Posts

Posts Likes Received

Likes ReceivedThe recent volatility in the U.S. stock market is relatively high, and there are many reasons for this.

Given the current overvaluation of U.S. stocks, various events during the election—such as the assassination attempt on Trump, the possibility of the incumbent president dropping out, and the market once again being swayed by Trump's remarks—have all increased the volatility of U.S. stocks.

As for the current earnings season, judging from the results already announced by ASML and TSMC, TSMC's performance largely confirms some of the market's expectations while maintaining a 10% growth rate for the semiconductor industry (excluding memory). This suggests that there isn't much more optimism for traditional industries.

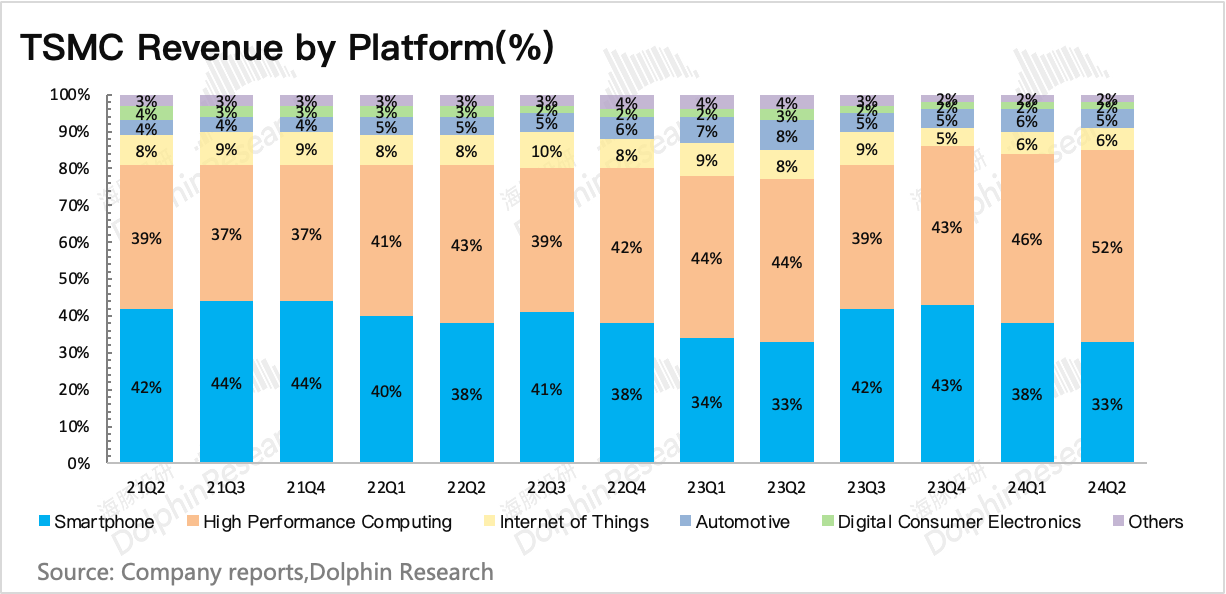

Additionally, Dolphin Research observed that in TSMC's revenue breakdown, HPC-related customer revenue has surged to 52%. While this is good news for Nvidia, it may not be as positive for downstream cloud customers in the short term, especially with their earnings reports imminent.

At the very least, Dolphin Research notes that capital expenditures from cloud giants like Microsoft are undeniably increasing. However, the question remains whether these cloud providers can generate enough revenue growth to cover these substantial new capital expenditures—something that will need to be validated by their earnings.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.