Posts

Posts Likes Received

Likes ReceivedUS President Biden announced his withdrawal from the 2024 presidential election, fully supporting Harris to secure the presidential nomination.

Amid recent media speculation, the final outcome is now settled. A last-minute change in the party's presidential candidate may still leave the Democrats with slim chances of victory.

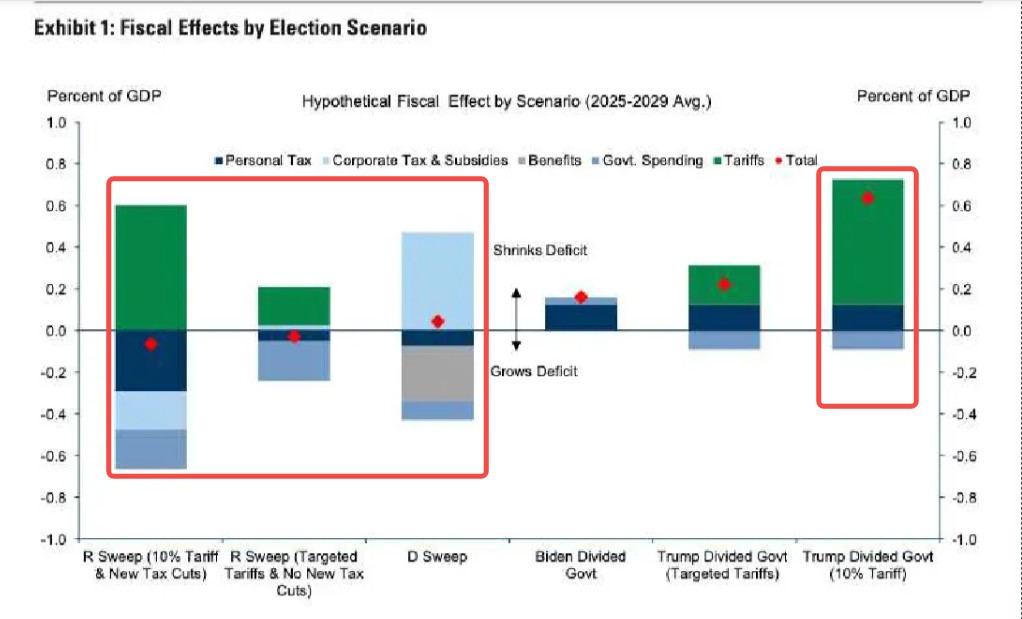

If a fully victorious Republican government emerges, the likely policy mix would be loose fiscal policies + relatively accommodative monetary policies, coupled with lower tolerance for illegal immigration.

However, historical trends suggest that since the majority of US household wealth is concentrated in financial assets, Trump places greater emphasis on the stock market. The recent sharp decline in major stocks due to election uncertainty, along with the market shift from large-cap to small-cap stocks and from high to mid-low valuation styles, is largely a preemptive adjustment based on election expectations.

In this cycle, the fundamentals of US mega-cap stocks, based on released earnings, show no serious issues—the key problem remains overvaluation. In contrast, the EPS growth of small and mid-cap companies has been mediocre. Once tech stocks correct to more attractive levels, their investment value will re-emerge.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.