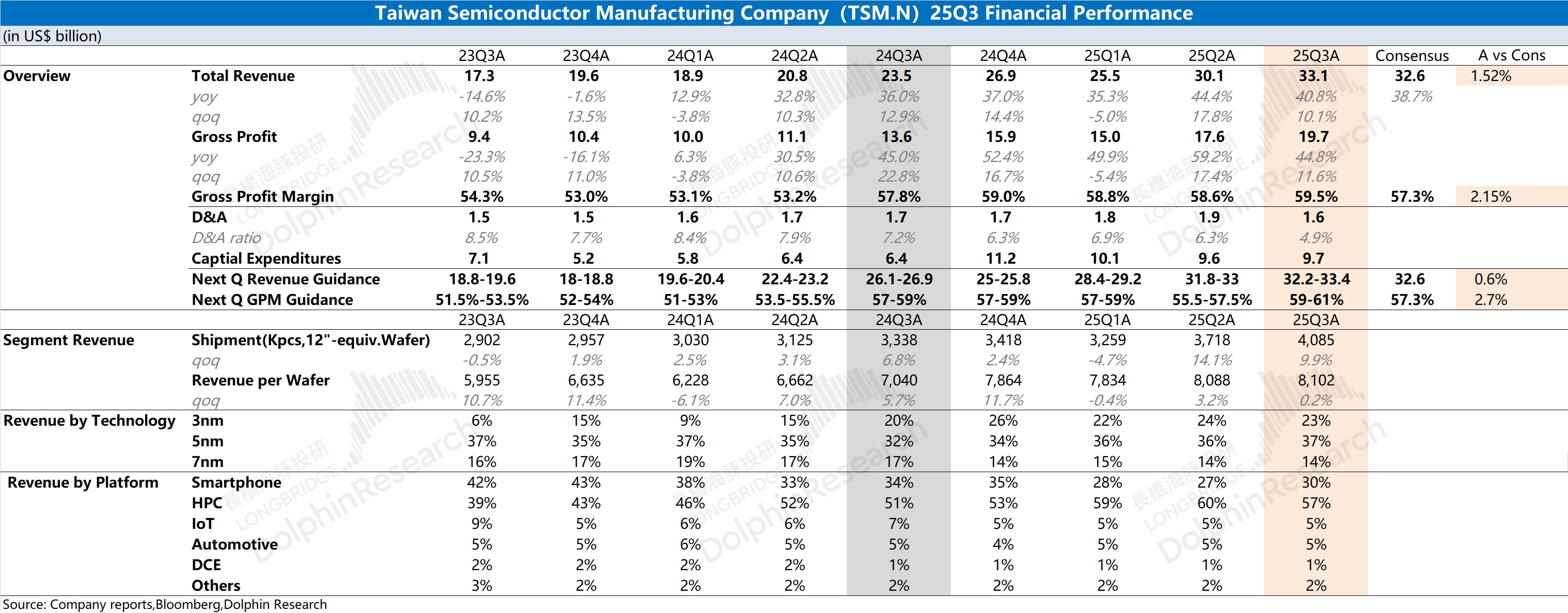

TSMC Quick Interpretation of Financial Report: The company's quarterly financial report performed well, with revenue and gross margin exceeding the revised expectations of buyers. Specifically for this quarter's financial report:

1) Revenue: Quarterly growth of 10%, mainly driven by shipment volume. Entering the third quarter, electronic products such as iPhones began the stocking phase, directly driving the seasonal increase in shipment volume. It is noteworthy that part of this quarter's quarterly growth was contributed by the depreciation of the US dollar. From the perspective of the New Taiwan dollar, the company's quarterly revenue grew by 6%, basically in line with expectations.

2) Gross Margin: The company's gross margin for this quarter reached 59.5%, significantly better than market expectations (57.3%). With average prices remaining relatively stable, the growth in gross margin was mainly due to the decline in unit fixed costs (depreciation and amortization). The substantial increase in shipment volume this quarter diluted the fixed cost per wafer under the scale effect.

Compared to this quarter's data, the market is more concerned about the company's capital expenditures and future operational guidance.

① Capital expenditure range increased to $40-42 billion, with speculation that fourth-quarter capital expenditure will reach $10.6-12.6 billion; ② The company expects next quarter's revenue to be $32.2-33.4 billion, which is close to buyer expectations. The biggest surprise is that the company provided a gross margin close to 60%, far exceeding market expectations (57.3%).

TSMC itself is the absolute leader in the wafer manufacturing industry, and with the mass production of 2nm, the company will further widen the gap with competitors. With its leading manufacturing capabilities, AI chips from manufacturers like NVIDIA and Broadcom require TSMC for production. Therefore, in this round of AI Capex boom, TSMC is the most important link in the AI semiconductor industry chain.

If major cloud service providers and companies like OpenAI significantly increase capital investment again, it will provide strong support for TSMC's performance growth and valuation. For more detailed content, please follow Dolphin Research's subsequent specific commentary and management Minutes. $Taiwan Semiconductor(TSM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.