Powell's Pivot: Will the Faith in U.S. Stocks Remain Unshakable?

Hello everyone, I am Dolphin Research!

The earnings season is finally coming to an end, and the long-awaited strategy weekly report is back! During this period, Powell's interest rate policy at the Jackson Hole meeting took a dramatic turn, and U.S. stocks surged and then fell back. The key question now is, as we enter September, can U.S. stocks reach new highs?

I. A Dramatic Turn in Federal Reserve Policy?

On the surface, it seems that Powell, who has always been hawkish, suddenly turned dovish at the Jackson Hole meeting. However, Dolphin Research is more concerned about the two key judgments Powell made when shifting his stance:

1) After a period of observation, it is believed that the inflation risk of tariffs is more of a one-time shock;

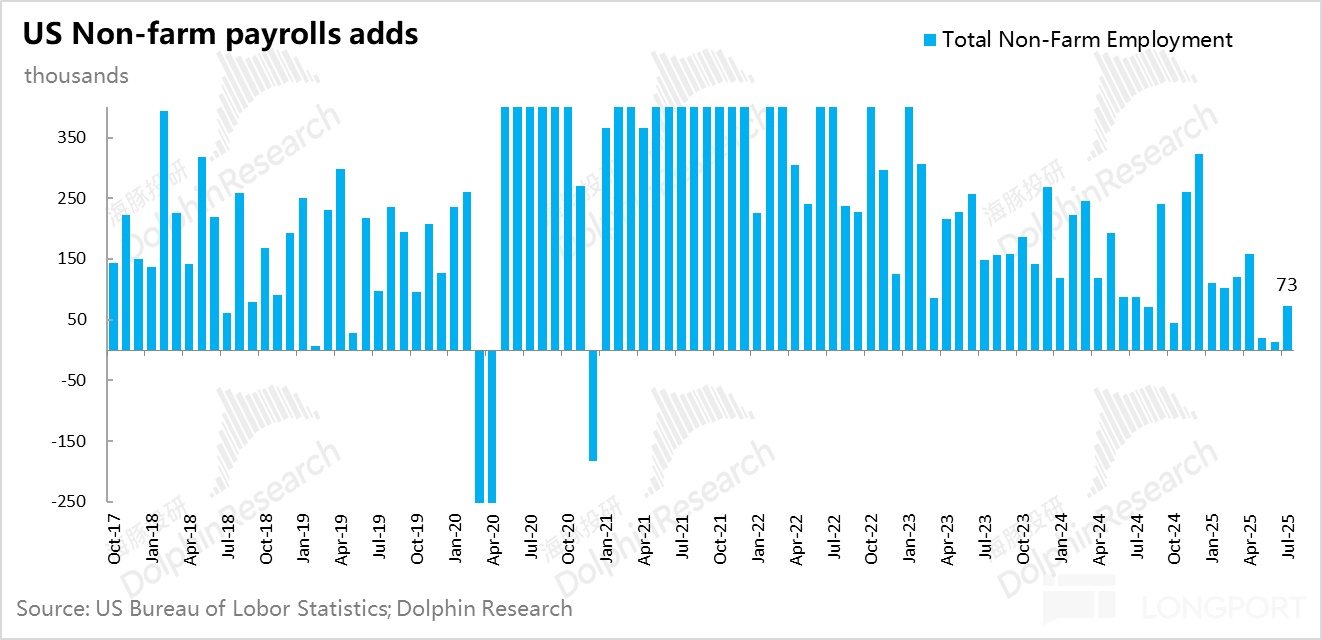

2) After the Labor Department's bottomless downward revision of new jobs in May and June (vs. wage growth from 2024 to 2025 showed almost no change, not stepping down at all), Powell now has a reason to cut rates. He stated in his speech that employment risks are rising, and under the circumstances of rising employment risks, the "wage-inflation" spiral is unlikely to truly transmit;

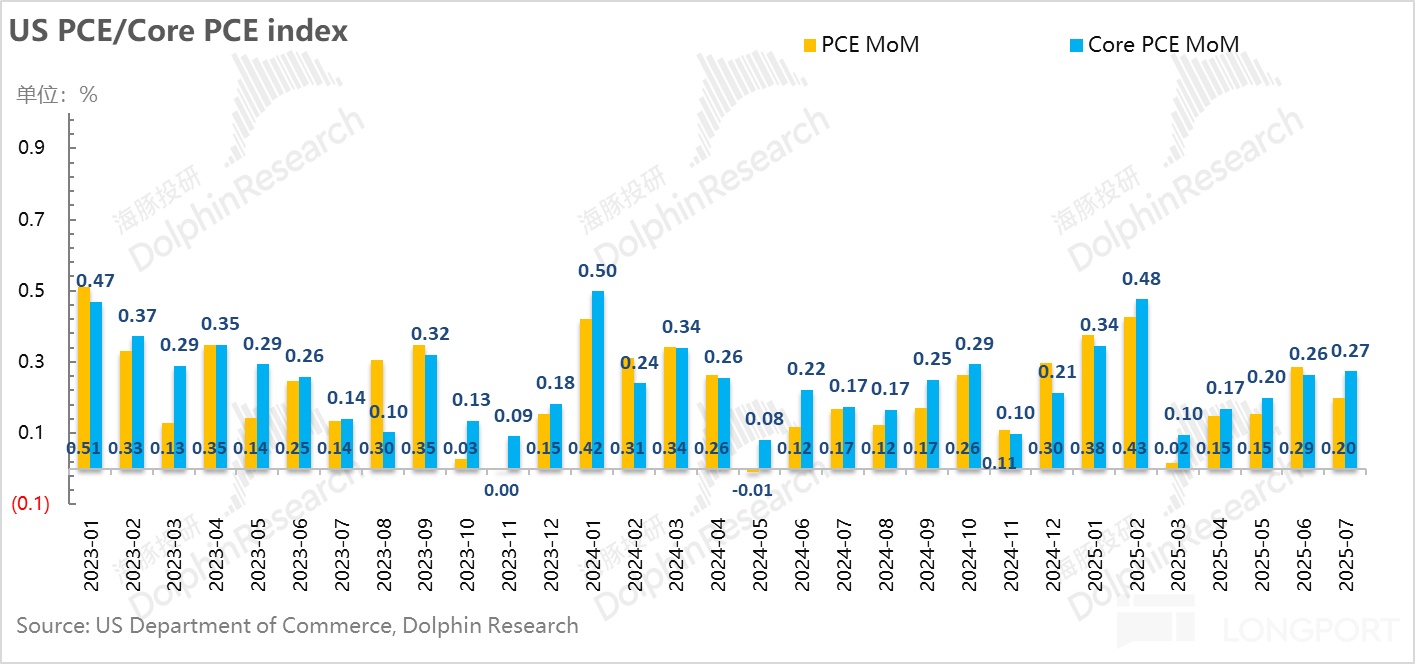

Therefore, in balancing the dual mandate, although the core PCE price index is marginally upward at present, considering employment risks, it may be necessary to adjust the current "restrictive" policy to a more "neutral" state.

In the mid-August strategy weekly report "U.S. Stocks: A Feast Towards a Bubble, Is It a Carnival or a Runaway?", Dolphin Research mentioned that the bottomless downward revision of employment data, the clarification of tariff issues, and the downward risk all seem to be deliberately "feeding" the Fed's decision-making system, allowing the current Fed to gracefully and smoothly shift to a dovish stance, while maintaining the Fed's credibility and dignity, and steering the real interest rate policy towards the direction Trump desires.

At Jackson Hole, Powell clearly "took the step down when given", and his attitude was not based on seeing clear unemployment issues or economic problems, but rather on facing potential employment prospects, preferring a "preemptive" approach to maximize employment. This is completely different from the previous press conferences where he expressed that he would not "preemptively" cut rates.

The result of this expression is that the market naturally believes there is a high probability of a 25 basis point rate cut in September, and this rate cut is a "preventive" one, not a recessionary cut based on a significant rise in unemployment.

The result of Powell's change in attitude is a sharp drop in the dollar, a slight decline in long-term bond yields, and the U.S. stock market, having already priced in a rate cut for some time, rose and then fell after Powell's shift, with the actual increase not being significant.

This also aligns with what Dolphin Research mentioned in previous strategy weekly reports—"Although U.S. stocks have entered bubble valuation levels, the market adjustment brought by the Fed's accelerated rate cuts still provides an opportunity to dance in the bubble. And if U.S. stocks do not adjust, the risk-reward of chasing new highs is not high."

II. U.S. Treasury Draining: Will the Second Half of TGA Rebuilding Rely on Bank Reserve Balances?

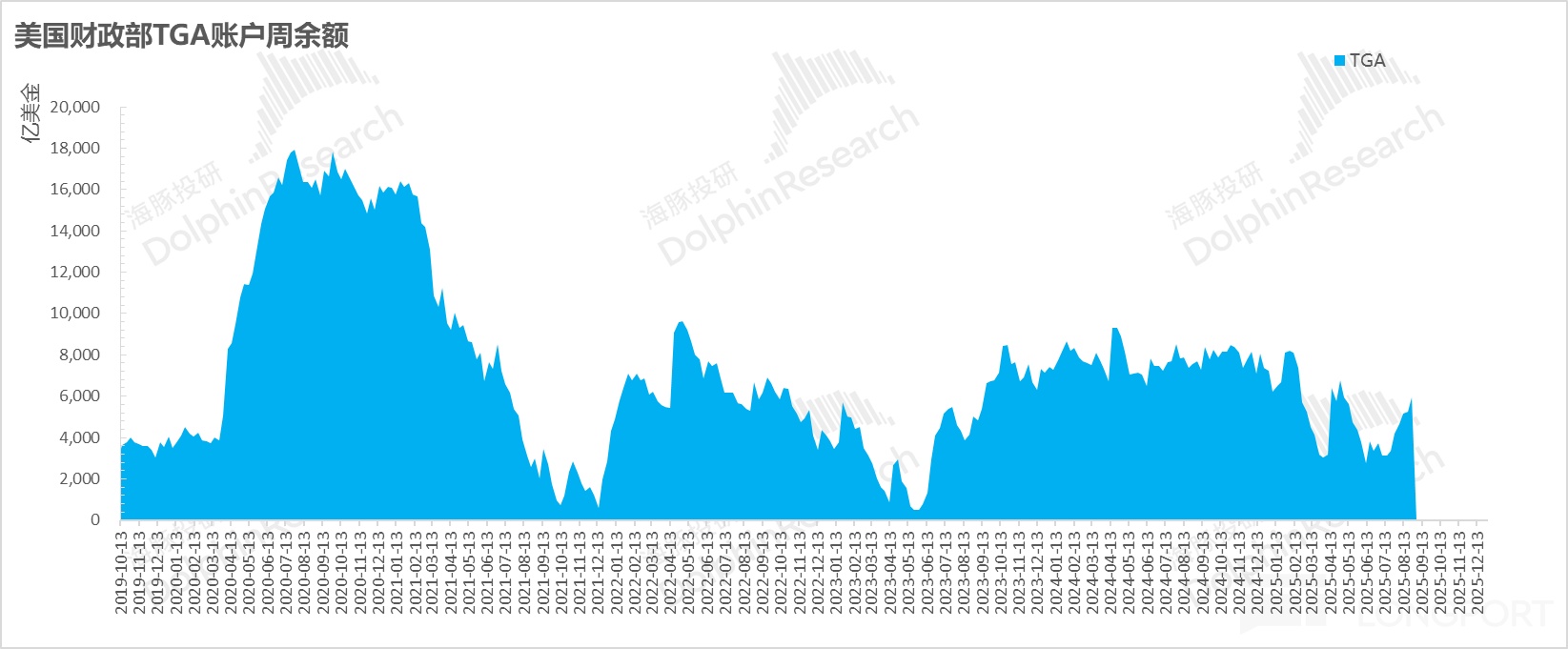

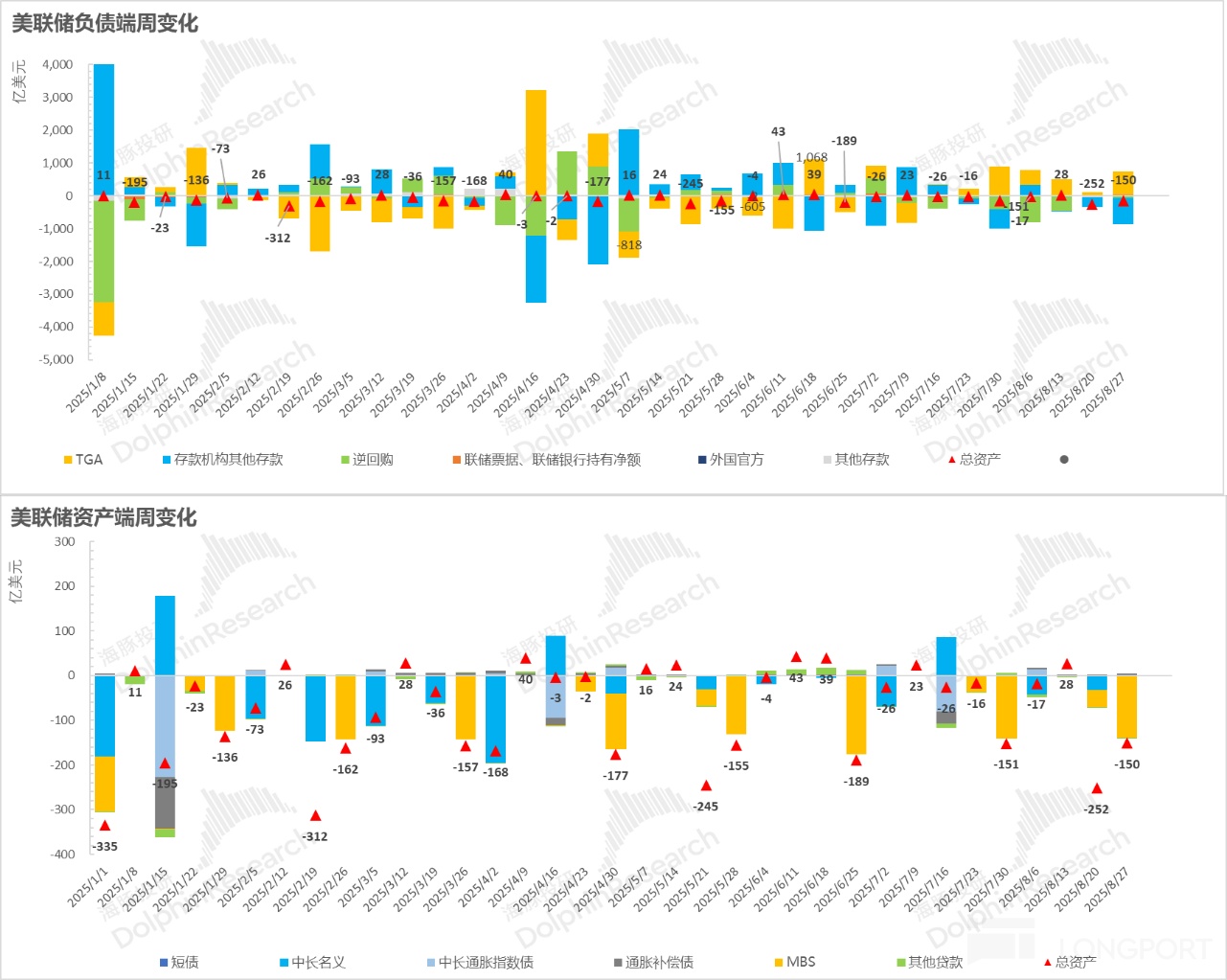

As of the week ending August 27, after five weeks of rebuilding, the U.S. Treasury's TGA account balance has risen from $350 billion to nearly $600 billion, with about half the way to go to reach the $850 billion target by the end of September.

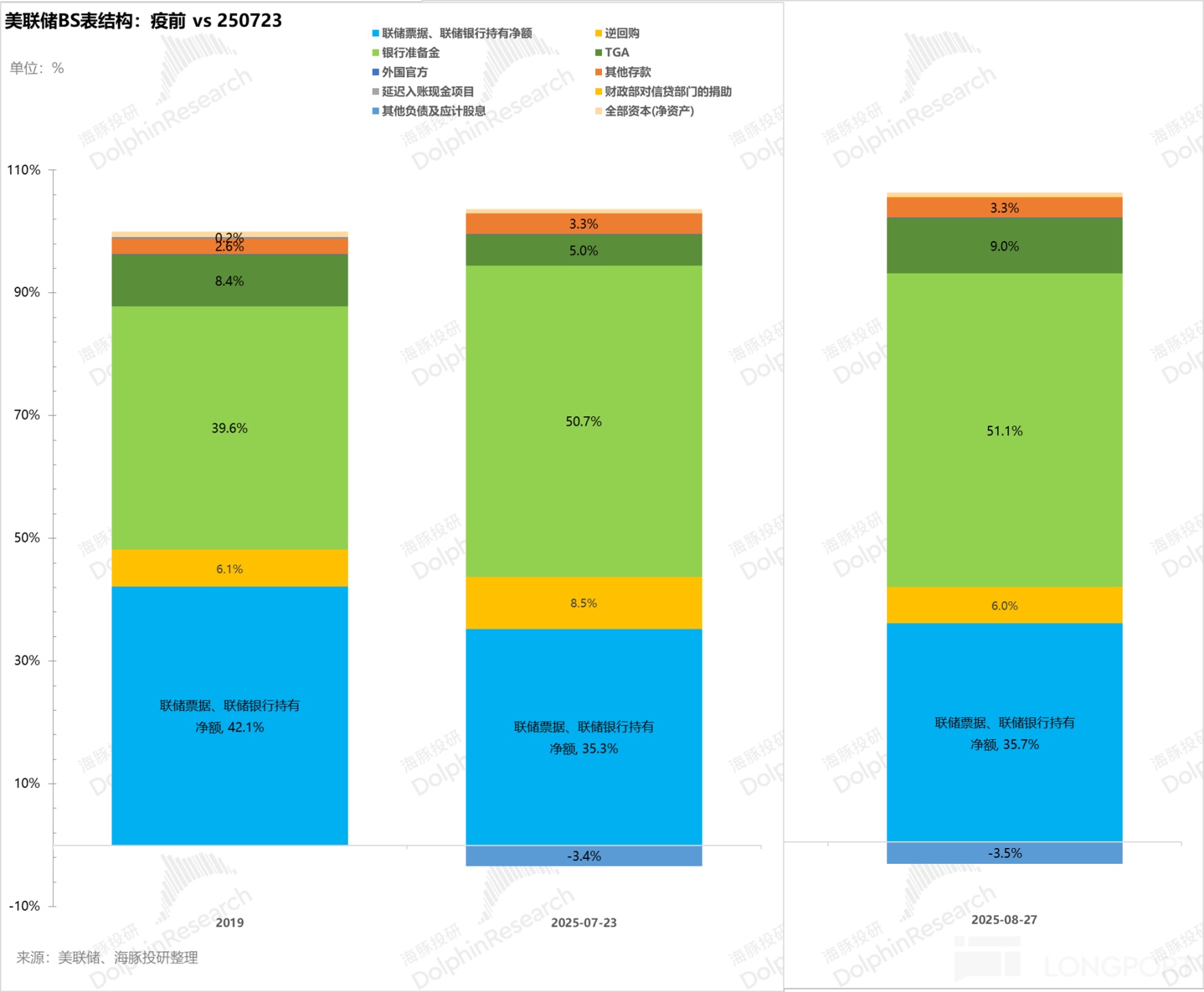

In the past five weeks of TGA account rebuilding, it is very clear that the main consumption is the bank deposit reserves and reverse repo balances that Dolphin Research mentioned earlier, but the overall progress is relatively mild and slow.

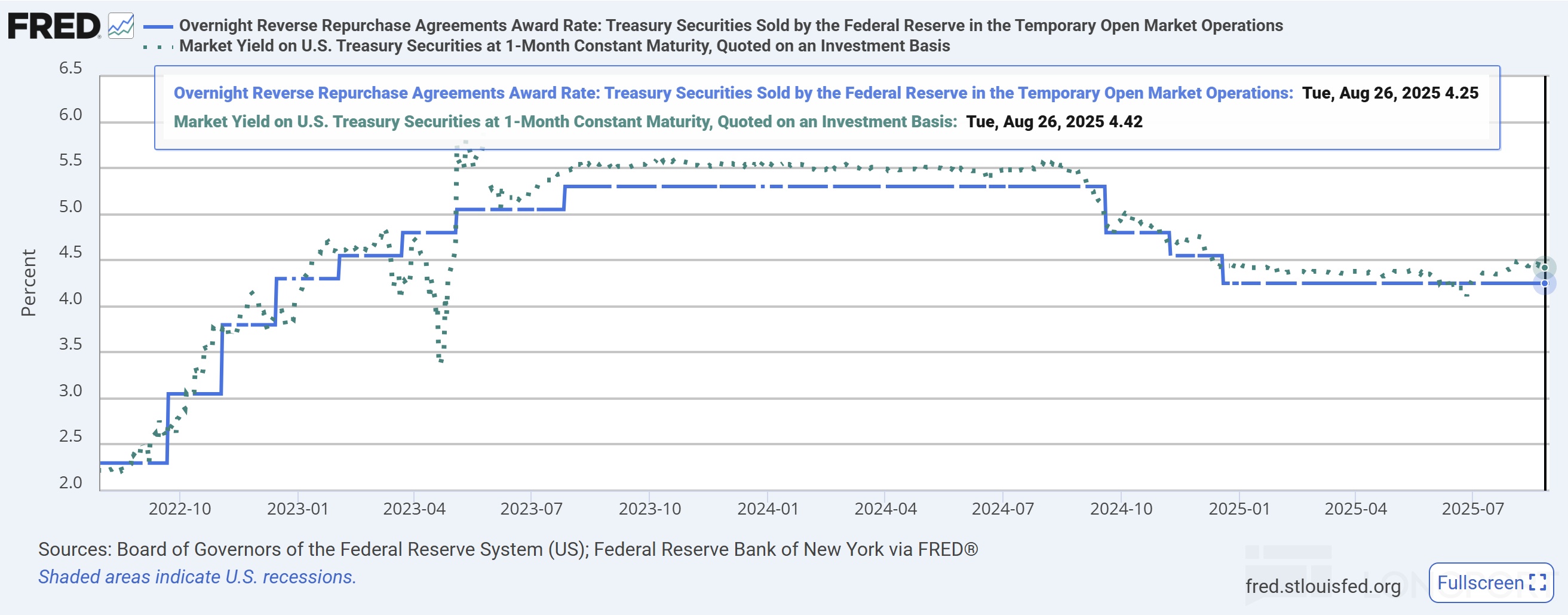

However, it can also be seen that after a month of rebuilding, although the reverse repo rate is still relatively stable, the reverse repo balance has been almost completely consumed from a proportion perspective, and the current reverse repo proportion has returned to the pre-pandemic state.

If the first half of the bank reserve balance was basically untouched, the second half of the TGA rebuilding may mainly rely on consuming the bank reserve balance. In fact, last week's TGA rebound was basically supplemented entirely by the bank reserve balance.

When mainly using bank reserves to supplement, the inverse relationship between the short-term stock market vs. the reduction in bank reserve balances may be relatively obvious. Therefore, even if the TGA rebuilding under the overall Bespoke operation is relatively mild and friendly, the market cannot rule out the short-term liquidity risks brought about by this process.

III. U.S. Stocks: Long-term "Fortress of Faith"?

Of course, if we overcome short-term risks such as overvaluation and liquidity shocks, Powell's shift almost seals the expectation for the U.S. economy next year—loose monetary policy + growth-promoting fiscal policy + private enterprise AI infrastructure investment cycle, which seems to predestine that the economic environment in 2026 will not be very bad.

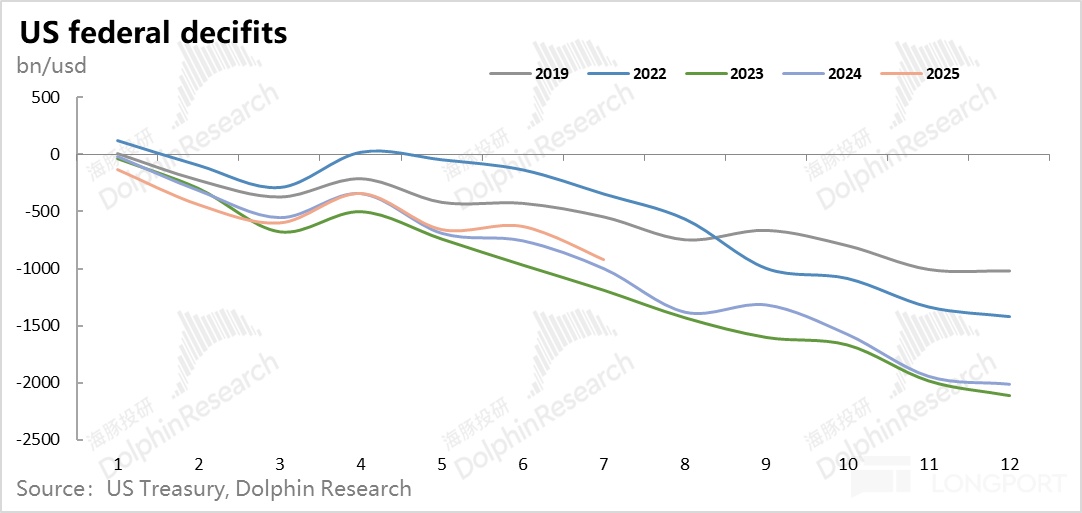

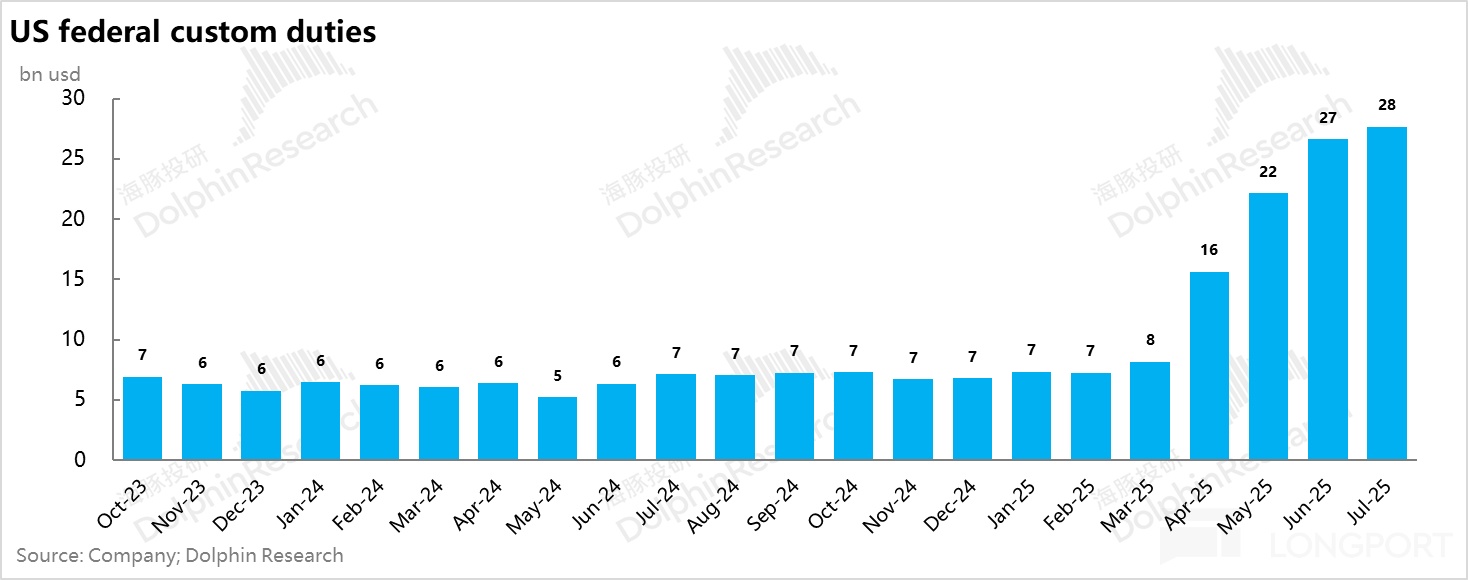

Even entering the post-pandemic era, the U.S. fiscal seems to have become addicted to fiscal stimulus: although tariff revenue has been rising monthly since Trump took office, the fiscal deficit so far this year is closer to the high deficit trajectory of 2023 and 2024.

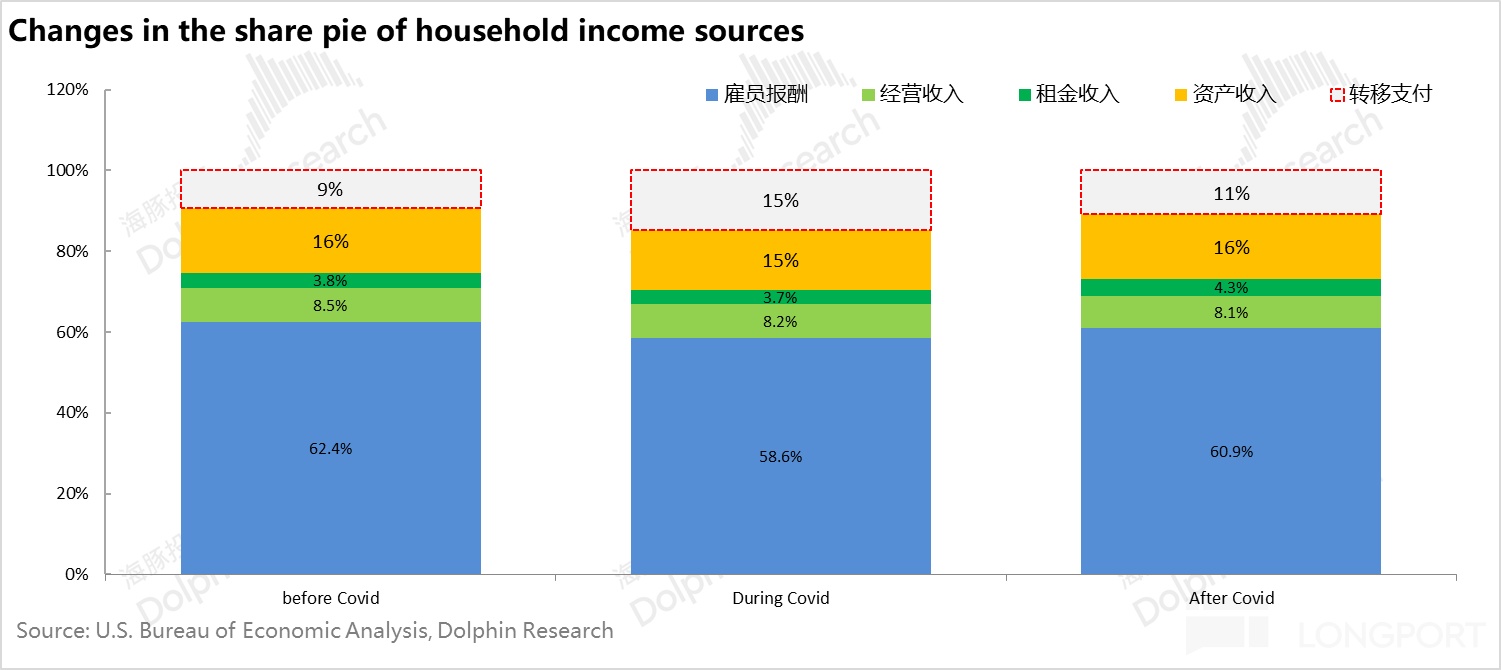

Moreover, a mutually corroborating point is that in the sources of U.S. household income, transfer income in 2025 (which surged significantly during the pandemic helicopter money period) once again significantly exceeds the growth of total income and the main income—employee salary income, with the growth rate standing above 10% again.

And if 2026 is to further increase tax cuts and raise deficit levels (the current market consensus for 2025 is about $1.9 trillion, and the expectation for 2026 is between $2.2-2.3 trillion), the economic downside risk in 2026 remains relatively small.

Thus, 2026 corresponds to monetary easing + fiscal stimulus + AI investment, with policy pro-cyclical + industry pro-cyclical, ensuring the outlook for 2026. In other words, if this TGA rebuilding can bring market adjustments, it may instead provide a buying opportunity at a low point.

IV. Portfolio Returns

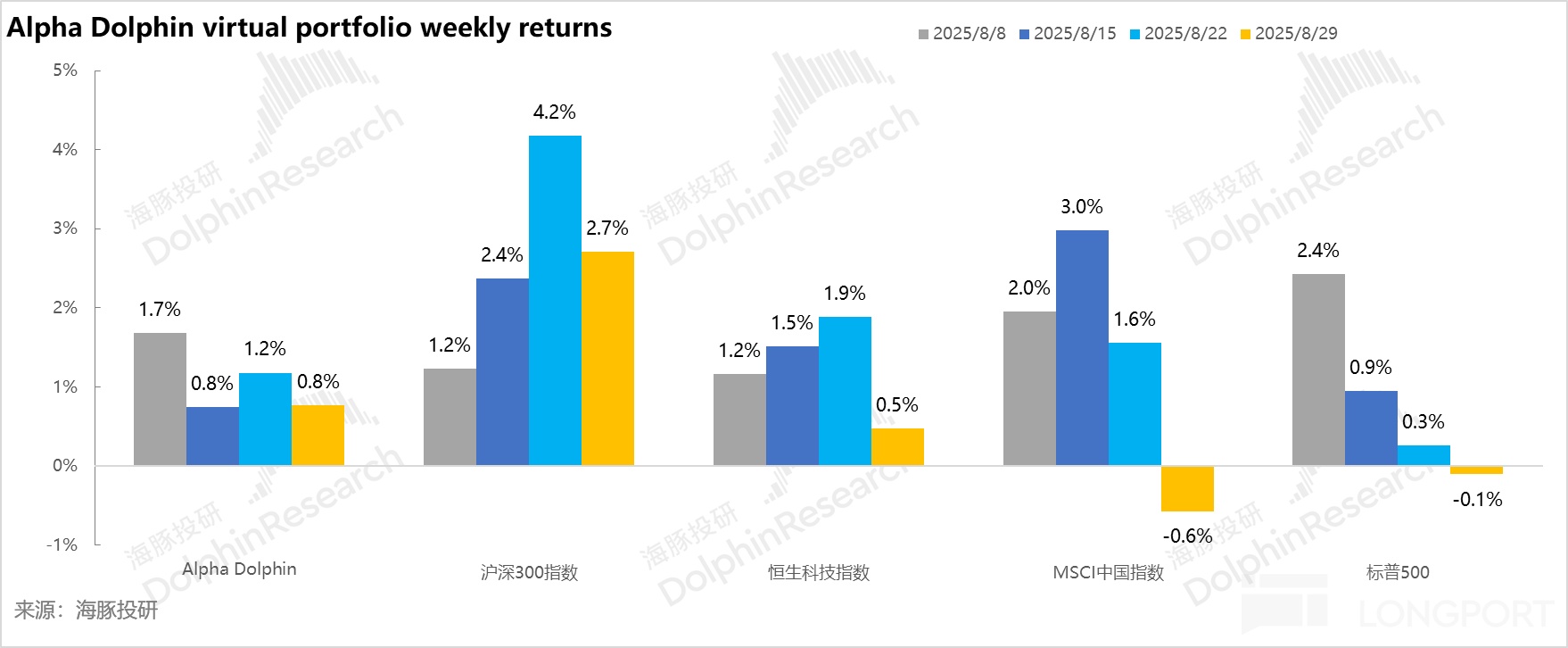

Last week, Dolphin Research's virtual portfolio Alpha Dolphin did not adjust its positions. It rose by 0.8% during the week, outperforming the benchmark market indices—Hang Seng Tech (+0.5%), MSCI China (-0.6%), and S&P 500 (-0.1%), but underperformed the CSI 300 (+2.7%).

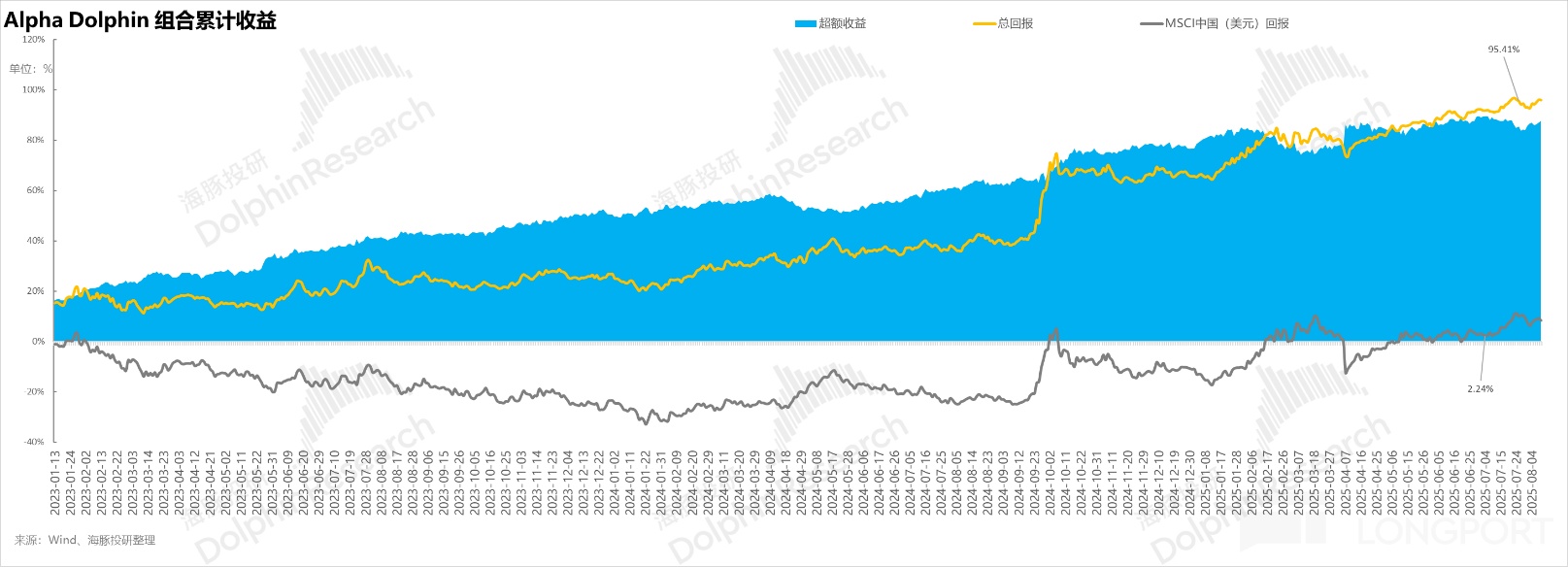

Since the portfolio began testing (March 25, 2022) until last weekend, the portfolio's absolute return is 101%, with an excess return of 88.6% compared to MSCI China. From the perspective of asset net value, Dolphin Research's initial virtual asset of $100 million has exceeded $204 million as of last weekend.

V. Individual Stock Gains and Losses Contribution

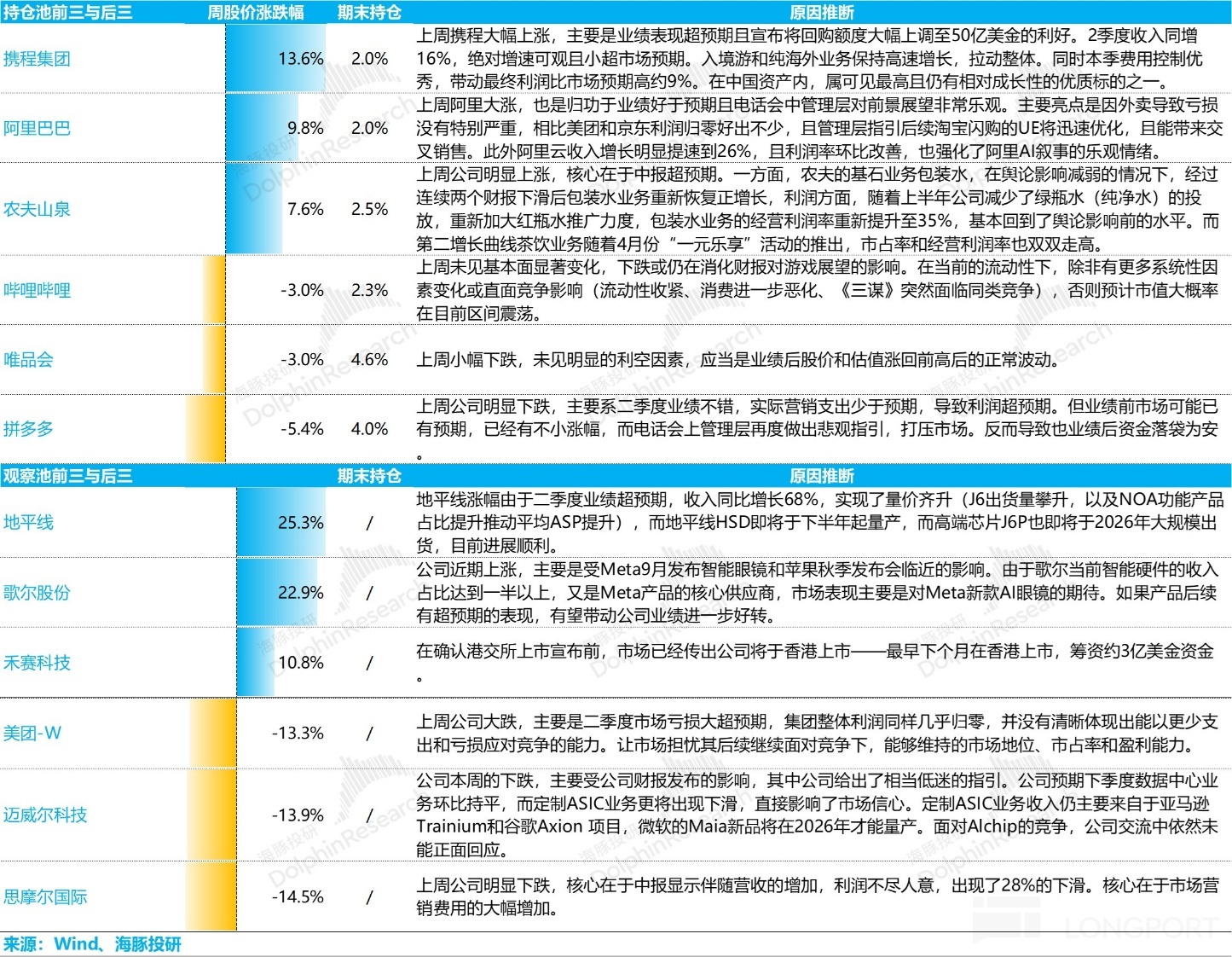

Last week, Dolphin Research's virtual portfolio Alpha Dolphin outperformed the market index mainly because companies in the portfolio such as Trip.com, Alibaba, and Nongfu Spring released earnings with good results or guidance, resulting in significant gains. Additionally, after the Fed announced a rate cut, the rise in gold also contributed significantly to the gold ETF.

The main explanations for individual stock price movements are as follows:

VI. Asset Portfolio Distribution

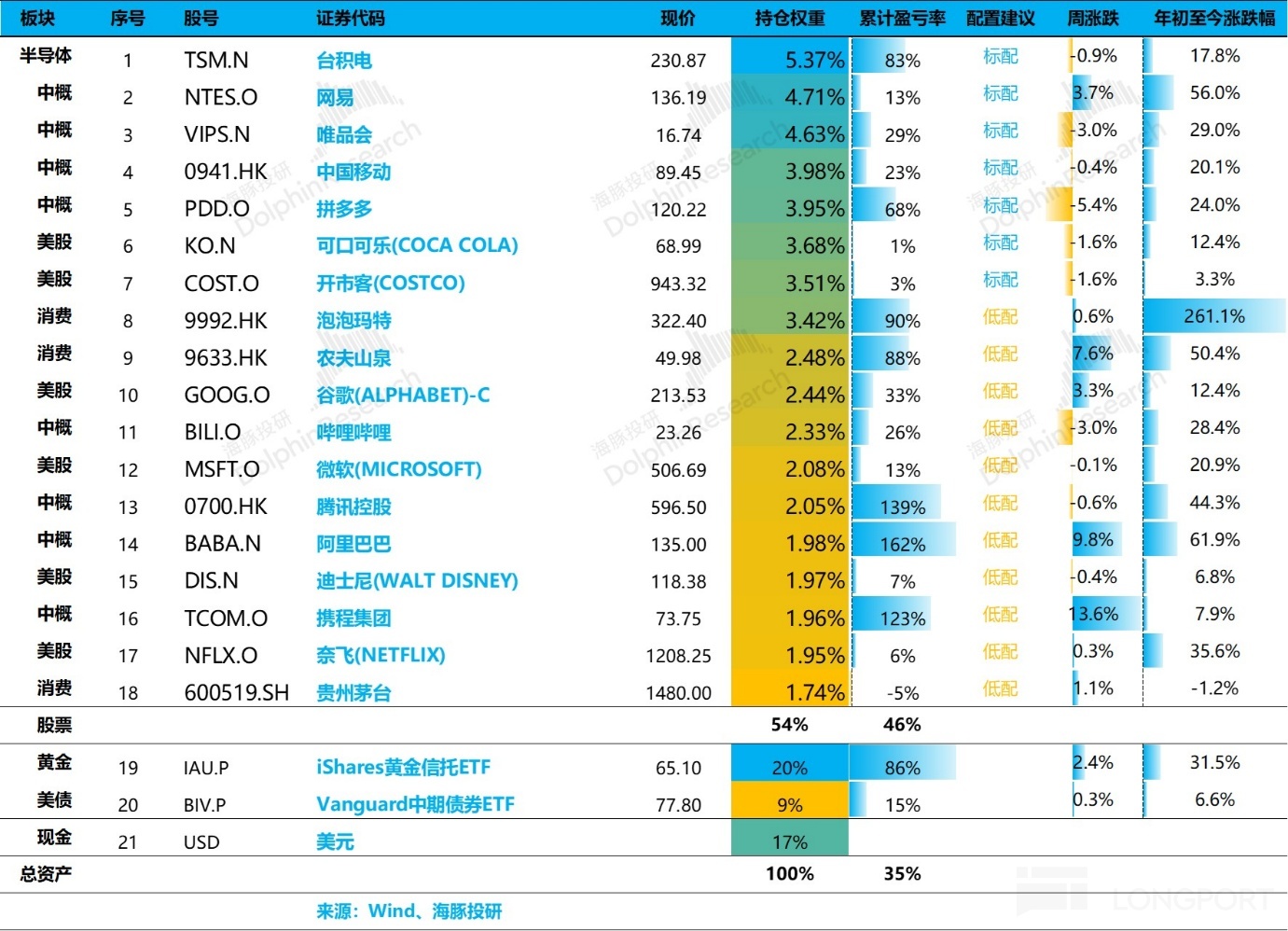

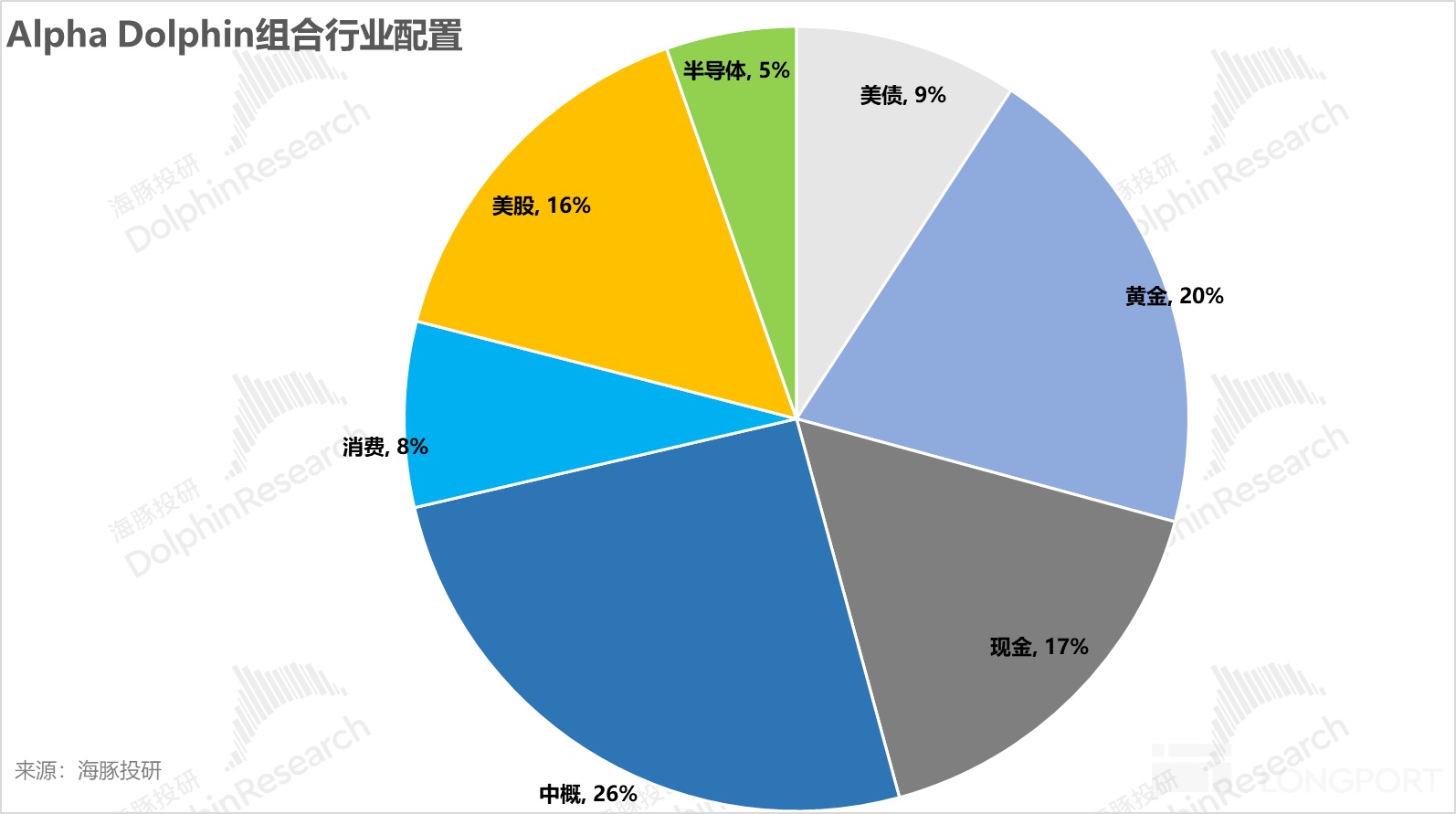

The Alpha Dolphin virtual portfolio holds a total of 18 individual stocks and equity ETFs, with 7 standard allocations and the rest underweight. Assets outside of equities are mainly distributed in gold, U.S. Treasuries, and U.S. dollar cash, with the current ratio between equity assets and defensive assets like gold/U.S. Treasuries/cash being approximately 54:46.

As of last weekend, the Alpha Dolphin asset allocation distribution and equity asset holding weights are as follows:

VII. Key Events This Week

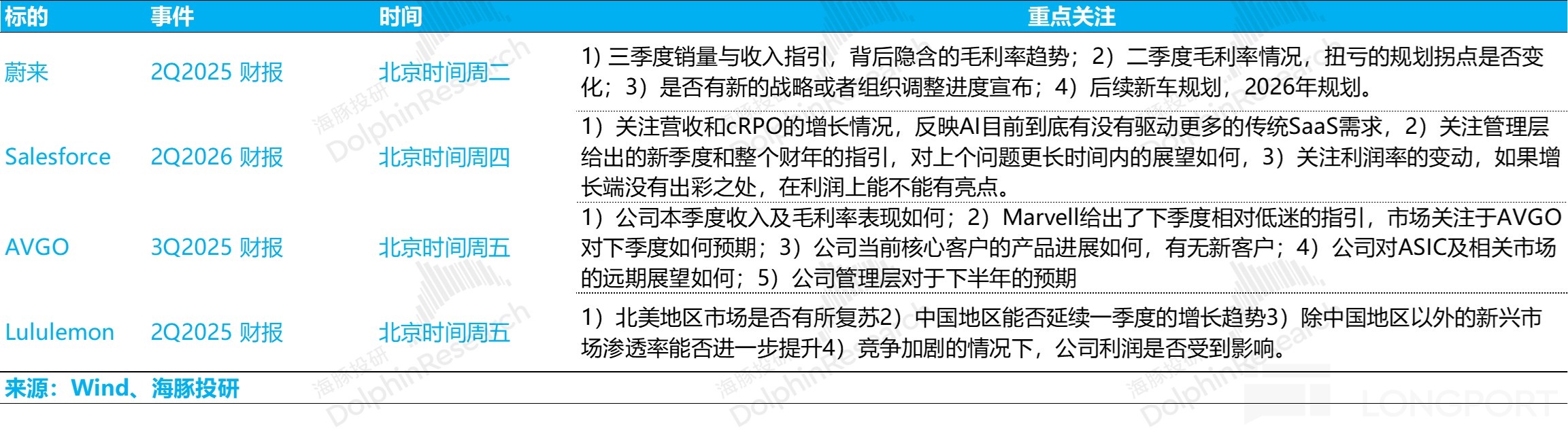

This week, the earnings reports of Chinese and American assets are all entering the final stage—there are two heavyweight companies in semiconductors and AI, with Broadcom representing ASICs and Salesforce representing AI in software applications.

Previously, due to Marvell's disappointing performance and Nvidia not providing any significant additional information, Broadcom is the only major semiconductor company left in the second quarter, especially with Google's strong capital expenditure and upward revision of capital expenditure expectations. As Google's core supply chain company for TPUs, Broadcom is of great significance this week.

Additionally, among Chinese assets, Nio, which has been narrating a turnaround story during this period, is also releasing its earnings at the last moment. After admitting "no price cuts, no market competition" with determination, can Li Bin provide new marginal incremental information in the conference call to further boost the currently recovering stock price?

Those interested in these issues and companies can continue to follow the first-line interpretations brought by Dolphin Research during the earnings season. The key focus areas of these companies are outlined by Dolphin Research as follows:

<End of Text>

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

For recent articles on Dolphin Research's portfolio weekly report, please refer to:

"A Fierce Struggle Like a Tiger, Trump Ultimately Cannot Escape 'Inflationary Debt'?"

"This is the Most Down-to-Earth, Dolphin Investment Portfolio Starts Running"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.