Posts

Posts Likes Received

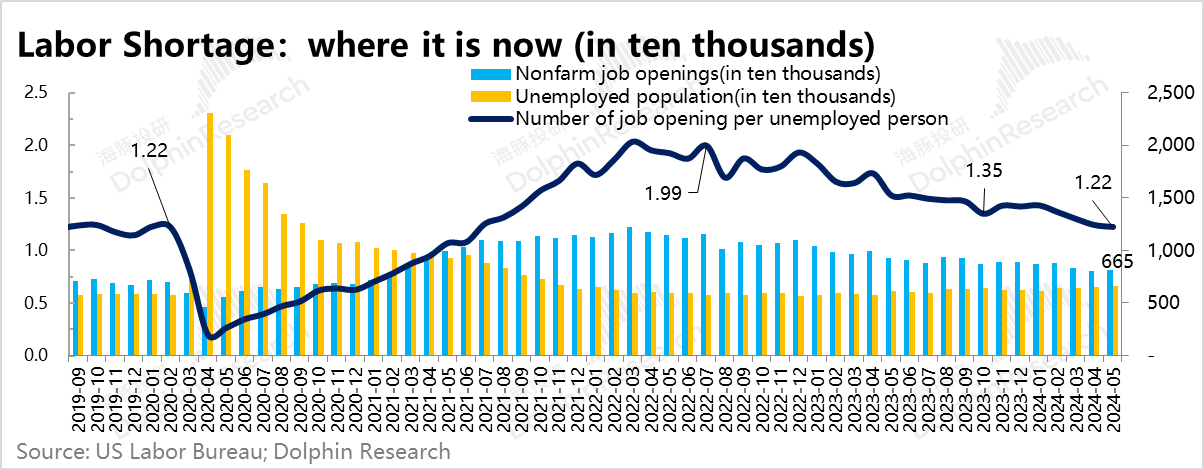

Likes ReceivedAs the unemployment rate rebounds to 4% and the tightness of the U.S. labor market returns to pre-pandemic levels, Powell's "dovish" characteristics are becoming increasingly evident.

From his speech, it can be seen that on the dual-objective scale of inflation vs. employment, he is gradually tilting toward employment. And this scale of his does not refer to the lagging indicators like the current month's non-farm payroll, as the current average monthly employment is still hovering around 250,000, which is an absolute high employment level.

He clearly places more emphasis on where labor supply and demand are heading. Not just Powell, but other Federal Reserve officials are also conveying that supply and demand are already in a balanced state. With further increases in the population to be employed, there may not be as many job openings to match.

This line of thinking is already a very concrete manifestation of the Fed Put, reflecting the Federal Reserve's urgent desire for a "soft landing" of the economy. The result is the tech growth index hitting new highs.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.