Posts

Posts Likes Received

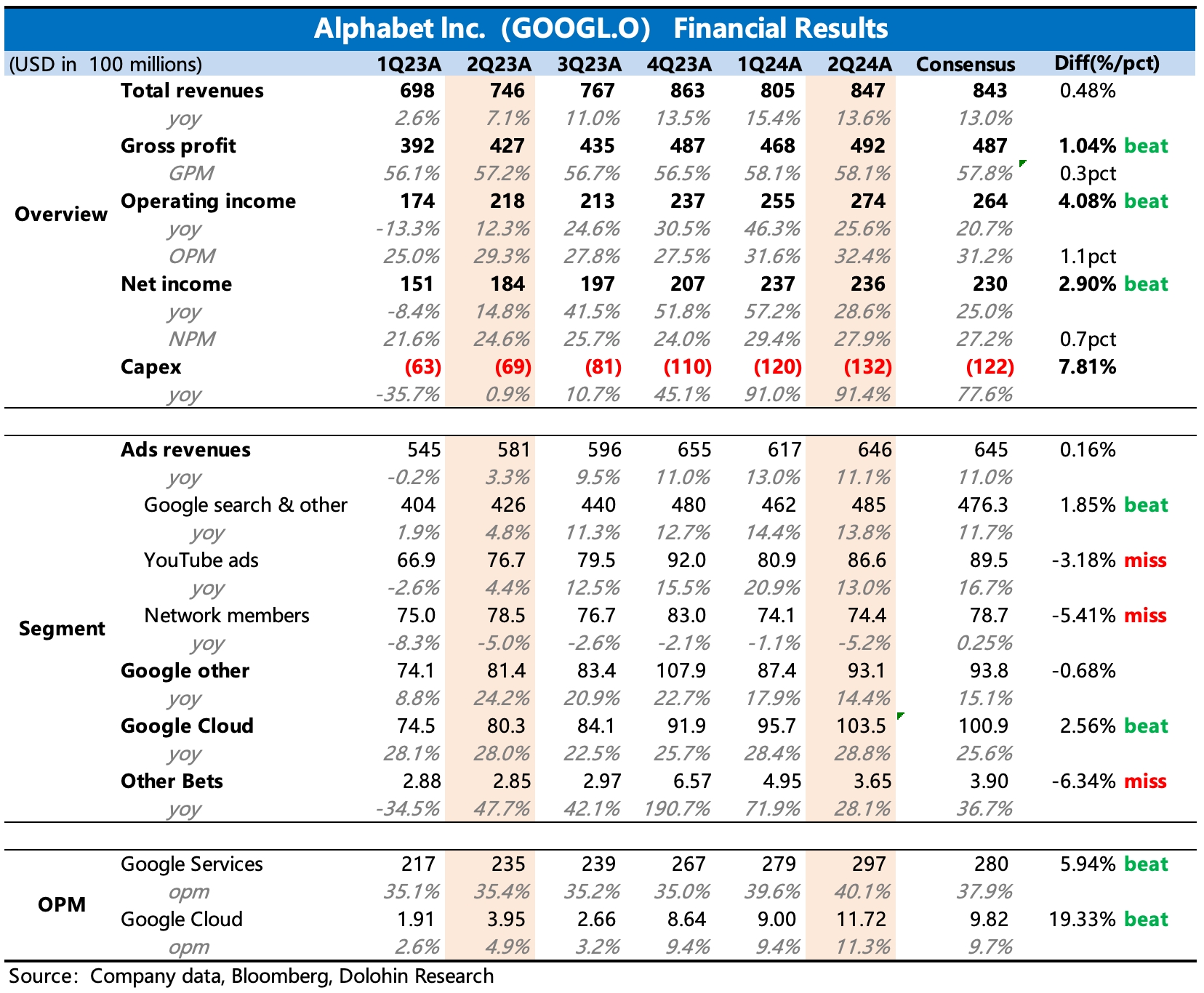

Likes Received$Alphabet(GOOGL.US) first take: The Q2 earnings report was a mixed bag. The good news includes (1) Search advertising and cloud business grew more strongly than expected; (2) Optimization of traffic costs and management expense compression from layoffs led to slightly better-than-expected profits despite inline revenue.

However, the bad news includes (1) YouTube ad performance was significantly below expectations, inconsistent with previous institutional research. While the strength in Search is pleasantly surprising, without YouTube's support, some issues around Search could have a greater impact on growth expectations in the second half of the year as macro conditions weaken marginally. (2) Higher-than-expected capital expenditures have raised market concerns about potential pressure on future cash flows and profit margin improvements.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.