Tesla's 'Life-or-Death Question': With AI's vast potential, does poor car manufacturing still matter?

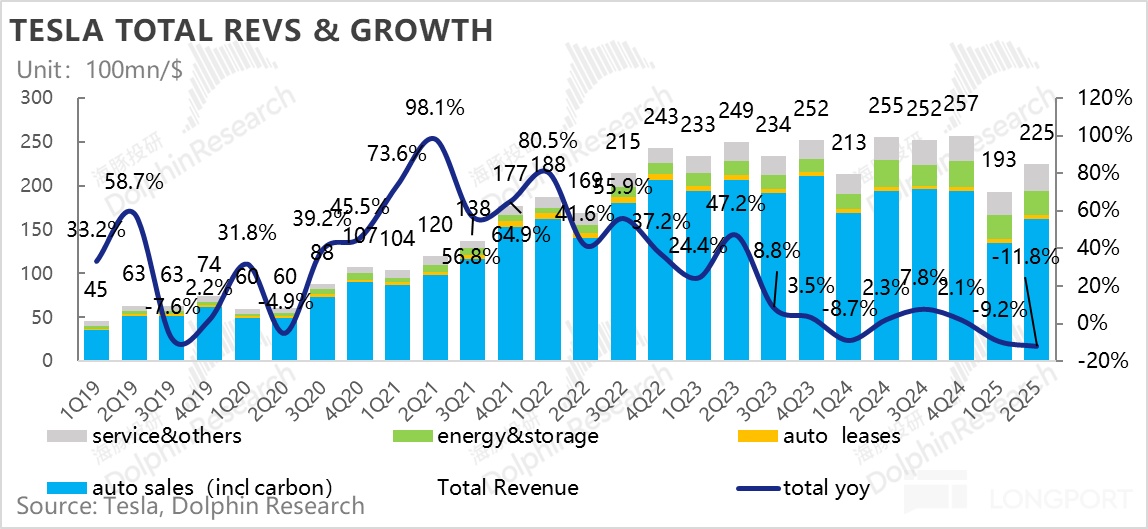

$Tesla(TSLA.US) Tesla (TSLA.O) released its Q2 2025 earnings report after the U.S. stock market closed on July 23, Beijing time. In summary, the Q2 performance was decent, but Tesla is a stock priced for the future. Especially at the current relatively high price of 330, exceeding expectations under high stock prices and low expectations is not worth celebrating. Here are the core details:

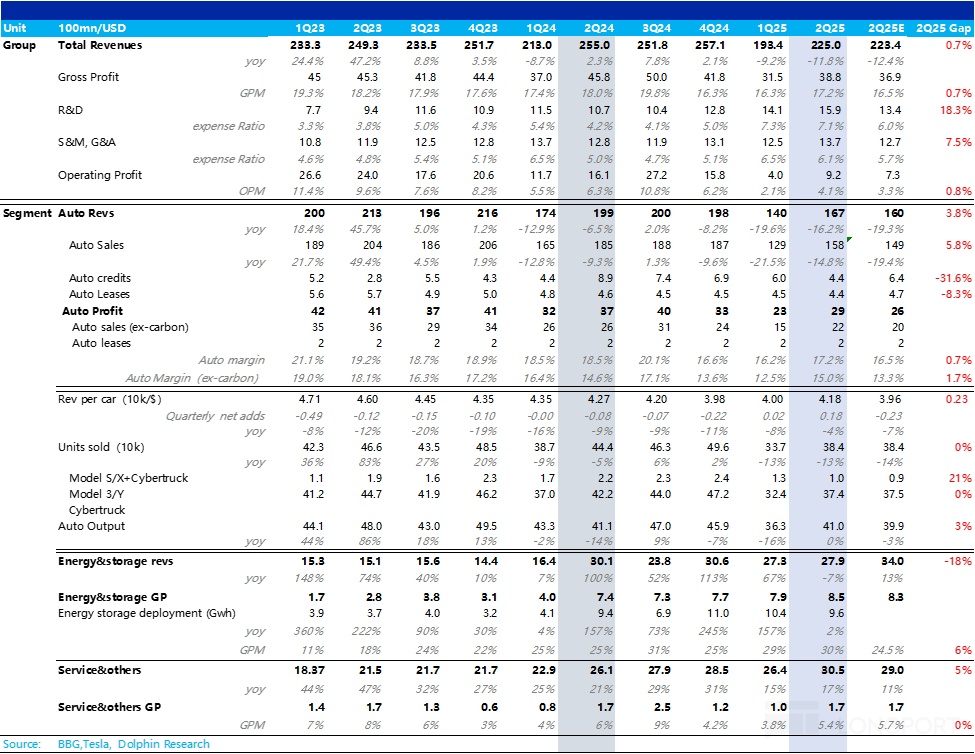

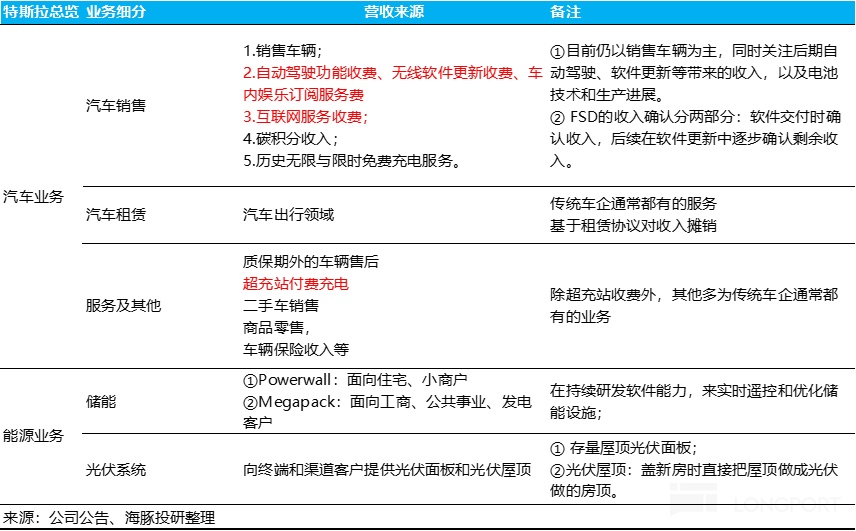

1. Total revenue performed well: This quarter's total revenue was $22.5 billion, exceeding market expectations by about $200-300 million. The energy storage business showed flat performance due to tariff impacts, which was already priced in, while the service business continued to rise quarter-on-quarter, also performing well. However, the real surprise was in the core automotive business, which finally began to recover!

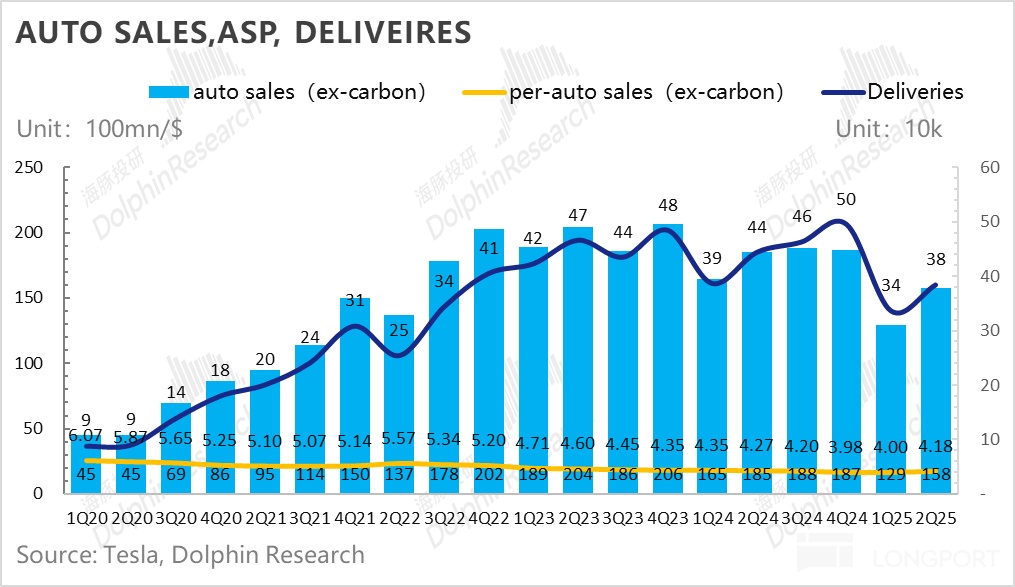

2. Car sales revenue and gross margin both met market expectations, emerging from the Q1 slump: Q2 car sales were $16.7 billion, finally exceeding expectations (market expectations were around $16-16.2 billion). Carbon credit revenue was below expectations due to policy factors, which was anticipated.

In the core automotive revenue (excluding carbon credits), this quarter was $15.8 billion, exceeding market expectations of around $15-15.2 billion, mainly driven by the price increase from the launch of the new Model Y Juniper.

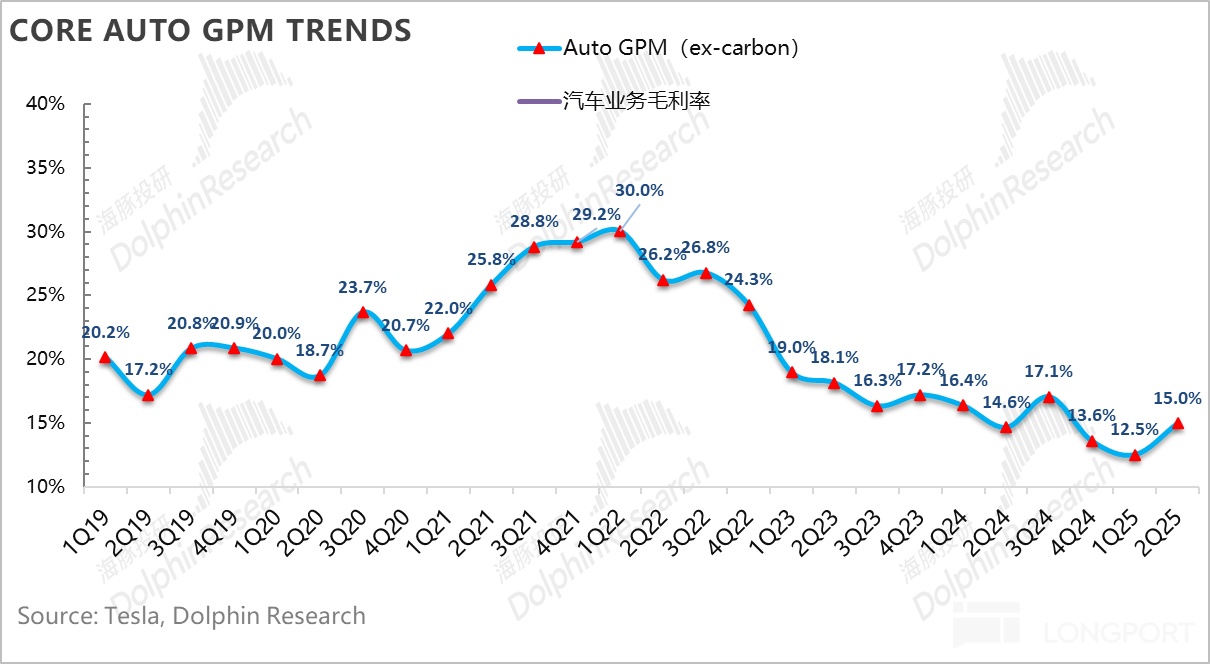

3. Car sales gross margin also began to rise quarter-on-quarter due to the price increase of Juniper and improved economies of scale: Q2 automotive sales gross margin (excluding carbon credits and leasing) was 15%, improving by 2.5 percentage points quarter-on-quarter, mainly due to the higher pricing of the Model Y Juniper launched in Q2, leading to higher car sales prices. Meanwhile, the amortized cost this quarter, due to the decline in economies of scale, offset the adverse impact of tariffs.

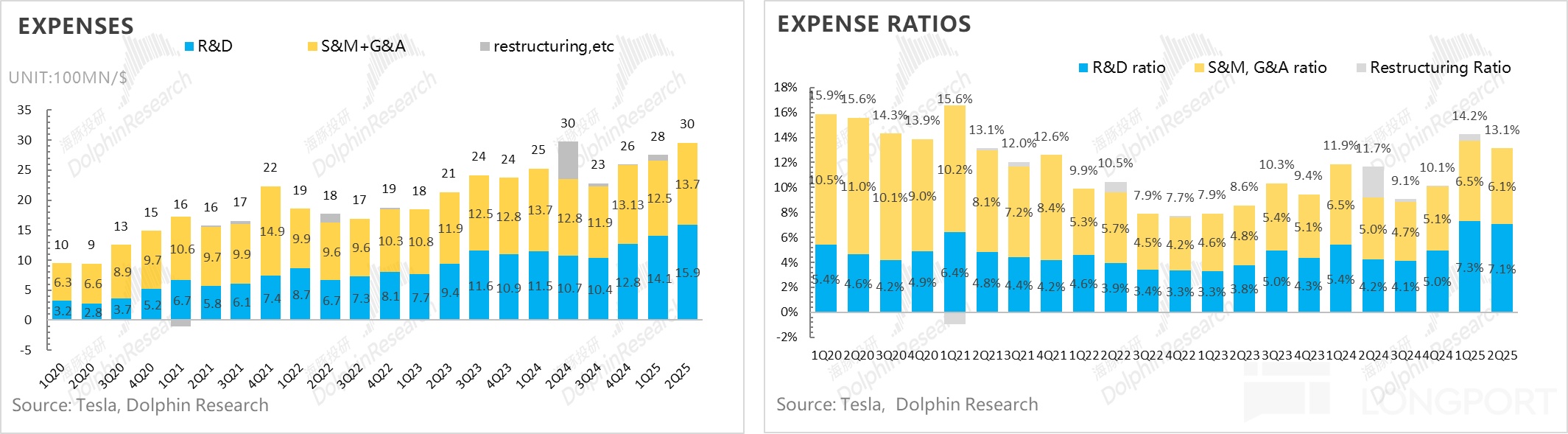

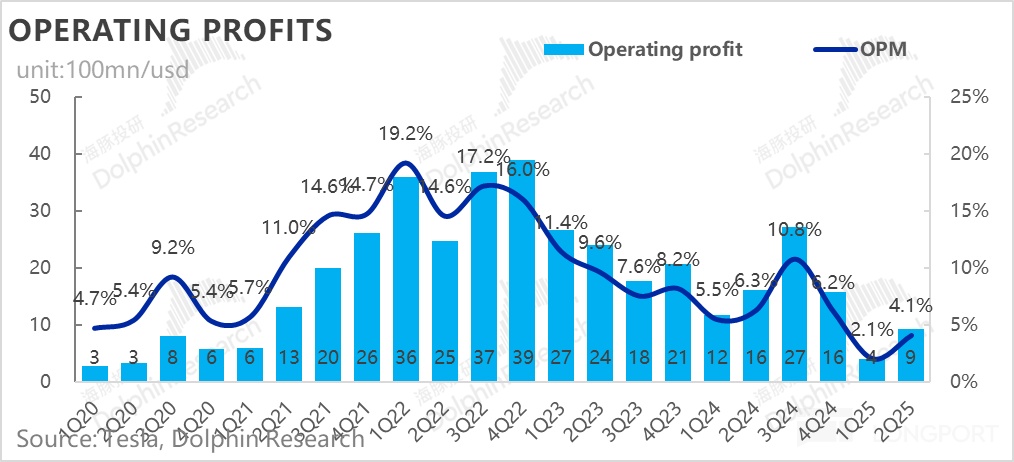

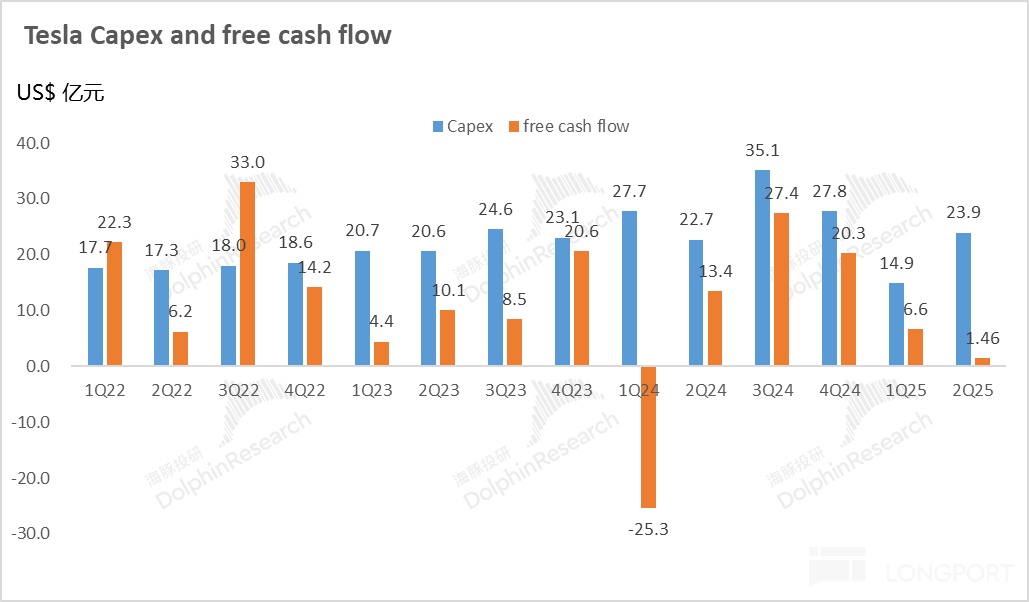

4. R&D expenses and capital expenditures are still heavily invested in AI's vast business: This quarter's R&D expenses were $1.59 billion, exceeding market expectations by $200 million. However, due to the quarter-on-quarter rise in gross margin (improved fundamentals in Q2), operating profit and profit margin both rose quarter-on-quarter.

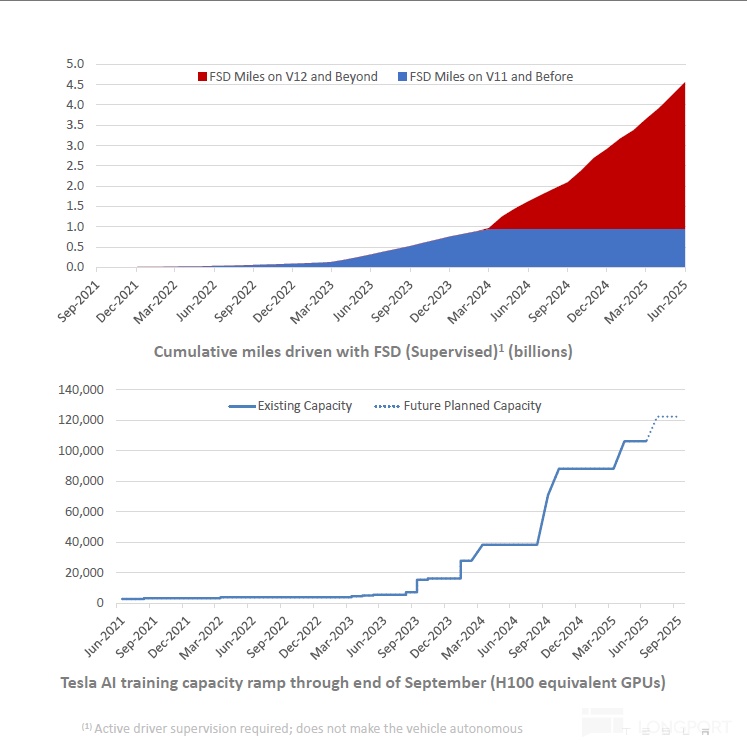

Free cash flow this quarter saw an increase in operating cash flow due to improved fundamentals, with capital expenditures at $2.4 billion, continuing to rise by $900 million quarter-on-quarter! Still heavily investing in AI business, Tesla added 16,000 H200 GPUs in Texas, so free cash flow still fell by $500 million quarter-on-quarter to just $150 million this quarter.

Dolphin Research's overall view:

The Q2 performance was decent, but since the Q1 report, the stock price has reached $330, largely due to the normal progress of the Robotaxi business and pricing in most of the vast business of Robotaxi and Optimus, somewhat decoupled from the performance of the automotive fundamentals.

Given the already relatively high stock price, the market will be relatively harsh, so compared to the Q2 performance itself, it is more necessary to look from a future perspective:

1. Car sales fundamentals are still under pressure:

a. The U.S. IRA $7,500 subsidy phase-out is the biggest negative factor: The U.S. Inflation Reduction Act's $7,500 IRA subsidy will end on September 30. Although U.S. demand in Q3 may be released in advance to some extent, Q4 sales in the U.S. region will inevitably decline after the subsidy phase-out, heavily relying on the mass production and launch progress of the long-awaited affordable Model 2.5.

b. Model 2.5 mass production is delayed again to Q4: For Tesla car sales, the new affordable model "Model 2.5" remains the most critical variable, and its production and delivery progress is crucial for Tesla's car sales fundamentals this year. Although repeatedly rumored to be canceled, this earnings call confirmed that this model will continue to be launched, but the mass production progress has been delayed by about a quarter, launching in Q4.

In this conference call, Tesla mentioned that due to prioritizing deliveries before the IRA subsidy expires (prioritizing the North American market to maximize production of existing models before the IRA policy expires), Model 2.5 mass production has been postponed to the next quarter, launching in Q4.

The delay in the mass production and launch plan of Model 2.5 may still lead to a further downward revision of the overall 2025 car sales expectations (currently market expectations are 1.6-1.65 million units), and close attention is still needed on the specific mass production ramp-up progress of this model.

(Note: The market previously expected Model 2.5 to be launched first in the U.S., in Europe in August, and in China by the end of 2025, making it difficult to achieve large-scale delivery before Q4. This time, Model 2.5 delivery is delayed again).

In terms of gross margin, regulatory credit adjustments will cause regulatory credits to continue to decline in subsequent quarters, and the impact of tariff costs on car sales will also be fully reflected in subsequent quarters, possibly leading to continued short-term pressure on gross margin.

Therefore, it can be seen that Tesla's car sales fundamentals are expected to remain under pressure until the official launch of Model 2.5 in Q4, and the energy storage business is also affected by tariffs, which will be fully reflected in subsequent quarters.

2. In the vast business of Robotaxi and Optimus, the current progress is basically consistent with the Q1 plan, and the arrival of this technology and progress inflection point is expected at the end of Q4 and early 2026:

① In the Robotaxi/FSD business:

a. In Robotaxi: Continuing as planned, no incremental information

Currently still proceeding as planned, with the first 20 unmodified Model Y vehicles already in small-scale trial operation in Texas, USA, since June.

Tesla's previous plan was to expand to multiple U.S. cities by the end of the year (generalized end-to-end algorithms support rapid expansion to other cities), aiming to reach 1,000 Robotaxis within a few months, while expanding geographically to San Francisco, Los Angeles, and San Antonio in the U.S. According to Tesla's previous plan, it is expected to have a significant impact on the financial statements in the second half of next year.

This earnings call's plan for this part of the business remains basically unchanged, with Tesla advancing regulatory approvals in multiple locations such as San Francisco and Nevada, aiming to cover about half of the U.S. population by the end of the year, with service areas and models showing exponential growth.

b. In the FSD business: The time inflection point is expected to achieve another major breakthrough in Q4 this year and early next year

Currently, Tesla's FSD (intelligent driving for passenger cars) is still based on the V13 software version and HW4.0 hardware, and the market is eagerly anticipating Tesla's next-generation intelligent driving version's major update, which is another major leap in the intelligent driving end (referencing Tesla's V12/V13 version's direct switch to end-to-end routes, bringing a significant performance leap):

The market is still anticipating the FSD 14.0 version on the software side and the HW5.0 version on the hardware side, with the HW 5.0 (now called AI 5) version's hardware computing power expected to reach over 2000+ TOPS. Compared to the existing model, the model parameters supported by the FSD 14.0 version will be several times the current size, and its performance is expected to leap to another level, thereby driving the penetration rate of FSD and the continued expansion of Robotaxi.

In terms of progress, according to research, the current plan is to start internal testing of the V14 alpha version in Q4 2025, and officially launch the V14 official version in Q1 2026. Musk also stated at the 2025 shareholder meeting that "HW 5.0 + V14 is the last piece of the puzzle to L5, and Tesla owners can sleep in the car in 2026."

② In the Optimus business: Gen 3 is expected to start mass production for the first time at the end of 2025 and early 2026

According to Tesla's plan in the Q1 conference call, thousands of robots will be put into trial use in Tesla factories by the end of 2025, with confidence in achieving an annual production of 1 million units within 4-5 years, expected to reach this goal by 2029 or 2030.

This earnings call's incremental information mentioned that the Gen 3.0 version design is complete, with a prototype to be launched within 3 months, mass production next year, and a target of achieving an annual production of 1 million units in 4 years, with progress basically consistent with previous plans.

According to research, Optimus is expected to launch the Gen-3 full-featured version at AI DAY in October 2025. Compared to the Gen-2 version, the Gen-3 version has achieved a significant performance improvement and continued cost reduction (cost reduction is expected to reach $16,500), and in terms of production planning, small-scale trial production is expected to be achieved in Q1 2026, and large-scale mass production is expected to begin in Q3 2026. Therefore, this mass production and release inflection point may also arrive in Q4.

Therefore, Dolphin Research's view on Tesla's stock price is that the current $330 stock price is still in an overvalued state, especially due to the delay in Model 2.5 mass production and the continued phase-out of the U.S. IRA $7,500 subsidy, making it highly likely that the car sales fundamentals will continue to be under pressure before the launch of Model 2.5.

However, in the vast business of FSD's next major iteration update and the imminent launch and mass production of Optimus Gen 3, this mass production and technology inflection point is very close (around the end of Q4 and early 2026), with strong stories and logic that are still very strong, belonging to short-term unverifiable but long-term still grand. Therefore, if the stock price can adjust due to expectations of car sales fundamentals (gradually increasing positions below 250-270), it is instead a very good entry opportunity.

Below is a detailed analysis of the earnings report:

I. Tesla: Finally delivered a decent report card

1.1 Automotive Revenue: The launch and price increase of the new Model Y Juniper helped the automotive business climb out of the slump

This quarter's total revenue was $22.5 billion, performing well, exceeding Dolphin Research's observed major bank expectations of around $22.3 billion. Although the energy storage business performed generally, the tariff impact was largely priced in (BBG expectations are relatively outdated), and the real highlight was in car sales revenue, finally exceeding market expectations after several quarters of missing expectations due to the price increase from the launch of the new Model Y Juniper.

Specifically:

In the automotive business, this quarter's total revenue was $16.7 billion, finally exceeding expectations (market expectations were around $16-16.2 billion). Carbon credit revenue was below expectations due to policy factors, which was anticipated (due to the withdrawal of CARB state exemptions in May, and 50% of Tesla's regulatory credit revenue comes from CARB state's ZEV credits).

However, in the most concerned market of carbon credit and leasing revenue, this quarter's real automotive sales were $15.8 billion, finally climbing out of the car sales slump from the previous quarter, exceeding market expectations of around $15-15.2 billion, mainly driven by the price increase from the launch of the new Model Y Juniper.

In the energy business, this quarter's energy business revenue was $2.8 billion, below expectations, still mainly dragged down by tariffs, but this impact has been largely priced in. In the service business, this quarter performed well, with Q2 service revenue of $3.05 billion, up $400 million quarter-on-quarter, mainly due to the continued expansion of supercharging stations bringing incremental revenue.

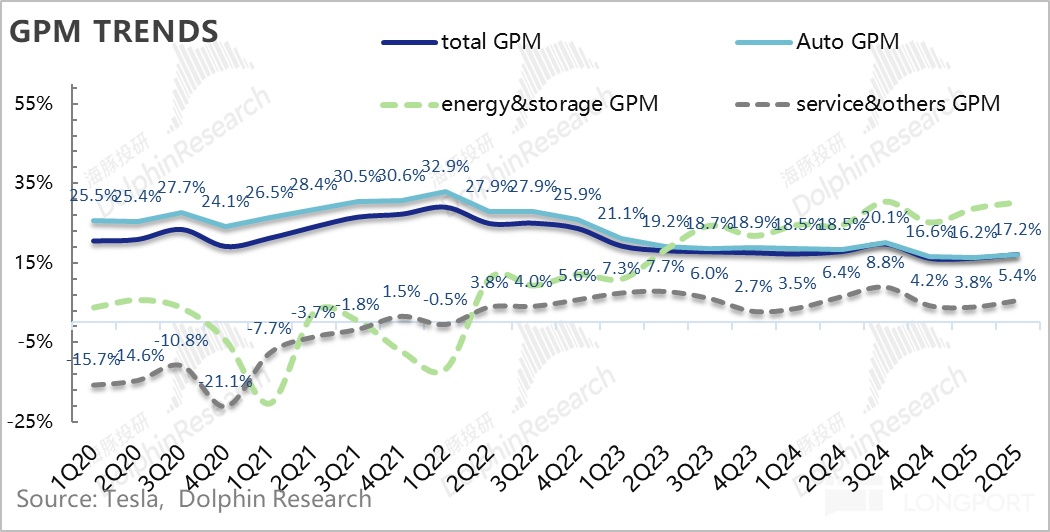

1.2 Car sales gross margin finally starts to recover!

Every earnings report, more important than revenue, and the real incremental information during the earnings report is always the performance of automotive gross margin.

Automotive gross margin finally climbed out of the worst car sales period from the previous quarter, with overall automotive gross margin rising from 16.2% in the previous quarter to 17.2% this quarter, and the most core carbon credit-free car sales gross margin was in a state of exceeding expectations (actual 15.5% vs. market expectations of 13.3%)!

In other businesses, the energy storage business gross margin was in a state of exceeding expectations, because Tesla's energy business mainly uses LFP batteries from China, which are greatly affected by tariffs, but the actual gross margin performance still exceeded expectations, possibly due to Tesla's own stockpiling of LFP batteries, coupled with an increase in the proportion of Megapack shipments. However, this business will still be dragged down by tariff uncertainties in the future, so Tesla also stated that it will start producing LFP batteries domestically in the U.S. this year to resist tariff impacts.

In the service business, this quarter's gross margin was 5.4%, which also rose quarter-on-quarter from the previous quarter, performing well, mainly due to the continued expansion of Tesla's supercharging network driving gross margin upward, offsetting the negative drag of the used car business.

II. Car sales fundamentals began to improve in Q2

As the most important observation indicator every quarter, automotive gross margin is of utmost importance, especially in the current situation where Tesla's existing models are aging and competition is intensifying. To clearly see the real situation of automotive gross margin, Dolphin Research separately broke down the automotive sales gross margin excluding carbon credits, automotive leasing gross margin, and overall automotive business gross margin.

Since the automotive leasing business is small in scale and has stable gross margin, the overall automotive gross margin is a combination of the two. The breakdown is mainly to observe the automotive sales gross margin excluding carbon credits.

Q2 automotive sales gross margin (excluding carbon credits and leasing) was 15%, exceeding market expectations of 13.3%, finally emerging from the worst car sales trough in Q1, improving by 2.5 percentage points quarter-on-quarter. Dolphin Research believes this performance is mainly due to the higher pricing of the Model Y Juniper launched in Q2, leading to higher car sales prices, and this quarter did not have the negative impact of production halts and ramp-ups on fixed amortized costs from Q1, but rather the release of economies of scale brought by improved sales quarter-on-quarter.

Let's break it down from the perspective of single-car economics:

2.2 Car sales prices finally start to rise after the Model Y Juniper update!

From the perspective of car sales prices, in Q2, Tesla's revenue per car sold (excluding carbon credits and automotive leasing sales) was $41,800, up $1,800 quarter-on-quarter, while the market expected car sales prices to still show a quarter-on-quarter decline. The core reason for the rise is due to the price increase after the Model Y Juniper update, offsetting incentives such as financing promotions, and the increase in the proportion of Model Y in the sales structure this quarter, with a decrease in the proportion of lower-priced sales in the Chinese region, leading to relatively strong performance in car sales fundamentals this quarter.

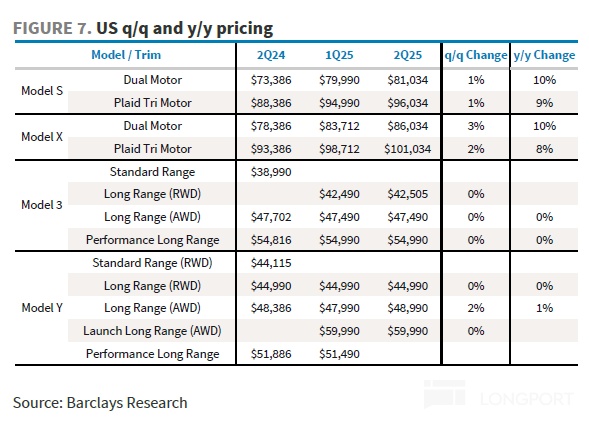

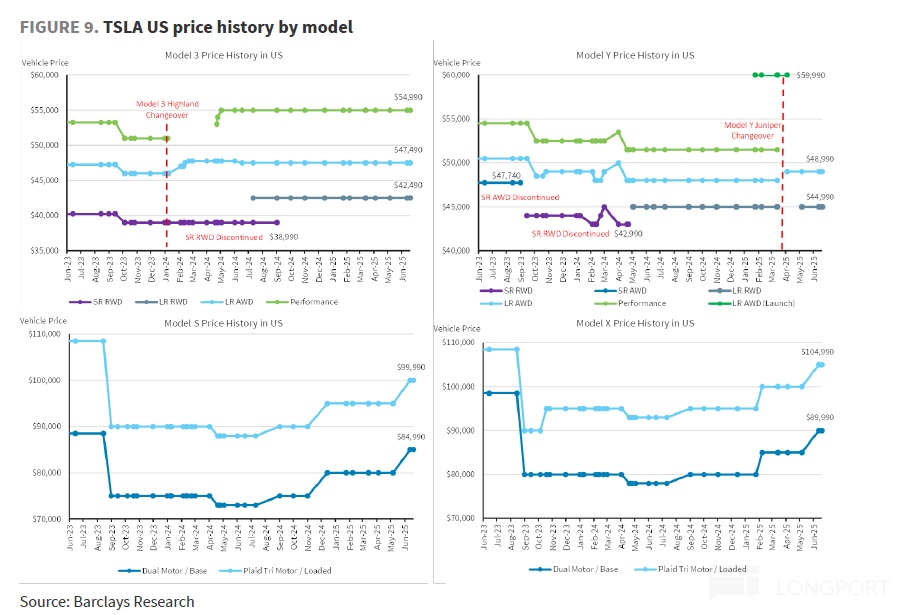

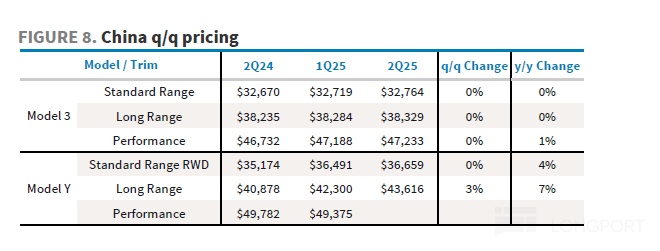

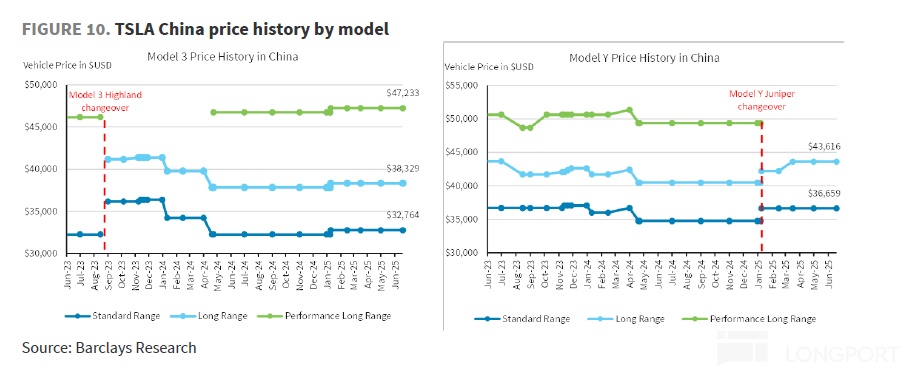

① Price adjustments for existing models: The starting price of the Model Y Juniper is higher than the old Model Y model, positively impacting car sales prices

a. In the U.S.: Model Y Juniper price increase

The starting price of the Model Y Juniper in the U.S. is $59,900, higher than the starting price of the new Model Y, and the prices of Model S/X have also been increased.

Although Tesla offered a 1.99% financing incentive for the Model Y in Q2 and a $2,000 trade-in subsidy for old Model Y owners, the price increase offset the negative impact of the financing activity.

b. In China: In China, the starting price of the Model Y Juniper also increased by about 3% compared to the old Model Y.

In terms of loan policies, a 5-year interest-free loan was launched for the Model Y just after its launch, and the Model 3 series launched a limited-time insurance subsidy of 8,000 yuan, with the rear-wheel drive/long-range version adding a 5-year interest-free policy.

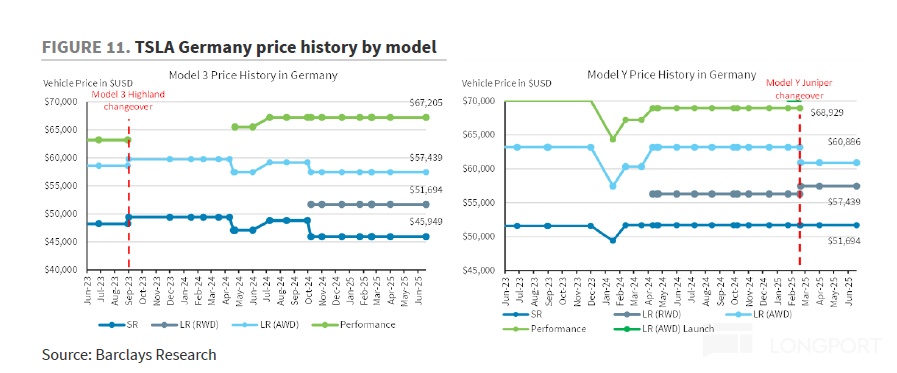

c. In Europe: In Q2, Tesla had both price increases and decreases for different versions of the Model Y in Europe;

② In terms of model structure: Relatively favorable, as the proportion of Model Y sales increased in Q2, and the proportion of U.S. models is rising

a. In the model structure: Due to the launch of the Model Y Juniper, the proportion of Model Y in this quarter increased quarter-on-quarter from the previous quarter (the Model Y Juniper was halted in Q1, with no such factor affecting Q2).

b. In terms of regional proportion: This quarter, the proportion of higher-priced U.S. and other regions increased, also raising car sales prices.

③ FSD business: FSD has not yet iterated to the next generation, and no significant catalyst for excess confirmation has yet appeared. The substantial growth in this part of the revenue still requires a major iteration of Tesla's FSD technology and its implementation in Europe and China.

2.3 Car sales cost increase mainly due to tariff impact

After discussing car sales prices, let's talk about car sales costs. Generally speaking, Tesla's cost reduction comes from four dimensions—1) scale dilution from sales release, full utilization of capacity; 2) technological cost reduction; 3) natural cost reduction of battery raw materials; 4) government subsidies. Specifically:

Dolphin Research broke down single-car costs into single-car depreciation and single-car variable costs. The single-car economic account for Q2 is as follows:

1) Single-car depreciation effect: Single-car amortized cost is declining quarter-on-quarter

This quarter's single-car depreciation was $3,700, with an absolute value down $600 quarter-on-quarter, and the single-car amortized cost rate also fell 2 percentage points quarter-on-quarter from 10.7% in the previous quarter to 9% this quarter. Dolphin Research believes the decline in single-car depreciation this quarter is mainly due to:

a) In terms of production costs: There is no longer the significant profit margin resistance from idle capacity and other ramp-up-related costs in Q1 (the resistance from the halt and ramp-up of the new Model Y).

b) Improvement in economies of scale quarter-on-quarter: Tesla's car sales in Q2 were 384,000 units, up about 14% quarter-on-quarter from 337,000 units in Q1, emerging from the Q1 car sales trough, and economies of scale are also improving quarter-on-quarter.

2) Single-car variable costs: Affected by tariffs, there is an upward trend

This quarter's single-car variable cost was $32,200, up $1,000 quarter-on-quarter, still mainly affected by tariffs (Q2 tariff costs increased by $300 million, with $200 million reflected in this quarter's car sales variable costs, equivalent to a negative drag of $520 on car sales costs)

3) Automotive gross margin finally begins to recover due to the rise in car sales prices and the decline in single-car depreciation costs:

Ultimately, due to the decline in single-car amortized costs this quarter, but the rise in single-car variable costs, the final car sales gross margin this quarter was 15% (excluding carbon credits), finally emerging from the Q1 car sales trough, improving by 2.5 percentage points quarter-on-quarter!

III. How will Tesla's car sales fundamentals evolve in 2025?

3.1 Q2 delivery volume exceeded market expectations, but it has already been priced into the stock price

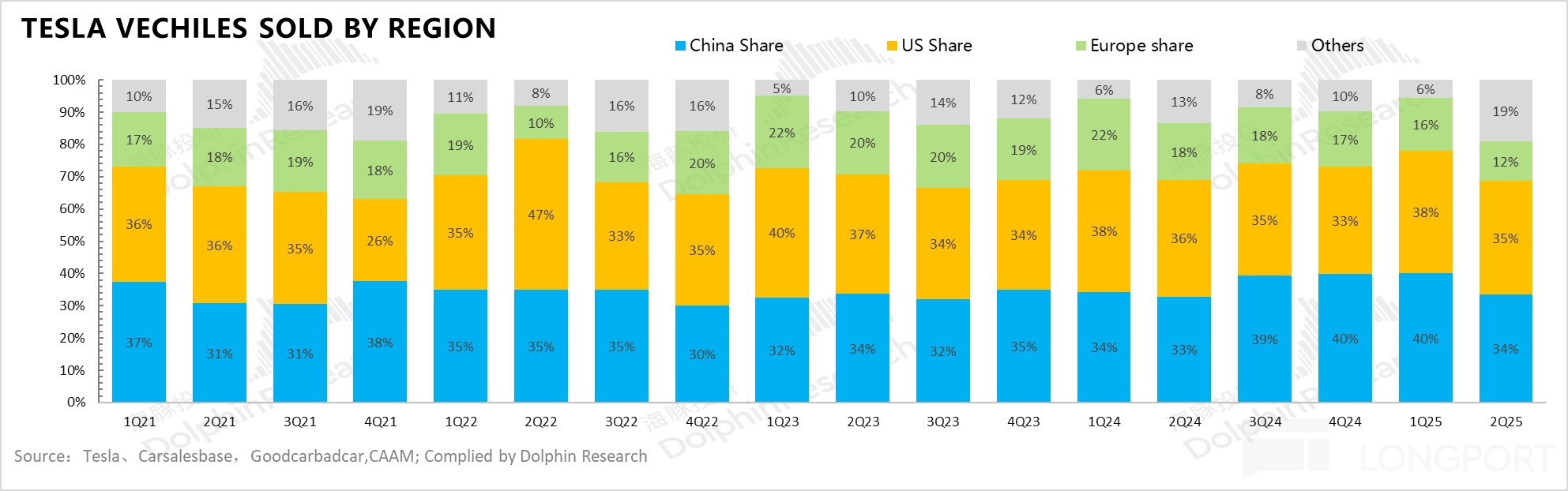

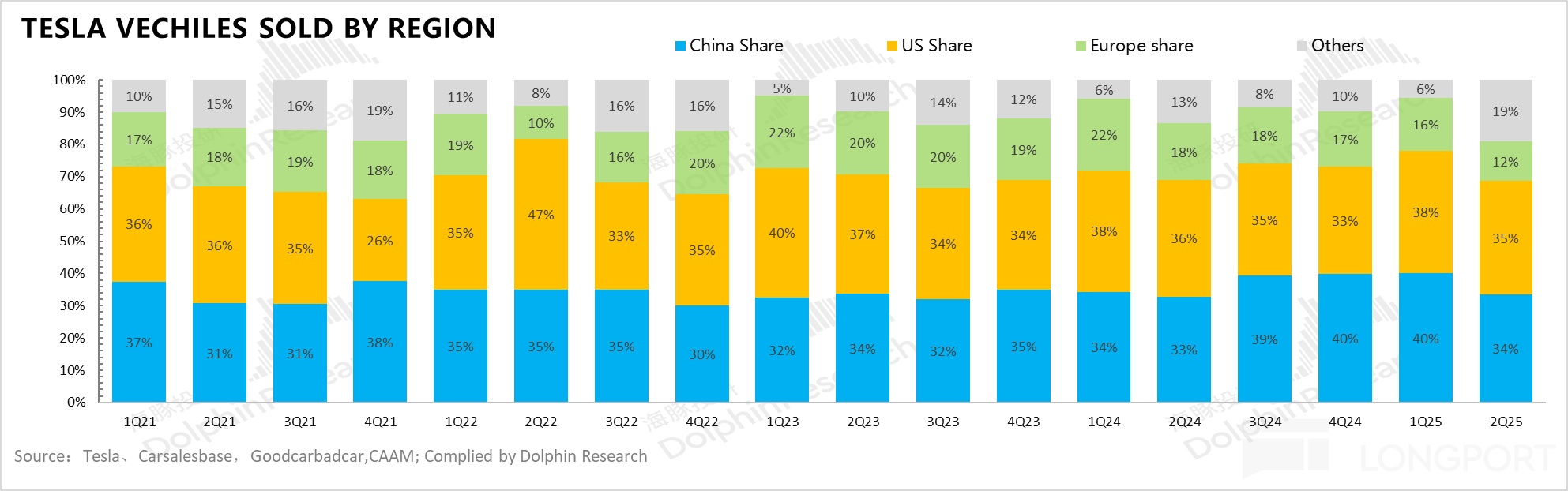

In Q2, Tesla actually delivered 384,000 units, exceeding the sell-side expectations of 380,000 units and the buy-side expectations of 360,000 units observed by Dolphin Research, mainly due to the U.S. market and other regions' sales exceeding expectations. By region:

By region:

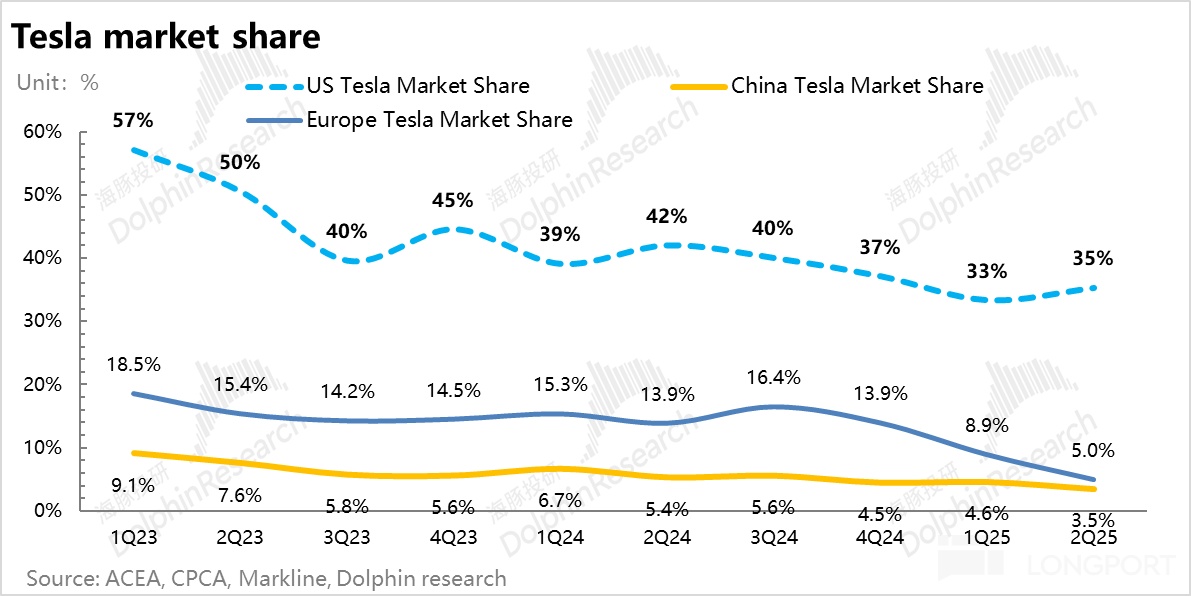

① In the Chinese market: Tesla's retail sales and market share in the Chinese region both declined quarter-on-quarter in Q2. Due to the intense competition in the new energy vehicle market, even though Tesla just launched an interest-free promotion policy for the updated Model Y, its competitiveness is clearly insufficient compared to the speed of new car launches by Chinese peers, and its market share is continuously declining.

② In the U.S. market: Tesla's sales and market share in the U.S. region both rose quarter-on-quarter in Q2. Due to the confirmation of the Inflation Reduction Act, the federal tax credit of $7,500 for new energy vehicles will end on September 30, 2025, officially pausing from October 1, 2025, so the U.S. market saw pre-consumption before the IRA expiration.

③ In the European market: Tesla's performance in the European market was also relatively average. Previously, in Q1, it was affected by Musk's political activities, which caused brand value damage, especially significant in Europe, as corporate fleet buyers account for a high proportion of sales in Europe.

④ In other markets: Other markets significantly exceeded market expectations this quarter, mainly due to the joint efforts of the Asian markets (Malaysia/Korea/Thailand).

3.2 Short-term car sales fundamentals still face headwinds, Model 2.5 mass production and launch delayed

For Tesla car sales, the new affordable model "Model 2.5" remains the most critical variable, and its production and delivery progress is crucial for Tesla's car sales fundamentals this year. Although repeatedly rumored to be canceled, this earnings call confirmed that this model will continue to be launched, but the mass production progress has been delayed by about a quarter, launching in Q4.

In this conference call, Tesla mentioned that due to prioritizing deliveries before the IRA subsidy expires (prioritizing the North American market to maximize production of existing models before the IRA policy expires), Model 2.5 mass production has been postponed to the next quarter, launching in Q4.

Currently, market expectations for Tesla's sales are at 1.65 million units (market expectations were at 1.8 million units before the Q1 earnings report), and buy-side expectations may have already fallen to 1.6 million units or even lower (down 200,000 units compared to 1.79 million units in 2024), mainly due to the mediocre performance of Tesla's existing models in the first half of the year, and the main sales increment this year is actually mainly on this Model 2.5 model, with the Model Y six-seater version expected to contribute relatively limited increment.

In terms of regions, the U.S. Inflation Reduction Act's $7,500 IRA subsidy will end on September 30. Although U.S. demand in Q3 may be released in advance to some extent, Q4 sales in the U.S. region will inevitably decline after the subsidy phase-out, heavily relying on the mass production and launch progress of the affordable Model 2.5.

In terms of gross margin, regulatory credit adjustments will cause regulatory credits to continue to decline in subsequent quarters, and the impact of tariff costs on car sales will also be fully reflected in subsequent quarters, possibly leading to continued short-term pressure on gross margin.

The delay in the mass production and launch plan of Model 2.5 may still lead to a further downward revision of the overall 2025 car sales expectations, and close attention is still needed on the specific mass production ramp-up progress of this model.

(Note: The market previously expected Model 2.5 to be launched first in the U.S., in Europe in August, and in China by the end of 2025, making it difficult to achieve large-scale delivery before Q4. This time, Model 2.5 delivery is delayed again).

IV. But more important than car sales fundamentals is the vast business of Robotaxi/FSD and Optimus

For Tesla, the current stock price trend ($330) is already relatively decoupled from the car sales fundamentals, and investors' real casting is in Tesla's vast business: Robotaxi/FSD and Optimus. Therefore, substantial progress in these two businesses, the next generation's progress, and Musk's planning implementation time are particularly important, and these two narratives may have major breakthroughs at the end of this year and early next year, with short-term narrative logic unverifiable:

① In the Robotaxi/FSD business:

a. In Robotaxi:

Currently still proceeding as planned, with the first 20 unmodified Model Y vehicles already in small-scale trial operation in Texas, USA, since June.

Although there are still many problems in the actual road test performance, Dolphin Research still believes that this is essentially the inherent defect of the end-to-end route, but in terms of running through the business model (Tesla's current end-to-end route has lower overall costs, and the technical route is highly generalized, allowing for rapid expansion to other cities and regions), it is still much more likely than the Waymo route.

Tesla's previous plan was to expand to multiple U.S. cities by the end of the year (generalized end-to-end algorithms support rapid expansion to other cities), aiming to reach 1,000 Robotaxis within a few months, while expanding geographically to San Francisco, Los Angeles, and San Antonio in the U.S. According to Tesla's previous plan,

it is expected to have a significant impact on the financial statements in the second half of next year.

This earnings call's plan for this part of the business remains basically unchanged, with Tesla advancing regulatory approvals in multiple locations such as San Francisco and Nevada, aiming to cover about half of the U.S. population by the end of the year, with service areas and models showing exponential growth.

b. In the FSD business: The time inflection point is expected to achieve the next major breakthrough in Q4 this year and early next year

Currently, Tesla's FSD (intelligent driving for passenger cars) is still based on the V13 software version and HW4.0 hardware, and the market is eagerly anticipating Tesla's next-generation intelligent driving version's major update, which is another major leap in the intelligent driving end (referencing Tesla's V12/V13 version's direct switch to end-to-end routes, bringing a significant performance leap):

The market is still anticipating the FSD 14.0 version on the software side and the HW5.0 version on the hardware side, with the HW 5.0 (now called AI 5) version's hardware computing power expected to reach over 2000+ TOPS. Compared to the existing model, the model parameters supported by the FSD 14.0 version will be several times the current size, and its performance is expected to leap to another level, thereby driving the penetration rate of FSD and the continued expansion of Robotaxi.

In terms of progress, according to research, the current plan is to start internal testing of the V14 alpha version in Q4 2025, and officially launch the V14 official version in Q1 2026. Musk also stated at the 2025 shareholder meeting that "HW 5.0 + V14 is the last piece of the puzzle to L5, and Tesla owners can sleep in the car in 2026."

② In the Optimus business: Gen 3 is expected to start mass production for the first time at the end of 2025 and early 2026

According to Tesla's plan in the Q1 conference call, thousands of robots will be put into trial use in Tesla factories by the end of 2025, with confidence in achieving an annual production of 1 million units within 4-5 years, expected to reach this goal by 2029 or 2030.

This earnings call's incremental information mentioned that the Gen 3.0 version design is complete, with a prototype to be launched within 3 months, mass production next year, and a target of achieving an annual production of 1 million units in 4 years, with progress basically consistent with previous plans.

According to research, Optimus is expected to launch the Gen-3 full-featured version at AI DAY in October 2025. Compared to the Gen-2 version, the Gen-3 version has achieved a significant performance improvement and continued cost reduction (cost reduction is expected to reach $16,500), and in terms of production planning, small-scale trial production is expected to be achieved in Q1 2026, and large-scale mass production is expected to begin in Q3 2026. Therefore, this mass production and release inflection point may also arrive in Q4.

III. On the expenditure side: Still heavily investing in AI's vast business

Tesla's R&D and sales expenses this quarter continued to increase, with R&D expenses at $1.59 billion, exceeding market expectations of $1.34 billion, still due to increased investment in AI intelligence and new vehicle series development, while sales and administrative expenses this quarter were $1.37 billion, exceeding expectations of $1.27 billion, mainly due to marketing investment for the launch of the Model Y Juniper.

Finally, due to the exceeding expectations on the gross margin side, offsetting the rise in operating expenses, the overall operating profit this quarter was $900 million, up $200 million quarter-on-quarter, with an operating profit margin of 4.1%, also rising 2 percentage points quarter-on-quarter.

In terms of free cash flow, this quarter's operating cash flow saw an increase due to improved fundamentals, but capital expenditures are still heavily investing in AI business, with capital expenditures this quarter at $2.4 billion, continuing to rise by $900 million quarter-on-quarter!

Tesla added 16,000 H200 GPUs in Texas, bringing the Cortex training cluster to an equivalent computing power level of 67,000 H100s, still heavily investing and paying for the vast business!

Finally, although this quarter's operating cash flow rose by $400 million quarter-on-quarter, due to the capital expenditure side rising by $900 million quarter-on-quarter, the final free cash flow still fell by $500 million quarter-on-quarter compared to the worst car sales period last quarter, to $150 million this quarter.

<End here>

Dolphin Research's historical articles, please refer to:

Hotspot Tracking:

October 25, 2025, "Is Musk really going to tear up the $25,000 Model 2?"

In-depth Research:

January 8, 2025, "The ultimate question, can FSD really support a $1.5 trillion Tesla?"

January 2, 2025, "Tesla FSD: Can the vast business withstand the test of reality?"

December 3, 2025, "Tesla's "stealthy move," is the Robotaxi story just a "decoy"?"

Earnings Report Commentary:

January 23, 2025, earnings report interpretation "The "torn" Tesla: Grand AI narrative "hard against" collapsing car sales fundamentals"

October 24, 2025, earnings report interpretation "The "king of drawing cakes" Tesla finally returns as a king!"

October 24, 2025, earnings report conference call "Tesla: Committed to delivering affordable models in the first half of 2025"

July 24, 2025, earnings report interpretation "Tesla: "AI big cake" is easy to talk about, but reality is too harsh"

July 24, 2025, earnings report conference call "Expected annual capital expenditure to exceed $10 billion, will continue to strengthen investment in AI chips"

April 24, 2025, earnings report interpretation "FSD contributes a stroke of genius, who still says Tesla is "paper-thin"?"

April 24, 2025, earnings report conference call "Next-generation model Model 2 may be launched early?"

January 25, 2025, earnings report interpretation "Tesla without the AI cloak: Endless price wars, unstoppable bleeding"

January 25, 2025, earnings report conference call "Tesla Q2 minutes: 24-year sales have no chance with "50%", but expenses still need to be raised"

December 1, 2023, hot comment "Tesla Cybertruck: Pricing too high, economic efficiency too low"

October 19, 2023, earnings report interpretation "Bubble bursting moment! Tesla, reality is harsh"

October 19, 2023, earnings report conference call "CT ramp-up slow, Mexico slow to build factory, Musk has bankruptcy "phobia""

October 12, 2023, in-depth "FSD intelligent driving: Can't support Tesla's next valuation miracle"

September 22, 2023, in-depth "Lion meets pack of wolves, can Tesla "watch the house"?"

September 19, 2023, in-depth "Tesla: How far is Musk's "trillion empire dream"?"

September 1, 2023, hot comment "New Model 3 on sale, price not down but up?"

July 20, 2023, earnings report interpretation "Trillion Tesla, only true fans dare to take over"

July 20, 2023, earnings report conference call "Tesla minutes: Gross margin lost, Tesla may continue to cut prices"

April 20, 2023, earnings report interpretation "Tesla: Year of drawing cakes, year of landing, "long-term companionship" is too difficult"

April 20, 2023, earnings report conference call "Tesla: Confident to sell cars at zero profit, harvest with autonomous driving"

January 26, 2023, earnings report interpretation "Tesla story reshaped, the moment of testing faith has arrived!"

January 26, 2023, conference call "Tesla minutes: "No opponent in sight for autonomous driving, the second Tesla may be in China"

October 20, 2022, earnings report interpretation "Fatal question: When demand is not enough, how to defend single-car profitability?"

October 20, 2022, conference call "Minutes: "Fuel cars must die, never reduce production at any time"

July 21, 2022, earnings report interpretation "Without the Shanghai factory pumping blood, what can Tesla rely on?"

July 21, 2022, conference call "Musk: Repeated price increases, I'm embarrassed"

June 6, 2022, opinion update "U.S. stock market turmoil, were Apple, Tesla, and Nvidia wrongly killed?"

April 21, 2022, "New energy thunder, Tesla strides forward and continues to be bullish"

April 21, 2022, "New factory capacity ramp-up, Tesla will deliver 1.5 million cars in 2022 (meeting minutes)"

February 28, 2022, opinion update "People's hearts are scattered, investing in Tesla needs "safety first""

January 27, 2022, conference call "Tesla: Musk reiterates the importance and value potential of FSD (conference call minutes)"

January 27, 2022, earnings report commentary "Tesla, galloping ahead, will it take a mid-game break?"

December 6, 2021, opinion update "Musk sells tickets to pay taxes, where will Tesla's stock price go?"

October 21, 2021, conference call "Tesla: Annual sales of one million are just around the corner, will Musk let go?"

October 21, 2021, earnings report commentary "Tesla: Cathie Wood shouts $3,000, is the sky the limit?"

July 27, 2021, conference call "Tesla 21 Q2 earnings conference call minutes"

July 27, 2021, earnings report commentary "Tesla: No best, only better!"

April 27, 2021, conference call "Tesla 2021Q1 earnings live minutes"

April 27, 2021, earnings report commentary "Tesla's uneventful Q1 report, what else is there to look forward to?"

June 3, 2021, in-depth "Tesla (Part 2): Misjudged or overestimated, where is Tesla's story told?"

May 21, 2021, in-depth "10 years 300 times, how long can the "magical" Tesla remain magical?"

Risk disclosure and statement of this article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.