Posts

Posts Likes Received

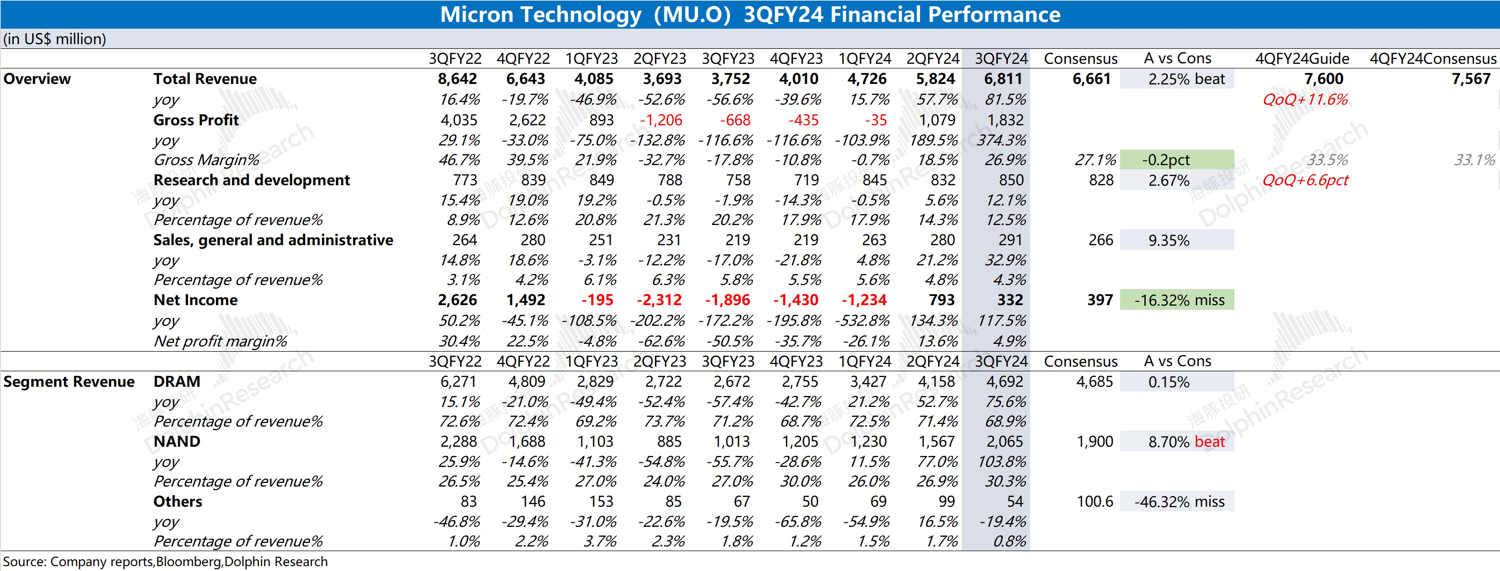

Likes Received$Micron Tech(MU.US)first take: Micron Technology's quarterly earnings report generally met market expectations. The continued recovery in revenue and gross margin was mainly driven by the improvement in the memory industry, which led to price increases for DRAM and NAND products.

The company's product shipments remained largely unchanged this quarter, with price increases being the main factor behind the performance recovery. Although the performance outlook remains positive, the company's guidance did not provide enough confidence to the market. While both revenue and gross margin are expected to improve next quarter, they are in line with market expectations. The lack of significant growth in shipments indicates that the recovery is primarily price-driven.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.