Posts

Posts Likes Received

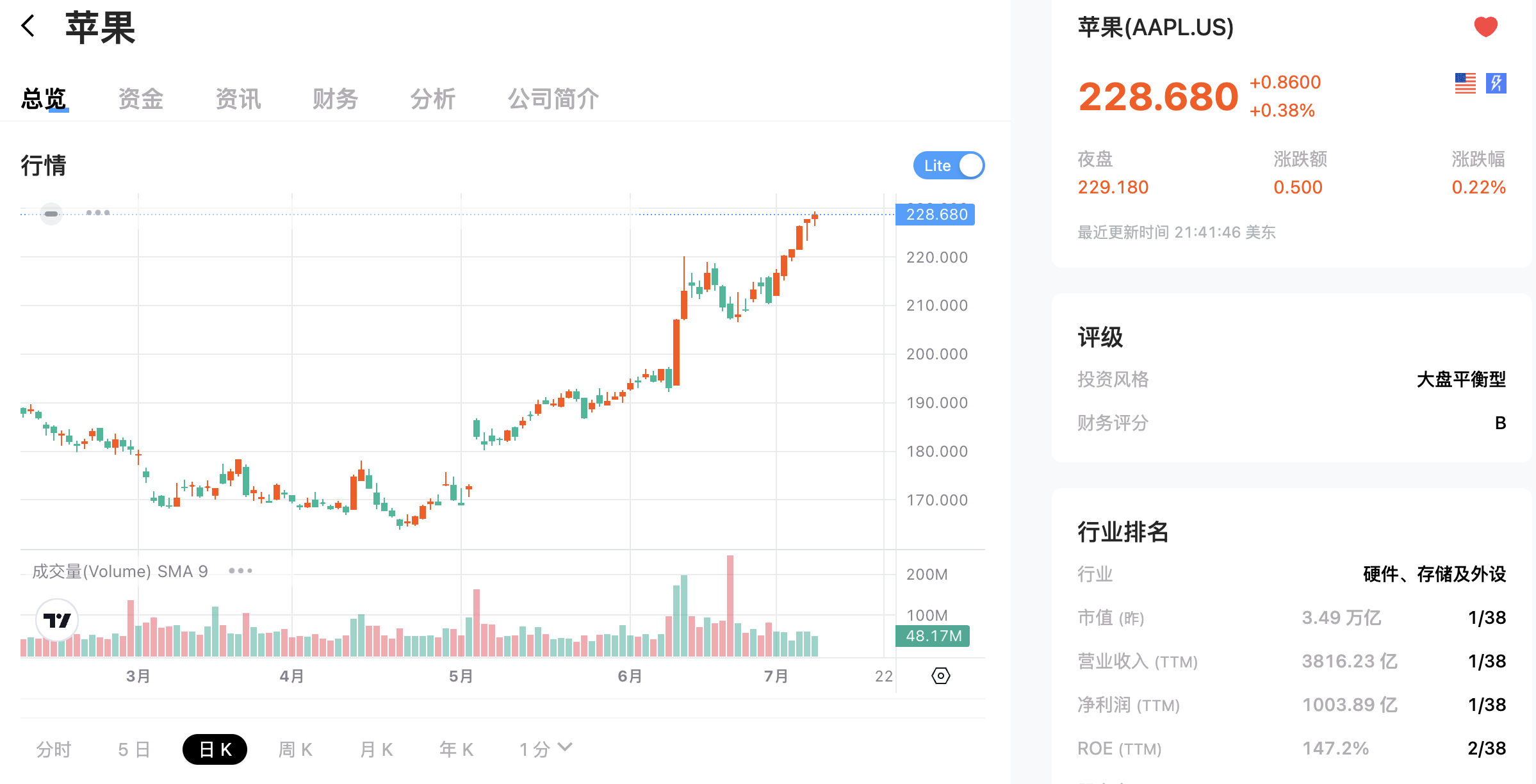

Likes Received$Tesla(TSLA.US) and $Apple(AAPL.US) have both been performing well recently, but I think Apple's stability is still stronger.

Current economic data points to a soft landing, and the tech stock rally continues. Tesla has risen to $260 per share, with too much AI expectation built in despite declining year-on-year sales and weak fundamentals, which actually increases the risk.

Currently, its stability is clearly inferior to Apple's, whether it's the resurgence of Apple's computer shipments (IDC data shows a 21% growth in personal computer shipments in Q2, the largest increase among global PC manufacturers) or the market rumors of increased iPhone 16 inventory targets after the 618 promotion boosted iPhone 15 sales. Apple's fundamentals are relatively better.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.