Posts

Posts Likes Received

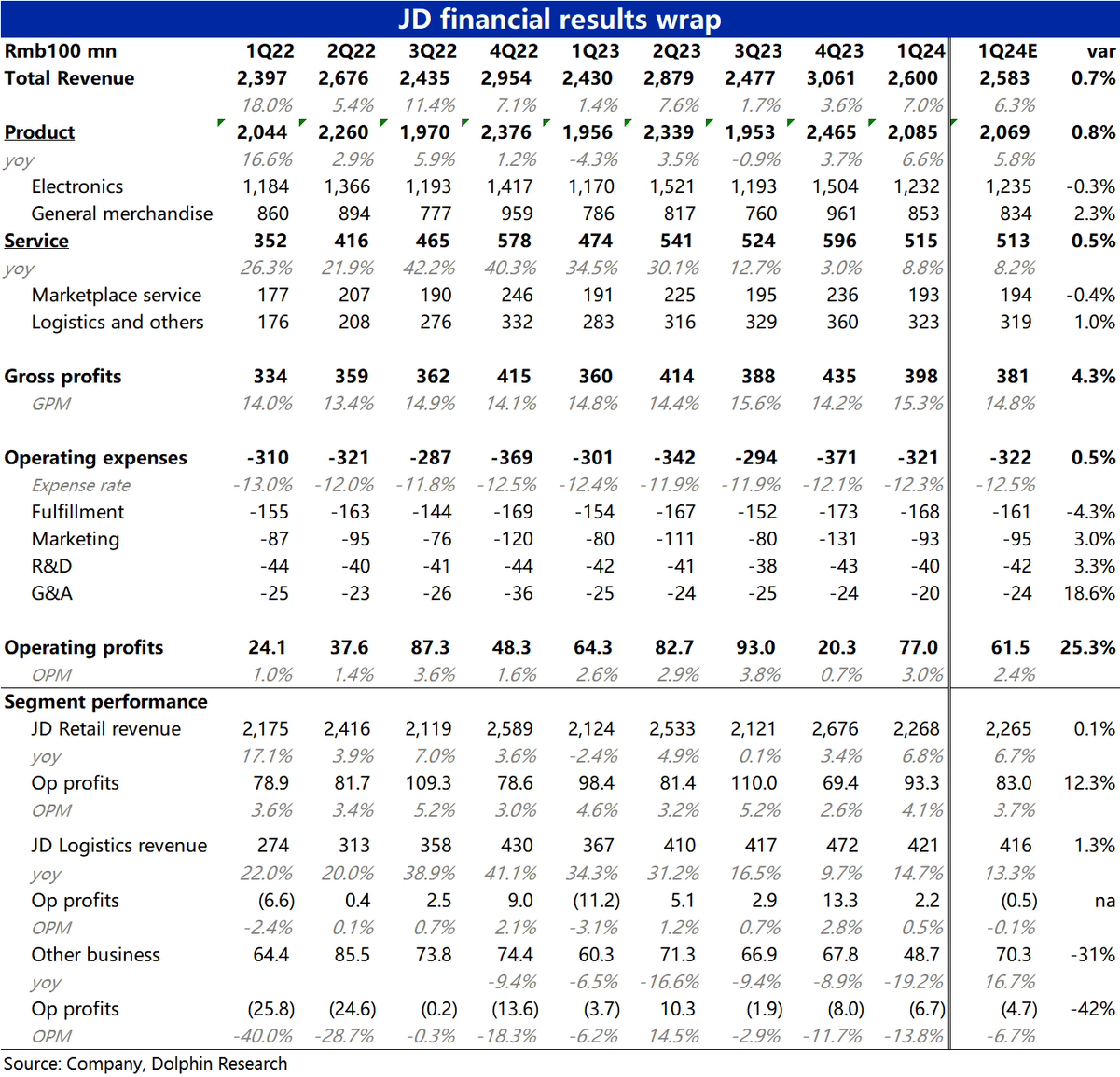

Likes Received$JD-SW(09618.HK)1Q24 first take: At first glance, JD.com's quarterly earnings report slightly exceeded expectations. The main highlight is that the year-on-year decline in profits from the core retail sector was far less severe than the company's guidance (-16%), with only about a 5% drop. Although Dolphin Research noted that some brokerages had predicted single-digit profit declines in their previews, making the actual performance in-line for some buyers, it still significantly exceeded mainstream expectations.

Breaking down the sources of the profit beat, revenue and expense items were largely in line with expectations. The key difference was that gross profit was about 1.8 billion yuan higher than expected, with gross margin increasing by approximately 0.5 percentage points year-on-year. This suggests that JD.com's self-operated product discounts did not widen, or the product mix improved.

However, in terms of shareholder returns, JD.com only added $100~200 million in buybacks from late March to today, a sharp reduction compared to the approximately $1.2 billion repurchased in Q1. While reducing buybacks after a significant rebound in stock price and valuation is reasonable, it is clearly not good news for investors who prioritize shareholder returns.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.