SEA: The Southeast Asian Little Tencent Completely 'Takes Off'?

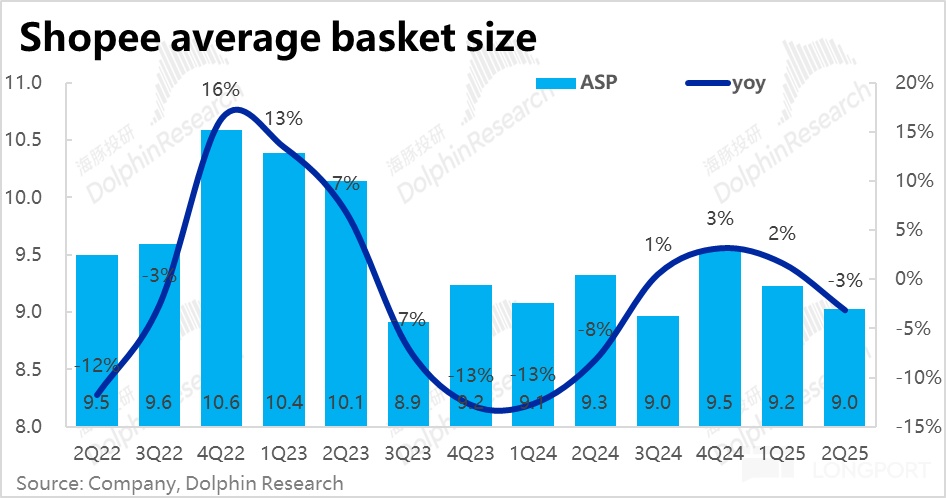

The Southeast Asian 'Little Tencent' $Sea(SE.US) delivered another very strong second-quarter report before the U.S. stock market opened on the evening of August 12. The growth of key metrics under its two core segments—GMV and loan balance—far exceeded expectations, with the growth side performing exceptionally well.

However, due to a resurgence in expenses, the profit margins of various segments generally declined quarter-on-quarter this season. But due to the strong growth, the final profit still beat expectations, overshadowing the minor flaws. The core points are as follows:

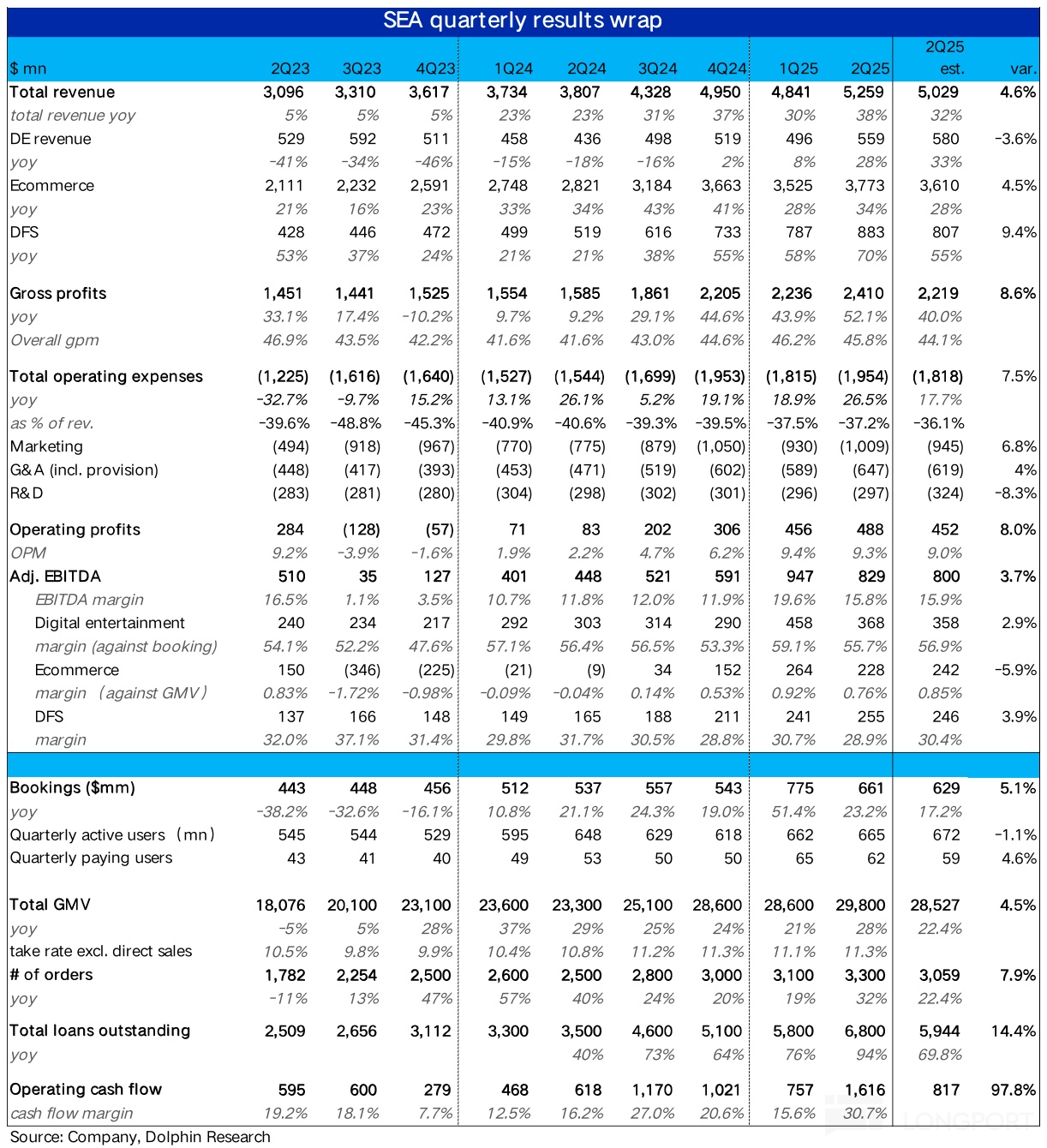

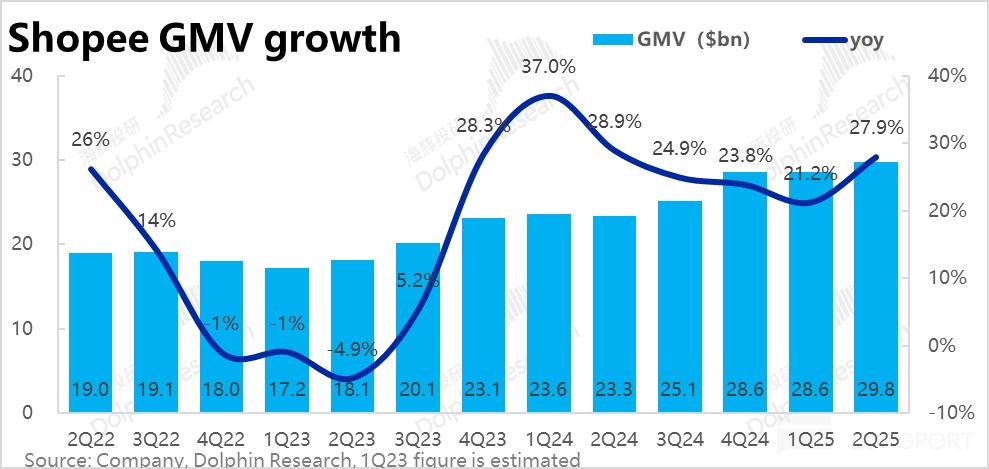

1. Explosive GMV growth, the biggest highlight: The most critical metric of the most critical segment—Shopee GMV—saw a year-on-year increase of 28% this season, significantly accelerating by about 7 percentage points from the previous quarter.

Although some Wall Street firms were optimistic before the earnings (e.g., JP Morgan expected a growth rate of 24%), the actual performance was even stronger than the optimistic expectations. Moreover, this season's growth was entirely driven by more 'healthy' order volume growth (+32% yoy), while the average order value decline was a drag.

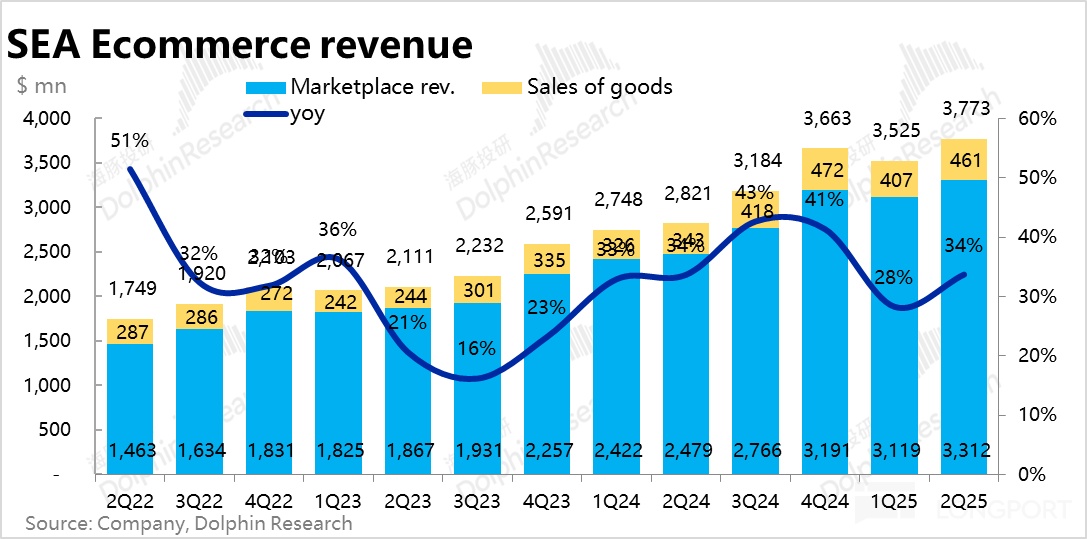

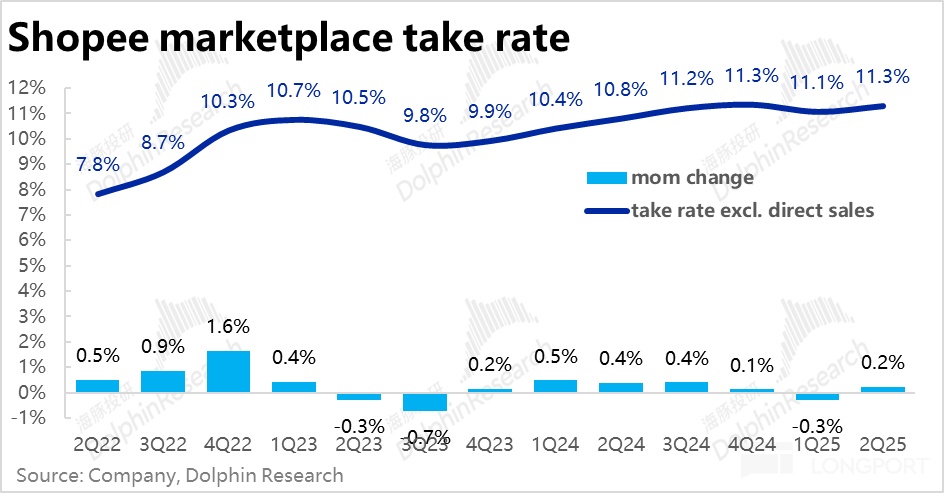

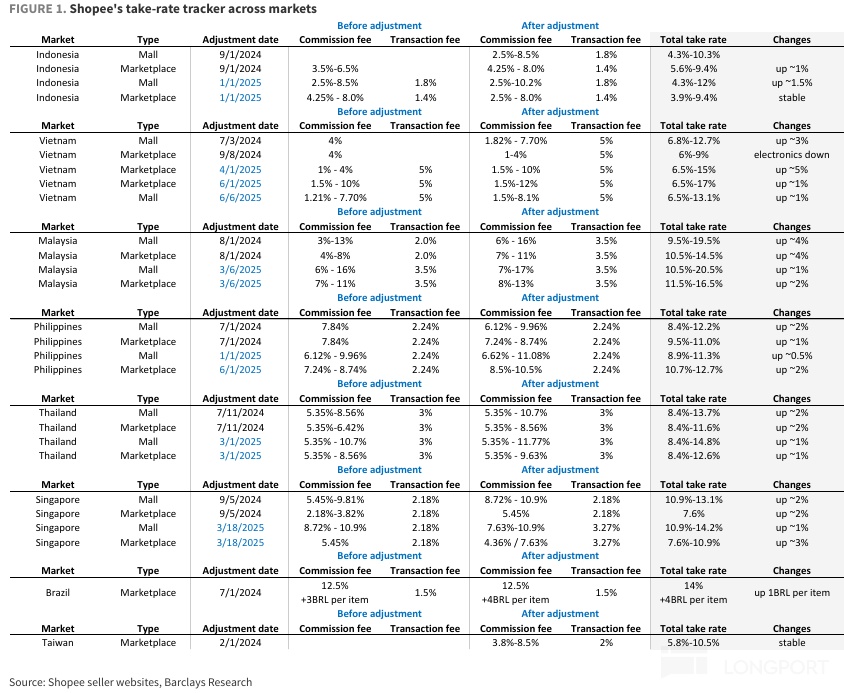

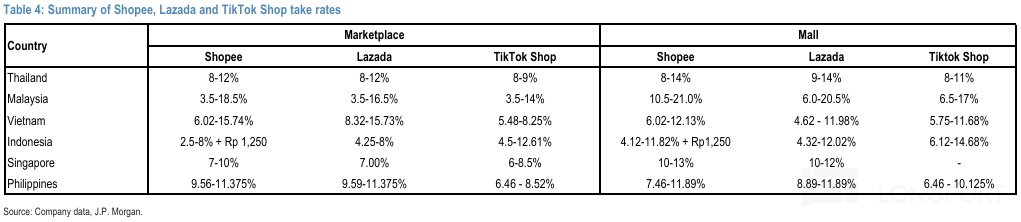

2. Southeast Asian e-commerce continues to improve monetization: This quarter, Shopee, Lazada, and TikTok Shop continued to jointly improve monetization rates in Southeast Asian countries in a rotational manner. Reflected in the financial report, Shopee's platform business monetization rate reached 11.3% this season, up 0.5 percentage points year-on-year (though the rate of increase has begun to narrow).

With strong GMV growth, Shopee's revenue this season increased by 34% year-on-year, significantly accelerating quarter-on-quarter and far exceeding the market's expected 28%.

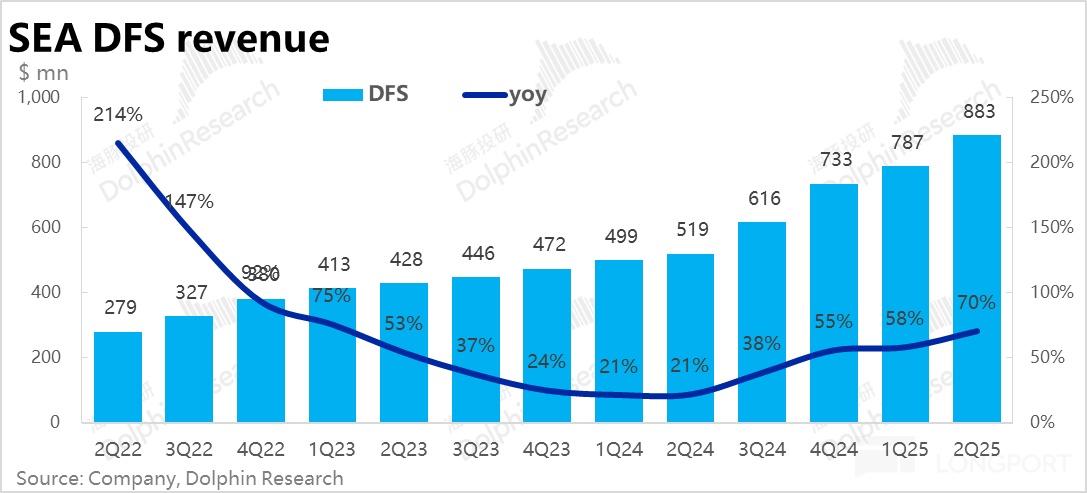

3. Rapid market expansion, Monee also accelerates growth: The second most important financial segment's revenue this season was $880 million, a year-on-year increase of 79%, also significantly accelerating quarter-on-quarter and far exceeding market expectations.

Behind this is the total loan balance, including on-balance-sheet and off-balance-sheet, which saw a net increase of $1 billion this season, compared to $500 million and $700 million in the previous two quarters, showing continuous acceleration.

Based on some research, Monee has largely completed its penetration of users within the Sea ecosystem and is expanding to corporate users and consumers outside the ecosystem. From this season's performance, the progress seems to be good.

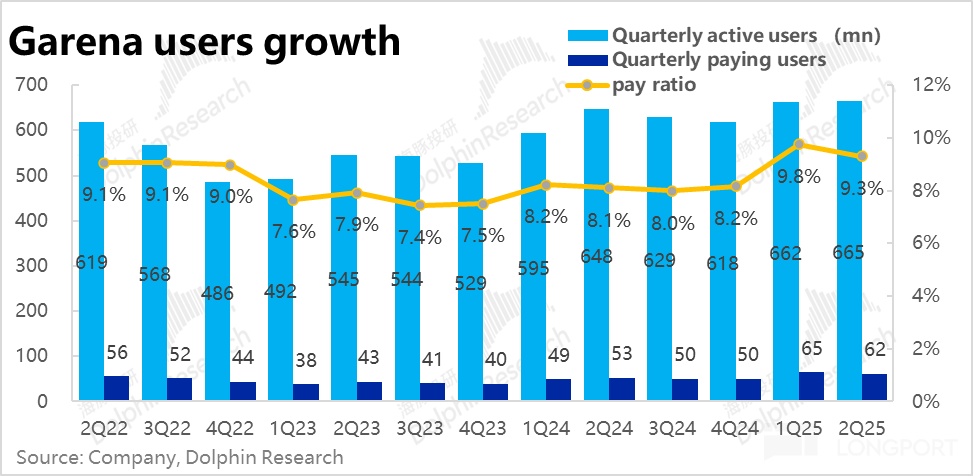

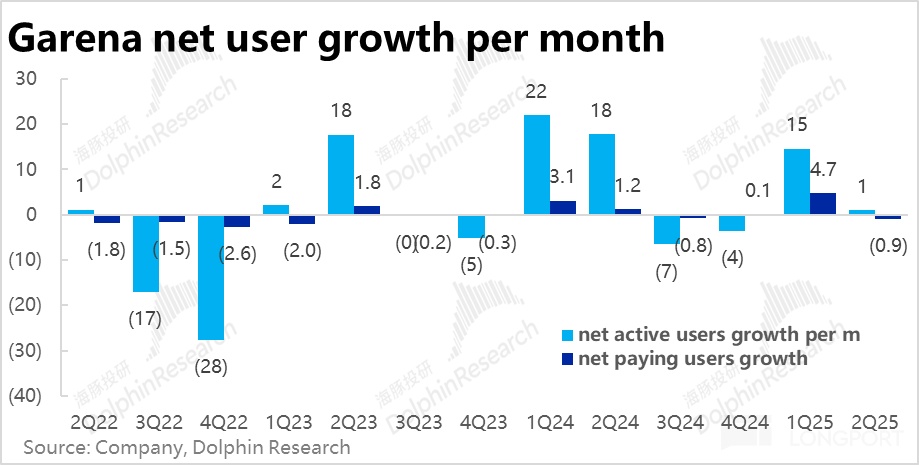

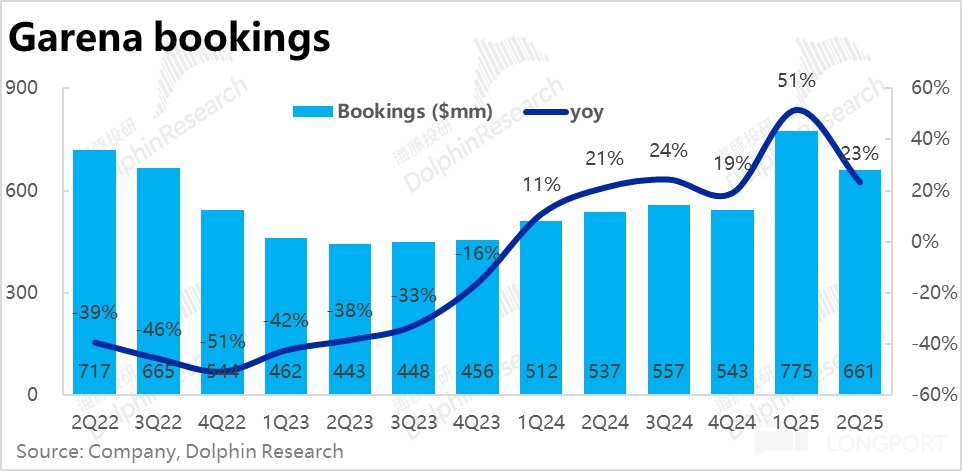

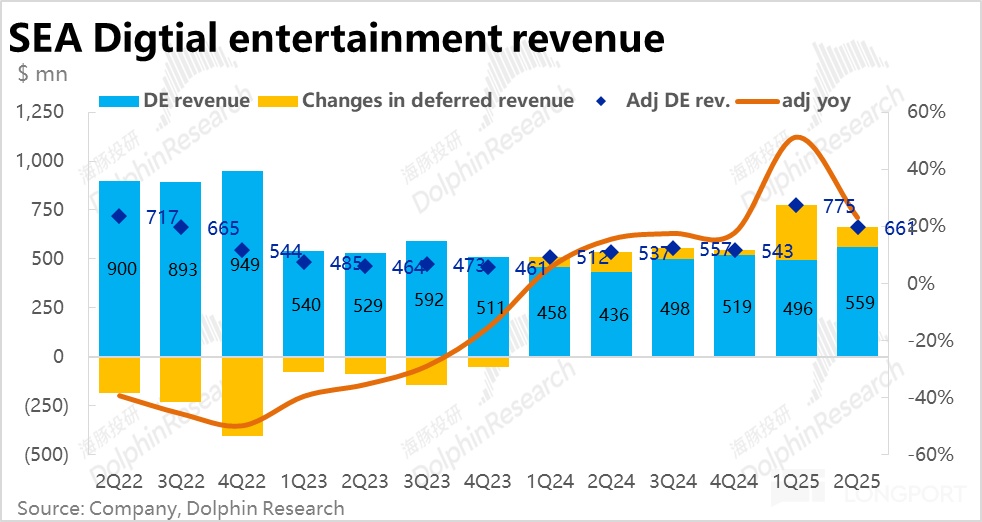

4. Garena's 'expected' cooling after the frenzy: After delivering 'explosive' results last quarter with the Naruto collaboration, this season's performance of the Garena gaming segment was largely an expected cooling.

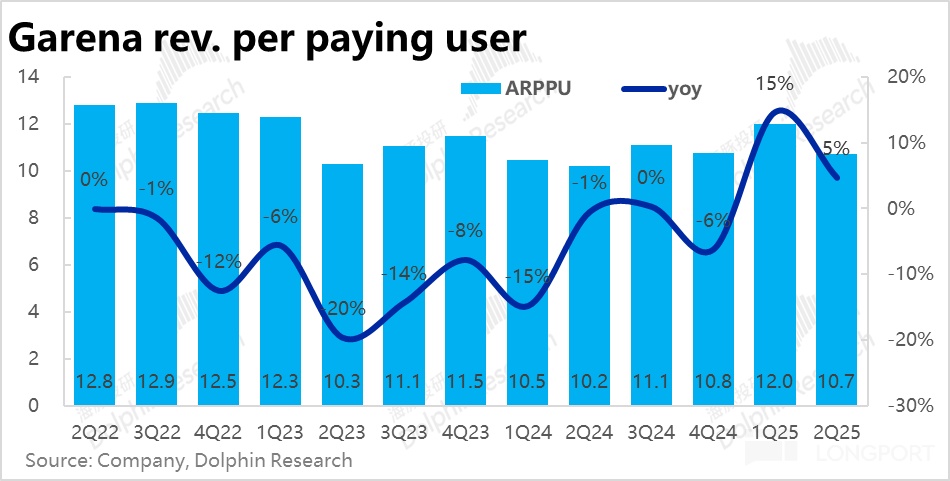

After some player sentiment was exhausted, this season's monthly active users' growth nearly stagnated, and paying users decreased by 3 million, with the payment rate turning downward. The year-on-year increase in average payment per user also declined from 15% to 5% quarter-on-quarter.

Due to the above impacts, the year-on-year growth rate of game business revenue slowed to 23% this quarter. However, although there was a significant cooling compared to the previous quarter, the market had already expected that the collaboration effect would not be sustained, and the actual revenue growth of over 20% is not bad and slightly exceeds more conservative expectations.

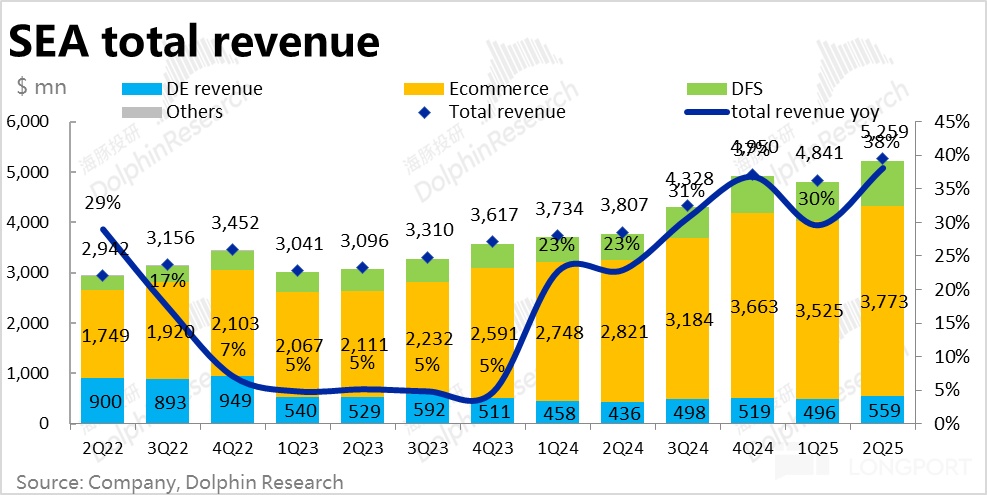

5. Strong growth but profit under pressure: Summarizing the above three major segments, e-commerce and financial segments showed strong growth, and the gaming business performed better than conservative expectations. This season, Sea's overall revenue grew by 38% year-on-year to approximately $5.26 billion, also significantly accelerating quarter-on-quarter, and beating market expectations by about 4.6%.

However, as some investment banks predicted, Sea is returning to an investment expansion cycle, leading to pressure on this quarter's gross margin and EBITDA profit margin, narrowing quarter-on-quarter.

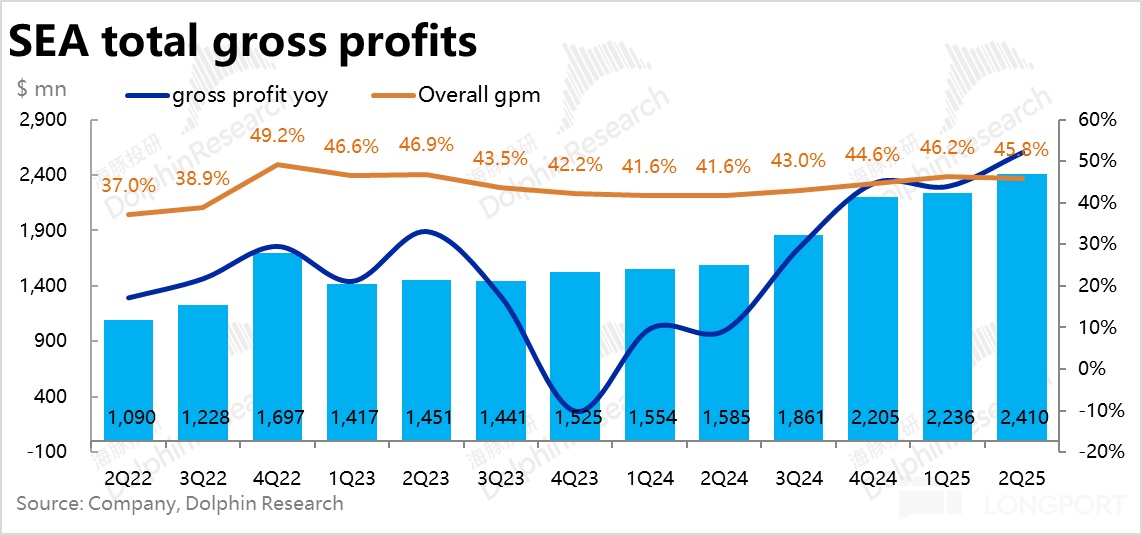

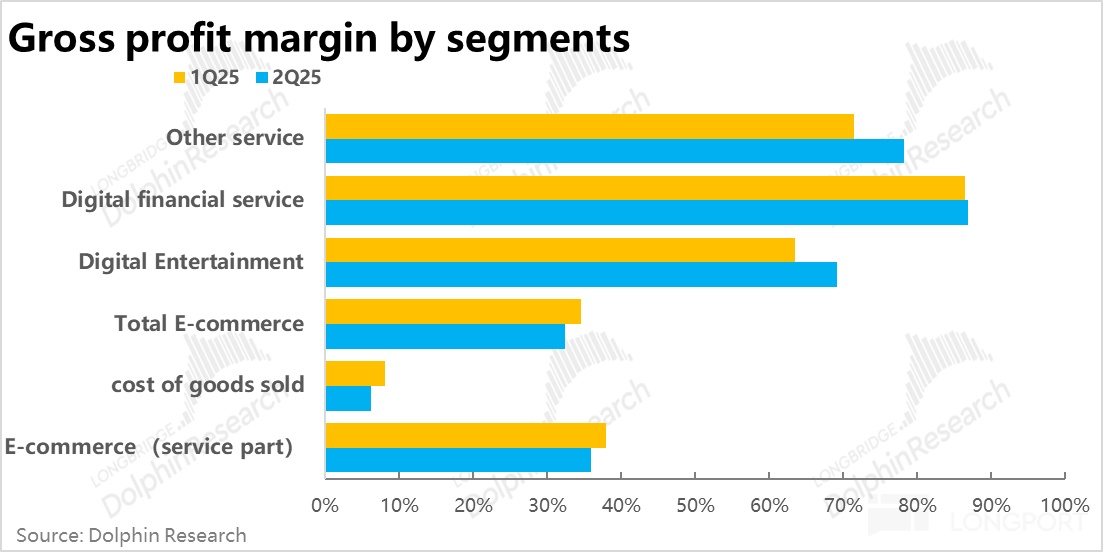

6. Decline in e-commerce gross margin, possibly due to logistics impact: Firstly, in terms of gross profit, the narrowing of the e-commerce business's gross margin (down 2 percentage points quarter-on-quarter) dragged down the company's overall gross margin, which slightly decreased by 0.4 percentage points from the previous quarter to 45.8%.

Based on research, Dolphin Research believes it is due to increased investment in logistics and freight subsidies (possibly partly to counter Meli's progress in lowering the free shipping threshold). Fortunately, the gross margins of other segments continued to improve slightly.

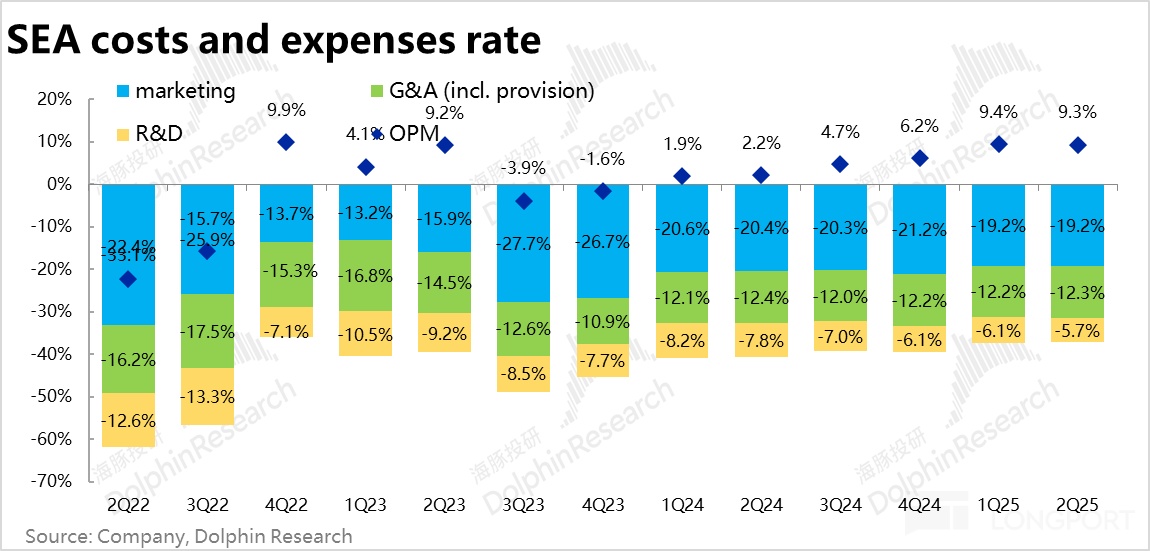

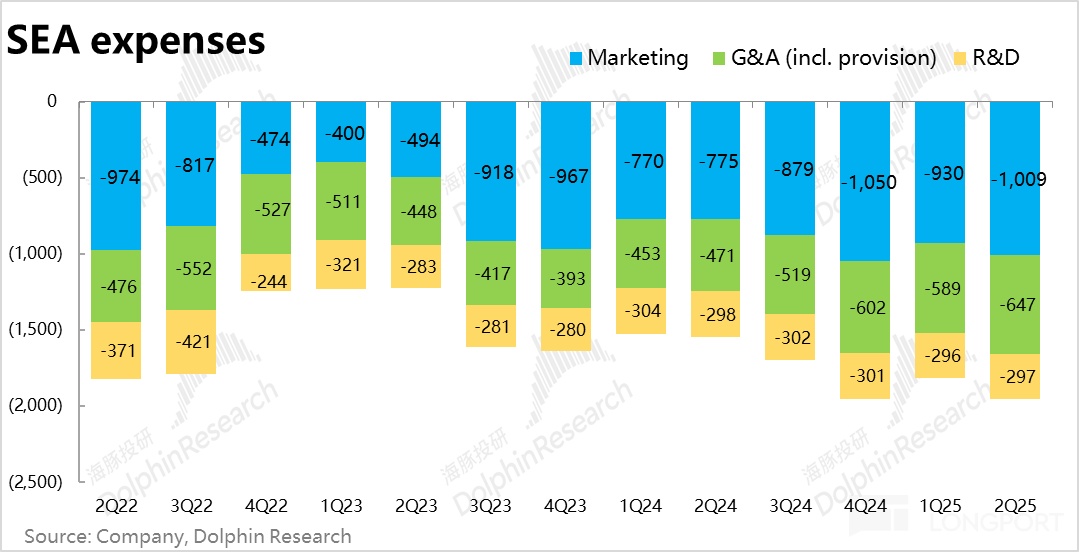

7. Expenses return to expansion: Compared to gross profit, the impact on the expense side is more significant. This quarter, the total operating expenses increased by 26.5% year-on-year, significantly accelerating quarter-on-quarter, and significantly higher than the market's expected 18%.

Specifically, marketing expenses increased by 30% year-on-year, and management expenses also increased by 37% due to bad debt provisions. This reflects the increased investment in e-commerce to optimize fulfillment timeliness and experience, as well as the increased customer acquisition costs and bad debt expenses brought by Monee's rapid growth outside the ecosystem.

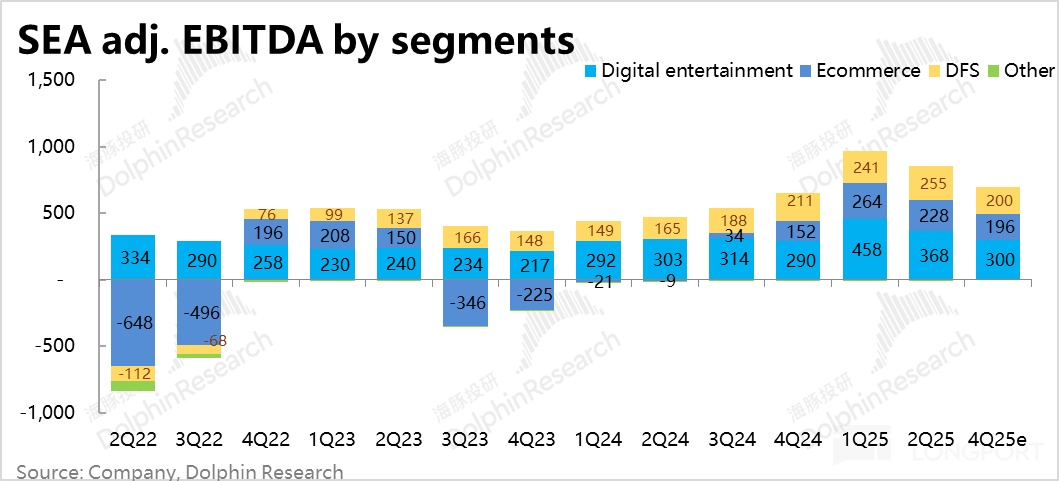

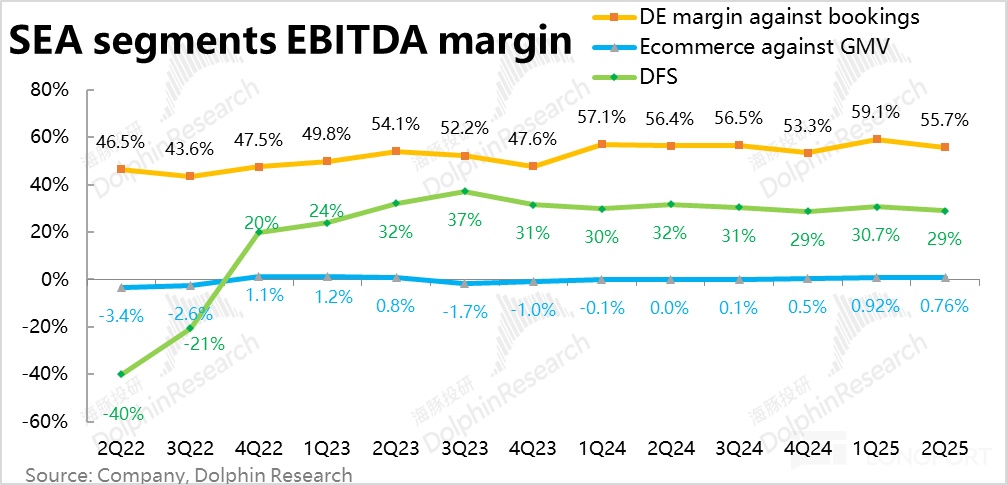

8. Profit margin under pressure, but profit amount still beats: Focusing on the company's adjusted EBITDA indicator, this season's profit margin was 15.8%, narrowing by 3.6 percentage points quarter-on-quarter, and 0.1 percentage points lower than expected, clearly showing that the profit margin is under pressure.

Moreover, by segment, whether due to logistics investment impact or increased marketing expenses, the profit margins of each business segment declined across the board this season.

The most watched e-commerce business's EBITDA as a percentage of GMV profit margin narrowed from 0.92% to 0.76% quarter-on-quarter, underperforming the market's expected 0.85%. This is not a good sign.

However, as mentioned earlier, the market had some expectations for the decline in profit margin this season. And due to the growth side's performance far exceeding expectations, the final profit amount was still nearly 4% higher than expected.

Dolphin Research's View:

Based on the above analysis, although the increase in expenses led to pressure on profit margins, making Sea's performance this season not flawless, how the market views the 'neutral' objective situation of significant expense growth often depends on the quality of business and revenue growth.

If growth is strong, the market is likely to interpret the increase in expenses as the company seeing a very optimistic demand outlook, requiring increased investment to drive business growth. Conversely, if business growth is poor, the increase in expenses would be seen as wasteful spending in the absence of growth.

Clearly, in the case of Sea's significant acceleration in GMV and loan balance growth in the financial business this season, the market is unlikely to overly concern itself with short- to medium-term expense growth and profit margin pressure, and it can be considered a reasonable behavior.

Looking at specific businesses,

1) In the e-commerce business, according to recent sell-side research, the competitive landscape in Southeast Asia remains stable, with no parties intending to increase subsidies to capture market share. On the contrary, Shopee, Lazada, and TikTok Shop have tacitly chosen to jointly improve monetization rates, growing revenue and profit together. This means that the Southeast Asian market is likely to maintain a stable competitive environment in the foreseeable future.

In this scenario, as long as there are no black swan events that significantly impact overall consumption, Shopee, as the market leader, is likely to continue steadily increasing market share and monetization levels, maintaining an excellent performance trend.

In terms of profit, due to Meli lowering the free shipping threshold in the Brazilian market and intending to increase direct competition with Shopee, and Shopee itself intending to enhance fulfillment capabilities, the speed of profit margin improvement in the e-commerce business may indeed temporarily slow down.

However, investment in fulfillment is a short-term potential profit suppressor, but in the long term, it is an important part of establishing competitive barriers in the e-commerce business. If it is only due to logistics investment, rather than a decline in monetization rate causing profit margin pressure, it will not be a major issue.

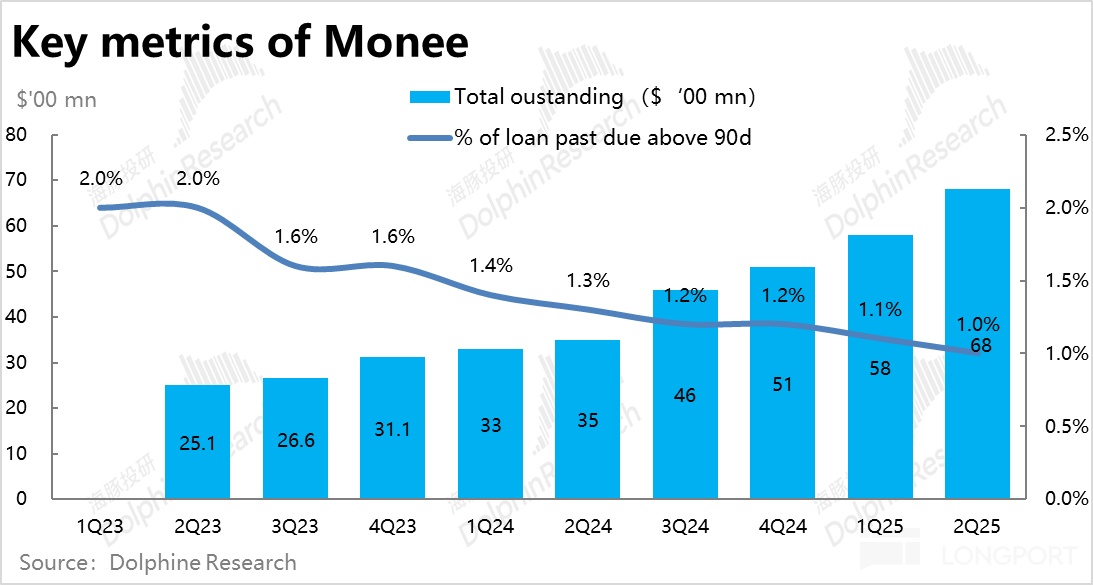

2) In the relatively opaque financial business, according to some research, Monee has nearly fully penetrated Sea's own ecosystem users, and future growth will focus more on expanding to external consumers and small and micro enterprises. Although there is no clear judgment on the long-term market space for Monee,

in Southeast Asia and Latin America, where banking services are very underdeveloped, Monee, which has just begun to expand to external users, clearly still has considerable space. Therefore, 'pure' growth may not be the biggest issue.

The bigger concern may be the increasing customer acquisition costs and when the profitability from single users will no longer be advantageous after accelerating the expansion of external users. Additionally, as users and scale continue to grow, whether the pressure of bad debt risk management will become a bottleneck.

Currently, Dolphin Research tends to believe that Monee's profitability and market space have undoubtedly not been fully priced.

Finally, from a valuation perspective, since Sea is still in a high-growth period and has not yet reached a stable profit margin level (especially in the e-commerce segment), Dolphin Research believes that the best approach to valuing Sea is to use range valuation or scenario valuation.

The main factors affecting valuation prediction differences are the stable profit margin of the e-commerce business and the size of the financial business space (how long can the revenue growth rate of tens of percent be maintained).

Therefore, Dolphin Research adopts a scenario-based approach for Sea, providing a baseline valuation and an optimistic valuation for reference.

1) In the baseline scenario, based on 2025 earnings, the gaming segment is given 13x adjusted net profit, the e-commerce segment 20x EV to EBITDA (implying a 2% EBITDA to GMV profit margin), and the financial business 18x adjusted net profit. After deducting unallocated headquarters costs (valued at 10x) and adding back net cash, the neutral stock price is estimated to be around $160, not much different from the current market value.

2) In the optimistic scenario, we move the valuation baseline to 2026 and raise the e-commerce business valuation to 20x EV to EBITDA (margin rising to 2.5%), and the financial business valuation multiple is also raised to 20x adjusted net profit. The gaming business valuation remains unchanged. In this scenario, the estimated stock price is about $210, still having considerable room compared to the current level.

If the company's e-commerce business can continue to maintain around 20% GMV growth in the next 2-3 years, while the profit margin can reach the above expectations, and the financial business continues 30%-40% revenue growth, and the gaming business does not underperform, then Sea will still have good upside potential.

Below is a detailed interpretation of the financial report:

I. Shopee E-commerce: GMV growth explodes again

The most important Shopee e-commerce segment showed extremely strong growth this quarter, arguably the biggest highlight of this performance. GMV reached $28.6 billion, a year-on-year increase of nearly 28%, significantly accelerating from the previous quarter. Although some sell-side analysts expected growth to accelerate this quarter (e.g., JP Morgan expected 24% growth), the actual performance was even stronger than the optimistic expectations.

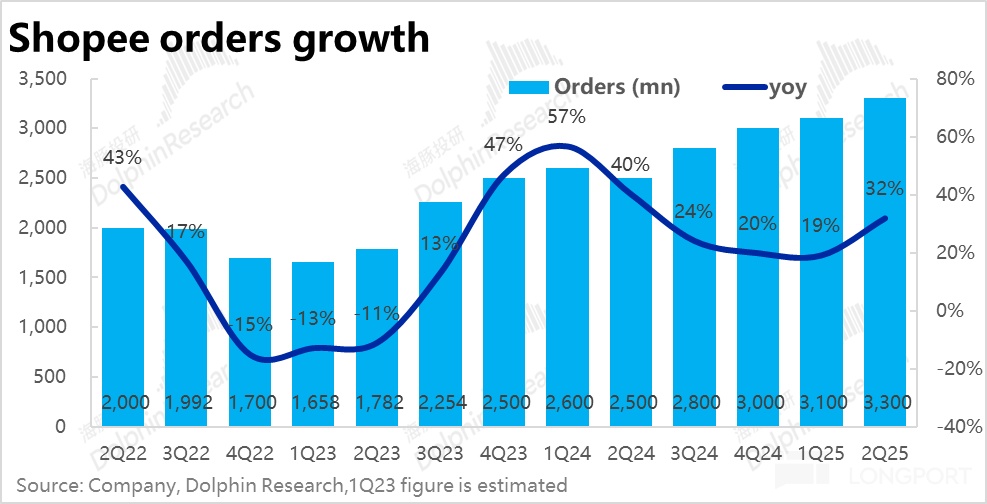

Moreover, this season's strong GMV growth was entirely driven by more 'healthy' order volume growth (year-on-year growth of 32%), while the average order value slightly declined (year-on-year about -3%), possibly indicating slightly increased discount efforts or further downward movement in the platform's user and product structure.

In terms of revenue and monetization, recently Shopee, including Lazada and TikTok Shop, have been improving monetization rates in multiple countries in a rotational manner. This season, reflected in the financial report, Shopee's platform business monetization rate reached 11.3% (up 0.5 percentage points year-on-year, though the rate of increase has begun to narrow).

With strong GMV growth and a continued rise in take rate, Shopee's revenue this season increased by 34% year-on-year, accelerating quarter-on-quarter again, and far exceeding the market's expected 28% year-on-year growth. In summary, the Shopee segment's performance on the growth side was very strong.

II. Monee Financial Business Accelerates Expansion

The financial segment confirmed revenue of $880 million this season, a year-on-year increase of 79%, with growth accelerating again, also far exceeding market expectations. The main driving force behind this is the total loan balance, including on-balance-sheet and off-balance-sheet, which reached $6.8 billion this season, with a net increase of $1 billion quarter-on-quarter, gradually accelerating from the $500 million and $700 million net increases in the previous two quarters.

It is evident that the strong revenue growth in the financial segment is driven by robust credit business. Based on some research, Monee has largely completed its penetration of Sea's own ecosystem users and is beginning to expand to corporate users and consumers outside the ecosystem. From this season's performance, the progress of expansion seems to be good.

Moreover, as the credit business expands, the proportion of bad debts overdue for more than 90 days continues to decline, reaching 1% this season, narrowing by 0.1 percentage points quarter-on-quarter. It is evident that the overall credit quality has not deteriorated.

However, it is also worth noting that this season's financial report confirmed bad debt provisions of $320 million, continuing to increase by 94% and 15% year-on-year and quarter-on-quarter, respectively. Although roughly matching the loan balance growth rate, it is not a major issue, but it will still drag on the segment's profit margin.

III. Garena Gaming: Cooling after the frenzy

After delivering 'explosive' results last quarter with the Naruto collaboration, this season's performance of the Garena gaming segment was largely an expected cooling.

In terms of underlying user data, this quarter's monthly active user growth stagnated again (a slight increase of 3 million quarter-on-quarter), and the number of paying users decreased by over 3 million, with the payment rate dropping to 9.3%. After the surge in revenue last quarter, player sentiment was somewhat exhausted, leading to an 'expected' cooling in player activity and payment willingness this season.

Due to the loss of paying users, the year-on-year increase in average payment per paying user also declined from 15% last quarter to 5% this quarter. This quarter's game business revenue growth slowed to 23% year-on-year, but given the high base last quarter, the market had already expected a slowdown. The actual performance was still slightly better than more conservative expectations.

In terms of GAAP revenue, this quarter was approximately $560 million, a year-on-year increase of 28%. Due to less deferred revenue recognition this quarter, the gap between GAAP revenue and revenue growth is not large.

IV. Increased logistics investment, e-commerce gross margin declines quarter-on-quarter, dragging down overall

Due to the two core segments, e-commerce and financial business, significantly exceeding expectations this season, Sea's overall revenue grew by 38% year-on-year to approximately $5.26 billion, exceeding expectations by about 4.6%.

In terms of gross profit, mainly due to the narrowing of the e-commerce business's gross margin (platform business gross margin down 2 percentage points quarter-on-quarter), the company's overall gross margin slightly decreased by 0.4 percentage points from the previous quarter to 45.8%. Dolphin Research believes this is mainly due to increased investment in logistics and freight subsidies.

However, the gross margins of the financial and gaming segments continued to improve slightly with scale effects, and from a year-on-year perspective, the overall gross margin still increased significantly by over 4 percentage points. With strong revenue growth, gross profit actually increased by 52% year-on-year to $2.41 billion, still a strong performance.

V. Enhancing experience and expanding market, expense growth begins to rise

Similar to the trend of declining e-commerce gross margin quarter-on-quarter, on one hand, the e-commerce business is increasing investment in logistics capabilities to optimize fulfillment timeliness and experience; on the other hand, Monee's expansion of external customers inevitably increases customer acquisition costs. This quarter, the total operating expenses amounted to nearly $1.95 billion, with a significant year-on-year increase of 26.5%, also significantly higher than the market's expected expense growth of 18%.

Specifically, marketing expenses increased by 30% year-on-year, and management expenses, including bad debt provisions, also increased by 37%. In contrast, R&D expenses remained flat year-on-year, indicating that most of the company's expense expectations have shifted to marketing expenses. It is indeed evident that the company has increased spending on customer acquisition.

VI. Under expense expansion, profit margins of all segments narrow quarter-on-quarter

Although Sea's performance on the growth side was quite impressive this season, objectively speaking, due to the narrowing of the e-commerce business's gross margin and the significant rise in overall expenses, the performance on the profit side was not as outstanding.

Focusing on the company's main adjusted EBITDA indicator, the EBITDA profit margin this season was 15.8%, narrowing by 3.6 percentage points quarter-on-quarter, and 0.1 percentage points lower than expected. Due to the growth side exceeding expectations, the actual profit amount was about $830 million, still slightly beating expectations, but the trend decreased by about $110 million quarter-on-quarter. The suppression of profit by expense expansion is still quite evident.

By segment, whether due to increased marketing expenses or logistics investment, profit margins also declined across the board.

The most watched e-commerce business's adj. EBITDA as a percentage of GMV profit margin narrowed from 0.92% last quarter to 0.76%, not meeting market expectations.

In the gaming segment, due to a decline in player activity this season and increased marketing expenses, the EBITDA as a percentage of bookings profit margin also decreased from 59% last quarter to 56% this season.

As for the financial business, due to increased bad debt provisions and customer acquisition costs for expanding outside the ecosystem, the EBITDA as a percentage of revenue also declined quarter-on-quarter from 30.7% to 28.9%.

<End of text>

Past analyses of [Sea] by Dolphin Research:

May 14, 2025, Conference Call Sea (Minutes): Unable to guide full-year game revenue, e-commerce profit margin target GMV of 2%~3%

May 14, 2025, Earnings Review Little Tencent Sea: Riding the 'Naruto' big IP, can explosive performance last?

March 5, 2025, Earnings Review SEA: No slip-ups, still 'Little Tencent'

March 5, 2025, Minutes Sea (Minutes): 25-year GMV expected to grow 20%

November 13, 2024, Earnings Review Sea: Southeast Asia's Little Tencent becomes 'Sweetheart' again?

November 13, 2024, Conference Call Minutes Sea: How to view future growth (3Q24 Conference Call)

August 13, 2024, Earnings Review Sea: Shattering ghost stories, Southeast Asia's Little Tencent is still doing well

August 13, 2024, Conference Call Minutes Sea: Will the good growth trend of e-commerce and gaming continue?

May 17, 2024, Earnings Review Southeast Asia's Little Tencent: 'Arch-enemy' becomes 'Friend', Sea rises again?

May 17, 2024, Conference Call Minutes Sea: Believing e-commerce competition will not become extreme again

March 5, 2024, Earnings Review TikTok's absence brings reversal, is SEA's spring coming?

March 5, 2024, Conference Call Minutes Sea: 24-year e-commerce GMV expected to achieve around 18% growth

In-depth:

June 8, 2022, 'Dual Business Flywheel Stops, SEA Deeply Trapped in Transformation Pain Period'

January 10, 2022, 'Staying in One Corner or Crossing the Sea? Southeast Asia is still SEA's 'Dragon Rising Land''

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.