Posts

Posts Likes Received

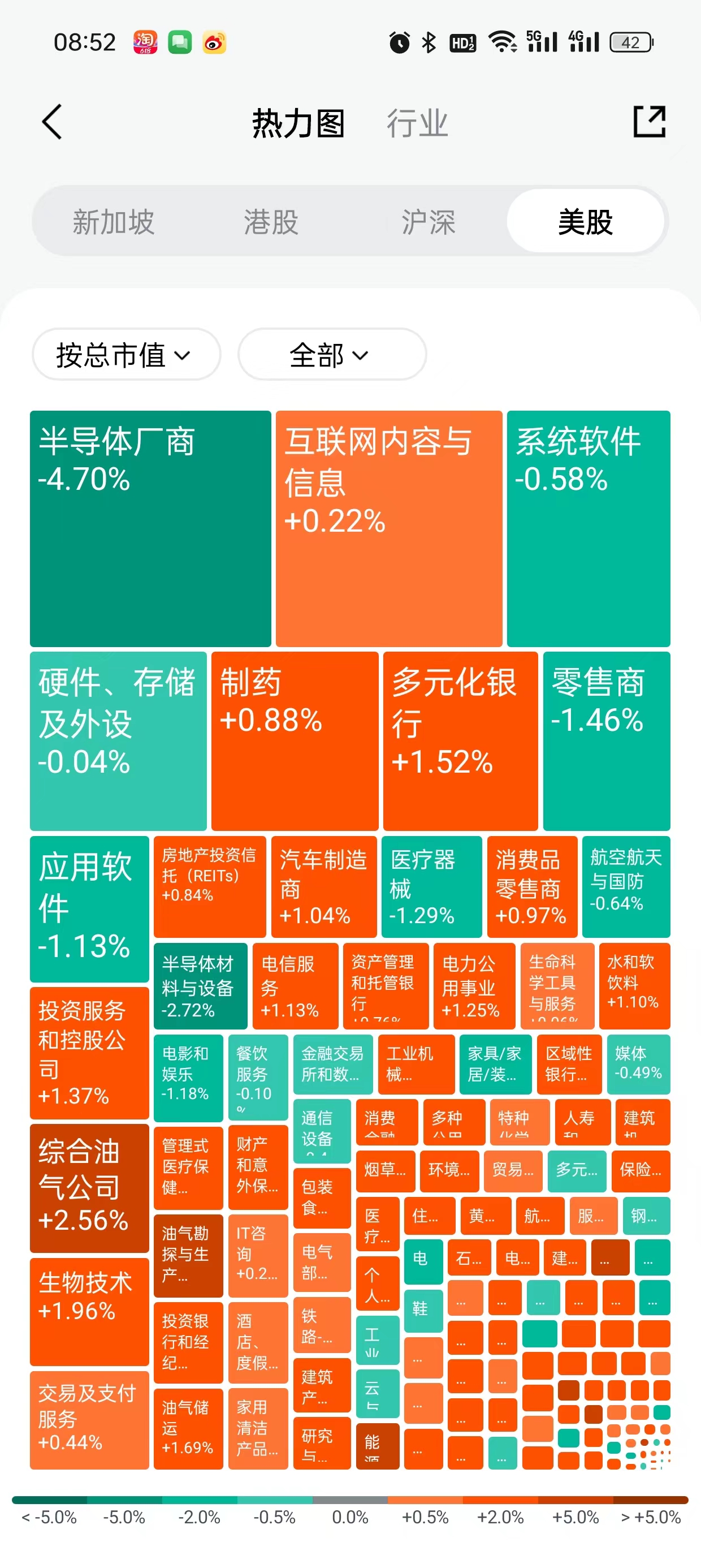

Likes ReceivedProfit-taking after the stock split surge + high-level executive selling (not only Jensen Huang is selling, but CFO Colette Kress is also selling), $NVIDIA(NVDA.US) continues to decline, dragging down the entire semiconductor sector from hardware to downstream terminals and software, and even upstream equipment.

In Dolphin Research's view, this round of NVIDIA's adjustment has nothing to do with fundamentals, but more with the overvaluation brought about by the previous split. Even after last night's decline, NVIDIA still has a market value of 2.9 trillion, ranking third, far ahead of Google, which has a market value of 2.2 trillion and ranks fourth.

Moreover, this round of AI's rise and fall is not related to the macro risk-free interest rate. After AI's decline, funds were reallocated to other sectors, which mostly rebounded, especially traditional oil and gas. The Nasdaq and S&P 500 indices appear to have fallen significantly, mainly because of the high weight of tech hardware.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.