.S. Economy Avoid Landing?

- Another Critical Moment! Will Powell Bail Out Yellen's Prodigality?

- When the Chips are Down Again, How Much Faith Can Endure the Test?

- Unstoppable Deficits, Holding Up the Dignity of U.S. Stocks

- 2024 U.S.: Good Economy, Quick Rate Cuts? Too Beautiful to Be True, Will Suffer Losses

- "2023 American Suicide Rebirth"

- "Fed Makes a U-turn, Can Powell Resist Yellen?"

- "Year-end US Stocks: Small Gains Bring Joy, Big Gains Harm Health"

- "Consumer Cooling Off, Is the US Fed Really Just a 'Tough-Talking' Central Bank Before Rate Cuts?"

- "US Stocks Overdrawn Again, Finally a Chance for Chinese Concepts"

- "The 'Sun Never Sets' Faith in US Stocks Returns, Is It Reliable This Time?"

- "High Interest Rates Fail to Douse Consumer Spending, Is America Really Thriving or Just Hype?" Under the tightening of the Federal Reserve, neither stocks nor bonds can escape!

Getting down to earth, Dolphin Research's investment portfolio is up and running!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.