Posts

Posts Likes Received

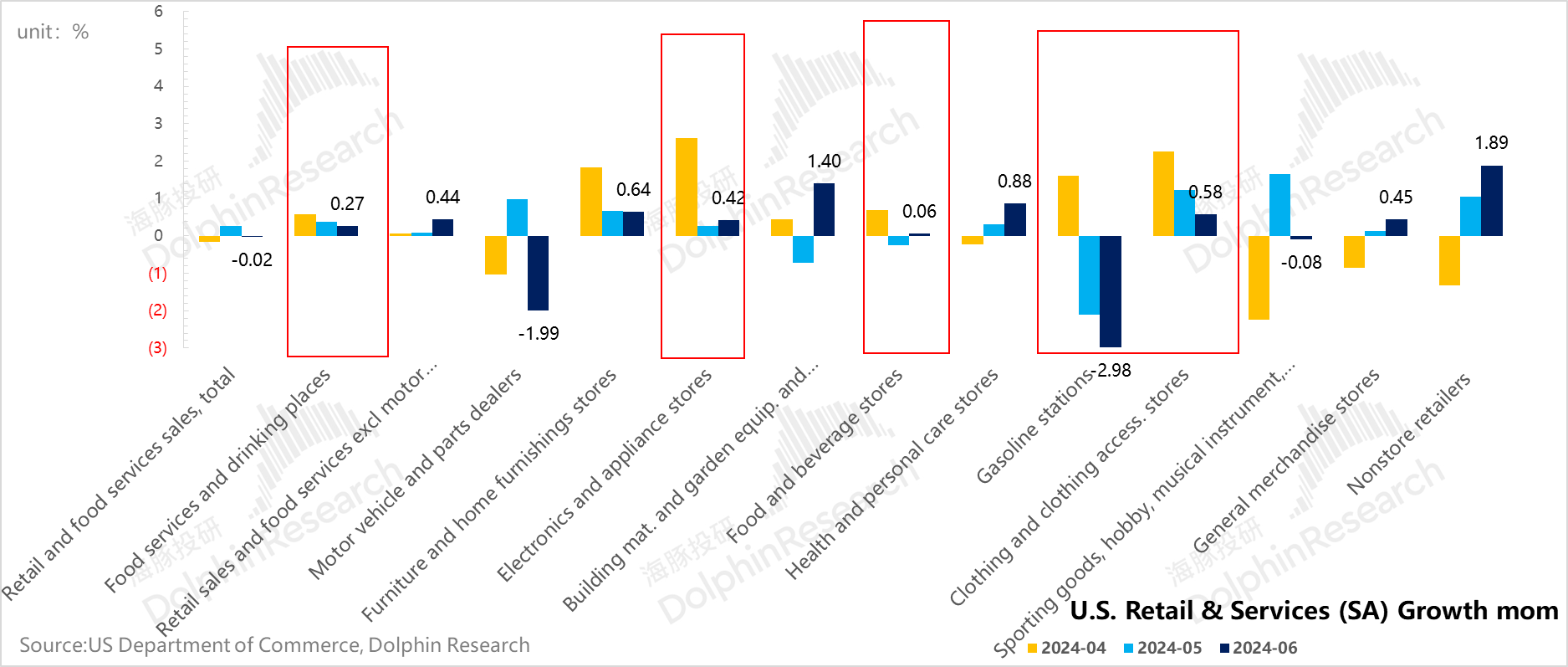

Likes ReceivedUS retail sales data for June was released. Seasonally adjusted month-on-month retail sales (including catering) fell by 0.02%, while excluding catering, it dropped by 0.07%.

As domestic demand among residents is gradually declining at this stage, retail sales, as one of the reflections of domestic demand, have become more important to monitor for trend changes. Looking at the big picture in June, seasonally adjusted month-on-month growth was essentially flat. Combined with the weak data from the previous two months, the month-on-month performance has been weak for three consecutive months, which is indeed unfavorable for consumption trends.

However, the June data requires a focus on structure: high-weight categories in retail, such as motor vehicles and gas stations, were the key industries dragging down retail sales in June. But if we look at core retail (excluding motor vehicles, gas stations, building materials, and gardening), the month-on-month growth rate accelerated further to 0.9% compared to 0.4% in the previous month, which is actually quite strong.

The key industries driving the better performance in core retail were mainly high-weight retail categories—online retail (accounting for 17% of retail sales) showed significant positive growth, and daily necessities (11%) saw restorative growth. Other mid-weight categories (5%) also contributed.

Meanwhile, catering consumption, which will also reflect in service consumption later, continues to gradually cool. This aligns with the recent labor department data showing weakening employment trends in the catering industry, implying that service consumption is gradually softening.

Overall, June's consumption data was actually better than what the surface numbers suggest. The weaker performance was mainly tied to high-interest-rate-sensitive sectors (e.g., automobiles) and oil price-driven disinflation. Apart from the cooling catering sector, which leans toward service consumption, other categories performed reasonably well.

Looking ahead, the market is full of expectations for rate cuts, and falling oil prices are beneficial for curbing inflation. At the very least, June's retail data still points toward an economic soft landing.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.