Posts

Posts Likes Received

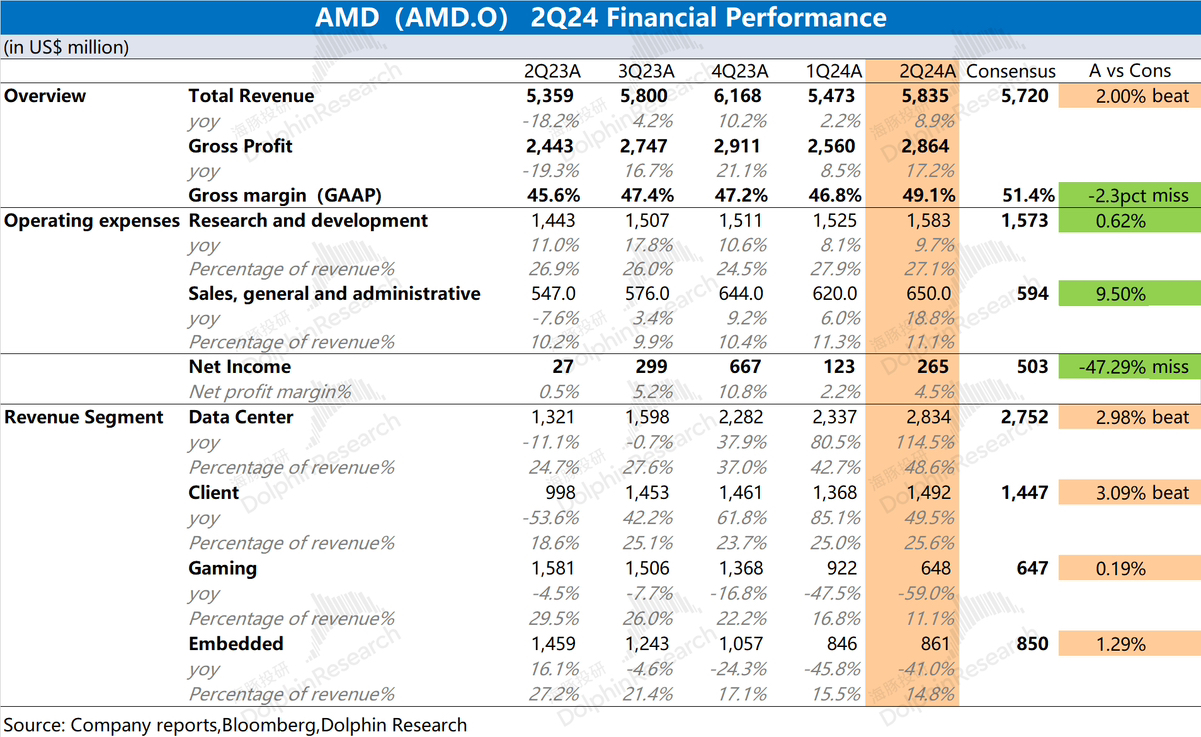

Likes Received$AMD(AMD.US) first take: The company's quarterly earnings report was mediocre. Revenue was slightly better than market expectations, while gross margin was below market expectations. The data center business continues to grow, but the gaming business saw a significant decline this quarter, resulting in only a slight improvement in the company's quarterly profits. Combined with the company's next-quarter revenue guidance ($6.4-7 billion) and non-GAAP gross margin (53.5%), both metrics showed improvement as expected.

Although the earnings report was relatively average, Dolphin Research believes the after-hours stock price increase was mainly driven by two factors: 1) The company raised its full-year data center GPU sales guidance from $4 billion to $4.5 billion; 2) Microsoft's capital expenditures this quarter increased to $19 billion, up 36% quarter-over-quarter. These two incremental pieces of information further boosted market confidence in data centers and AI.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.